Today is August 15, the 49th anniversary of the de facto end of Bretton Woods, creating the fiat currency world we know today. Bitcoin’s birthday is October 31, 2008, but it has a spiritual secondary birthday of today — the widespread beginning of fiat money.

Until August 15, 1971, dollars were backed by gold at a fixed rate of $35/ounce. The dollar was the world’s reserve currency, and underpinning this reserve was this gold backing. Any foreign government could convert their dollars to gold.

At least, they could *conceptually* convert dollars to gold. In reality, by 1971, the US was “writing checks” (printing dollars) that the gold vaults couldn’t “cash” (or metal!) — a run on the gold, so to speak, would metallurgically bankrupt the vaults.

Before 1971, there really wasn’t a notion of purely fiat money with floating exchange rates — or at least not one that was taken seriously. The US was the manufacturing center of the world and dollars were the needed, default currency, backed by gold.

Nixon delivered the following speech on August 15th, announcing this change and codifying it with Executive Order 11615, closing the gold window. It never opened again.

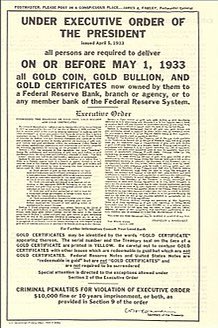

What’s really fascinating is that because gold backed the entire monetary system, owning (non-jewelry) gold was *illegal* from 1933 until 1974. Gold was the settlement ledger for currencies, the true reserve, although the more easily portable/official reserve was the US dollar.

There are many things about a gold standard that make little sense (eg, the supply can increase with a newly discovered mine in South Africa or Russia!) and its inflexibility provides fewer tools for dealing with economic shocks like the Covid one we are dealing with now.

But more so than anything else, gold represented a de facto store of value — and this was *codified* into the financial system until 1971. Seeing as gold now trades at >$2000/ounce, vs $35/ounce in 1971, there’s clearly a divergence between fiat and gold.

And yet gold is: heavy, next to impossible to send around the world (think checks are bad?), hard to divide, and hard to verify. This was NOT a problem before 1971 because the US dollar was none of these things and yet had the backing of/convert ability to gold!

This is why I consider today to be the second birthday of Bitcoin. From 1971-2008, there really wasn’t a financial instrument that had “fixed” dimensions, a reputable store of value but with an easy form of settlement/transmission, which the US dollar until Aug 15 provided.

Given how long it’s been since gold was a reserve currency, and how antiquated gold vaults seem, Bitcoin — for all its flaws — is a logical and superior successor. Particularly given how much money is now being printed by every government, kept in check by...nothing.

Read on Twitter

Read on Twitter