New paper about state and local government finances in the pandemic

New paper about state and local government finances in the pandemic w @erikloulou

w @erikloulou Main findings

-State and local govs more dependent on sales tax laid off more employees

-The $150 billion in federal aid saved public jobs

-Large state rainy day funds dampened these effects

Unlike the federal government, state and local govts are subject to balanced budget requirements. They can borrow to fund capital projects, but NOT to fund operating expenditure. Each year, operating expenditure must equal operating revenue.

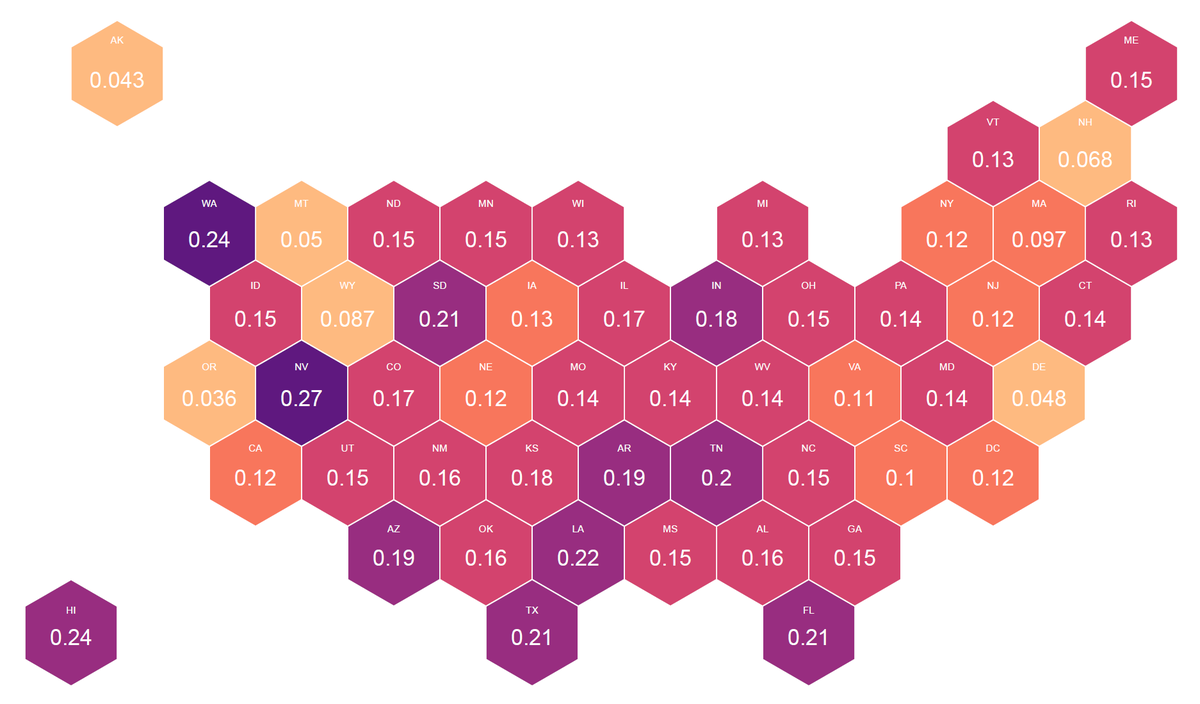

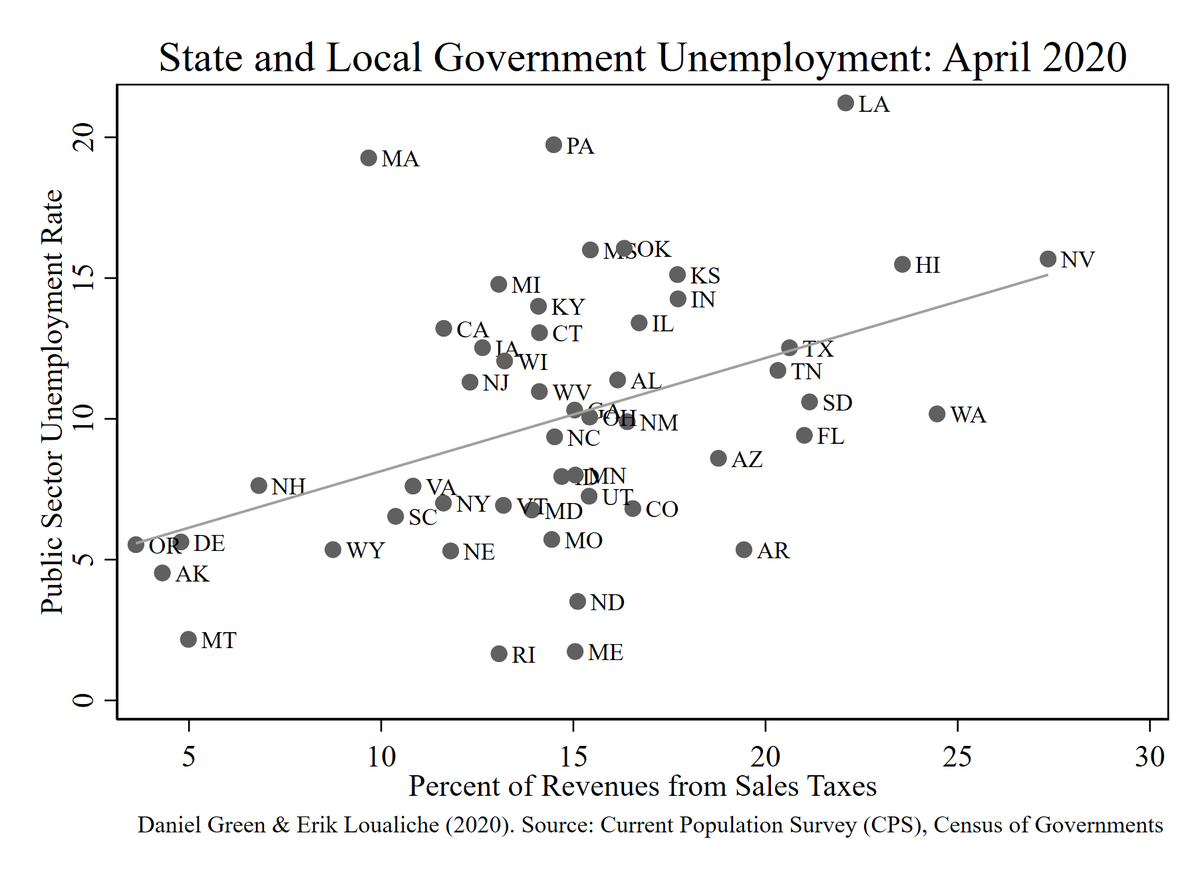

The early lockdowns lead to a dramatic decline in sales tax collections. New York and Florida for example both saw sales tax revenues down 21% yoy in April 2020. Our first measure of fiscal exposure to the pandemic is the sales tax share of state and local government revenues.

Variation in sales tax exposure across states predicts the cross-section of the ~1 million state and local government worker layoffs in April 2020.

State and local govs have been clamoring for federal “bailouts.” The CARES Act allocated $150 billion to state, local, and tribal governments. Did it help? A kink lets us find out!

21 states received the minimum aid of $1.25bn. This introduces a lot of variation in award size relative to annual revenues of state and local governments!

States that got more federal aid relative to annual revenues saw markedly fewer layoffs of state and local workers. We estimate about 440,000 fewer in April 2020. Each dollar of state and local aid in the cares act supported about 33 cents of annual public sector payrolls.

State and local governments must run balanced budgets. When revenue falls spending must also go down.

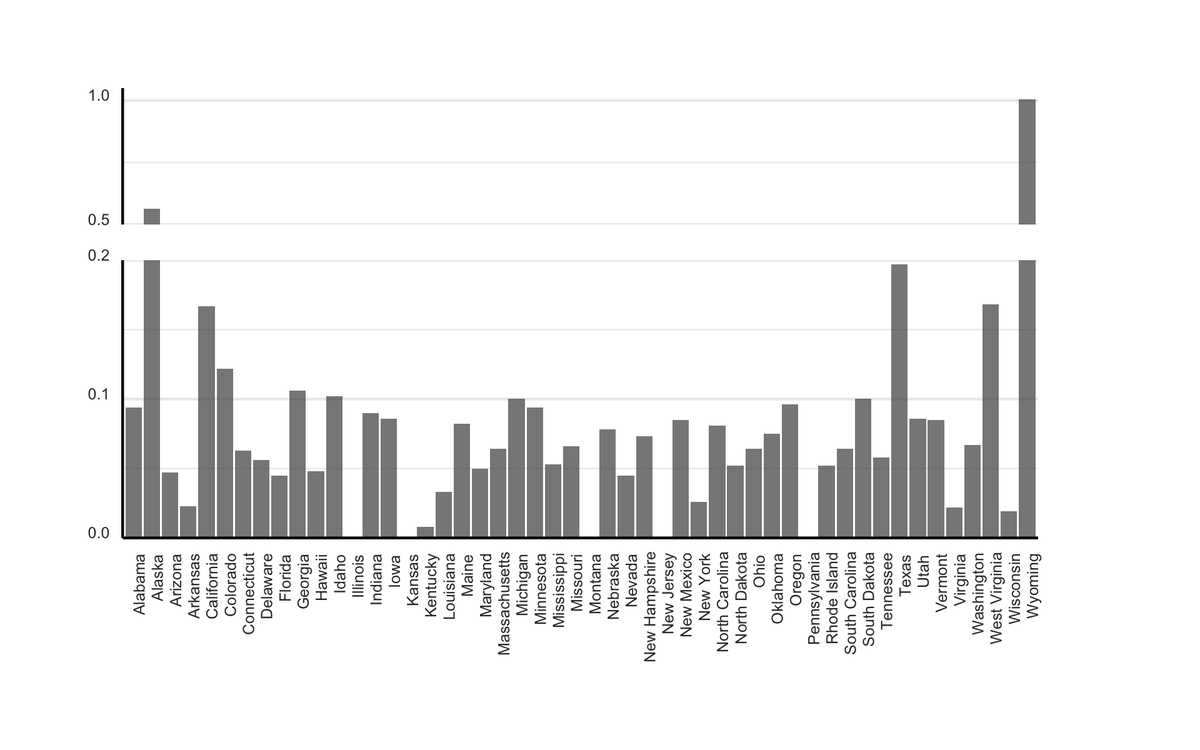

States maintain rainy day funds to smooth shocks: Plotted here as a fraction of annual expenditure.

States maintain rainy day funds to smooth shocks: Plotted here as a fraction of annual expenditure.

States with high levels of rainy day funds saw a much lower elasticity of employment to our measures of fiscal shocks.

This is evidence that balanced budget constraints on states are binding, and we are not just capturing a wealth effect.

This is evidence that balanced budget constraints on states are binding, and we are not just capturing a wealth effect.

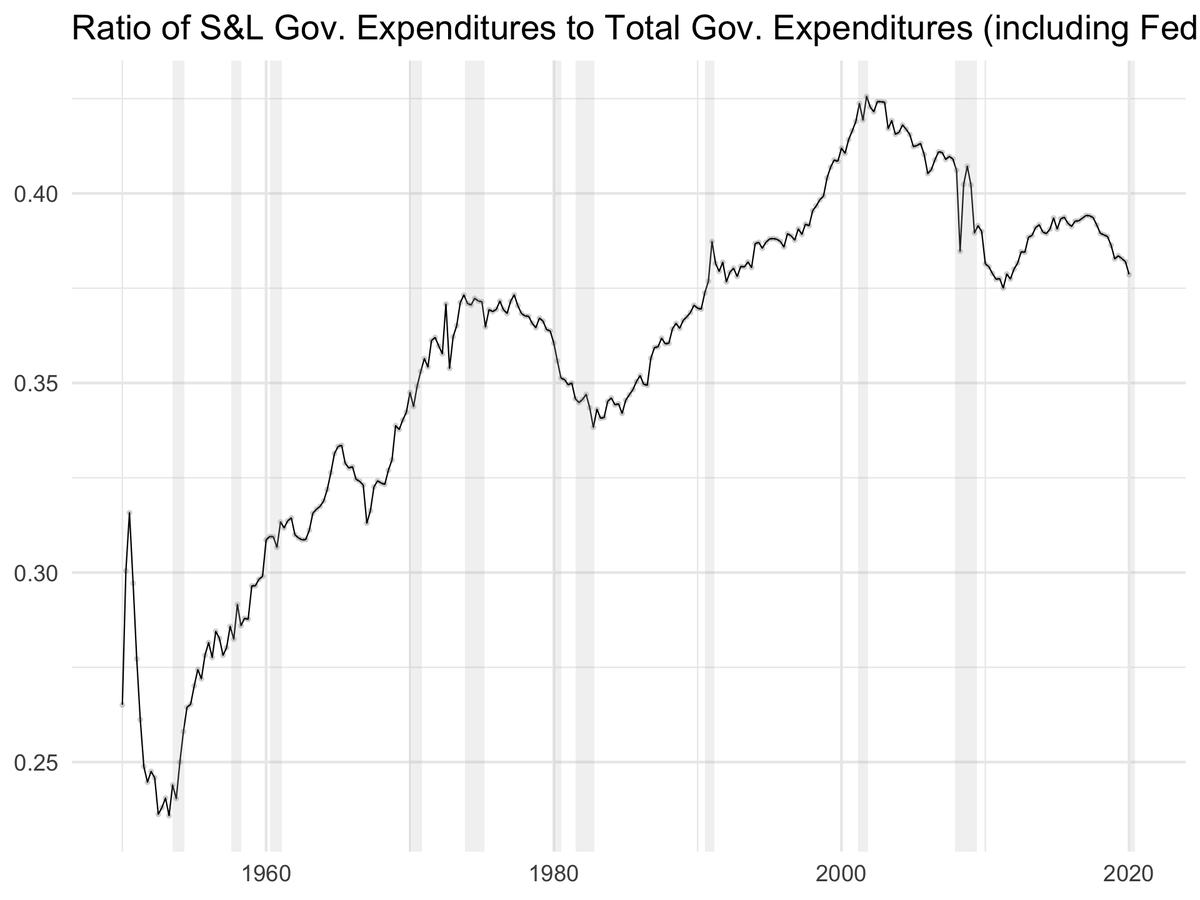

Balanced budgets constrain government spending to be procyclical. This was less of an issue when state and local was a smaller share of total gov spending. Today S&L are around 37%.

Takeaways:

State and local governments are in trouble. Things will be much worse in the coming fiscal year when planned expenditures have to match anticipated revenues. More "bailouts" from the federal government could help maintain vital public services.

State and local governments are in trouble. Things will be much worse in the coming fiscal year when planned expenditures have to match anticipated revenues. More "bailouts" from the federal government could help maintain vital public services.

Full paper here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3651605

Read on Twitter

Read on Twitter