China led the global recovery out of the 2008 crisis and helped power a commodity supercycle. I was curious about if something similar could happen in the wake of COVID.

Learned a few interesting things, a thread for econ nerds (or if you are curious!) (1/16)

Learned a few interesting things, a thread for econ nerds (or if you are curious!) (1/16)

(2/16): A bit of backstory. 2008 was a different time when a rising China was to be accommodated.

The government in response to the crisis cast aside 13% of the GDP - nearly $600B in stimulus spending. Shock and awe measure the extent of which few saw coming

The government in response to the crisis cast aside 13% of the GDP - nearly $600B in stimulus spending. Shock and awe measure the extent of which few saw coming

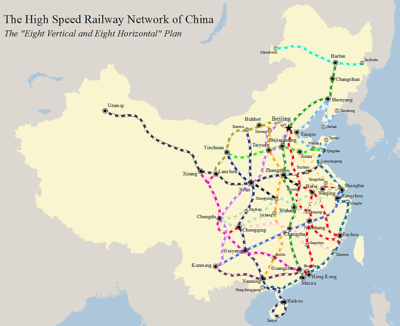

(3/16): What did it do?

It financed high-speed rail, roads, bridges everything. Backed by relaxed terms of credit, Chinese companies built. So much so that it powered a global commodity boom which helped countries like Australia avoid a recession entirely in 2008 and 09!

It financed high-speed rail, roads, bridges everything. Backed by relaxed terms of credit, Chinese companies built. So much so that it powered a global commodity boom which helped countries like Australia avoid a recession entirely in 2008 and 09!

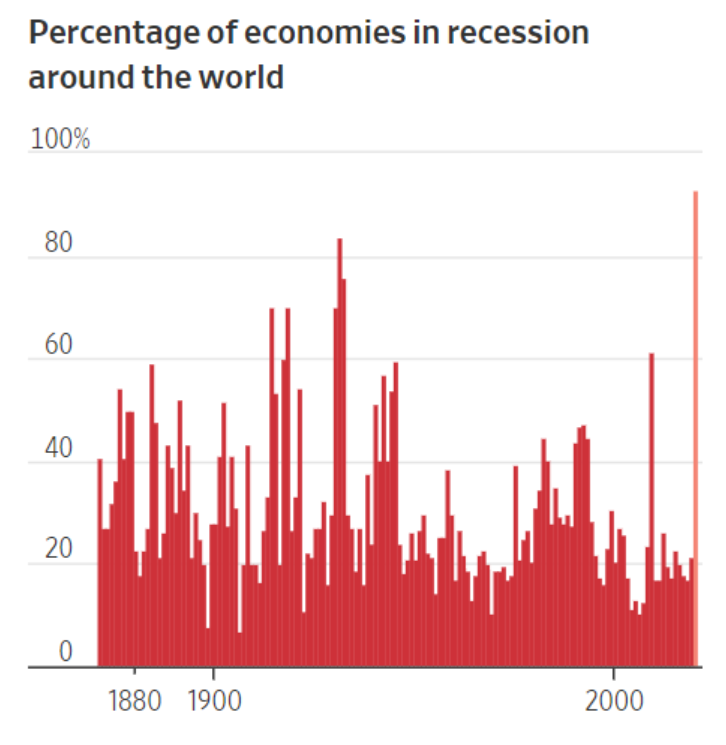

(4/16): It's been said enough but COVID-19 is truly an interesting economic conundrum that we do not really have a playbook for.

Look at the chart below - never before has 9/10th of all the countries entered a recession together.

Look at the chart below - never before has 9/10th of all the countries entered a recession together.

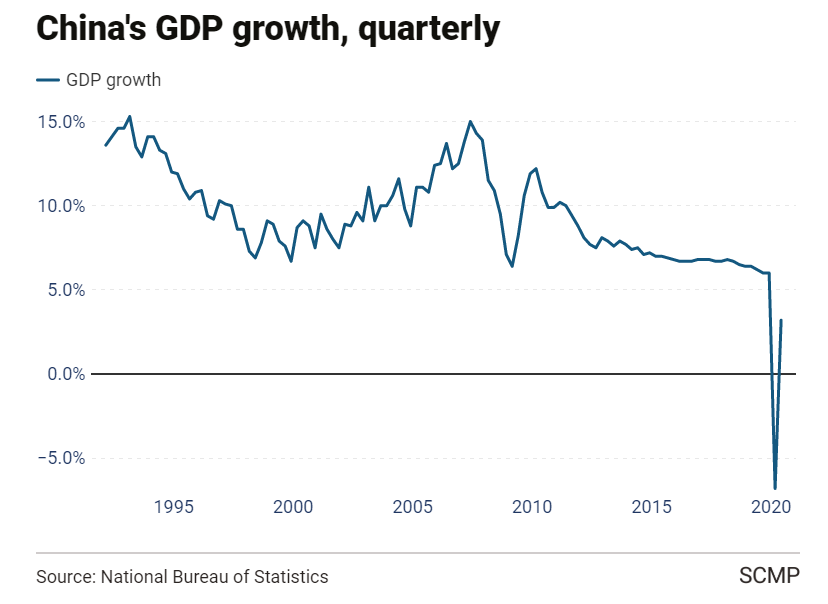

(5/16): Chinese economy too shrunk by ~7% in 1st quarter - its first decline since the end of the Cultural Revolution in 1976.

Surprisingly, the economy beat the forecasts for the 2nd quarter and grew at a healthy ~3% becoming the 1st major world economy to posit +ve growth

Surprisingly, the economy beat the forecasts for the 2nd quarter and grew at a healthy ~3% becoming the 1st major world economy to posit +ve growth

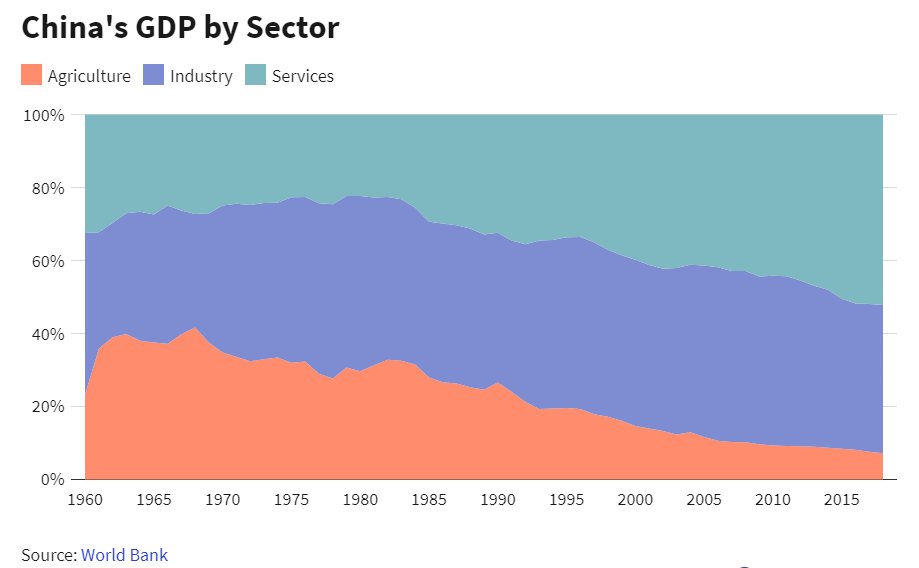

(6/16): What explains the rebound?

This chart . Industry contributes an unparalleled 40% to the GDP. In S Korea and Germany, the number is 33% and 30% respectively. In the U.S. and the U.K. it is <18%

. Industry contributes an unparalleled 40% to the GDP. In S Korea and Germany, the number is 33% and 30% respectively. In the U.S. and the U.K. it is <18%

This chart

. Industry contributes an unparalleled 40% to the GDP. In S Korea and Germany, the number is 33% and 30% respectively. In the U.S. and the U.K. it is <18%

. Industry contributes an unparalleled 40% to the GDP. In S Korea and Germany, the number is 33% and 30% respectively. In the U.S. and the U.K. it is <18%

(7/16): As the largest global exporter whose share of exports *increased* during the pandemic, China got back to work as the virus was curbed.

Take a case of masks. Pre-pandemic - China made 10M masks a day (50% of global supply). Within a month, it had increased to 120M/day!

Take a case of masks. Pre-pandemic - China made 10M masks a day (50% of global supply). Within a month, it had increased to 120M/day!

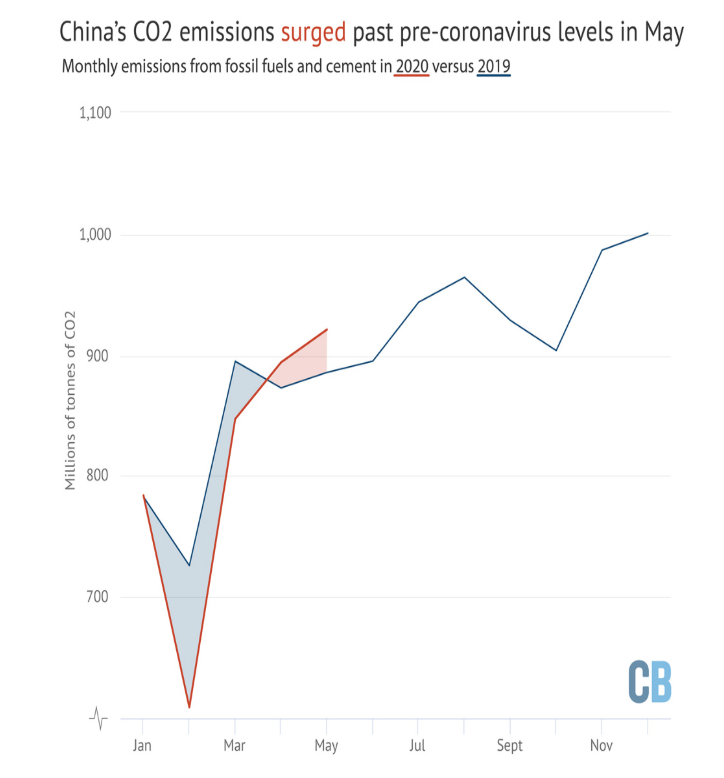

(8/16): Overall, the industrial production has risen and has helped migrants come back to the factories (80% of the migrants are estimated to be back) and the factories are chugging along. Another marker - the emissions are rising too. They are now past the levels of 2019

(9/16): So, industry has picked up and is growing.

The problem however lies with consumer spend which continues to lag. It remains below the levels of 2019 defying the predictions of forecasters.

Why?

The problem however lies with consumer spend which continues to lag. It remains below the levels of 2019 defying the predictions of forecasters.

Why?

(10/16): For one, the government stimulus this time is considerably smaller than in 2008. The stimulus in 2008 fuelled a debt binge across the country which has made the Chinese firms the most indebted globally.

The policymakers are not looking to start a new debt party

The policymakers are not looking to start a new debt party

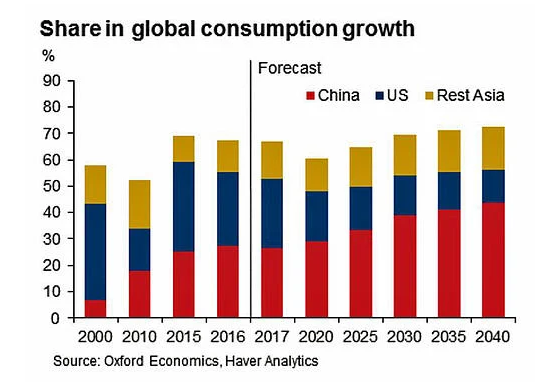

(11/16): Chinese consumers spend over $7T annually. That alone would be the 4th largest GDP on its own. It has supported the sales of Apple, driven up the share price of Tesla.

The spending on luxury goods is ~$80B (1/3rd of total market). In short, their demand holds the key

The spending on luxury goods is ~$80B (1/3rd of total market). In short, their demand holds the key

(12/16): Small businesses are hurting too. Over 0.5M businesses have closed and new business registration dipped by a third in the current crisis.

(13/16): Unlike stimulus in USA which focused on putting money in the hands of people, China seems to have taken a route more familiar to it with its limited stimulus.

More construction.

While delivering glory, it also takes longer to trickle down https://www.nytimes.com/2020/07/30/business/china-economy-infrastructure.html

More construction.

While delivering glory, it also takes longer to trickle down https://www.nytimes.com/2020/07/30/business/china-economy-infrastructure.html

(14/16): In short, the focus is again on construction with a smaller outlay than 2008 (where the recession was not as bad). Consumers & SMEs are hurting and remain moribund.

The pain is deep and it is Chinese consumers that most analysts are watching https://www.bloomberg.com/news/articles/2020-07-28/china-s-covid-19-rebound-lost-momentum-in-july-as-consumers-wary?srnd=economics-vp&sref=ptBDLfpB

The pain is deep and it is Chinese consumers that most analysts are watching https://www.bloomberg.com/news/articles/2020-07-28/china-s-covid-19-rebound-lost-momentum-in-july-as-consumers-wary?srnd=economics-vp&sref=ptBDLfpB

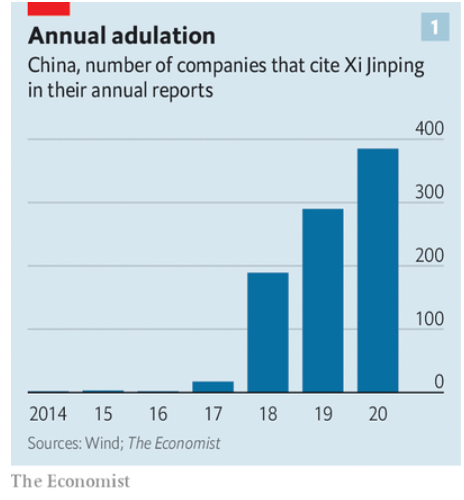

(15/16): The government too recognizes it and the increasing focus of Xi Jinping has been to turn inwards as China faces global ire over a multitude of issues.

What this means, is blurry lines between the party and the market

https://www.economist.com/briefing/2020/08/15/xi-jinping-is-trying-to-remake-the-chinese-economy

What this means, is blurry lines between the party and the market

https://www.economist.com/briefing/2020/08/15/xi-jinping-is-trying-to-remake-the-chinese-economy

(16/16): Watch out for the Chinese consumer. That might hold the clue for an economic pick up, not just in China but outside as well.

Summarized this in my weekly newsletter. Thanks for following along <fin> https://evolvingeconomy.substack.com/p/chinese-growth-mirage

Summarized this in my weekly newsletter. Thanks for following along <fin> https://evolvingeconomy.substack.com/p/chinese-growth-mirage

Read on Twitter

Read on Twitter