With the meteoric rise of the athlete-investor, folks often ask me WHAT professional athletes are investing in...

But we don't often talk about WHY they are investing or HOW so many have the capital to invest today.

Let's fix that with a Thread

But we don't often talk about WHY they are investing or HOW so many have the capital to invest today.

Let's fix that with a Thread

1/ It's no secret that private capital into startups & technology businesses has grown rapidly over the past decade

Alongside this rise, we've also witnessed the growing visibility and coverage of the biggest stars in Sport becoming active angel investors & VCs with their money

Alongside this rise, we've also witnessed the growing visibility and coverage of the biggest stars in Sport becoming active angel investors & VCs with their money

2/ This, to be sure, is a relatively recent phenomenon.

Historically, even the biggest stars in their respective Sports had more limited career earnings, compared to counterparts today.

To me, that's still what makes breakouts like Magic, Junior, Roger and Arnold so special

Historically, even the biggest stars in their respective Sports had more limited career earnings, compared to counterparts today.

To me, that's still what makes breakouts like Magic, Junior, Roger and Arnold so special

3/ But the 80s & 90s era of athlete-backed steakhouses has given way to a new generation of Sports stars who (among other assets classes) eagerly invest in Tech

The first WHY is pretty simple: They grew up with it! The athlete-tech investor started first as an athlete-tech user

The first WHY is pretty simple: They grew up with it! The athlete-tech investor started first as an athlete-tech user

4/ While important, it doesn't exactly answer the HOW behind the WHY

To know this, we need to appreciate one of the single biggest structural changes to happen to traditional media in our lifetimes:

The absolute necessity of broadcasters to own rights to Tier 1 sports content.

To know this, we need to appreciate one of the single biggest structural changes to happen to traditional media in our lifetimes:

The absolute necessity of broadcasters to own rights to Tier 1 sports content.

5/ In an asynchronous digital streaming world, there's few shared viewing experiences left. Vast majority of these are live sporting events.

Recognizing value in their content, Leagues have commanded increasingly higher premiums for the rights-- leading to massive revenue growth

Recognizing value in their content, Leagues have commanded increasingly higher premiums for the rights-- leading to massive revenue growth

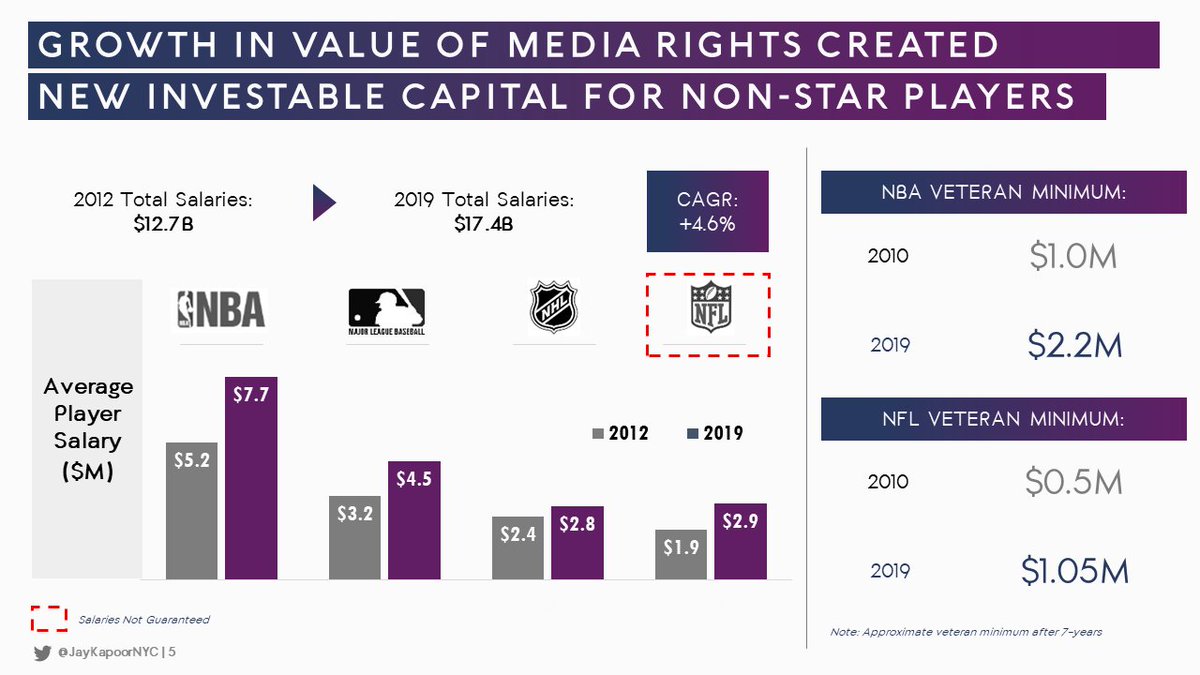

6/ Alongside making billionaire owners even richer, this growth in media rights value has minted many more millionaire players

Thanks to strong negotiation of league minimums, even non-star players now have some investable capital -- something historical counterparts never did

Thanks to strong negotiation of league minimums, even non-star players now have some investable capital -- something historical counterparts never did

7/ But putting it all on media rights would be shortsighted

After all, to build longevity as an investor you need both CAPITAL + ACCESS to deal flow.

That's where savvy athletes took to social media to build their audiences. For some, those audiences incl. founders & Tier 1 VCs

After all, to build longevity as an investor you need both CAPITAL + ACCESS to deal flow.

That's where savvy athletes took to social media to build their audiences. For some, those audiences incl. founders & Tier 1 VCs

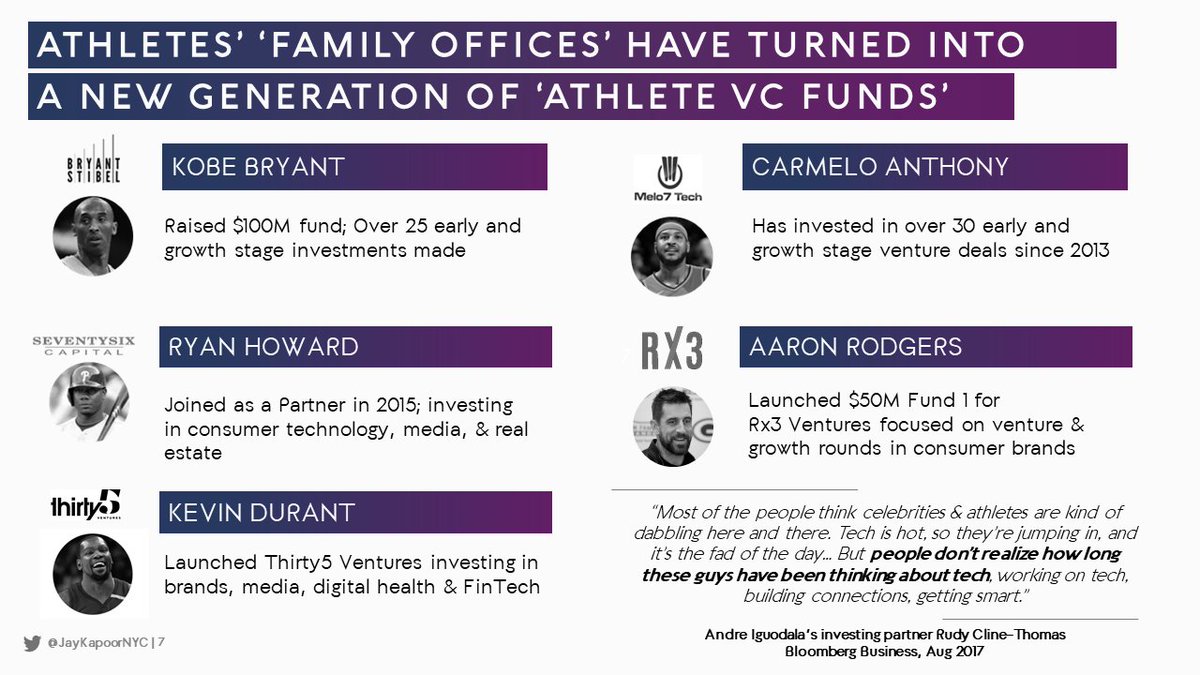

8/ That last piece re: ACCESS can't be stressed enough. It's what separates an athlete's family office from an 'Athlete VC'

Plus, it answers the question some might have about WHY athletes don't just stay as passive LPs

Why pay Mgmt Fees when you've got both capital & access?

Plus, it answers the question some might have about WHY athletes don't just stay as passive LPs

Why pay Mgmt Fees when you've got both capital & access?

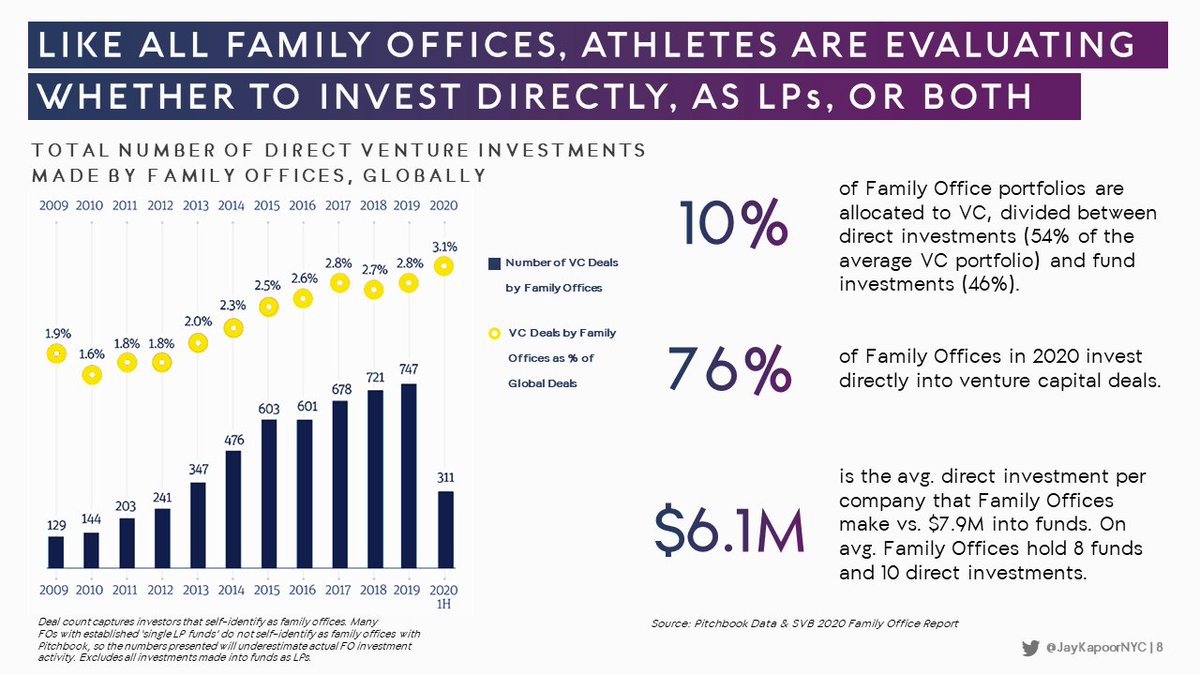

9/ In fact, this isn't a trend restricted to just athletes. All family offices are evaluating how they can invest more directly

Sure they check sizes may be lower but over 76% of family offices invest directly into VC deals, so why should athlete family offices be any different?

Sure they check sizes may be lower but over 76% of family offices invest directly into VC deals, so why should athlete family offices be any different?

10/ Lastly, and I hear it consistently from athletes that join me on @thegameplanshow

WHY athletes invest directly in technology entrepreneurs comes from their clear focus on the impact

Backing women, underrepresented minorities, ESG, etc

Things most VC funds don't do enough.

WHY athletes invest directly in technology entrepreneurs comes from their clear focus on the impact

Backing women, underrepresented minorities, ESG, etc

Things most VC funds don't do enough.

Hope you enjoyed learning about the WHY behind the rise of the athlete investor.

If this topic interests you, please consider subscribing to The Game Plan, a weekly podcast where we interview top athletes about their very own WHYs

28 episodes & counting! https://www.thegameplan.show/

If this topic interests you, please consider subscribing to The Game Plan, a weekly podcast where we interview top athletes about their very own WHYs

28 episodes & counting! https://www.thegameplan.show/

Read on Twitter

Read on Twitter