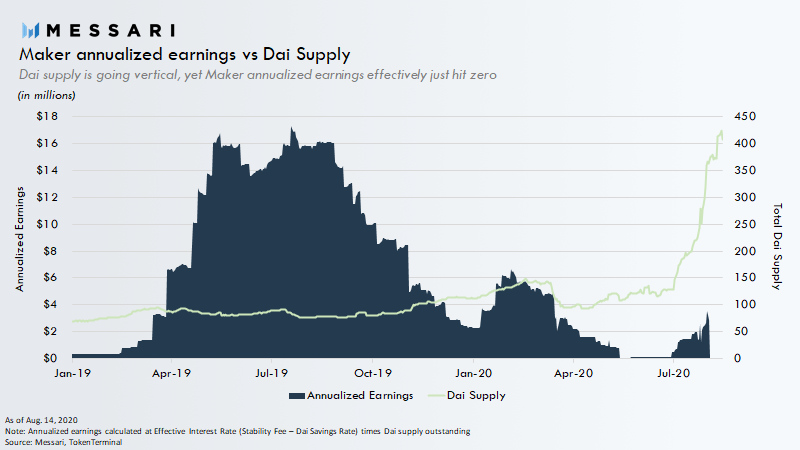

While Dai's supply is going parabolic, Maker's annualized earnings effectively just hit zero.

Interest rates can't get up and MKR holders aren't being compensated at all for their crucial role in managing and backstopping the MakerDAO system.

1/

Interest rates can't get up and MKR holders aren't being compensated at all for their crucial role in managing and backstopping the MakerDAO system.

1/

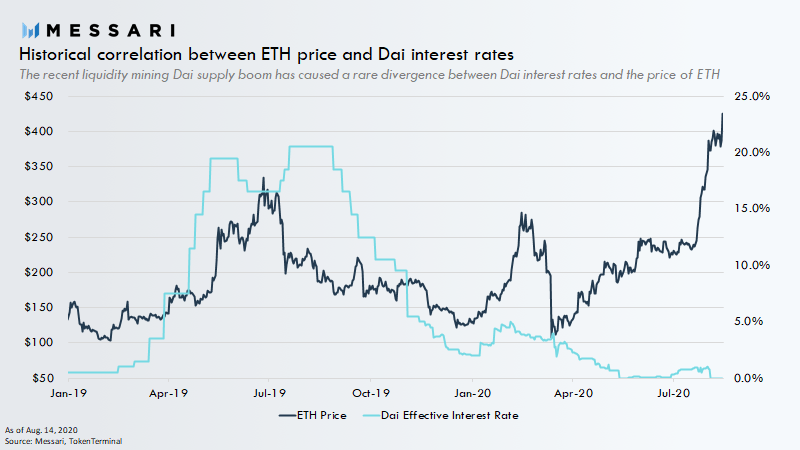

Historically, the largest driver of Dai interest rates has been the price of ETH.

Bullish = leverage

leverage

Bearish = deleverage

deleverage

However, Dai now finds itself in an unprecedented position where demand for leverage is skyrocketing while interest rates are plummeting.

Bullish =

leverage

leverageBearish =

deleverage

deleverageHowever, Dai now finds itself in an unprecedented position where demand for leverage is skyrocketing while interest rates are plummeting.

The critical question for MKR investors has now become: Is this divergence temporary or has the historical relationship between ETH prices and Dai interest rates been severed?

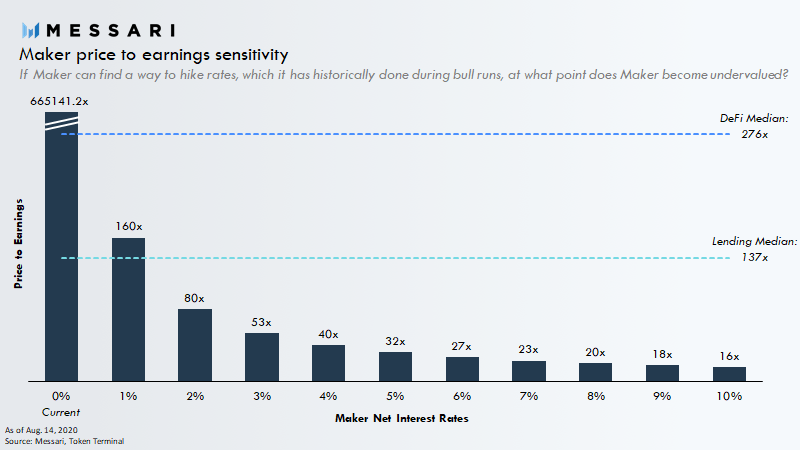

And if MKR can get rates up what's the opportunity?

And if MKR can get rates up what's the opportunity?

At Dai’s current supply of $407 million, it wouldn’t take a big interest rate increase before MKR is priced substantially below its peers.

DeFi protocols trade at a median 276x earnings, while lending vertical specifically trades at 137x.

DeFi protocols trade at a median 276x earnings, while lending vertical specifically trades at 137x.

Is Maker worth the bet that interest rates will rise?

Is Maker too fundamentally challenged to be worth it?

Or are there just more attractive risk / reward opportunities elsewhere? https://messari.io/article/an-opportunity-for-maker

Is Maker too fundamentally challenged to be worth it?

Or are there just more attractive risk / reward opportunities elsewhere? https://messari.io/article/an-opportunity-for-maker

Read on Twitter

Read on Twitter