THREAD: Trump's Executive Order on further pausing #StudentLoans payments is a scam. It DOESN'T automatically extend the payment forbearance included in the CARES Act. Get ready for mass confusion, a crush of individual applications, & late payments reported to credit bureaus.

The CARES Act directs Education Secretary @usedgov to:

1. Suspend payments on federal #StudentLoans

2. Stop charging interest

3. Report suspended payments to credit bureaus as regular timely payment

Loan servicers like @Navient were required to implement it - no applications

1. Suspend payments on federal #StudentLoans

2. Stop charging interest

3. Report suspended payments to credit bureaus as regular timely payment

Loan servicers like @Navient were required to implement it - no applications

The CARES Act suspension of #StudentLoan payments expires on September 30, 2020.

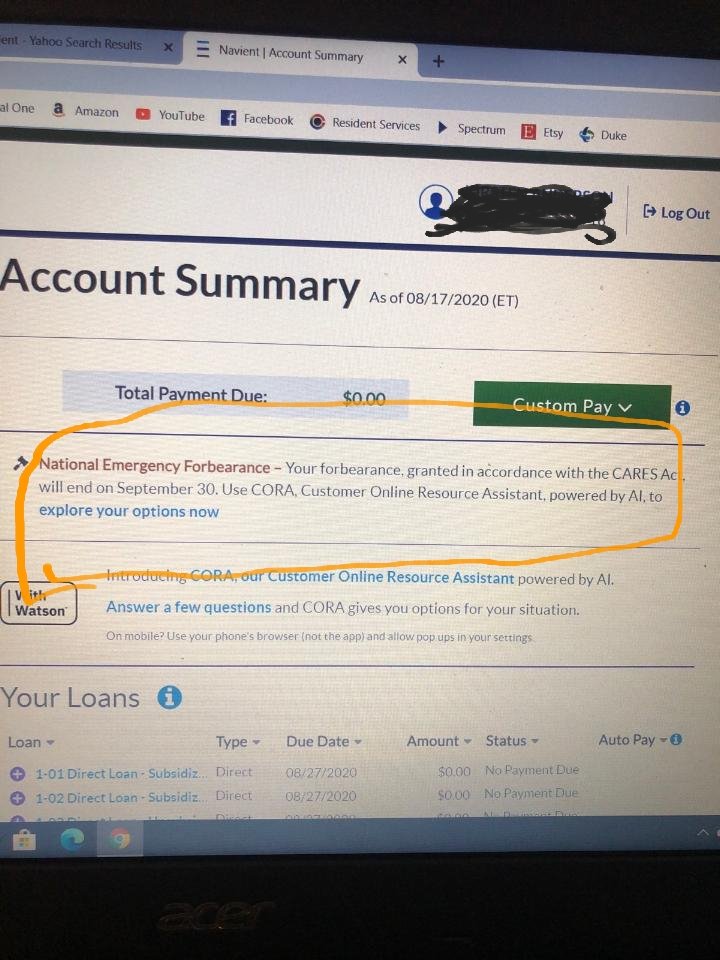

After that, it's business as usual, despite Trump's posturing. That's why borrowers are starting to receive notices like this:

After that, it's business as usual, despite Trump's posturing. That's why borrowers are starting to receive notices like this:

Trump's August #ExecutiveOrder on #StudentLoan payments directs the Secretary of Education to use her authority in EXISTING law (Higher Education Act of 1965).

It doesn't continue CARES Act authority, because it can't. Instead it relies on "Economic Hardship Deferments"

It doesn't continue CARES Act authority, because it can't. Instead it relies on "Economic Hardship Deferments"

The current process for getting a #studentloan Economic Hardship Deferment approved by @usedgov involves each borrower individually applying and submitting documentation of eligibility including proof of income.

Trump's #ExecutiveOrder on #StudentLoans gives @BetsyDeVosED authorization to waive or modify *federal regulations* that control how #EconomicHardshipDeferments are implemented.

It doesn't--and can't--modify the *controlling law* passed by Congress (Higher Ed Act of 1965)

It doesn't--and can't--modify the *controlling law* passed by Congress (Higher Ed Act of 1965)

Not sure if @BetsyDeVosED is still at her million-dollar vacation home or not, but Department of Education @usedgov hasn't yet announced which #EconomicHardshipDeferments regulations it's going to modify/waive due to #COVID19.

Loan servicers are waiting to hear from Betsy.

Loan servicers are waiting to hear from Betsy.

The other twist is that because #StudentLoan #Deferments are controlled by *federal law*, the Secretary of Education can't change those requirements even if she wanted to.

The Higher Education Act of 1965, as amended several times, doesn't allow for mass approval of deferments

The Higher Education Act of 1965, as amended several times, doesn't allow for mass approval of deferments

Slight chance I missed this language (the HEA has been amended several times) but I cannot find any authority that allows for blanket #studentloandeferments to be given out en-masse.

Correct me if I'm wrong.

Correct me if I'm wrong.

Bottom line:

1. #StudentLoanBorrowers have to interact w/ their loan servicer to get further payment extension

2. Borrowers **don't know this**

3. Could be a clusterf*ck depending on @BetsyDeVosED & whether the good people at @FAFSA can push her HARD

1. #StudentLoanBorrowers have to interact w/ their loan servicer to get further payment extension

2. Borrowers **don't know this**

3. Could be a clusterf*ck depending on @BetsyDeVosED & whether the good people at @FAFSA can push her HARD

#StudentloanBorrowers risk late payments reported to credit bureaus &capitalization of accumulated interest increasing principal amount owed

We have to wait & see what @BetsyDeVosED does. Alternatively, apply for #EconomicHardshipDeferment now if you qualify as existing

We have to wait & see what @BetsyDeVosED does. Alternatively, apply for #EconomicHardshipDeferment now if you qualify as existing

Trump's Executive Order on #StudentLoan payments also doesn't specify that payments deferred under the order qualify as "payments made" under the #PSLF Public Service Loan Forgiveness program.

Read on Twitter

Read on Twitter