1/ In their 2019 paper, Complexity Investing, NZS suggests that, “products, services…can be optimized for RESILIENCE…cash generative businesses that...fund a series of OPTIONAL investments…”

Thermo Fisher, $TMO, epitomizes this strategy

https://static1.squarespace.com/static/5ca38f3216b6405d11e3d4b4/t/5cd77067c830251ea8301574/1557622902586/ComplexityInvesting_9.1.8_Aug19-1.pdf

@bradsling

Thermo Fisher, $TMO, epitomizes this strategy

https://static1.squarespace.com/static/5ca38f3216b6405d11e3d4b4/t/5cd77067c830251ea8301574/1557622902586/ComplexityInvesting_9.1.8_Aug19-1.pdf

@bradsling

2/ TMO uses cash generated from their resilient businesses, laboratory equipment, supplies and services as well as diagnostic instruments, and through a systemic M&A program, buys high optionality businesses serving the pharmaceutical industry

https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/taking-a-longer-term-look-at-m-and-a-value-creation

https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/taking-a-longer-term-look-at-m-and-a-value-creation

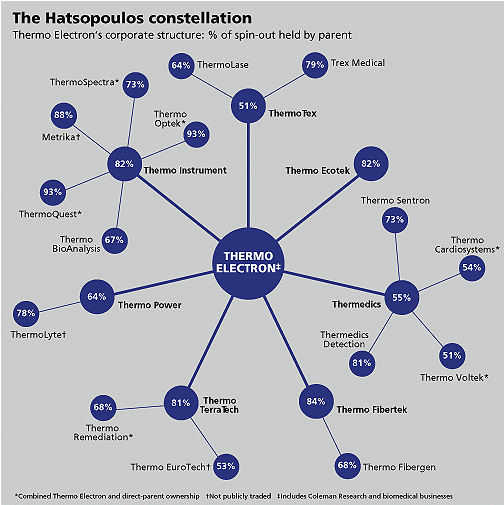

3/ The Company’s lineage begins with Fisher Scientific in 1902 and separately, Thermo Electron in 1956

By January 2004, Thermo finished simplifying their corporate structure, buying out minority shareholders of 22 subsidiaries spun out in the 1990s and divesting non-core assets

By January 2004, Thermo finished simplifying their corporate structure, buying out minority shareholders of 22 subsidiaries spun out in the 1990s and divesting non-core assets

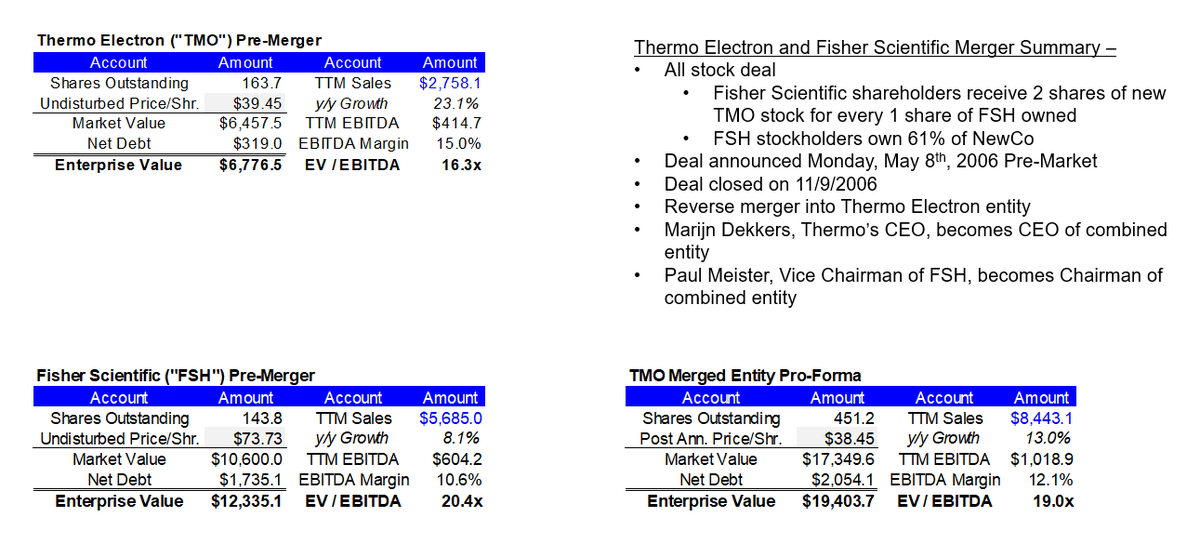

4/ On 11/9/2006, the businesses merged to form TMO in an all stock deal with Fisher shareholders owning 61% of the combined entity

TMO operated two segments; Analytical Instruments and Laboratory Products and Services

Thermo’s CEO, Marijn Dekkers became CEO of Thermo Fisher

TMO operated two segments; Analytical Instruments and Laboratory Products and Services

Thermo’s CEO, Marijn Dekkers became CEO of Thermo Fisher

5/ Dekkers resigned in late 2009 to become CEO of Bayer. TMO promoted their 41-year-old COO, Marc Casper, to CEO

Casper joined Thermo as an SVP in 2006 following their acquisition of Kendro, a $200mm revenues / year business he lead as CEO https://www.newtownbee.com/kendro-laboratory-products-names-marc-n-casper-president-and-ceo/

Casper joined Thermo as an SVP in 2006 following their acquisition of Kendro, a $200mm revenues / year business he lead as CEO https://www.newtownbee.com/kendro-laboratory-products-names-marc-n-casper-president-and-ceo/

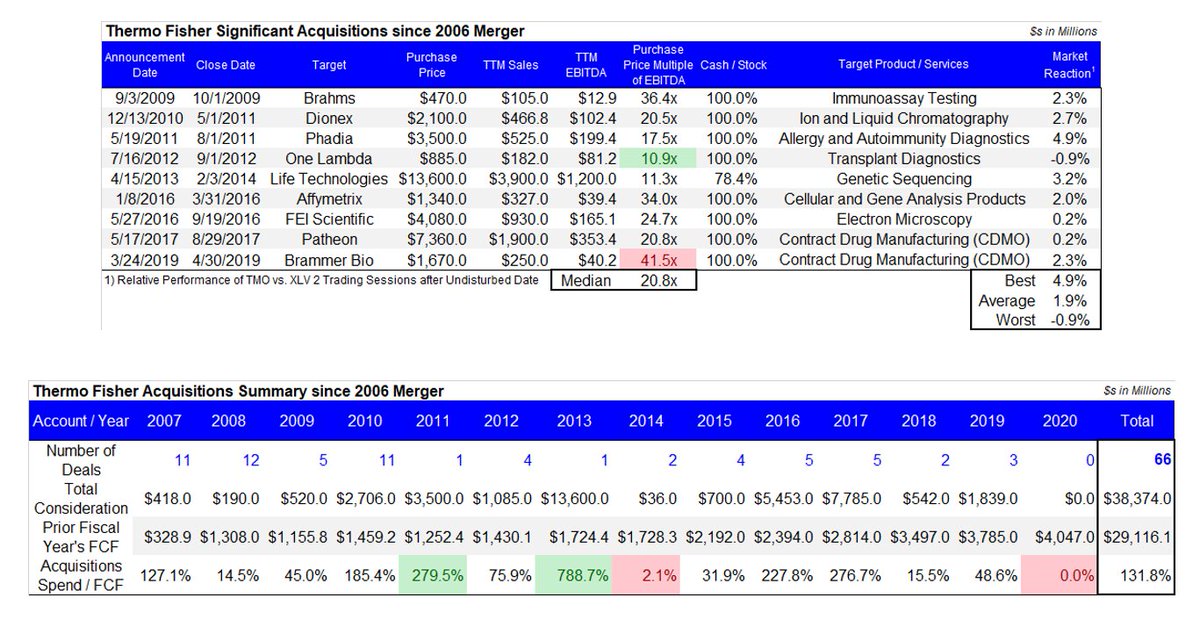

6/ Under Casper’s leadership, The Company has spent 1.3x their FCF on 66 deals, adding $10.1B in sales and $2.6B in EBITDA

In that time, TMO’s stock annualized total returns have outperformed the S&P 500 and its Health Care Segment, XLV, by 11.5% and 9.7% respectively

In that time, TMO’s stock annualized total returns have outperformed the S&P 500 and its Health Care Segment, XLV, by 11.5% and 9.7% respectively

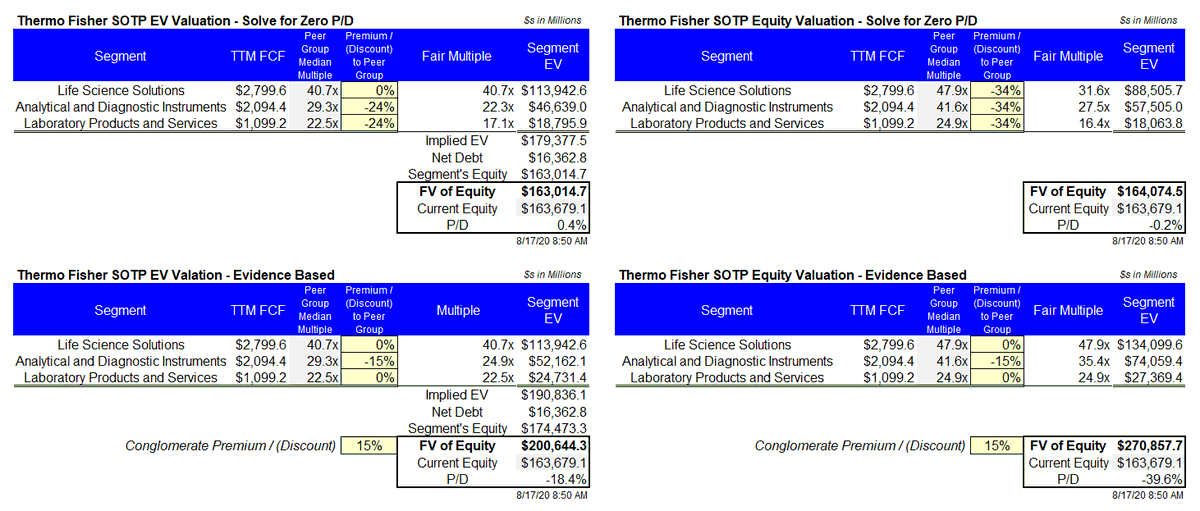

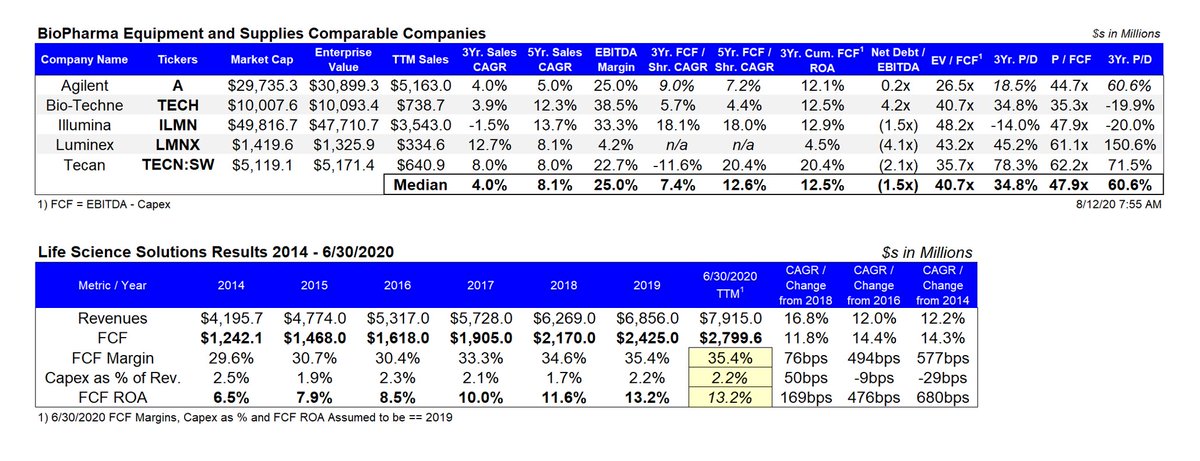

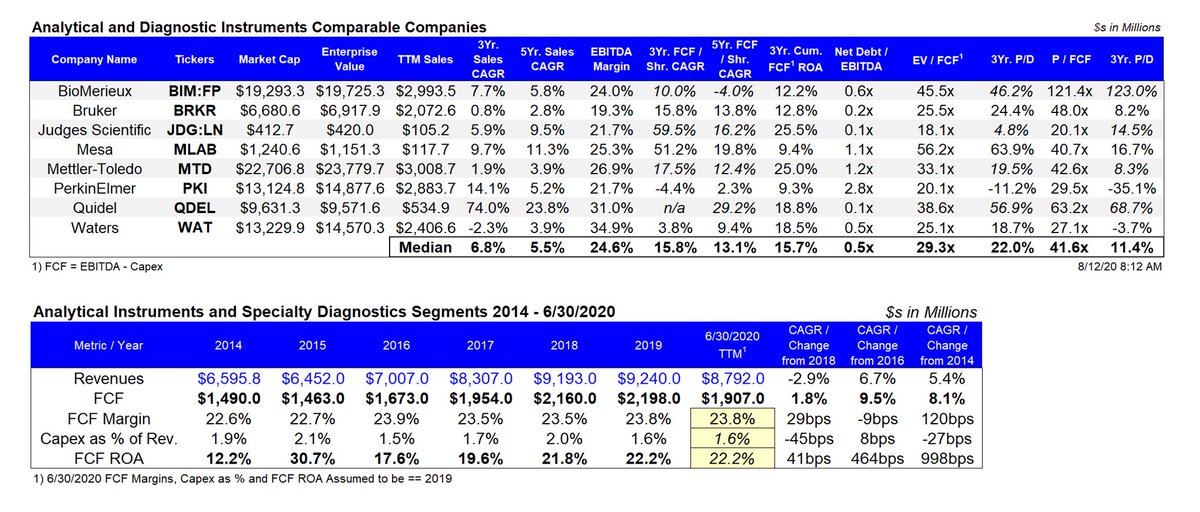

7/ Valuing each segment separately using publicly traded pure-play comparable companies, TMO’s EV is cheap and their equity even cheaper where the stats do not justify a discount

Their track record of value creation deserves a conglomerate premium on top of the segment's values

Their track record of value creation deserves a conglomerate premium on top of the segment's values

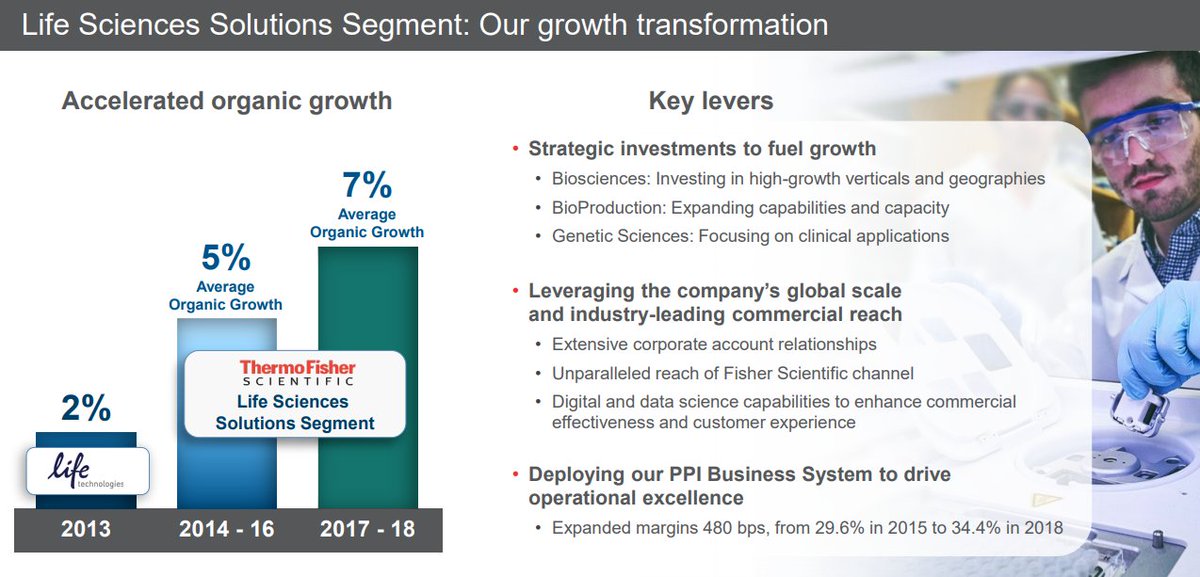

8 / TMO’s Life Science Solutions Segments (LSS) generated $2.8B in FCF last year and is The Company’s most valuable collection of businesses

LSS Segment Sales, FCF and FCF ROA all compare favorably to their peer group

LSS Segment Sales, FCF and FCF ROA all compare favorably to their peer group

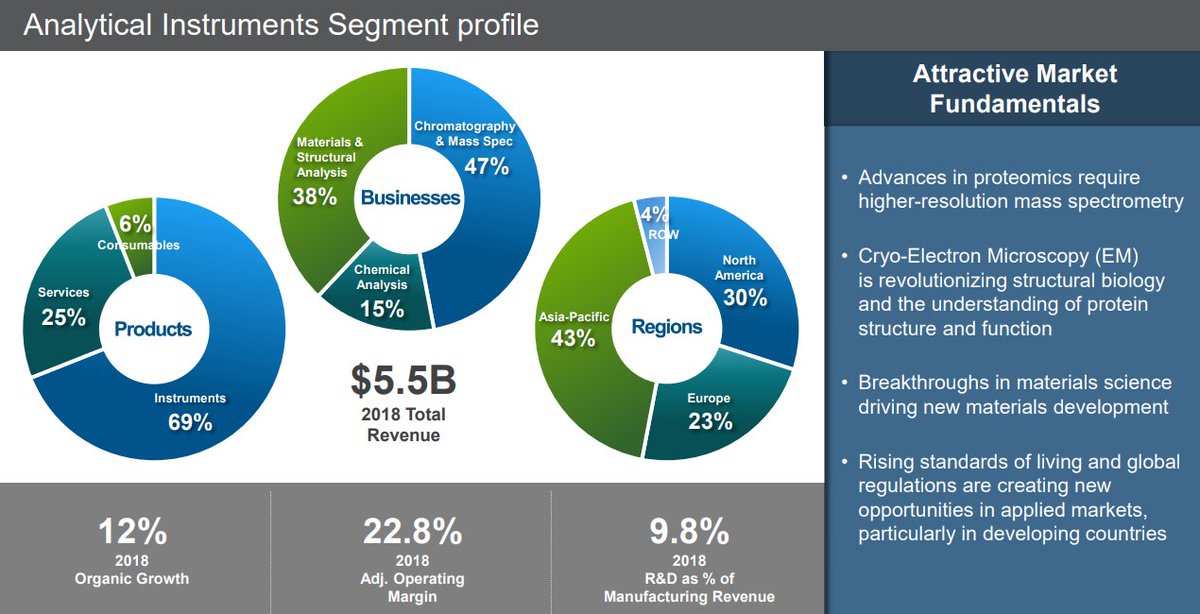

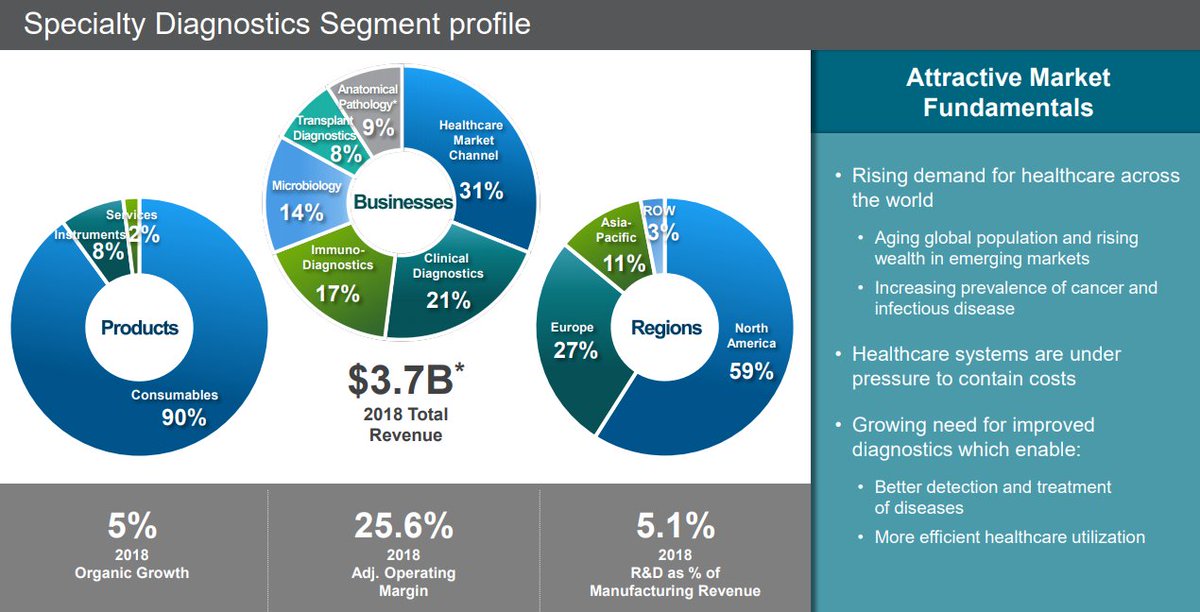

9/ TMO’s Analytical Instruments and Specialty Diagnostics Segments have similar margin profiles, 23-24%, and capex needs, 1-2% of sales annually

The Segments combined 8.1% 5Yr. FCF CAGRs is nearly ½ that of their peer group and so deserves a discounted valuation

The Segments combined 8.1% 5Yr. FCF CAGRs is nearly ½ that of their peer group and so deserves a discounted valuation

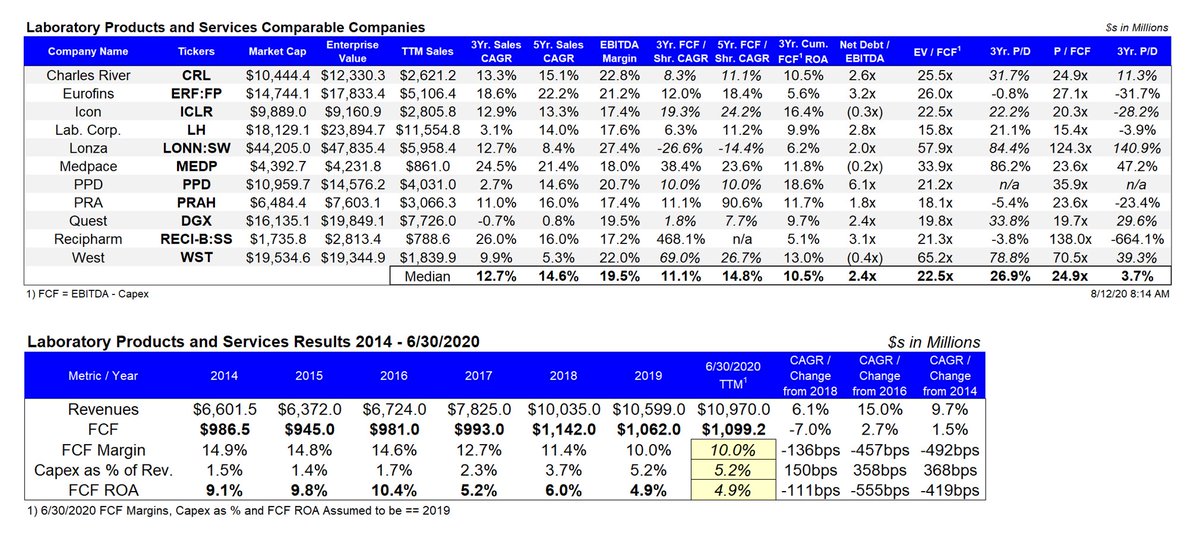

10 / The Laboratory Products and Services Segment masks TMO’s contract drug manufacturing business (CDMO) a market growing ~25% annually

Lonza is a pure-play CDMO and trades for 59.7x FCF, in contrast to mid 20s multiples for diagnostics businesses and CROs

Lonza is a pure-play CDMO and trades for 59.7x FCF, in contrast to mid 20s multiples for diagnostics businesses and CROs

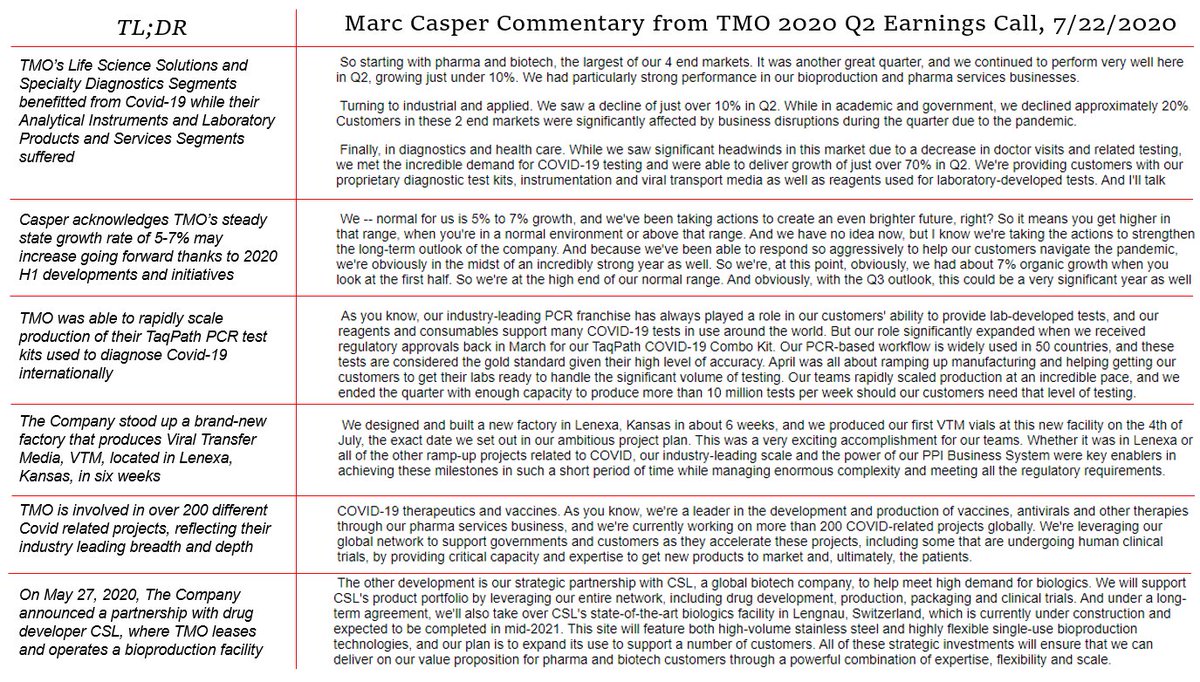

11/ Covid-19 has generated significant demand for TMO’s PCR tests as well as their cross-segment offerings supporting vaccine research and development

The Company’s investments and response to the crisis evokes Andy Grove’s quote

https://venturebeat.com/2020/04/23/intel-ceo-bad-companies-are-destroyed-by-crises-great-companies-are-improved-by-them/

The Company’s investments and response to the crisis evokes Andy Grove’s quote

https://venturebeat.com/2020/04/23/intel-ceo-bad-companies-are-destroyed-by-crises-great-companies-are-improved-by-them/

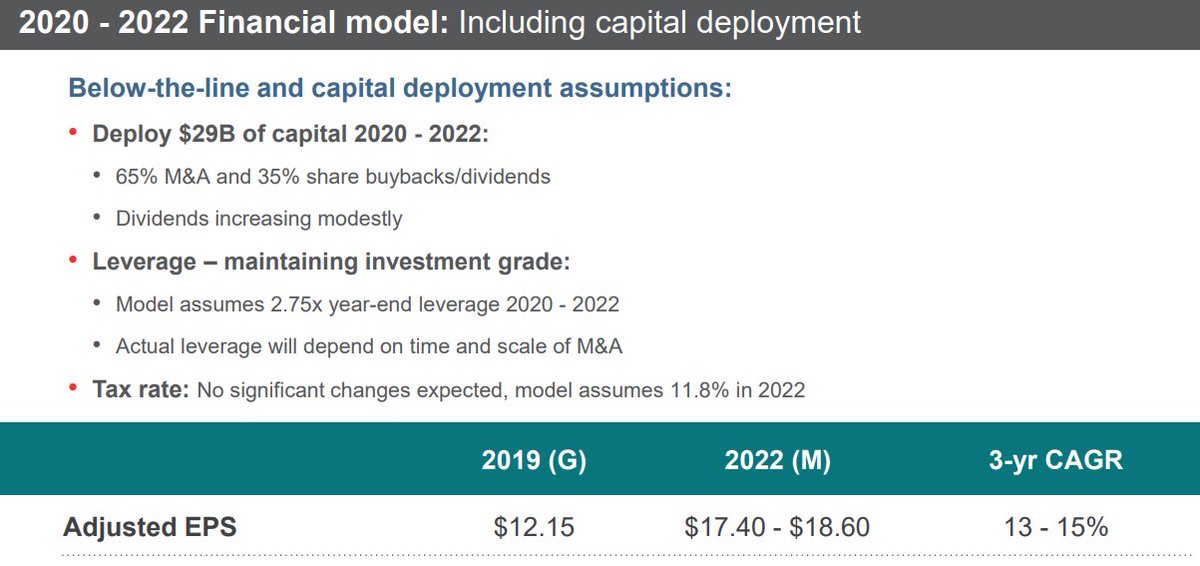

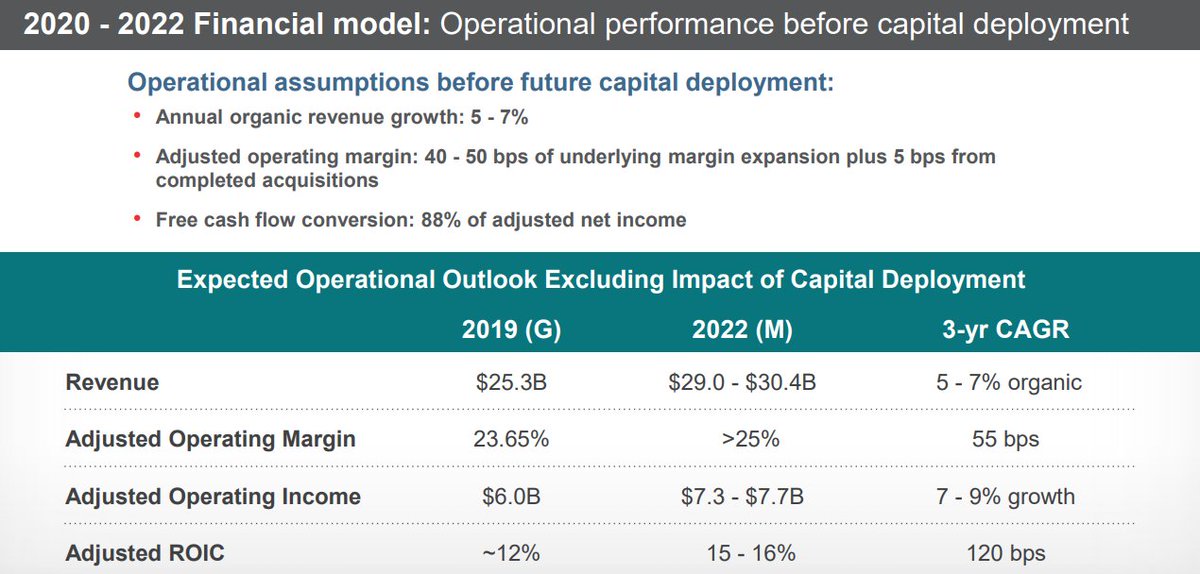

12/ TMO expects to 65% of FCF on M&A over the next three years, significantly less than the 1.3x FCF they used over the last decade

Their failed Gatan and Qiagen bids evidence hurdles The Company will face due to their size

https://www.prnewswire.com/news-releases/thermo-fisher-scientific-and-roper-technologies-announce-termination-of-gatan-acquisition-300864264.html

https://www.reuters.com/article/us-qiagen-m-a-thermo-fisher/thermo-fisher-terminates-deal-for-genetic-testing-firm-qiagen-idUSKCN2591P3

Their failed Gatan and Qiagen bids evidence hurdles The Company will face due to their size

https://www.prnewswire.com/news-releases/thermo-fisher-scientific-and-roper-technologies-announce-termination-of-gatan-acquisition-300864264.html

https://www.reuters.com/article/us-qiagen-m-a-thermo-fisher/thermo-fisher-terminates-deal-for-genetic-testing-firm-qiagen-idUSKCN2591P3

13/ TMO is a conglomerate of best in breed businesses that together form a juggernaut with strong future prospects powering health care and pharma industries

Valuation is reasonable and management is long-tenured, heavily invested, owning ~$733mm of stock and very capable

Valuation is reasonable and management is long-tenured, heavily invested, owning ~$733mm of stock and very capable

Read on Twitter

Read on Twitter