1/ Christmas comes 4 times a year, you've been lied to your whole life.

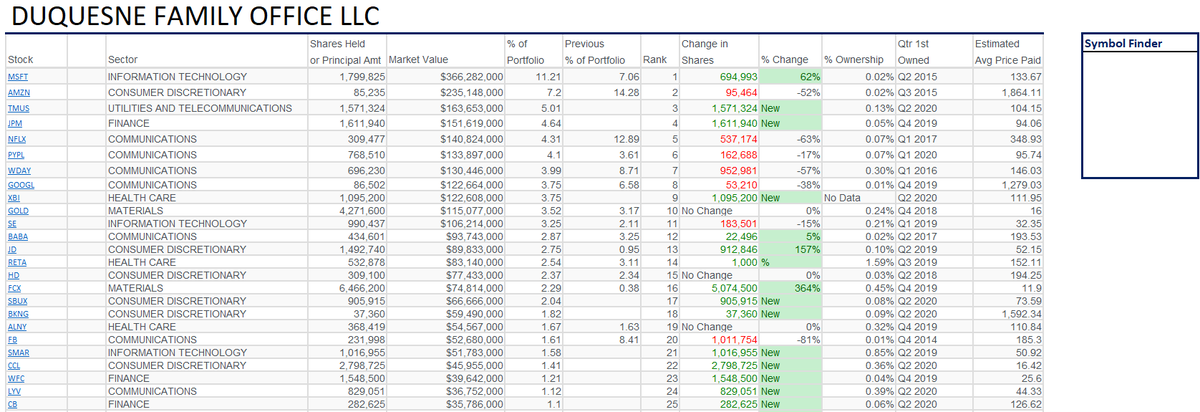

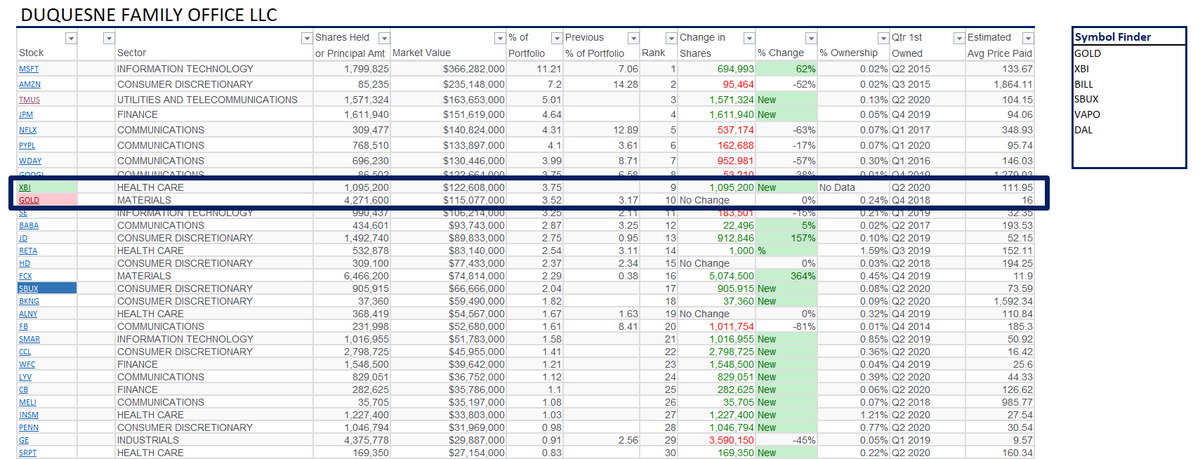

Going to start a little thread on the GOAT'S most recent 13f filing... 1st points, he substantially slashed $NFLX holdings, cut some $AMZN but increased $MSFT quite a bit. You'll also notice a # of new pos

Going to start a little thread on the GOAT'S most recent 13f filing... 1st points, he substantially slashed $NFLX holdings, cut some $AMZN but increased $MSFT quite a bit. You'll also notice a # of new pos

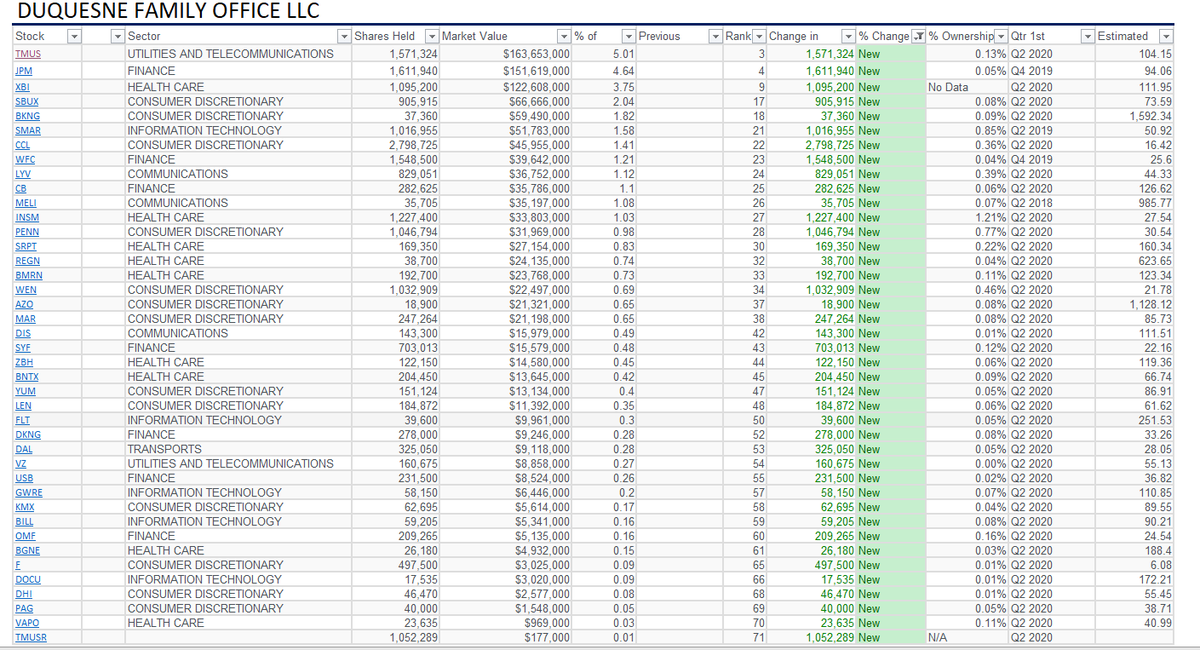

2/ Druck opened up a number of new positions... Plenty of very interesting names that include recovery plays... $TMUS $CCL $XBI are new positions that already make up a large % of his portfolio. You can also see $PENN and $SMAR peppering in more software and gambling plays

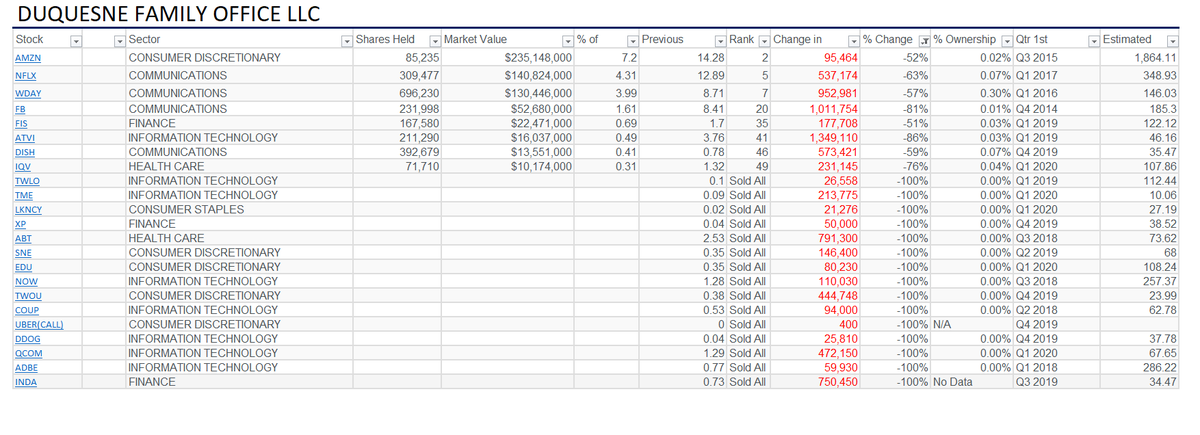

3/ Here is a snapshot of positions he cut by 50% or more... $AMZN he slashed by 52% but it's still 2nd in his porfolio... some names he took profit on completely were $TWLO $DDOG $TWOU $NOW

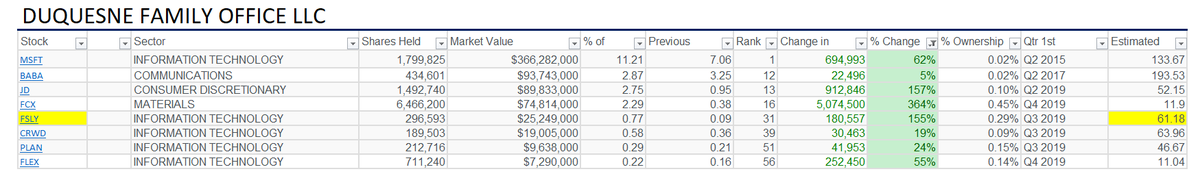

4/ Some notable positions GOAT Druck increased... $FSLY is the one that pops out at me. In march, I made note that Druck was buying this one, and it was one of the factors that had me buy it as well. Also see $CRWD $FCX $JD and $PLAN. Check out his estimated cost as well.

5/ I think it should be emphasized.... Druck made no changes to his $GOLD position, and added a large new Biotech position via $XBI... Two sectors worth noting for their recent out performance, and you can reasonably assume he believes it will continue that way.

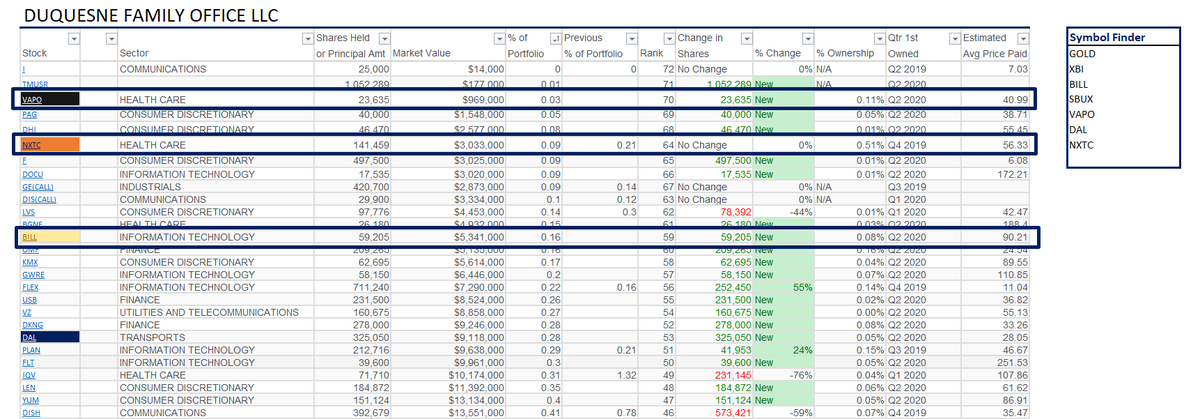

6/ Micro cap position he added worth checking out IMO is $VAPO... Med instrument stock. Other interesting play, which has since gotten crushed is $NXTC and recent high flyer $BILL which has popped up pretty regularly on my screens.

7/ I'll be analyzing my other favorite hedge funds this weekend, and cross reference holdings. But I always start with Druck, he's the GOAT IMO.

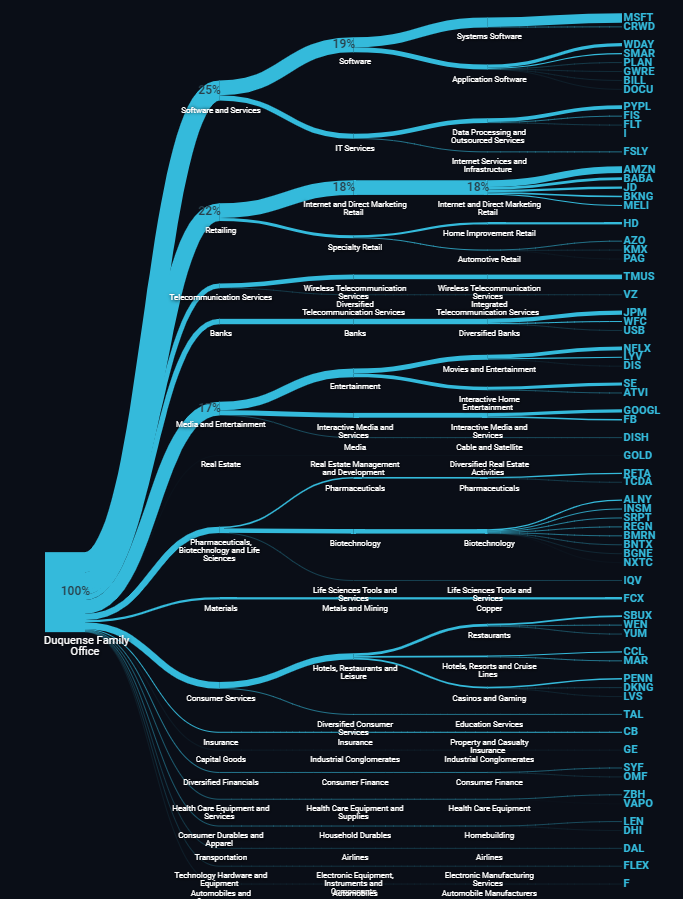

8/ I've worked hard at reverse engineering his process through these filings. You can see he stays diversified in a number of sectors, sort of a mix of Growth and "Value", but not in the traditional sense. Besides finding great plays, you can learn a TON from picking these apart.

8/ Tree/Root map of Drucks diversification... Still heavy SaaS, Internet retail/IOT in general $SE $AMZN $MSFT $TMUS

Read on Twitter

Read on Twitter