1/ Separating the Wheat from the Chaff: Backwardation as the Long-Term Driver of Commodity Futures Performance (Feldman, Till)

"The share of return variance explained by backwardation rises from 24% at a 1-year horizon to 64% using 5-year time periods."

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=892387

"The share of return variance explained by backwardation rises from 24% at a 1-year horizon to 64% using 5-year time periods."

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=892387

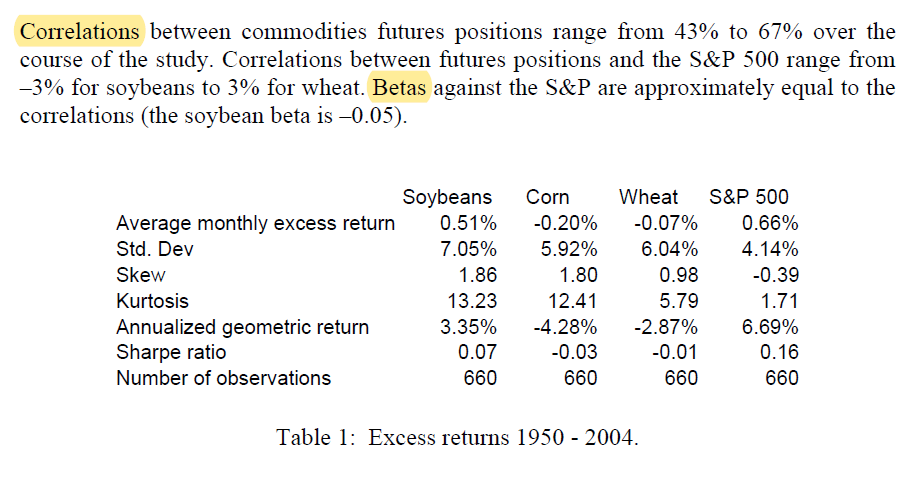

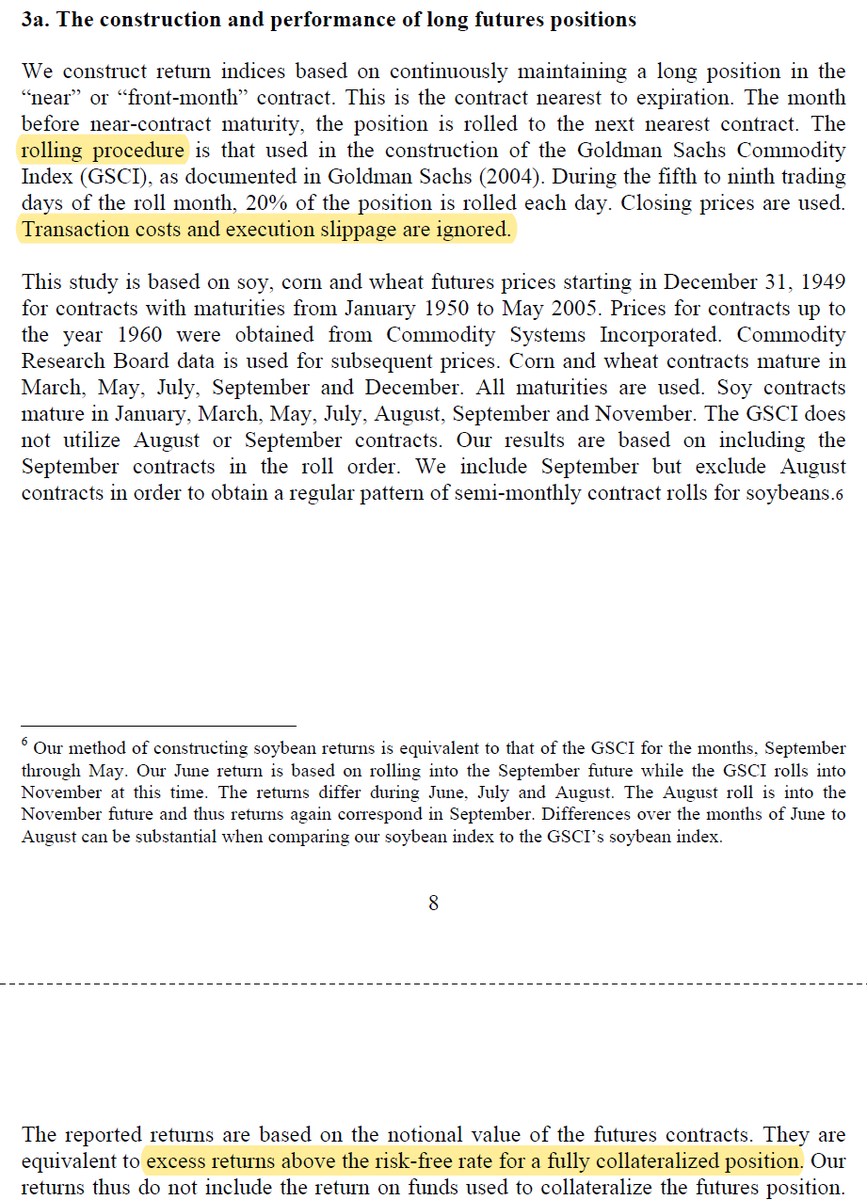

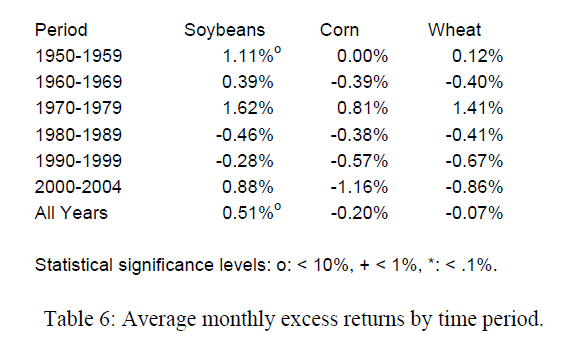

2/ Returns are excess returns for fully-collateralized positions (no transaction costs or slippage). The GSCI rolling procedure is used.

"Correlations between commodities futures positions range from 43% to 67% over the course of the study."

"Correlations between commodities futures positions range from 43% to 67% over the course of the study."

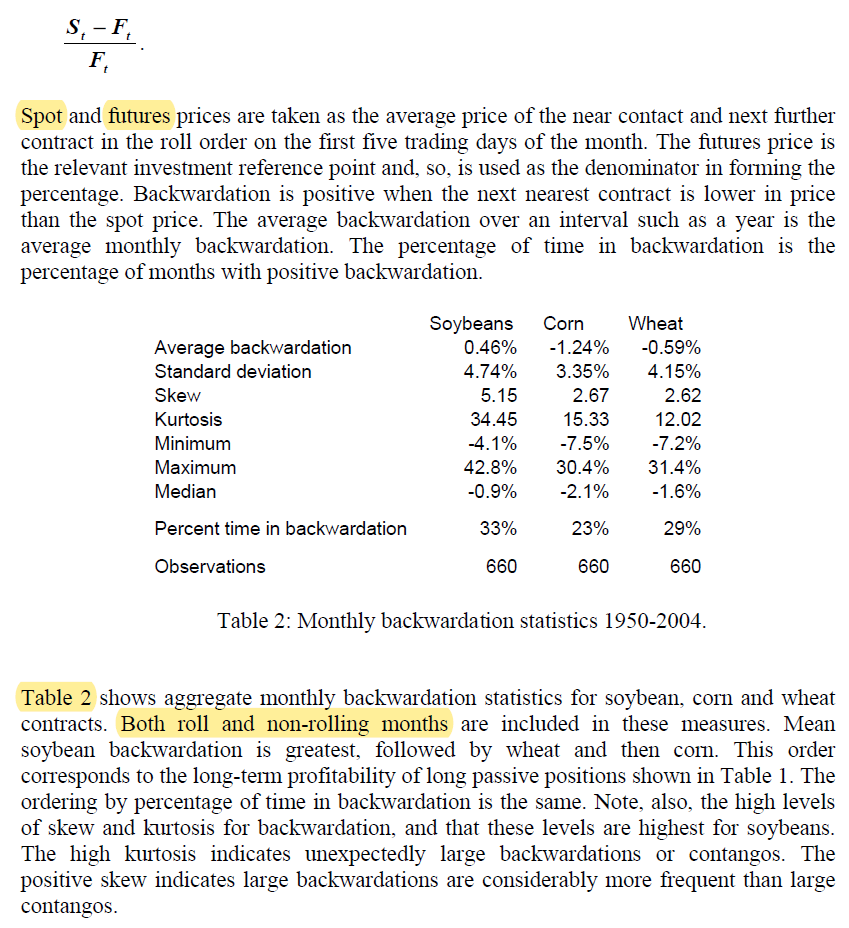

3/ Spot = near contract; Future = next contract

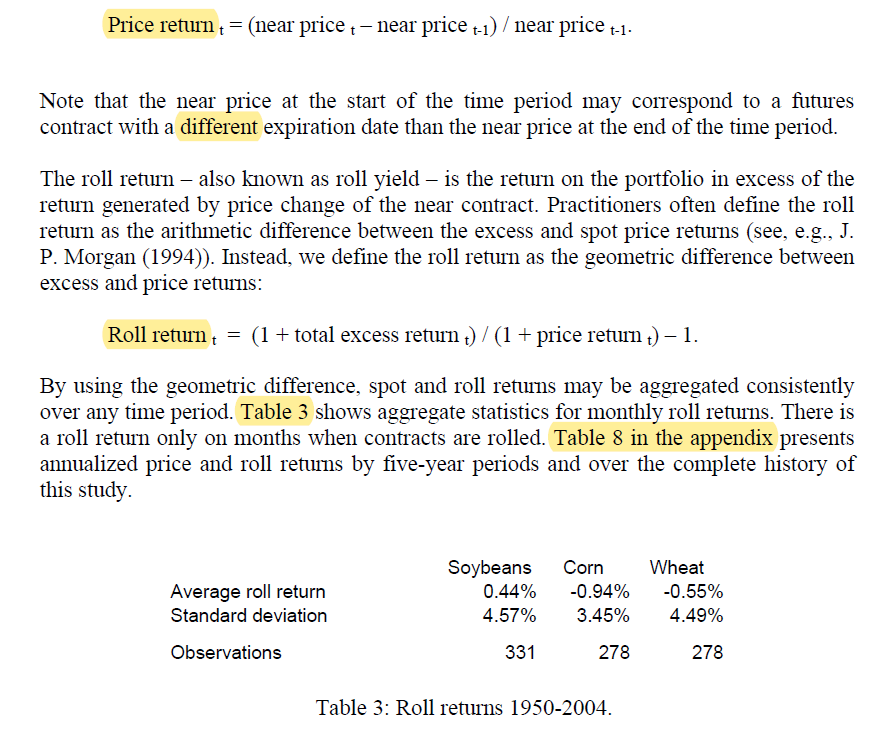

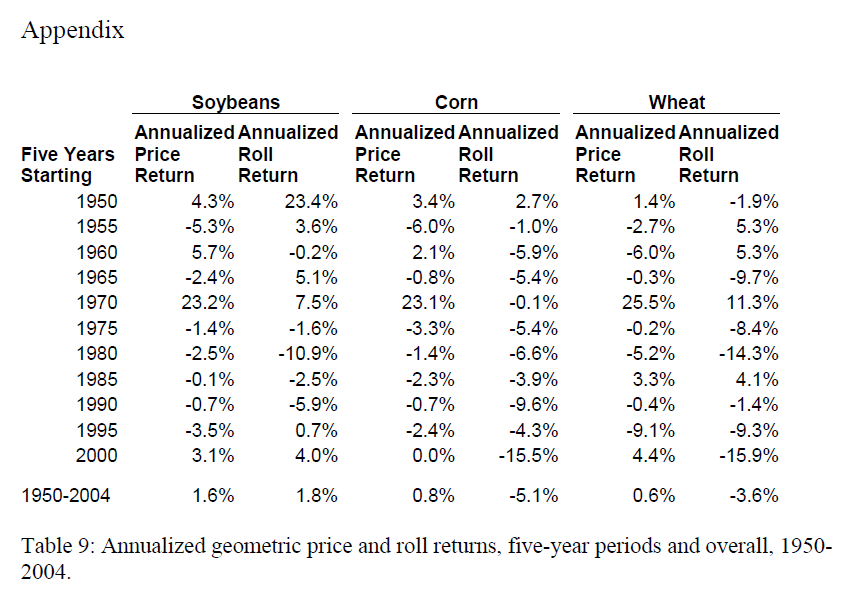

The authors separate total excess returns into spot price returns and roll returns.

Soybeans have tended to be in backwardation and have had positive roll returns; the reverse is true for corn and wheat.

The authors separate total excess returns into spot price returns and roll returns.

Soybeans have tended to be in backwardation and have had positive roll returns; the reverse is true for corn and wheat.

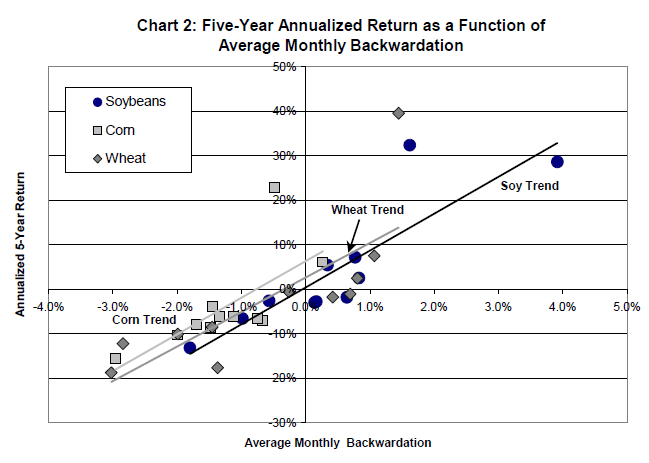

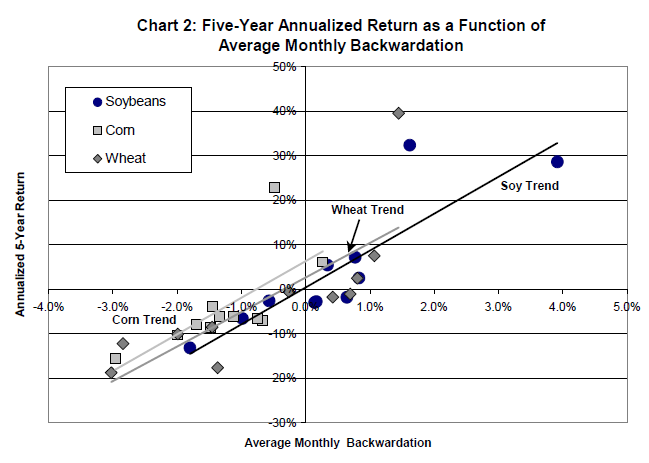

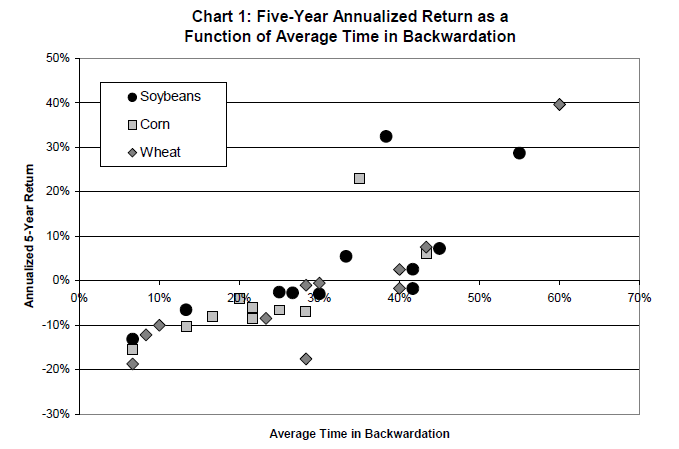

4/ "The trend lines have almost identical slopes, indicating similar responses to a change in average backwardation.

"The three outlier observations with 20% or greater annualized returns are for the 1970-1974 period, which saw unusually strong advances in agricultural prices."

"The three outlier observations with 20% or greater annualized returns are for the 1970-1974 period, which saw unusually strong advances in agricultural prices."

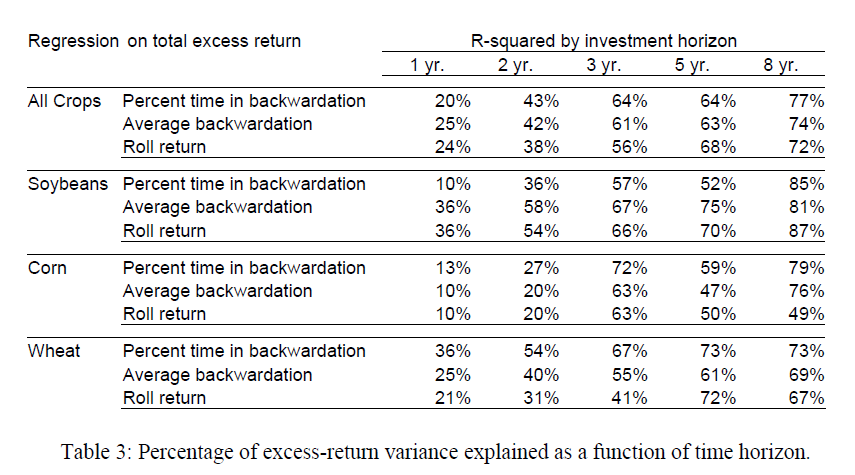

5/ "Backwardation and roll return have increasing explanatory power with the length of investment time horizon.

"Short-term variability in prices is high, which should make the spot return dominanate over shorter horizons. Over longer periods, prices tend to be mean-reverting."

"Short-term variability in prices is high, which should make the spot return dominanate over shorter horizons. Over longer periods, prices tend to be mean-reverting."

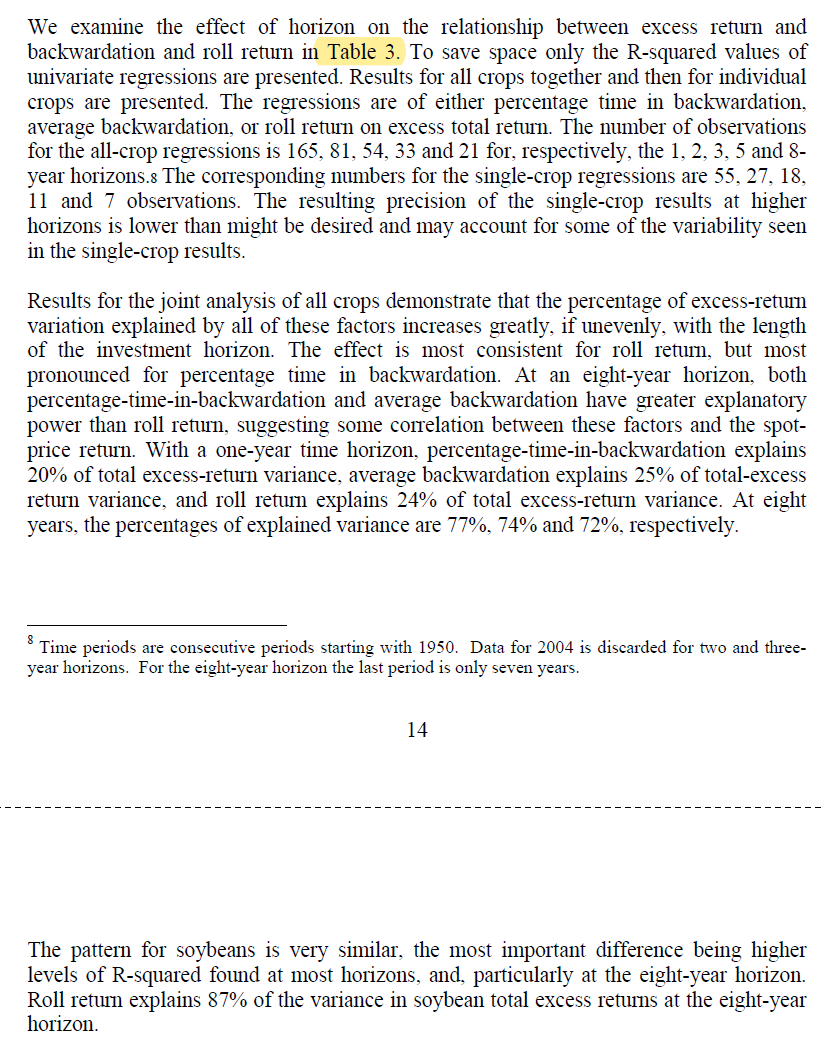

6/ "Seasonality makes it difficult to identify the premium embedded in a futures price without forming an explicit expectation as to the contract price at expiration. Nevertheless, average annual backwardation is still an important determinant of annual return."

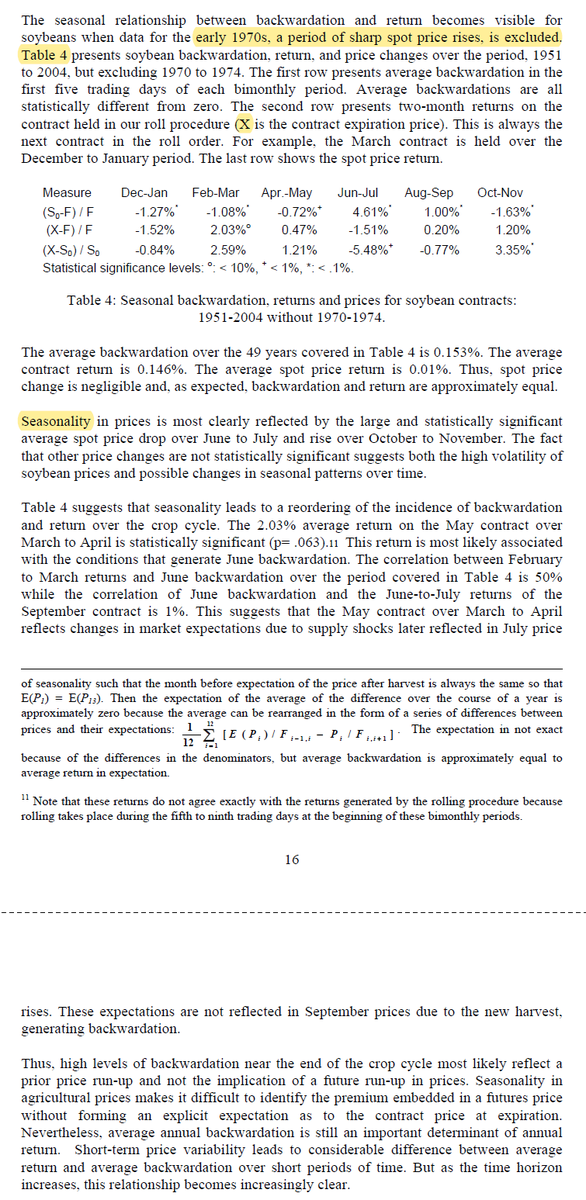

7/ "Soybean backwardation has generally weakened over time. This is consistent with our hypothesis that inadequate storage was likely a factor in soybean price dynamics during this period. The next section shows that inventories were exceptionally low as well."

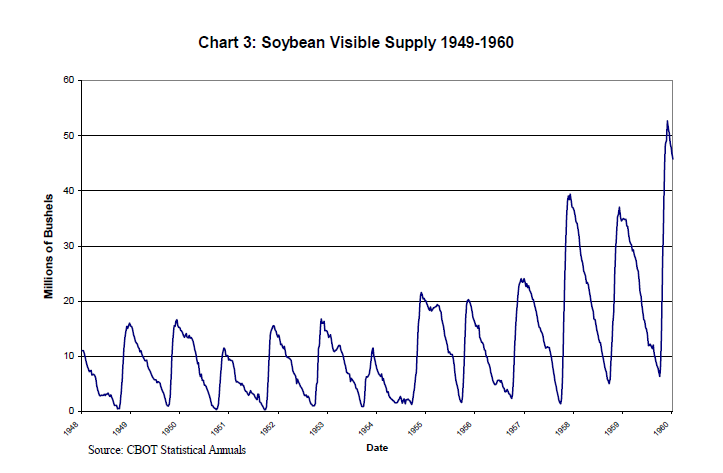

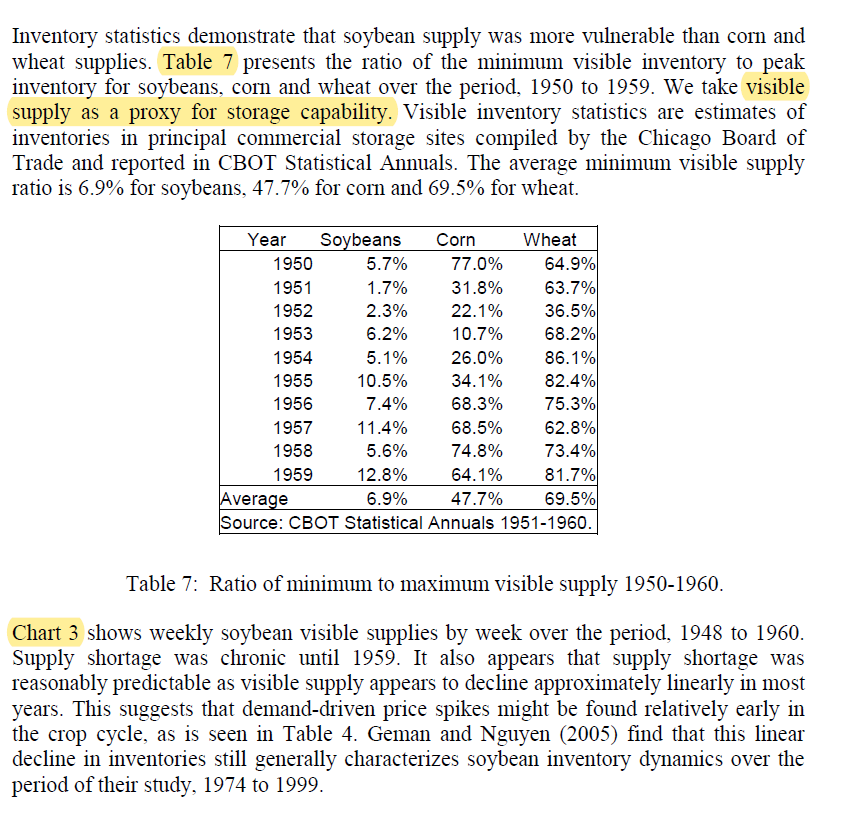

8/ "We take visible supply as a proxy for storage capability.

"Chart 3 shows weekly soybean visible supplies by week over the period, 1948 to 1960. Supply shortage was chronic until 1959."

"Chart 3 shows weekly soybean visible supplies by week over the period, 1948 to 1960. Supply shortage was chronic until 1959."

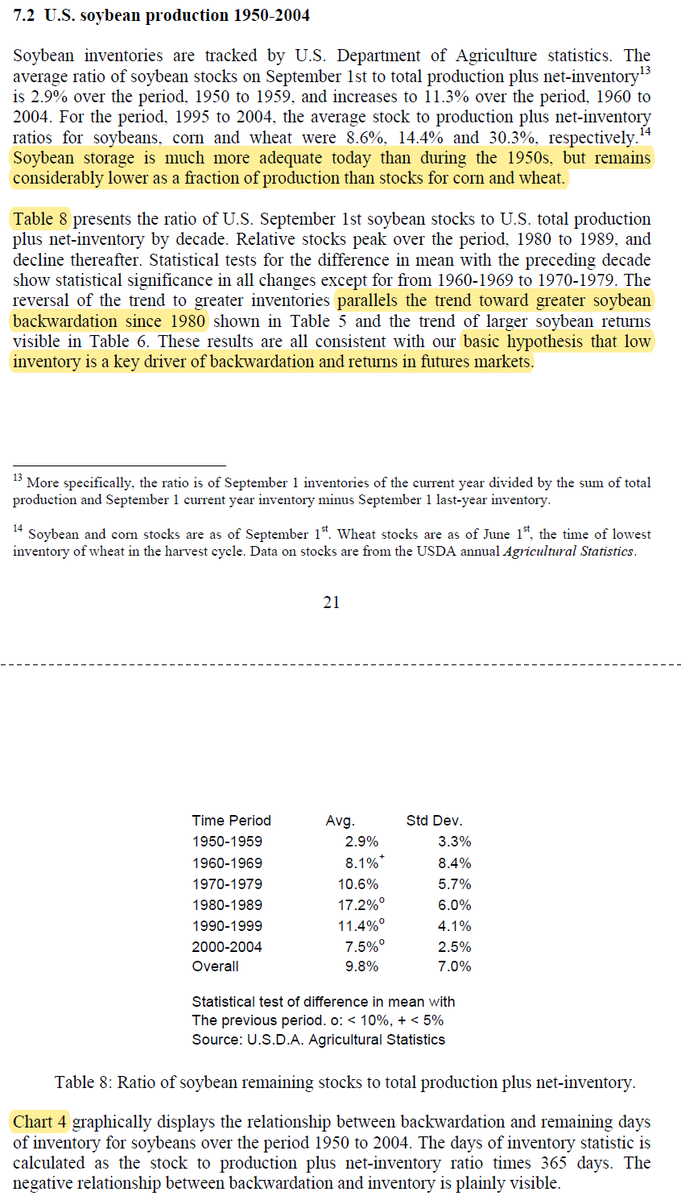

9/ "The reversal of the trend to greater inventories parallels the trend toward greater soybean backwardation since 1980 (Table 5) and the trend of larger returns (Table 6). This is consistent with our hypothesis that low inventory is a key driver of backwardation and returns."

10/ "The second rationale for a long-term, passive investment in commodity futures would be to predict that factors are in place to repeat the 1970-74 experience.

"Howell points out how excessive monetary stimulus has contributed to high returns of commodities in the past."

"Howell points out how excessive monetary stimulus has contributed to high returns of commodities in the past."

11/ Related research:

Long-Short Commodity Investing: A Review of the Literature (Miffre)

https://twitter.com/ReformedTrader/status/1275543016980180994

Investing with Style (Asness, Ilmanen, Israel, Moskowitz)

https://twitter.com/ReformedTrader/status/1233555552833134593

Carry (Koijen, Moskowitz, Pedersen, Vrugt) https://twitter.com/ReformedTrader/status/1188911052253040640

Long-Short Commodity Investing: A Review of the Literature (Miffre)

https://twitter.com/ReformedTrader/status/1275543016980180994

Investing with Style (Asness, Ilmanen, Israel, Moskowitz)

https://twitter.com/ReformedTrader/status/1233555552833134593

Carry (Koijen, Moskowitz, Pedersen, Vrugt) https://twitter.com/ReformedTrader/status/1188911052253040640

Read on Twitter

Read on Twitter