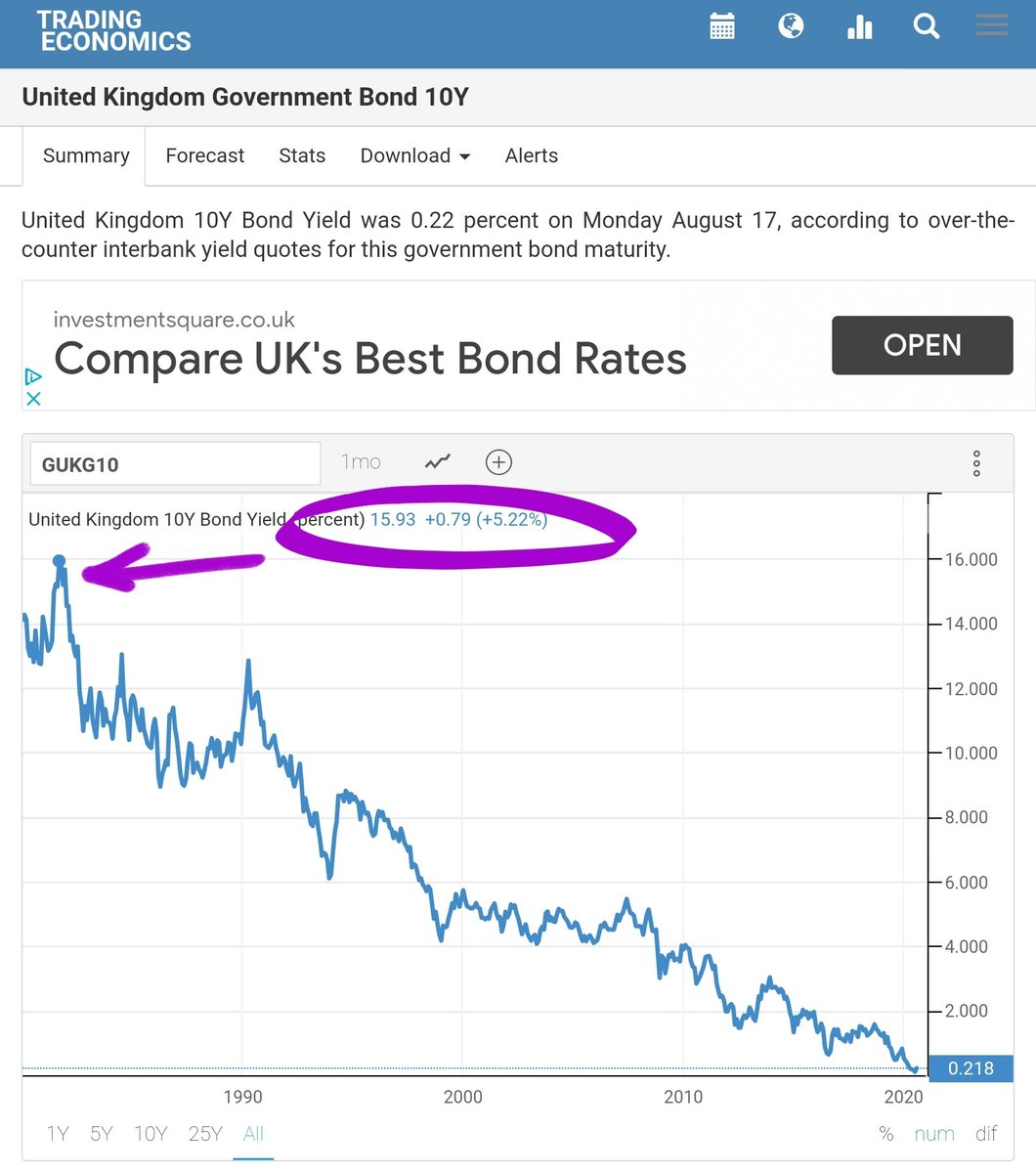

Here in the UK our "risk free rate", off which all other investments are priced is 0.22% this morning

To put it in terms of our national obession: I read recently that someone had got a 5yr fix on his mortgage at 1.38%.

We all understand that cheap payments lead to high prices.

To put it in terms of our national obession: I read recently that someone had got a 5yr fix on his mortgage at 1.38%.

We all understand that cheap payments lead to high prices.

But it was not ever so. Back in September 1981 that same rate was near as spit 16%.

I wonder what a 5yr fix (and the monthly payment) would have been then?

I wonder what a 5yr fix (and the monthly payment) would have been then?

I myself remember my personal mortgage rising by 5 percentage points over about 18 months to a fairly lofty 15.4% in 1990.

The pips, as the man said, were squeaking.

The pips, as the man said, were squeaking.

And not just mine.

I well remember the not so warm reminiscences of a couple whose entire family income was devoted to keeping that payment up.

*Literally* just enough for egg and chips 7 nights a week.

And they were lucky both to be in work.

I well remember the not so warm reminiscences of a couple whose entire family income was devoted to keeping that payment up.

*Literally* just enough for egg and chips 7 nights a week.

And they were lucky both to be in work.

So now we must ask ourselves what has happened to bring this happy state of affairs into existence?

The 0.22% I mean.

Why are the Bradford & Bingley happy to lend for 5yrs at 1.38%?

The 0.22% I mean.

Why are the Bradford & Bingley happy to lend for 5yrs at 1.38%?

And will this propitious trend of ever cheaper monthly payments that we have enjoyed these past near *40 years* continue?

Or flatten off?

Or, (begone such heretical thoughts!).. even reverse?

Or flatten off?

Or, (begone such heretical thoughts!).. even reverse?

I think its a fix. A con.

At least now it is.

At least now it is.

That half a trillion quid they have printed to suppress that risk free rate on the Gilt.

Along with the *trillions* and *trillions* emanating from the Fed the BoJ and the ECB.

It has artificially depressed the rate.

Along with the *trillions* and *trillions* emanating from the Fed the BoJ and the ECB.

It has artificially depressed the rate.

I'm not looking for a Nobel Prize for having figured this out. The issuing Central Banks have said so.

Directly, clearly and unambiguously.

Directly, clearly and unambiguously.

But perhaps when it is put in those terms:

"It's a fix. A con."

"It's a fix. A con."

You might think twice before you gamble your financial life on it.

The guy with that 1.38% 5yr fix.

To get that rate he will have needed a fair bit of equity. The bank will have looked at his income and outgoings. They'll be pretty happy that it is highly unlikely that he will not pay.

To get that rate he will have needed a fair bit of equity. The bank will have looked at his income and outgoings. They'll be pretty happy that it is highly unlikely that he will not pay.

And more importantly: that even of he does, when they repossess they will get their money back.

And they will have an econometric model of the economy.

So that if X affects Y, and A loses his business so that B loses his job...

So that if X affects Y, and A loses his business so that B loses his job...

All in all. Big Bank plc is sitting pretty.

But what happens if the Big Con hits a brick wall? Or even stumbles?

The Fed. The Yanks. With their wide open prairies. The orange groves of Florida. And their mil-it-ary..

[ Best in the world. Everyone says it. So it must be true. ]

[ Best in the world. Everyone says it. So it must be true. ]

They can do what they like.

And them lot over in Europe.

Arrogant Krauts. Aided and abetted by the garlic flavoured Frenchies and oily Eyeties. They'll all gang up on us and do whatever they can to make our lives a misery.

It'll be "We're all right Jack!". Or whatever that sounds like in Eurospeak.

Arrogant Krauts. Aided and abetted by the garlic flavoured Frenchies and oily Eyeties. They'll all gang up on us and do whatever they can to make our lives a misery.

It'll be "We're all right Jack!". Or whatever that sounds like in Eurospeak.

No, we plucky Brits.

Here in Global Britain. Singapore on Thames.

Here in Global Britain. Singapore on Thames.

We are paddling our own canoe now. Taken back control ye see?

No more being bossed around by a cosy club of 500M consumers with their common standards, common market and (to a large part) common currrency.

No more being bossed around by a cosy club of 500M consumers with their common standards, common market and (to a large part) common currrency.

[ And please: Nobody @ me about the shortcomings of the EU or the Euro.

I am well aware.

I am talking about the possibility of higher rates. And for this specific instance, being outside the EU impacts. Negatively. Or at least I think it does. ]

I am well aware.

I am talking about the possibility of higher rates. And for this specific instance, being outside the EU impacts. Negatively. Or at least I think it does. ]

So of the four:

The Fed. The ECB, the BoJ and the Old Lady of Threadneedle St.

When the searchlight of the international capital markets is directed into the retinas.

Asking "Will we get our money back?" And shouting "Ve hav vays of making you talk!!"

Who might blink first?

The Fed. The ECB, the BoJ and the Old Lady of Threadneedle St.

When the searchlight of the international capital markets is directed into the retinas.

Asking "Will we get our money back?" And shouting "Ve hav vays of making you talk!!"

Who might blink first?

And despite the Big Con. There are still International Capital markets.

When we import French electricity, Samsungs and iPhones. And grapes from sunny Spain.

Johnny Foreigner. He will not just take our word that "we're good for the money". And hence he will not take our money. For they are one and the same.

It is dollars that must be provided.

Johnny Foreigner. He will not just take our word that "we're good for the money". And hence he will not take our money. For they are one and the same.

It is dollars that must be provided.

And that's where it just might get a bit eggy.

The Great Staycation of 2020 is helping I think. Although foreign tourists spending their hard earned here must be down and down catastrophically.

The Great Staycation of 2020 is helping I think. Although foreign tourists spending their hard earned here must be down and down catastrophically.

But if Sterling wobbles. Slides a bit. Near to the precipice's edge... That's the time to worry.

No chance of that though is there.

The Big Con, that's here to stay. All the old rules: out the window.

I don't know why we ever had them in the first place.

[ End ]

The Big Con, that's here to stay. All the old rules: out the window.

I don't know why we ever had them in the first place.

[ End ]

Read on Twitter

Read on Twitter