Investing book recommendations. In order —

Next is execution of the process — the ability to focus, developing a healthy rhythm and being resilient through the tough phases.

Put your heart on the line and when pushed, push back harder.

3/14

Put your heart on the line and when pushed, push back harder.

3/14

Risk before Return. To succeed you have to first survive.

(The whole of Incerto series but if you could read only one —)

4/14

(The whole of Incerto series but if you could read only one —)

4/14

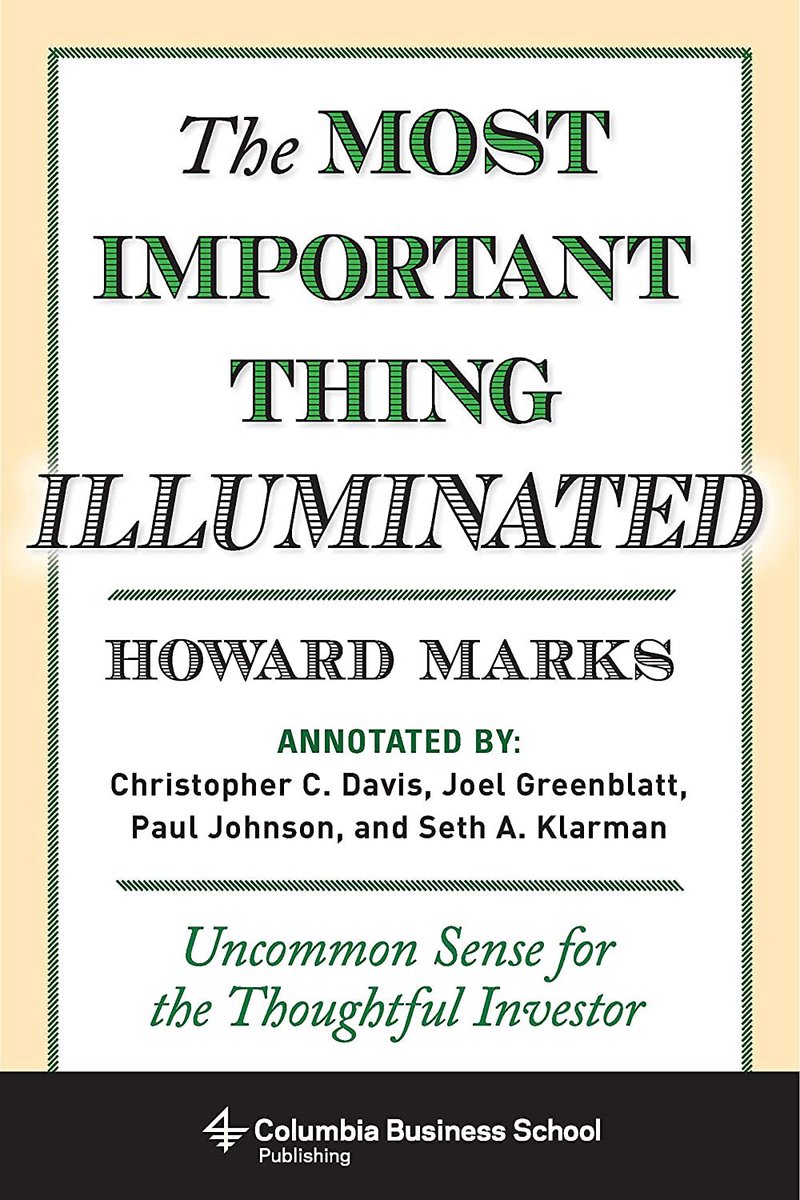

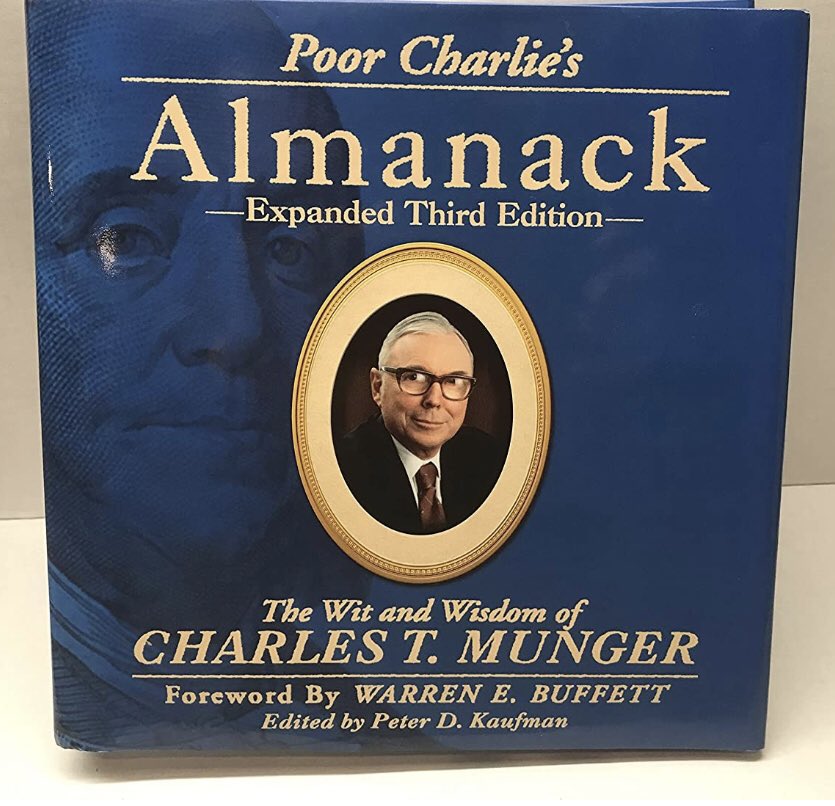

Foundation to build your latticework on —

(Would recommend the illuminated edition of The Most Important Thing)

7/14

(Would recommend the illuminated edition of The Most Important Thing)

7/14

The fund managers —

Berkshire AGM transcripts & Seth Klarman letters.

Notice how Seth handled himself during the Tech bubble, how clearly he articulated and communicated his philosophy.

If you understand the Berkshire transcripts, you need little else.

And these:

10/14

Berkshire AGM transcripts & Seth Klarman letters.

Notice how Seth handled himself during the Tech bubble, how clearly he articulated and communicated his philosophy.

If you understand the Berkshire transcripts, you need little else.

And these:

10/14

The toolbox —

A lot of Mauboussin papers are available online for free. They are a great resource.

11/14

A lot of Mauboussin papers are available online for free. They are a great resource.

11/14

Read on Twitter

Read on Twitter