Here is my secret mental map for the next bull market in crypto...

(Alternate title = Why as I'm long #DeFi with diamond hands)...

1. We are early in the DeFi bull. I didn't realize how early until I saw this interview with Chamath.

Thread alert https://twitter.com/vakeraj/status/1275981722291757056?s=20

https://twitter.com/vakeraj/status/1275981722291757056?s=20

(Alternate title = Why as I'm long #DeFi with diamond hands)...

1. We are early in the DeFi bull. I didn't realize how early until I saw this interview with Chamath.

Thread alert

https://twitter.com/vakeraj/status/1275981722291757056?s=20

https://twitter.com/vakeraj/status/1275981722291757056?s=20

2. LOVE the dude, but I can't tell you how blown my  was when I heard him say that... This isn't some fucking flake. Chamath = founder of Social Capital, an early Facebook $FB exec, and part owner of the Golden State Warriors.

was when I heard him say that... This isn't some fucking flake. Chamath = founder of Social Capital, an early Facebook $FB exec, and part owner of the Golden State Warriors.

was when I heard him say that... This isn't some fucking flake. Chamath = founder of Social Capital, an early Facebook $FB exec, and part owner of the Golden State Warriors.

was when I heard him say that... This isn't some fucking flake. Chamath = founder of Social Capital, an early Facebook $FB exec, and part owner of the Golden State Warriors.

3. Chamath understands $BTC. He started accumulating it around $80 and he once owned 5% of all the bitcoin in the world. He bought it, though, locked it away and just ignored the sector altogether. I can guarantee you he's looking at DeFi right now. If he's not, he will be.

4. Even among diehard crypto users, not everyone's buying DeFi tokens yet. Look at this survey from @CL207. CL posts about DeFi all the time, yet not even half of his followers have exposure to the sector. https://twitter.com/CL207/status/1294241216599531520?s=20

5. Here's another great survey from @blockfolio posted by my boy @CryptoToit https://twitter.com/CryptoToit/status/1294716200971317250?s=20

6. So, we've established that we're early. Now let's look at what's coming next:

All of these standalone L1 blockchains ($BTC, $ETH, $BNB etc) are about to merge into one. It'll happen thanks to interoperability ($DOT, $ATOM, etc), multi-chain DEXes ($RUNE, $SWTH, etc.)...

All of these standalone L1 blockchains ($BTC, $ETH, $BNB etc) are about to merge into one. It'll happen thanks to interoperability ($DOT, $ATOM, etc), multi-chain DEXes ($RUNE, $SWTH, etc.)...

7. ... L2s/sidechains ( @StarkWareLtd, $STAKE, $OMG, $REN, etc), and every single one of these are either already online or coming online in Q4 2020.

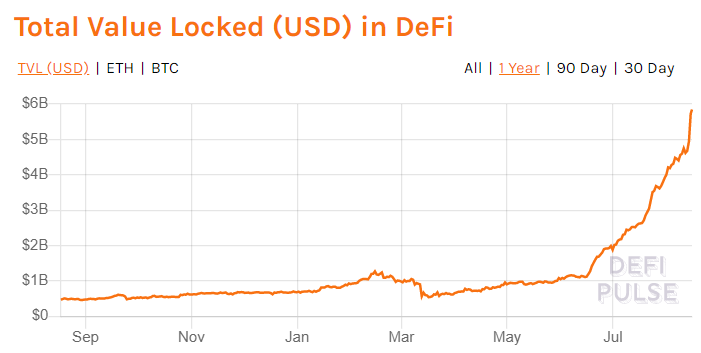

8. Meanwhile, DeFi on $ETH has exploded. This is not a turtle-pace explosion like Moore's Law which doubles every two years. DeFi is doubling in size every MONTH. @defipulse

9. And now, DeFi is spreading to other chains. $KAVA is taking it to $BNB... $OKS is taking it to $TRX... $REN is moving backwards through the matrix and bringing $BTC onto $ETH, and even $XRP is talking about taking DeFi to banks.

10. Here is the important part: I cannot overstate the impact cross-chain will have on DeFi. Here's why: right now, total value locked in DeFi = $5.8 billion. Global market cap of ALL cryptos is $382 billion. That means just 1.5% of the total market is locked in DeFi.

11. If we look at ETH alone, about 4% of all existing ETH are locked in DeFi. I expect to see that hit as much as 15-25% in the next 2 yrs. And, eventually, once cross-chain is easy, that means 15-25% of ALL cryptos could be locked in DeFi.

12. Bear with me, fren. So, let's say 10% of ALL crypto gets locked in DeFi... that's about $38 billion. Why will people lock up that much crypto? So they can borrow more and speculate on stuff like DeFi tokens (You can't borrow 1:1, usually you have to be overcollateralized...

13. ... so that means about 50% of the $38 billion will flood the crypto ecosystem... it's like brand new money. It's $19 BILLION flowing into DeFi investments... and even that could be conservative).

14. Furthermore, I think we're entering a bull... the Robinhood stock crowd is coming. $BTC halving is done. $BTC maxis are seeing DeFi  . Bond yields are negative when adjusted for inflation. Investors are seeing gold and stocks hit all-time highs and looking at other options.

. Bond yields are negative when adjusted for inflation. Investors are seeing gold and stocks hit all-time highs and looking at other options.

. Bond yields are negative when adjusted for inflation. Investors are seeing gold and stocks hit all-time highs and looking at other options.

. Bond yields are negative when adjusted for inflation. Investors are seeing gold and stocks hit all-time highs and looking at other options.

15. We will see a repricing for bitcoin taking it somewhere toward $100,000. ETH could top $4,000 (maybe even $8,000). So, now, we have to 10x that $19 billion I mentioned to $190 billion of new cash in DeFi! (and that's just leveraged buying...

16. ...it doesn't count "new money" that will flow into the sector, i.e. people spending fiat directly to buy DeFi tokens).

17. Altogether, in a crazy bull, I think DeFi could grow by $500 billion+ (possibly $1 trillion), and the total market cap for ALL cryptos could surpass $5 trillion (remember, bitcoin at $100k means BTC's market cap alone is pushing $2 trillion).

18. So here's the point: we might not have seen anything yet. Look for the truly "iron" DeFi projects to explode. Things like $SNX, $RUNE, $LEND, $COMP, $YFI, etc. could hit market caps north of $10 billion.

19. Even those numbers feel conservative if my truly longer-term vision comes true. And here's what that vision is:

Banks will tap DeFi to add value for their customers. They will use it to boost yields on savings accounts and CDs...

Banks will tap DeFi to add value for their customers. They will use it to boost yields on savings accounts and CDs...

20. DeFi will merge with banking. Or rather, DeFi will eat it.

21. Now, let me say, if you can read and comprehend this post, you're ahead of even people like Chamath. We are the new Chamath's, in fact. We could be him buying bitcoin at $80... only we're buying DeFi instead.

22. What to do now? Hold and educate others on this sector to keep it growing. Build something if you can. Post on Medium or LinkedIn. Get involved with a DAO. Call out scams, promote the good stuff, and keep accumulating iron. https://twitter.com/redphonecrypto/status/1286683647471386624?s=20

23. Most importantly: Stay humble (I could be dead wrong... this could be the #DeFi top for all I know). Stay eager to learn. Watch what people deliver, not what they promise. Grow wealthy. But have a plan for using that wealth to help others. OK. That's it. Much love, CT.

Read on Twitter

Read on Twitter