The Fed has quietly purchased a solid amount of bank debt.

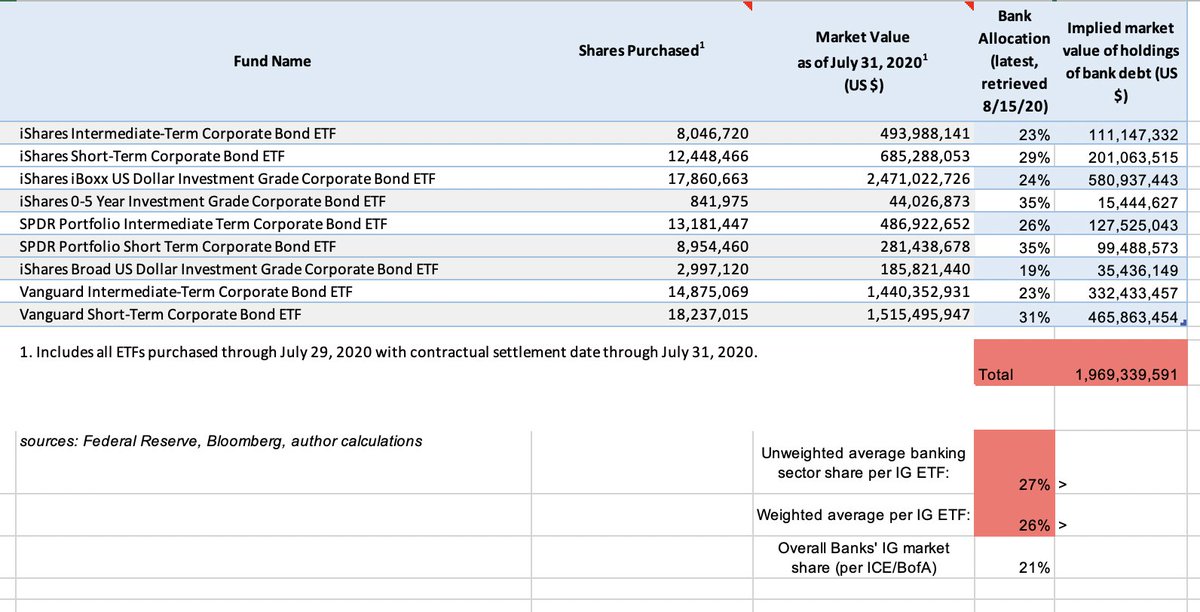

Despite specifically excluding banks from its corporate bond purchase programs, by including ETFs, the Fed has indirectly bought bank debt to the tune of ~$2 billion, more than 15% of its purchases. (1/x)

Despite specifically excluding banks from its corporate bond purchase programs, by including ETFs, the Fed has indirectly bought bank debt to the tune of ~$2 billion, more than 15% of its purchases. (1/x)

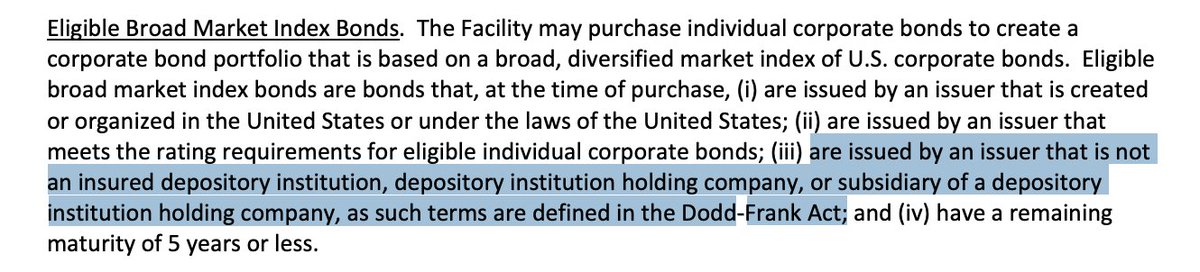

The Fed explicitly excluded banks from its otherwise-diversified corporate bond purchases (while I have some guesses, I'm not sure why?): https://www.federalreserve.gov/monetarypolicy/smccf.htm

Yet, in each of the investment-grade ETFs the Fed purchased, banks were the largest sector.

This should not come as a surprise; banks make up a large portion of the IG credit market (see ICE/BofA row below).

However, the ETFs were—by this measure—slightly overweight banks:

This should not come as a surprise; banks make up a large portion of the IG credit market (see ICE/BofA row below).

However, the ETFs were—by this measure—slightly overweight banks:

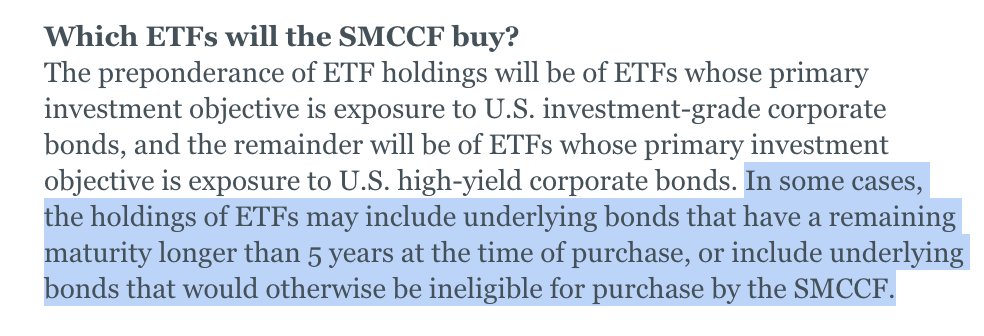

While the Fed noted that "in some cases" bonds underlying purchased ETFs may not otherwise conform to its terms for buying bonds, the result here is that bank debt—despite the Fed noting its specific prohibition—has made up upwards of 15% of the Fed's corporate bond purchases.

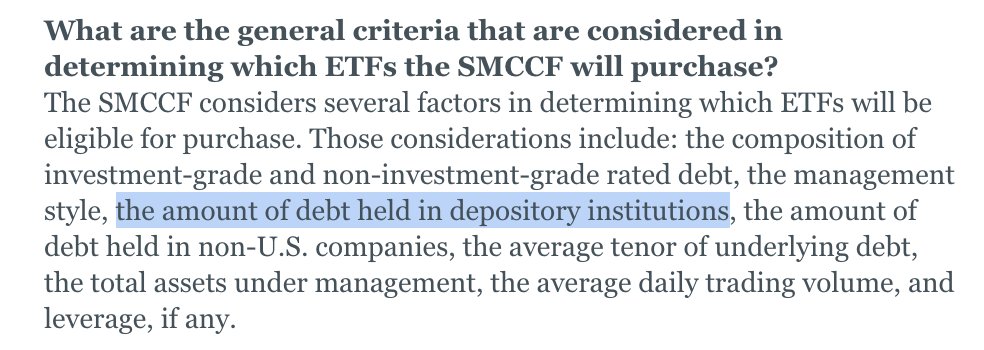

Important to note here too that the Fed explicitly mentions that, when deciding which ETFs to purchase, it will consider the share invested in banks, which seems inconsistent with three of the nine IG funds holding ~30% banks:

Some of these holdings are technically "bail-in-able" debt—to be written off/converted to equity when a bank fails.

But, given the Fed holdings are thru ETFs, it would not become a direct holder of bank equity.

There is also a bit more bank debt held via high-yield ETF.

(6/6)

But, given the Fed holdings are thru ETFs, it would not become a direct holder of bank equity.

There is also a bit more bank debt held via high-yield ETF.

(6/6)

Read on Twitter

Read on Twitter