I've just analyzed all the @AaveAave liquidation events.

There are 1629 *non-zero* liquidation events with ~$41.47M in value

Total liquidations over time looks like this

More details in the THREAD

There are 1629 *non-zero* liquidation events with ~$41.47M in value

Total liquidations over time looks like this

More details in the THREAD

There are 278 unique liquidators, and the liquidation events are very competitive.

Top 10 liquidators account for 90.89% of the total liquidated amount (~$37.7M) in 880 liquidation events

Even though you can liquidate your position, this has only happened once

Top 10 liquidators account for 90.89% of the total liquidated amount (~$37.7M) in 880 liquidation events

Even though you can liquidate your position, this has only happened once

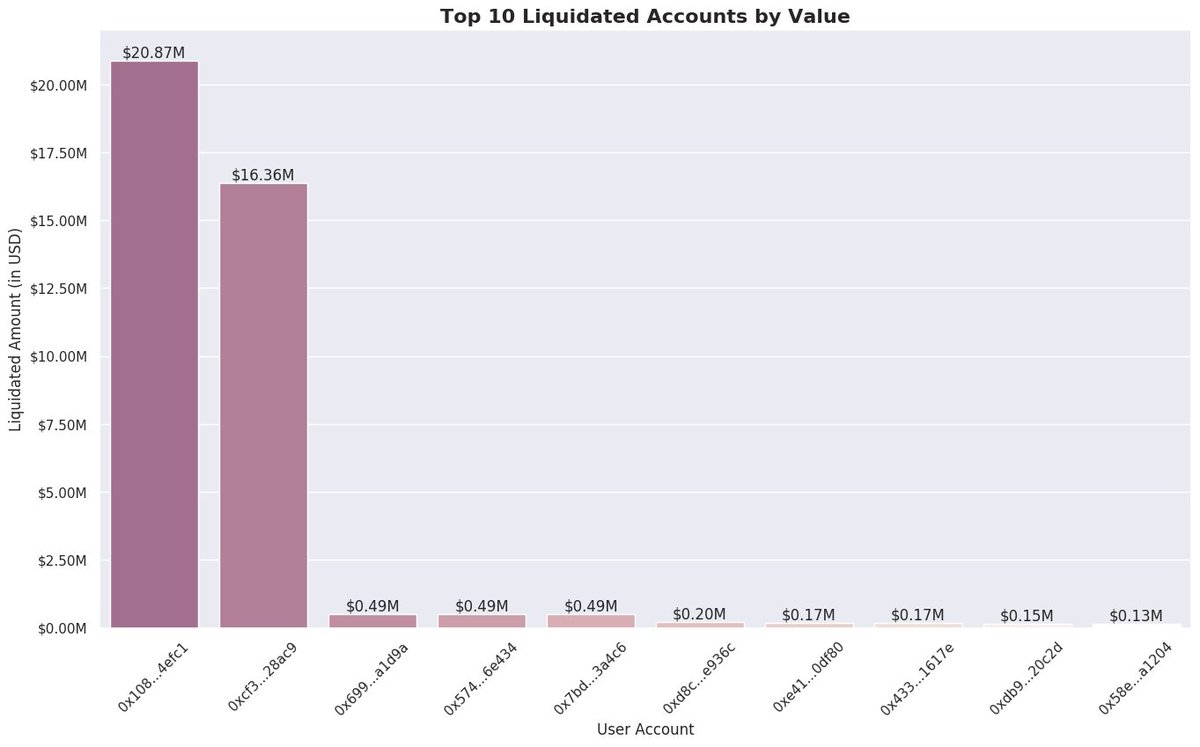

Total number of liquidated accounts amount to 359

Out of all the liquidated account, top 2 accounts represent 89.77% (~$37.23M) of total value liquidated.

Top 10 accounts represent 95.31% of the total

Out of all the liquidated account, top 2 accounts represent 89.77% (~$37.23M) of total value liquidated.

Top 10 accounts represent 95.31% of the total

ETH has been liquidated the most, followed by USDC, LINK, DAI & LEND

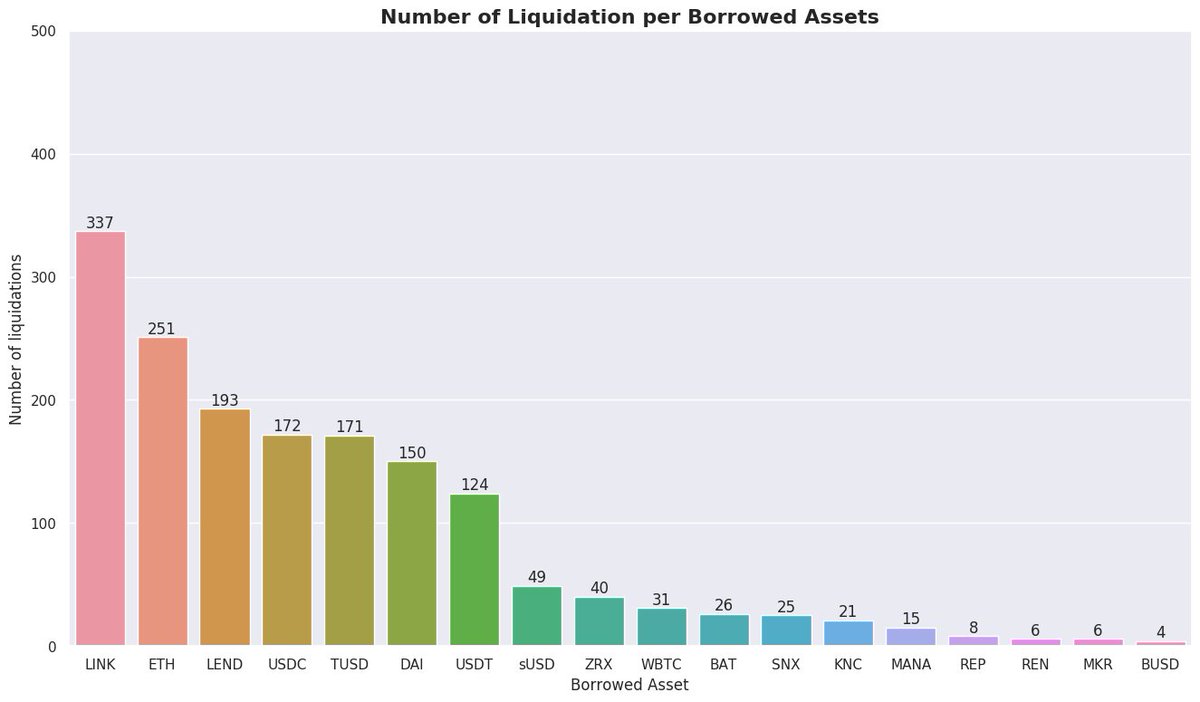

LINK is the most borrowed asset in which liquidation happens, followed by ETH, LEND & USDC

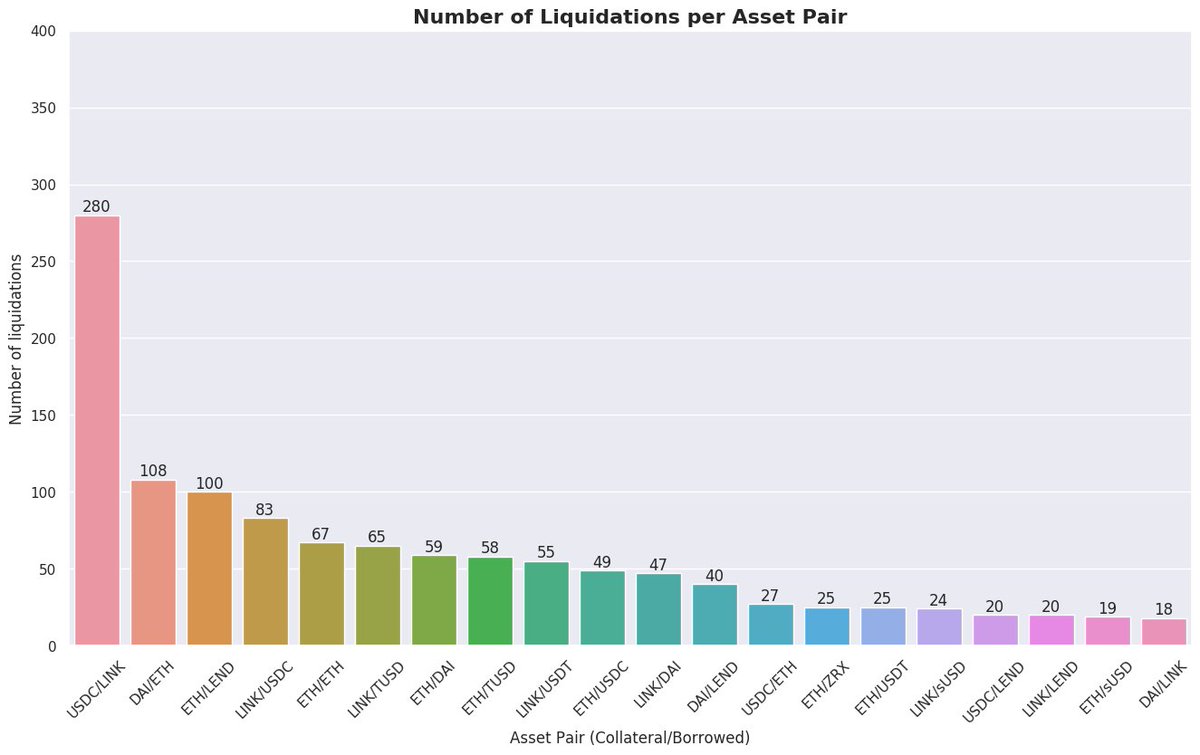

Pairwise it's USDC/LINK, DAI/ETH, ETH/LEND & LINK/USDC.

Pair is in Collateral/Borrowed form

LINK is the most borrowed asset in which liquidation happens, followed by ETH, LEND & USDC

Pairwise it's USDC/LINK, DAI/ETH, ETH/LEND & LINK/USDC.

Pair is in Collateral/Borrowed form

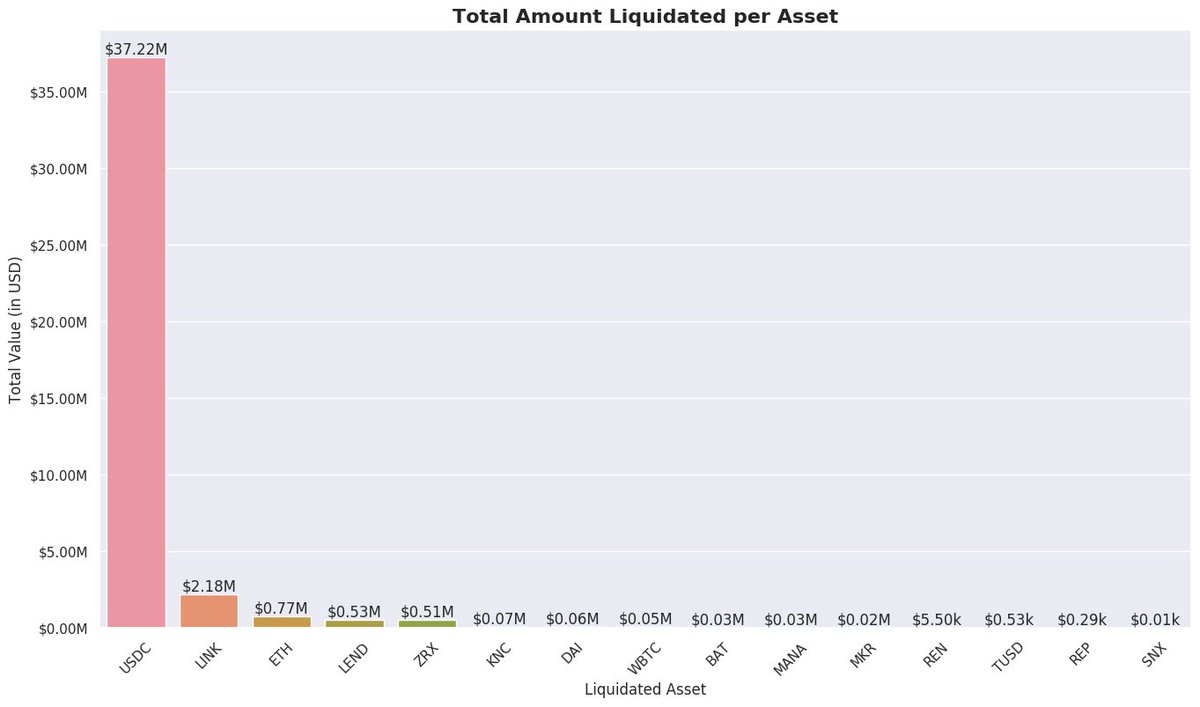

Amount wise, most liquidations happened to:

USDC - $37.22M (89.75%)

LINK - $2.18M (5.25%)

ETH - $0.77M (1.85%)

USDC - $37.22M (89.75%)

LINK - $2.18M (5.25%)

ETH - $0.77M (1.85%)

In Asset Pairs, it is as follows:

USDC/LINK - $37.13M (89.53%)

LINK/USDC - $0.93M (2.2%)

LINK/TUSD - $0.66M (1.59%)

(Figure only shows top 10 asset pairs)

USDC/LINK - $37.13M (89.53%)

LINK/USDC - $0.93M (2.2%)

LINK/TUSD - $0.66M (1.59%)

(Figure only shows top 10 asset pairs)

LINK as borrowed asset accounts for 75.38% of total liquidation in value followed by USDC (2.1%), TUSD (1.73%) & USDT (1.47%)

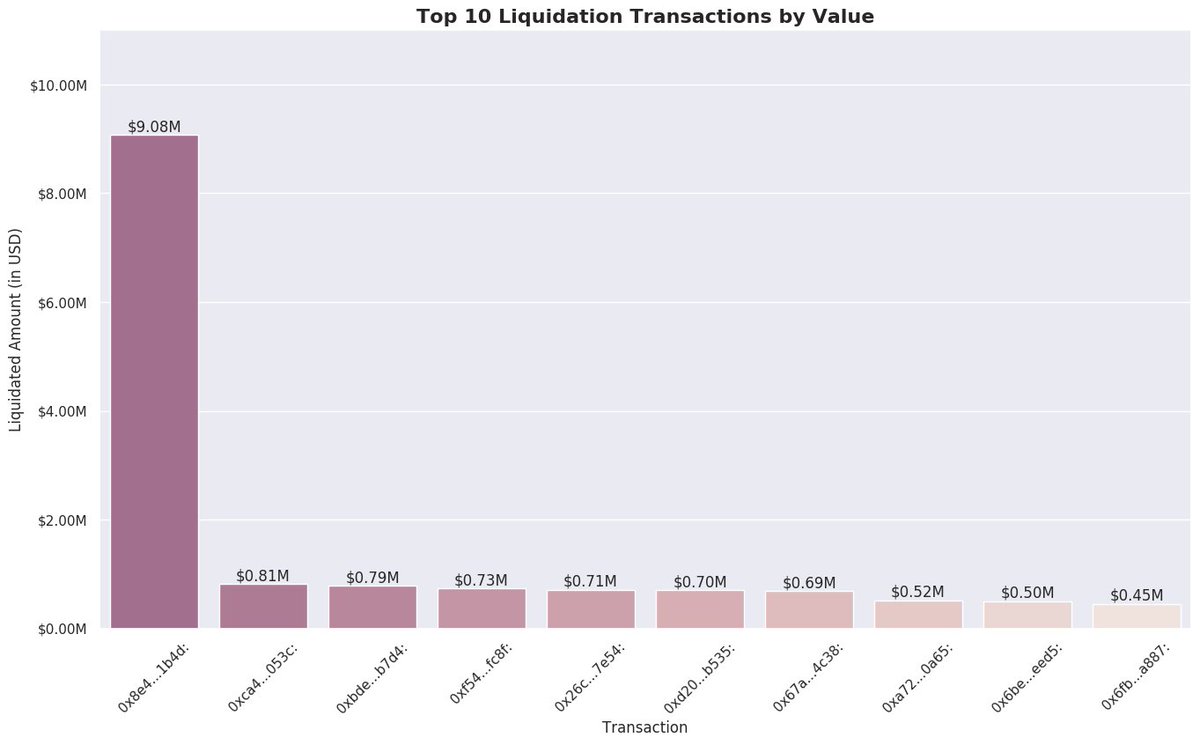

Biggest liquidation event is worth $9.08M (USDC/LINK). This is that transaction https://etherscan.io/tx/0x8e49050106d70b7ffbdf74477edc8195a45590051d53a5138c0d236f616b1b4d

Second biggest is only worth $0.81M

Second biggest is only worth $0.81M

There are more details in the Jupyter Notebook worked on, which can be found here - https://github.com/mubaris/aave_liquidations

Feel free to check it out

Thanks for reading

Special thanks to @graphprotocol for making on-chain data easily available and @coingecko for historic price APIs

Feel free to check it out

Thanks for reading

Special thanks to @graphprotocol for making on-chain data easily available and @coingecko for historic price APIs

Read on Twitter

Read on Twitter