1/ W/o further ado, the @cosmos update for @OurNetwork__ that went missing in this wk's issue bc of technical difficulties

a) a modified DeFi equivalents on Cosmos chart

b) smart contracting alternatives in Cosmos

c) rising $ATOM price impacts aggregate network staking rate

a) a modified DeFi equivalents on Cosmos chart

b) smart contracting alternatives in Cosmos

c) rising $ATOM price impacts aggregate network staking rate

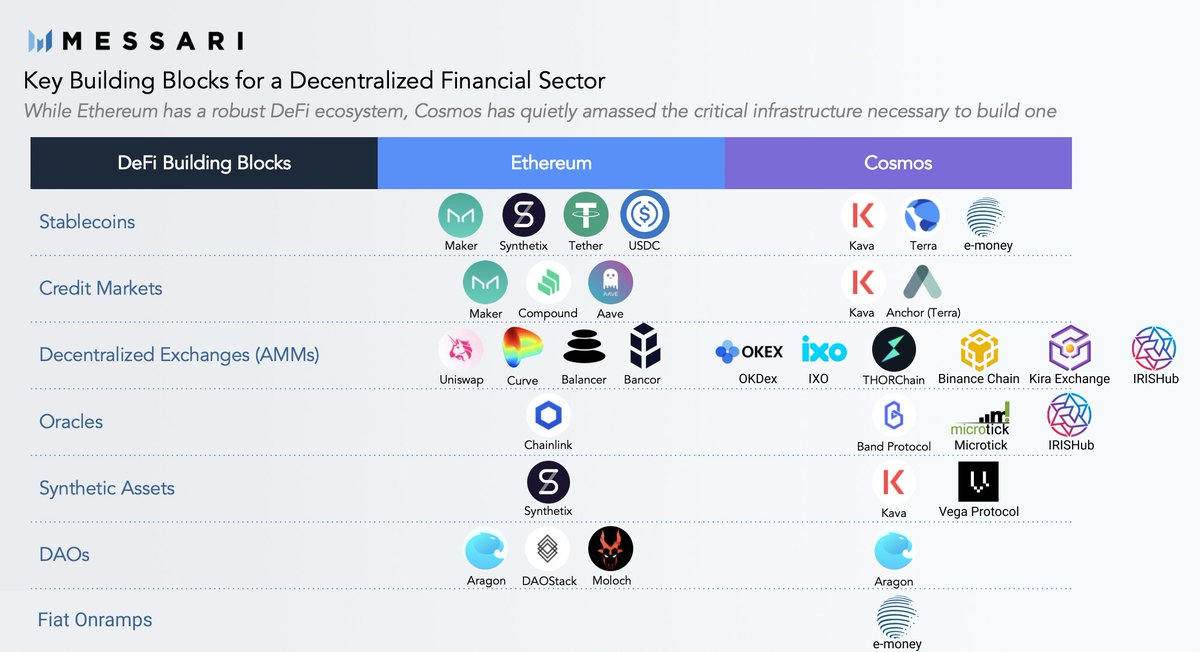

2/ Last week, @WilsonWithiam & @RyanWatkins_ called out key Cosmos projects in DeFi.

I added addt'l lower key projects like @irisnetwork @emoney_com @vegapro @microtick_zone @kira_core @ixoworld @OKEx to paint a fuller picture of what else is bubbling up beneath the surface.

I added addt'l lower key projects like @irisnetwork @emoney_com @vegapro @microtick_zone @kira_core @ixoworld @OKEx to paint a fuller picture of what else is bubbling up beneath the surface.

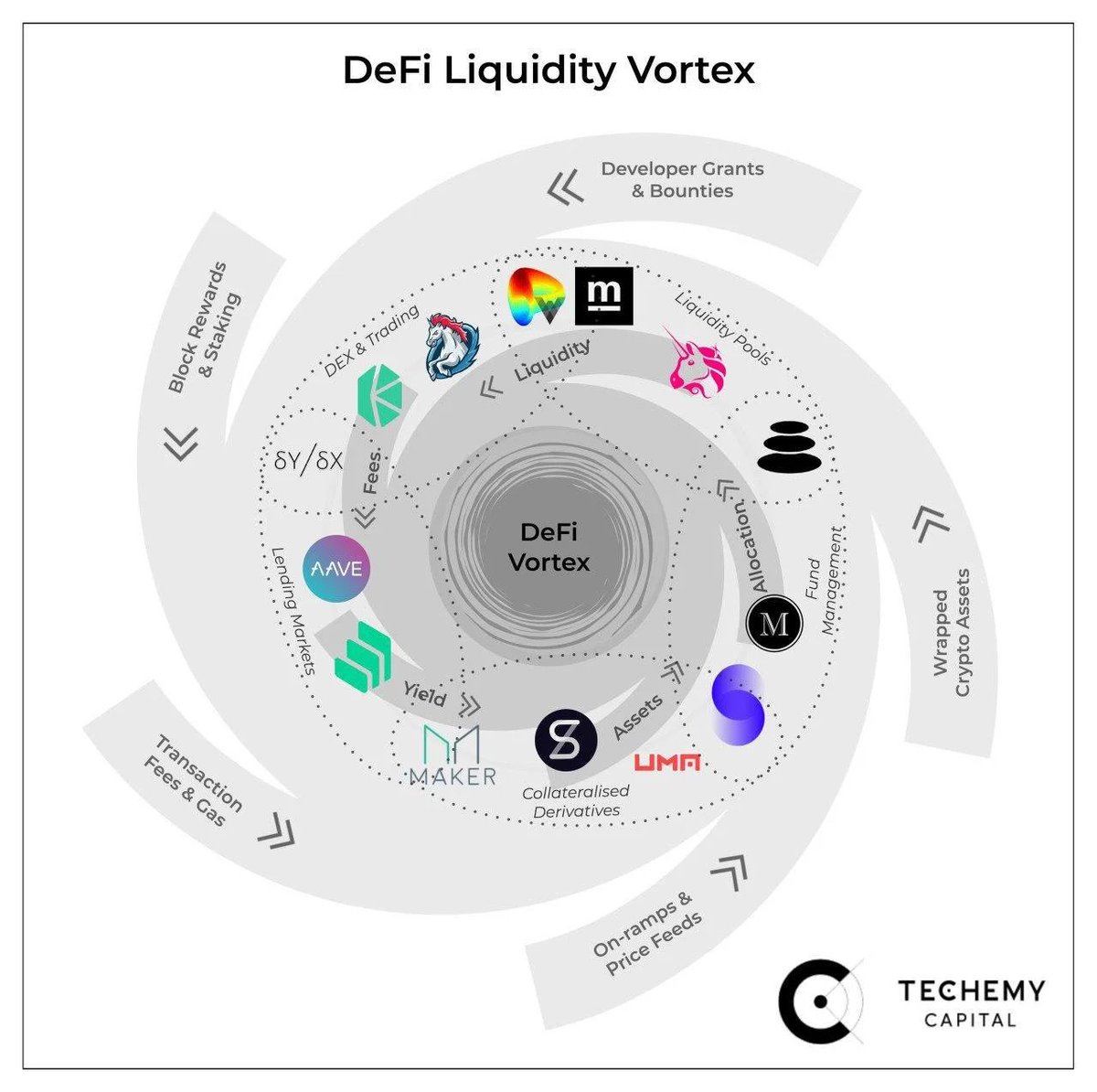

3/ These Cosmos equivalents are forming the inner sphere of @paulsalis's DeFi Liquidity Vortex.

Liquidity pools: @irisnetwork @thorchain_org

DEXs & trading: @OKEx @Binance_DEX

Lending/credit markets: @kava_labs @terra_money

...

Liquidity pools: @irisnetwork @thorchain_org

DEXs & trading: @OKEx @Binance_DEX

Lending/credit markets: @kava_labs @terra_money

...

4/ ...

Collateralized derivs/synthetics: @vegaprotocol @kava_labs

Fund mgmt/DAOs: @AragonProject & technically @CosmosGov

Cosmos is in its 2nd yr of mainnet. This is where its DeFi ecosystem is. Now, what of its smart contracting ecosystem?

Collateralized derivs/synthetics: @vegaprotocol @kava_labs

Fund mgmt/DAOs: @AragonProject & technically @CosmosGov

Cosmos is in its 2nd yr of mainnet. This is where its DeFi ecosystem is. Now, what of its smart contracting ecosystem?

5/ SC alts in Cosmos, powered by Tendermint:

- @agoric: ocaps-based JS smart contract framework, Zoe

- @kadena_io: pact SC lang w/ ABCI compat

- @heystraightedge: runs vanilla @CosmWasm VM for permissionless SC

- @SecretNetwork: privacy-preserved SC running on @CosmWasm VM

- @agoric: ocaps-based JS smart contract framework, Zoe

- @kadena_io: pact SC lang w/ ABCI compat

- @heystraightedge: runs vanilla @CosmWasm VM for permissionless SC

- @SecretNetwork: privacy-preserved SC running on @CosmWasm VM

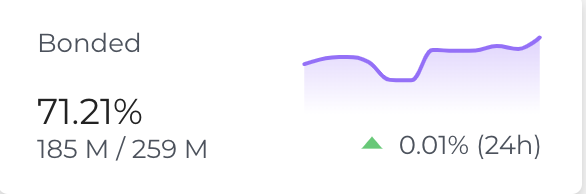

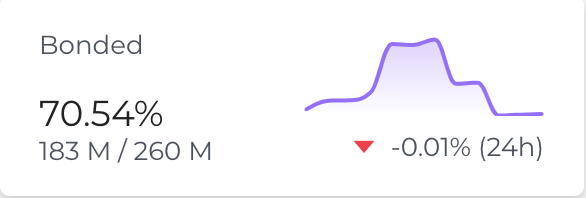

6/ Lastly, speaking of bull market, w/ $ATOM price rising, thus, opportunity cost of staking growing, aggregate staked rate of the network is decreasing.

Screenshot on the left was taken 3 days ago vs ss on the right, taken today.

Screenshot on the left was taken 3 days ago vs ss on the right, taken today.

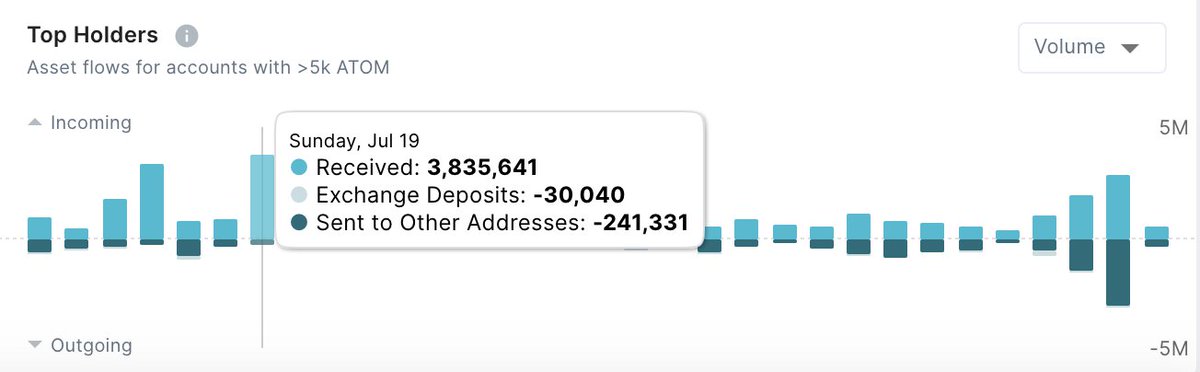

7/ On July 19, one of the biggest HODL events was observed. You can see 3.8M $ATOM moved into indiv wallets that day.

9.8M total ATOM were held in user wallets while just 2.2M sat on exchanges.

9.8M total ATOM were held in user wallets while just 2.2M sat on exchanges.

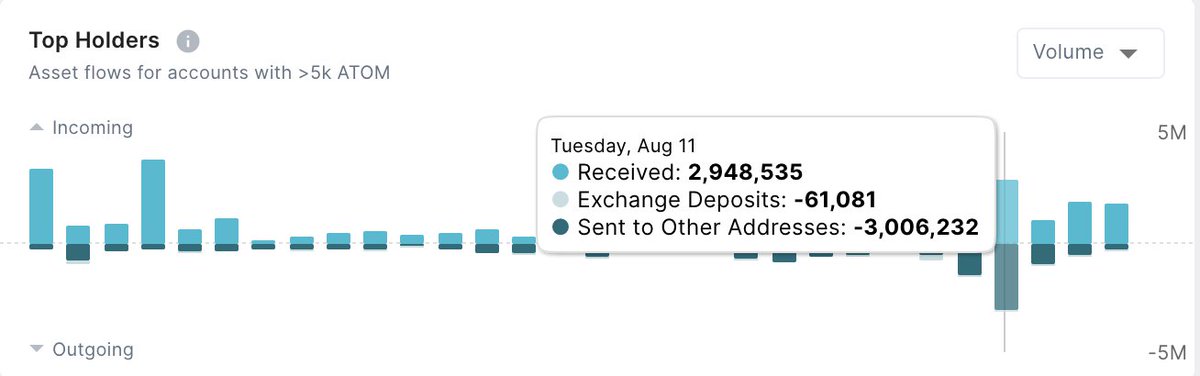

8/ 3 wks later, a spike in movement of $ATOM out of those wallets is observed. No major factors except price changed in those 3 weeks.

9/ If you bond $ATOM on Cosmos Hub, your rate of return is ~7% + a 21 day lockup time—quite the opportunity cost, esp in the backdrop of a very hot 2ndary mkt, not to mention all the DeFi games happening elsewhere.

10/ Ofc, Cosmos' staking incentives rise as network stakerate falls. If it ever falls below 66.66%, then the protocol will automatically begin to increase rewards asymptotically until it reaches 20%.

More about Cosmos token economics: https://blog.cosmos.network/economics-of-proof-of-stake-bridging-the-economic-system-of-old-into-the-new-age-of-blockchains-3f17824e91db

More about Cosmos token economics: https://blog.cosmos.network/economics-of-proof-of-stake-bridging-the-economic-system-of-old-into-the-new-age-of-blockchains-3f17824e91db

11/ Question is, will that be enough to counteract the draw of an external market that may drive prices up by 100-200x in the next 6 months? And what could that do to staking incentives of PoS networks?

Read on Twitter

Read on Twitter