Quick observations for fintech businesses/digital banks from financial results of Monzo, Revolut & Starling

Lesson 1: LENDING HURTS. Starling earned 2.1m from interest but has 2.2m in bad loans. Monzo has an even riskier loan portfolio.

Thread

Lesson 1: LENDING HURTS. Starling earned 2.1m from interest but has 2.2m in bad loans. Monzo has an even riskier loan portfolio.

Thread

Lesson 2: card transaction fees still makes up a large portion of the models for the 3 digital banks - about 63% of income for Revolution, 55% for Monzo & 45% for Starling.

So earnings are not so diversified as card transactions fees is main earner. This is a major income risk.

So earnings are not so diversified as card transactions fees is main earner. This is a major income risk.

Lesson 3: The Starling model of having a marketplace for vendors to sell their services doesn’t seem to be yielding great results. Starling only got a commission of £72,000 for period.

If the model is going to survive, volumes have to go up for commission to be worth it.

If the model is going to survive, volumes have to go up for commission to be worth it.

Lesson 4: Earning per customer is rather low.

When you divide earnings by customer - Monzo earned £20 per customer for the year, Revolution earned £24 and starling earned £21.

In some cases (eg. Revolut) the cost of running the accounts is more than amount earned from customer

When you divide earnings by customer - Monzo earned £20 per customer for the year, Revolution earned £24 and starling earned £21.

In some cases (eg. Revolut) the cost of running the accounts is more than amount earned from customer

Lesson 5: Customers’ deposits still very low. Collectively, 3 banks held about £4.8b in deposits. Compare that to 2018 levels of Barclays (£197 billion) or RBS (£184 billion). Virgin Money, a similar bank, has £64b in deposit.Average deposit for Resolut per customer stood at £236

Lesson 6: Burn rate is highhhhhhh!

Pursuing a growth model and trying best to acquire new customers, mean a high customer acquisition cost.

So, making 20 to 30 pounds a year on customer while spending several times over to maintain accounts.

Pursuing a growth model and trying best to acquire new customers, mean a high customer acquisition cost.

So, making 20 to 30 pounds a year on customer while spending several times over to maintain accounts.

Lesson 7: This issue of valuation.

In words of @LexSokolin, “If you look at the unicorn valuations of these companies, they are pricing on a per user basis valuation somewhere like $1,000…the reality is all of these companies are making 20 to 30 bucks a year per customer...”

In words of @LexSokolin, “If you look at the unicorn valuations of these companies, they are pricing on a per user basis valuation somewhere like $1,000…the reality is all of these companies are making 20 to 30 bucks a year per customer...”

The unit economies don’t tally with their present valuations. £30 pounds a year in customers revenue is hard to use to justify £1,000 per customer in enterprise revenue.

Time will answer on questions.

Time will answer on questions.

If you want to read in more details, @Siftedeu has a great article on this.

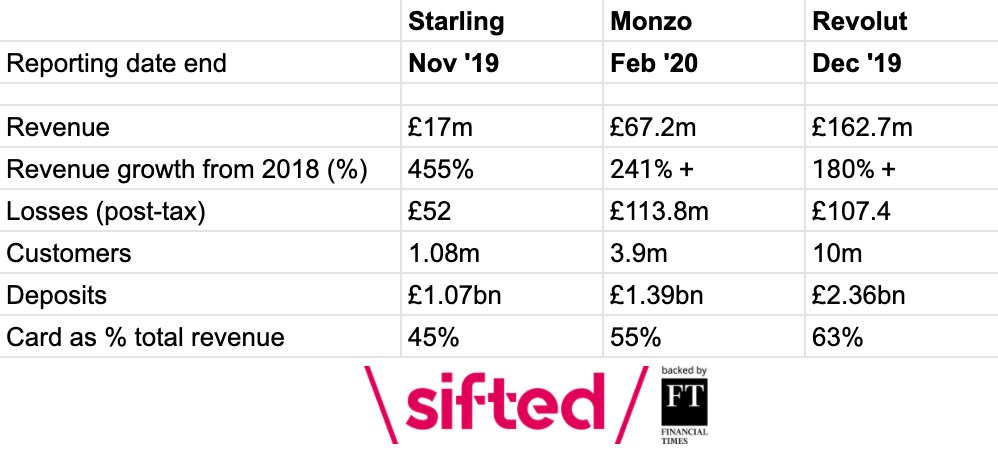

Also, see this summary chart from them on the 3 banks:

Also, see this summary chart from them on the 3 banks:

Read on Twitter

Read on Twitter