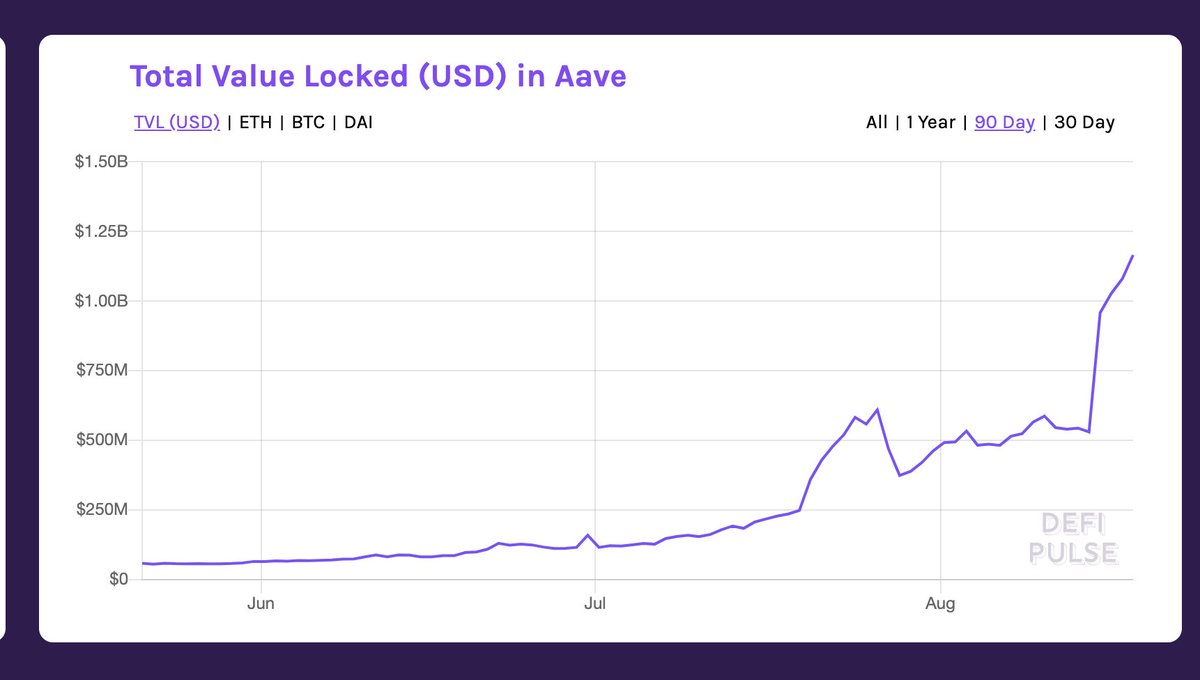

. @AaveAave 's TVL just keeps growing.

Why?

It's simply the best shovel you could have

For Liquidity Mining

Thread:

Why?

It's simply the best shovel you could have

For Liquidity Mining

Thread:

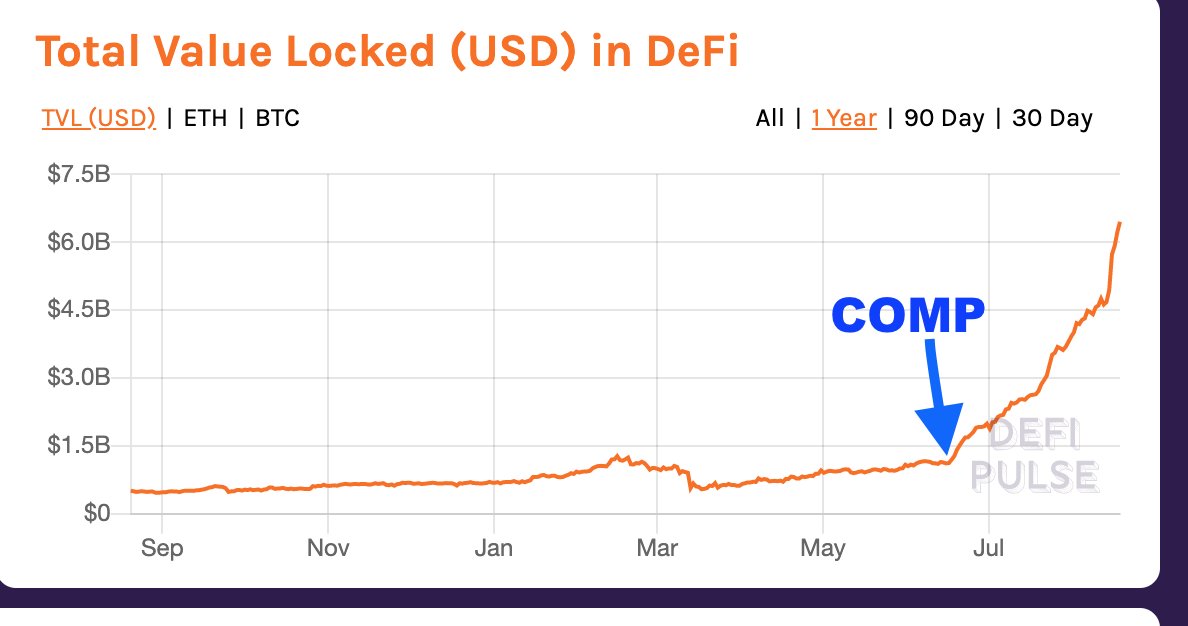

1/ COMP started the yield farming craze.

By distributing governance tokens to users

TVL of COMP exploded.

Other protocols soon followed suit.

By distributing governance tokens to users

TVL of COMP exploded.

Other protocols soon followed suit.

2/ For yield farming, you need assets to farm.

The most common farming asset is stablecoins.

But it's a bull market.

Why would you sell your ETH?

Even earning 100% yield could be a trap

If ETH shoots up 10% overnight.

The most common farming asset is stablecoins.

But it's a bull market.

Why would you sell your ETH?

Even earning 100% yield could be a trap

If ETH shoots up 10% overnight.

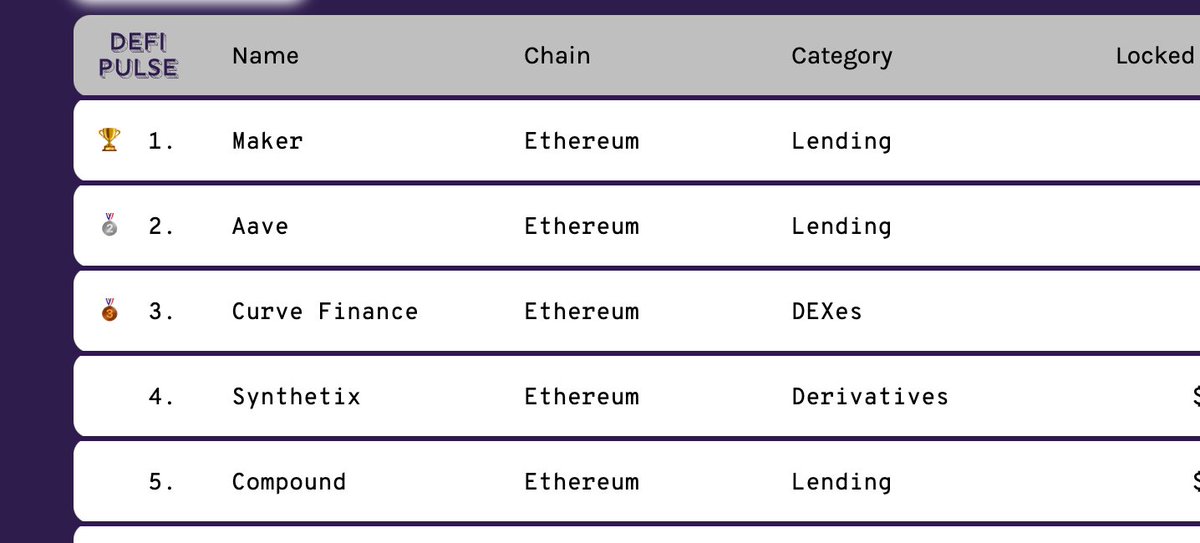

3/ Enter collateralized Lending and Debt

By collateralizing your ETH on MakerDAO or Compound

You retain ETH Upside but also get stablecoins

You can farm yield with.

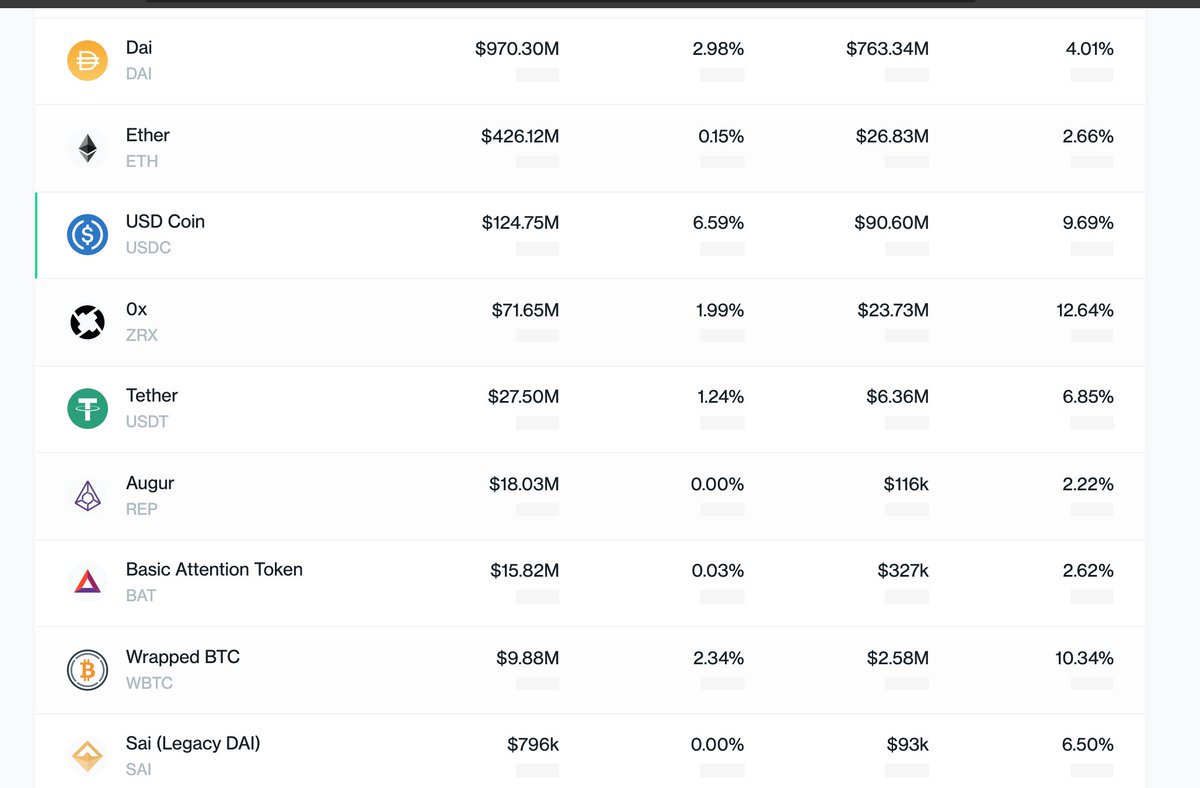

But Compound has a limited range of collateral.

By collateralizing your ETH on MakerDAO or Compound

You retain ETH Upside but also get stablecoins

You can farm yield with.

But Compound has a limited range of collateral.

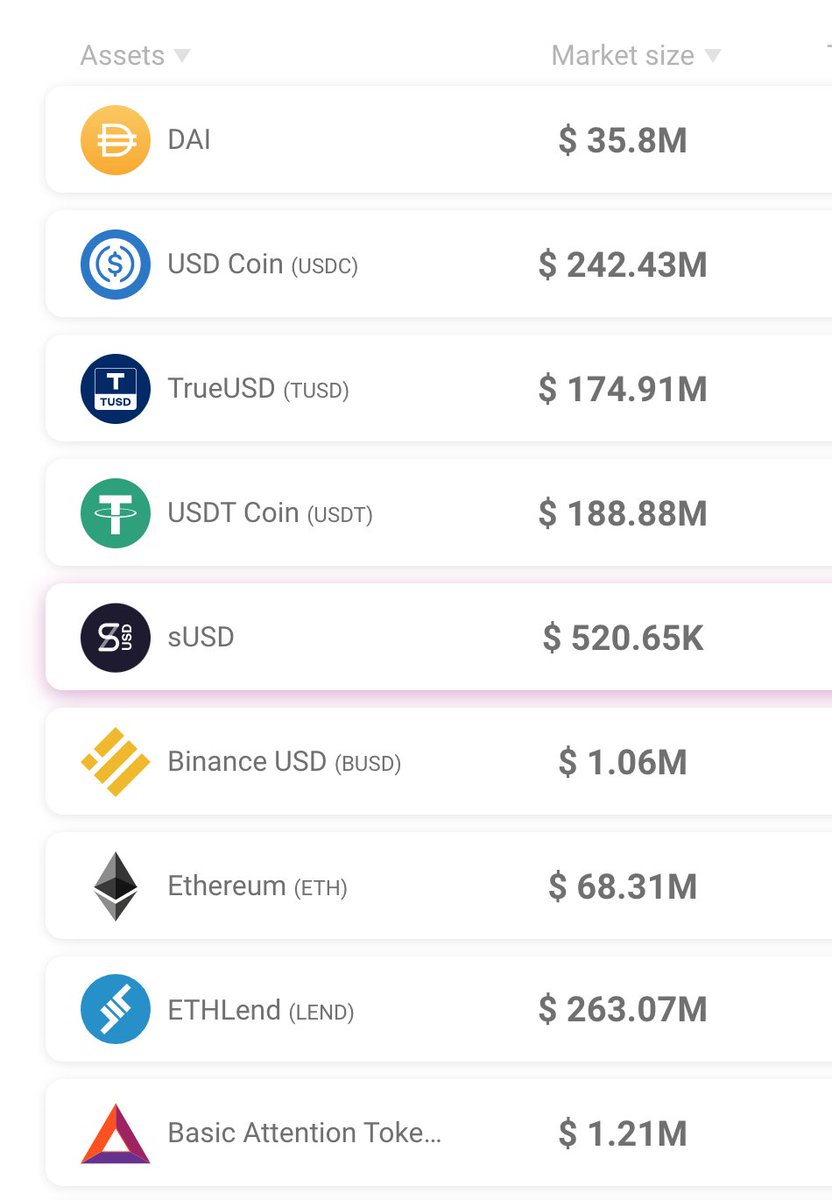

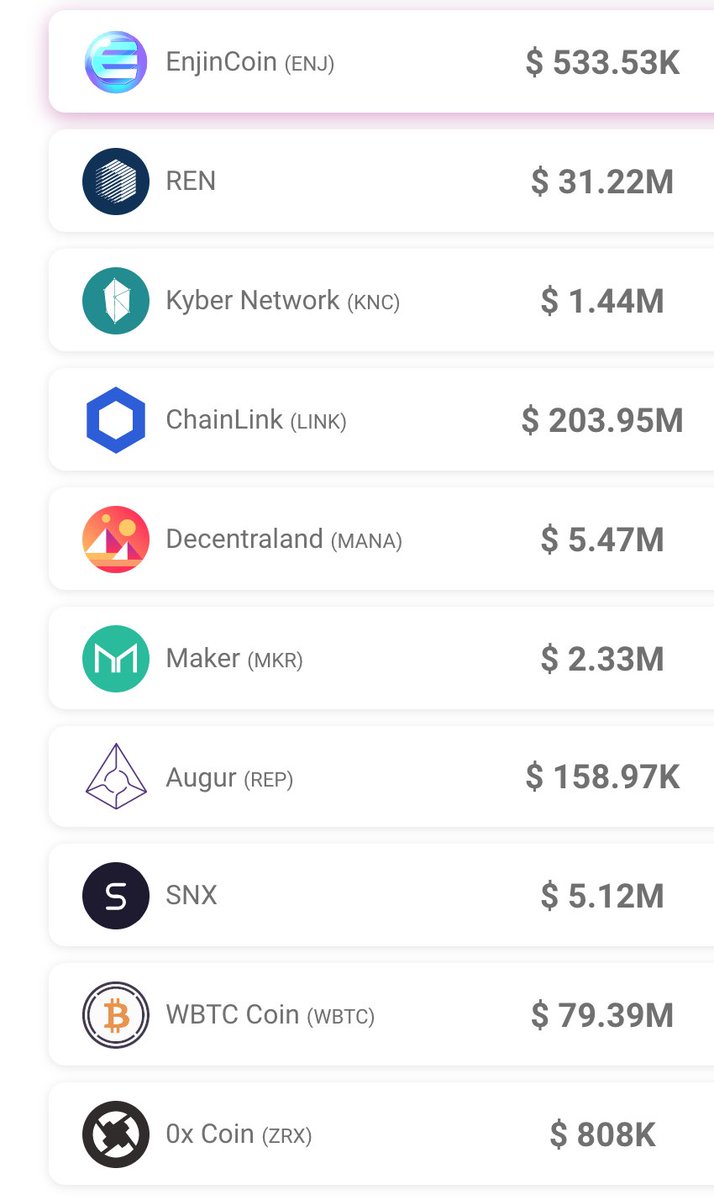

3/ Aave has the whole shebang.

Every major DeFi token is on Aave.

That means every major DeFi Community:

-Link Marines

-SNX Spartans

-MKR holders (ironically!)

-BItcoiners

Can all collateralized their favorite holdings

And farm yield with it.

Every major DeFi token is on Aave.

That means every major DeFi Community:

-Link Marines

-SNX Spartans

-MKR holders (ironically!)

-BItcoiners

Can all collateralized their favorite holdings

And farm yield with it.

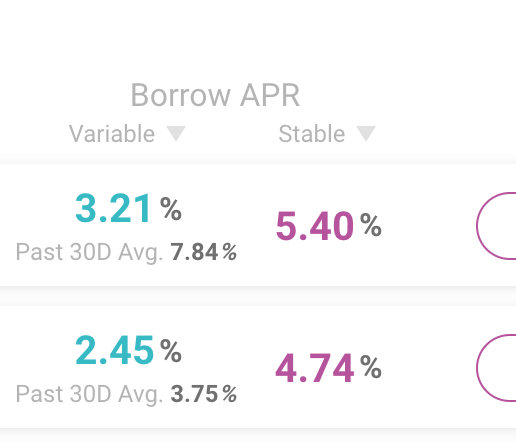

4/ Besides covering all major tokens

Aave also has many borrower and lender friendly features.

Fixed APR lets borrowers to lock in interest rates

To ensure their farms are profitable.

Variable APR allows lenders to maximize lending yield.

Aave also has many borrower and lender friendly features.

Fixed APR lets borrowers to lock in interest rates

To ensure their farms are profitable.

Variable APR allows lenders to maximize lending yield.

5/ The liquidation process on Aave is also very smooth and efficient.

Since each liquidation is partial

And each liquidation involves the loan being partly paid back

Borrowers usually are able to still save some collateral.

Since each liquidation is partial

And each liquidation involves the loan being partly paid back

Borrowers usually are able to still save some collateral.

Read on Twitter

Read on Twitter