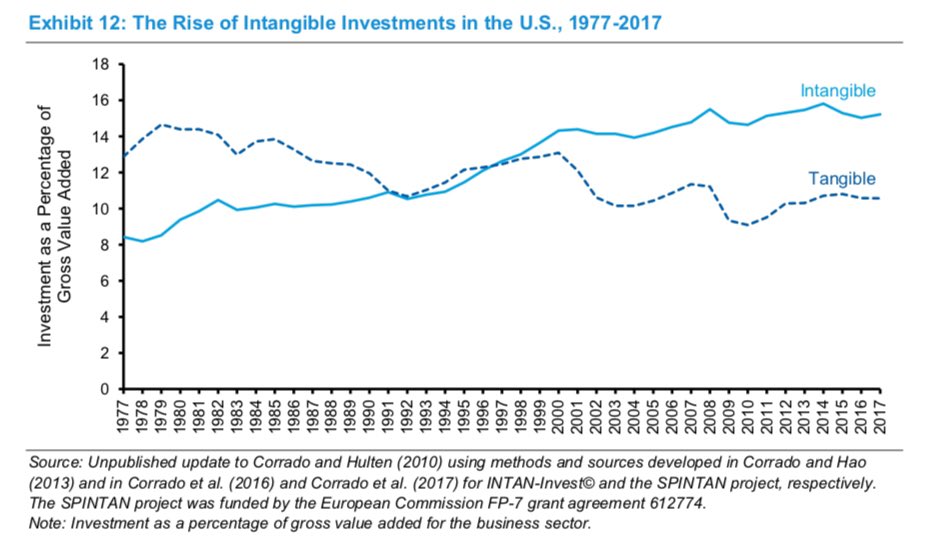

1/ People who value equities based on forward *earnings* create opportunities for other people who know expected long-term *cash flows*, discounted by the cost of capital, determine stock prices. This is especially true in a world where intangible assets create pricing power.

2/ The stock market is a currently a mechanism that transfers wealth from people who don't understand that investments in many intangible assets that create long term pricing power are expensed rather than capitalized, to people who do understand the value of intangible assets.

3/ The investment opportunity created by widespread underappreciation of the rising importance of intangible assets has been aided and abetted by accounting standards that change to reflect the real world of business at a pace best described as lethargy bordering on sloth.

Read on Twitter

Read on Twitter