Based on everyone’s interest on saving/investing, I’ve decided to make a thread of quick, beginner tips that anyone (young/old) can take advantage of. It’s important to have multiple channels of income in your progress in life, rather than relying on one source forever.

It’s worth noting that it’s always better to manage your portfolio by divvying up your capital into these different buckets to diversify and lower the risk of losing, instead of betting all your money on one horse.

Disclaimer: no returns on your money is ever “guaranteed”. All methods carry their own risk-return dynamics, and you are free to research, learn and educate yourself on these instruments. Investopedia and some YouTube can help a newcomer navigate these waters.

1. Savings accounts. Conventional or Islamic savings account can be setup in every bank in the UAE. The cash you earn can be deposited into these accounts and you can earn a fixed x% back every year (ranging 0.25%-2%). Some require a minimum balance to open an account.

1. This is typically considered a safe and reliable option for parking your cash and earning a modest return, instead of cash sitting idly. Ideally, a big part of your money should be in these types of “safe” accounts in a later stage of your life to preserve your wealth.

2. Mutual funds. You can access these passive investment funds through your bank or through a broker. A mutual fund is a type of financial vehicle made up of a pool of money from many investors to invest in securities like stocks, bonds, and other assets.

2. They are operated by professional money managers, such as Blackrock and Fidelity, who allocate the assets to produce capital gains (price increases of your share of the fund) or income (annually, semi-annually, quarterly in the form of dividends or coupons).

2. There are many strategies for mutual funds: equities, dividend appreciation, fixed-income, index, etc. Pick a strategy that you are comfortable with and have a long term plan in play. You pay a fee every year in management fees to keep your money invested.

3. Equities. Shareholders’ equity represents the amount of money that would be returned to a company’s shareholders if all of the assets were liquidated or sold, and all of the company’s debt was paid off.

3. Typically, the money you put in as shares (units of your ownership) are used by the company to increase cash in its balance sheet, spend money to expand its operations, additional research & development costs, pay off debt, etc.

3. The return to the investor comes in the form of capital gains of each share, and/or dividends (profits of the company that can be given out to shareholders) paid every year, if the company is profitable.

3. The risk here has a very wide range, and careful consideration of the company’s financial health and forward looking (forecasted) growth is essential. Risk in equities is compensated with greater rewards to your capital vs. a savings account/mutual fund.

3. You can do this by either opening an account with ADX through Smartpass to access the local market or open an account with Interactive Brokers/Saxo Bank to invest in global shares and other instruments of your liking.

4. ETFs. An exchange traded fund (ETF) is a type of security that involves a collection of securities - such as stocks- that often tracks an underlying index (like the S&P 500 that tracks US companies with the highest market capitalization).

4. They are very similar to mutual funds, but they are listed on exchanges and can be accessed by yourself through Interactive Brokers/Saxo bank. ETFs offer low expense ratios and fewer broker commissions than buying the stocks or the index individually.

4. There exists an ETF for anything: from VOO (Vanguard S&P 500 ETF) which tracks the S&P 500 index to HERO which tracks companies in the video game and esports industry. ETFs offer more diversification and cheaper entry points than individual stocks.

5. Real Estate. Real, hard assets that can be offices, residential, commercial/retail, logistics, industrial, etc. Considered to be a stable source of income, you can earn a rental income from your tenants every year in exchange for their use of the space.

5. Short term leases have higher yields to compensate the shorter contract life, and long term leases have relatively lower yields but a longer life contract to give you an ease of mind. These require larger amounts of your capital (money) to dish out and buy the properties.

5. Retail investors who are starting with a smaller pool of capital can buy REITs instead to have the same exposure to the properties, but pay less (explained in the next tweet).

5. Check out http://propertyfinder.ae for properties within the UAE or contact the brokers that list them and inquire about properties elsewhere, as the broker market has a very large network that have insights on availability, pricing, occupancy rates, etc.

6. REITS. A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate.

6. Similar to mutual funds, they make it possible for individual investors to earn dividends from real estate investments as they pool capital from many investors, without having to pay, manage, or finance any properties themselves.

6. Because it’s a company, you buy a share of it to earn the profits. These were setup in the ‘60s to allow everyone to gain exposure to commercial real estate portfolios - something that was only available to wealthy investors.

6. Considered to be more diversified than actual RE, depending on the sector/asset/geographic focus. They also pay almost the entirety of their profits out to shareholders as dividends instead of reinvesting. The yields here range and can go 5% and higher. Recommend IB for this.

7. P2P Lending. This more of a credit/lending type of strategy, similar to the idea of a bank lending money as a loan and earn interest on it.

7. P2P (Peer-to-peer) lending is a form of lending by individual investors to SMEs (small to medium enterprise) that are in need of cash to grow their business or pay off debt that is maturing soon.

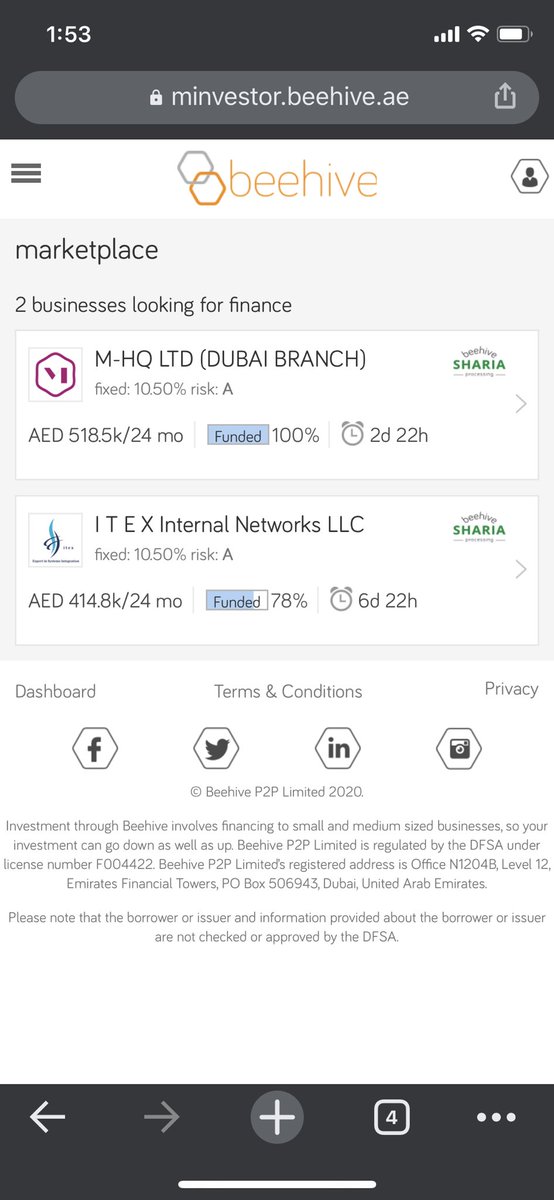

7. Certain organizations, like @beehiveUAE in Dubai, have setup these platforms where investors can pool their capital together and fund businesses in the UAE accordingly. Invoice financing and Working Capital financing are the most common mediums of lending here.

7. Beehive has conventional and sharia compliant lending so everyone can access this platform. Invoice financing involves a receipt, given as collateral/security for the loan, that is payable to the holder after 30-90 days.

7. SMEs require cash today to continue their operations and grow, so they utilize this sort of financing to gain cash now, and give investors/lenders the receipt that entitles them to the cash that will be payable with some interest.

7. Working capital financing is money lent to SMEs to expand their business, but with no invoice as collateral, which is compensated with a higher rate on the loan. Credit ratings go from A (high quality credit) to D (junk-quality credit).

7. The higher the rating, the less the rate on the loan is, as the company is relatively safe and has healthy cashflows to pay back the loan. The lower the rating, the higher the risk but greater the reward through higher rates. Yields go from 7% and higher.

Read on Twitter

Read on Twitter