The further up the income statement you go, the more you learn about the inherent economics of a business. The further down the income statement you go, the more you learn about the people who run the business

I'm entirely convinced that the first place you need to start with every business is Gross Profits. This isn't groundbreaking stuff, but value investors usually start with FCF or NI and immediately disqualify companies if they're not generating it today

The first place to start with any business is studying the unit economics

If the economics of a single transaction does not make sense, chances are the company doesn't have good prospects

The powerful thing about this is you may not see this reflected in the P/L at first

If the economics of a single transaction does not make sense, chances are the company doesn't have good prospects

The powerful thing about this is you may not see this reflected in the P/L at first

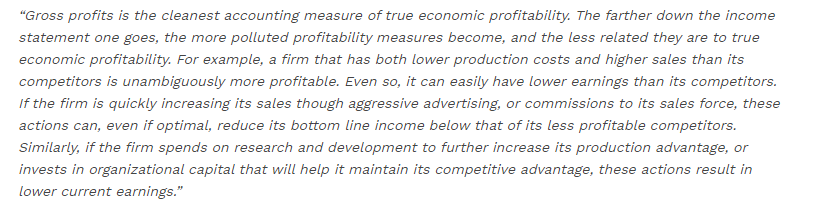

“Gross profits is the cleanest accounting measure of true economic profitability. - Robert Novy-Marx"

- Andrew Kuhn ( )

)

Read Geoff's article: EBITDA and Gross Profits: Learn to Move Up the Income Statement https://bit.ly/2PYoHxj

- Andrew Kuhn (

)

)Read Geoff's article: EBITDA and Gross Profits: Learn to Move Up the Income Statement https://bit.ly/2PYoHxj

Geoff has talked about his #1 model for a business is Market Power

Market Power = the ability to make demands on customers and suppliers free from the fear that those customers and suppliers can credibly threaten to end their relationship with you

Market Power = the ability to make demands on customers and suppliers free from the fear that those customers and suppliers can credibly threaten to end their relationship with you

He wrote about it in this writeup back in 2017:

Geoff’s Mental Model #1: “Market Power”

https://focusedcompounding.com/geoffs-mental-model-1-market-power/

Geoff’s Mental Model #1: “Market Power”

https://focusedcompounding.com/geoffs-mental-model-1-market-power/

"Market power is often misunderstood as being an advantage one competitor has over another. That’s the wrong way of thinking about it. Businesses don’t squeeze profits from competitors. Businesses squeeze profits from customers and suppliers.

Often, competitors engage in rivalry that undermines each other’s bargaining position with customers and suppliers. In such industries, customers can play one competitor off against another.

By doing this, they can negotiate for higher product quality, lower prices, longer payment terms, etc. However, there are industries free from that kind of rivalry.

As investors, those are the industries we want to focus on. The best businesses in the world are in the best

As investors, those are the industries we want to focus on. The best businesses in the world are in the best

industries in the world. And the best industries in the world are those where the rivalry between competitors does not undermine the market power these businesses have over their customers and suppliers."

A good place to start with this on screens is screening for Gross Profits / Total Assets and then studying the businesses from there

Remember, If the economics of a single transaction does not make sense, chances are the company doesn't have good future prospects

Remember, If the economics of a single transaction does not make sense, chances are the company doesn't have good future prospects

Read on Twitter

Read on Twitter