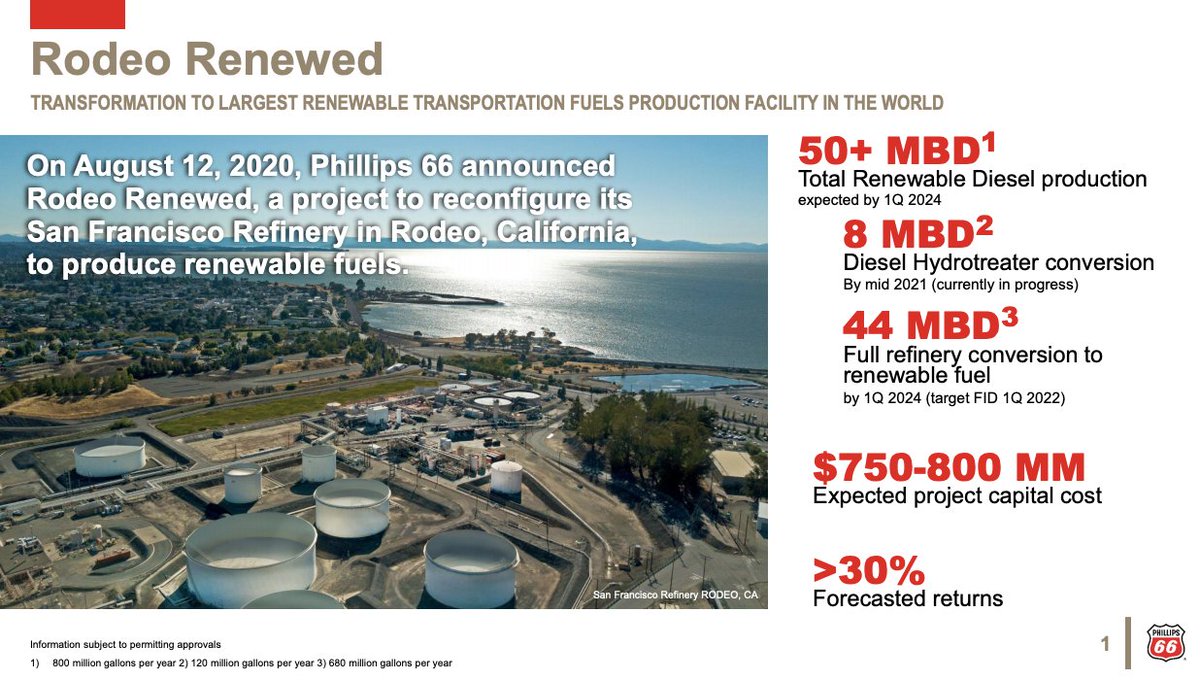

hey #energytwitter, cool to hear @Phillips66Co will convert its San Fran  refinery

refinery into the world's largest renewable diesel plant (targeting ~20m bbl/yr production beginning 2024). the project is called "Rodeo Renewed."

into the world's largest renewable diesel plant (targeting ~20m bbl/yr production beginning 2024). the project is called "Rodeo Renewed."

https://www.phillips66.com/newsroom/rodeo-renewed

a few reflections from :

:

1/12

refinery

refinery into the world's largest renewable diesel plant (targeting ~20m bbl/yr production beginning 2024). the project is called "Rodeo Renewed."

into the world's largest renewable diesel plant (targeting ~20m bbl/yr production beginning 2024). the project is called "Rodeo Renewed."https://www.phillips66.com/newsroom/rodeo-renewed

a few reflections from

:

:1/12

"conventional" energy firms, whose businesses revolve around #fossilfuels, need to see pathways that allow them to decarbonize. #climateaction  can happen faster if we work *with* the truth that corporations, perhaps esp. incumbents, have a powerful bias toward existence.

can happen faster if we work *with* the truth that corporations, perhaps esp. incumbents, have a powerful bias toward existence.

2/12

can happen faster if we work *with* the truth that corporations, perhaps esp. incumbents, have a powerful bias toward existence.

can happen faster if we work *with* the truth that corporations, perhaps esp. incumbents, have a powerful bias toward existence.

2/12

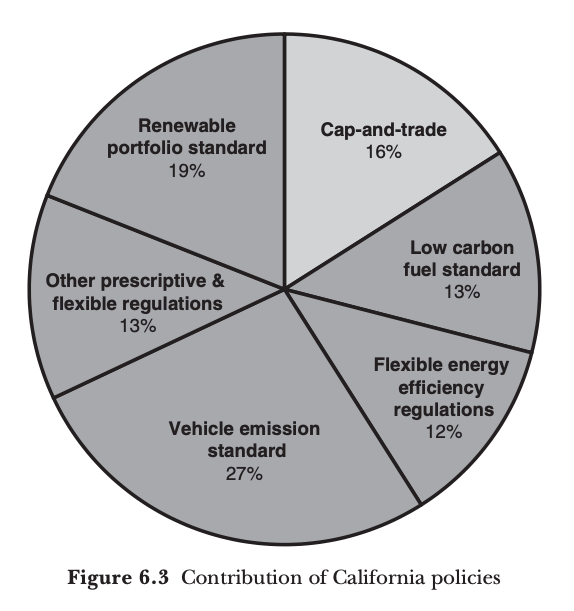

an announcement like this doesn't happen w/o policy: in this case, Cali @AirResources Board's #lowcarbonfuelstandard. Acc to @MarkJaccard, the #LCFS quietly contributes ~13% of Californian GHG reductions, making it key to the state #energytransition.

https://bit.ly/3iFLuu8

3/12

https://bit.ly/3iFLuu8

3/12

also, renewable diesel, a "drop-in" biofuel (meaning compatible w/ existing engines/infrastructure), has a key role to play in reducing GHGs from heavy-duty transport over the near-/medium-term. this is an incredibly hard-to-abate subsector, as @pembina has long argued.

4/12

4/12

capital budgets are a scarce resource in the oil+gas industry these days & competition for investment all the fiercer for it.  needs a

needs a  #cleanfuelstandard #CFS to get projects like this one (worth USD $750m-800m) underway in our own energy sector.

#cleanfuelstandard #CFS to get projects like this one (worth USD $750m-800m) underway in our own energy sector.

https://s22.q4cdn.com/128149789/files/doc_presentations/2020/08/Rodeo-Renewed-IR-Slides.pdf

5/12

needs a

needs a  #cleanfuelstandard #CFS to get projects like this one (worth USD $750m-800m) underway in our own energy sector.

#cleanfuelstandard #CFS to get projects like this one (worth USD $750m-800m) underway in our own energy sector.https://s22.q4cdn.com/128149789/files/doc_presentations/2020/08/Rodeo-Renewed-IR-Slides.pdf

5/12

several  refiners ( @MarathonPetroCo, HollyFrontier, CVREnergy) have recently revealed plans to move aggressively into biofuels. every

refiners ( @MarathonPetroCo, HollyFrontier, CVREnergy) have recently revealed plans to move aggressively into biofuels. every  in US production capacity jeopardizes

in US production capacity jeopardizes  's ability to attract $ for our own domestic expansion into clean fuels.

's ability to attract $ for our own domestic expansion into clean fuels.

https://www.reuters.com/article/us-phillips-66-biofuels/phillips-66-to-reconfigure-california-refinery-for-renewable-fuels-idUSKCN2582GP

6/12

refiners ( @MarathonPetroCo, HollyFrontier, CVREnergy) have recently revealed plans to move aggressively into biofuels. every

refiners ( @MarathonPetroCo, HollyFrontier, CVREnergy) have recently revealed plans to move aggressively into biofuels. every  in US production capacity jeopardizes

in US production capacity jeopardizes  's ability to attract $ for our own domestic expansion into clean fuels.

's ability to attract $ for our own domestic expansion into clean fuels.https://www.reuters.com/article/us-phillips-66-biofuels/phillips-66-to-reconfigure-california-refinery-for-renewable-fuels-idUSKCN2582GP

6/12

so, the #CleanFuelStandard needs to send a signal strong enough to support financing of new domestic production capacity. it'd be a real loss if all the #CFS did, biofuel-wise, was increase  's trade deficit with

's trade deficit with  .*

.*

old data, but indicative:

https://www.cer-rec.gc.ca/nrg/ntgrtd/mrkt/snpsht/2016/11-02rgltnmrktcndtn-eng.html?=undefined&wbdisable=true

7/12

's trade deficit with

's trade deficit with  .*

.*old data, but indicative:

https://www.cer-rec.gc.ca/nrg/ntgrtd/mrkt/snpsht/2016/11-02rgltnmrktcndtn-eng.html?=undefined&wbdisable=true

7/12

*important note here to say that biofuels are just one of the clean fuel technology options whose financing a robust #CFS would support (& of course, not all biofuels are created equal). EV charging, hydrogen, biogas/RNG, fossil refinery upgrades are also all on the table.

8/12

8/12

still, a project like Rodeo Renewed involves risk (it's "a bet on the [continuity of a positive] regulatory environment," per @BorensteinS).

https://sanfrancisco.cbslocal.com/2020/08/12/phillips-66-refinery-in-rodeo-converting-to-renewable-fuels/

9/12

https://sanfrancisco.cbslocal.com/2020/08/12/phillips-66-refinery-in-rodeo-converting-to-renewable-fuels/

9/12

but the green  light shows substantial energy industry investment remains possible in a jurisdiction that both prices carbon and mandates reductions in the GHG intensity of fuels (what the CA #LCFS does / Cdn #CFS would do).

light shows substantial energy industry investment remains possible in a jurisdiction that both prices carbon and mandates reductions in the GHG intensity of fuels (what the CA #LCFS does / Cdn #CFS would do).

10/12

light shows substantial energy industry investment remains possible in a jurisdiction that both prices carbon and mandates reductions in the GHG intensity of fuels (what the CA #LCFS does / Cdn #CFS would do).

light shows substantial energy industry investment remains possible in a jurisdiction that both prices carbon and mandates reductions in the GHG intensity of fuels (what the CA #LCFS does / Cdn #CFS would do). 10/12

last, the quiet rider to the Rodeo announcement was the closure of Phillips66's 44.5k bbl/d Santa Maria refinery, which primarily upgrades heavy crude oil (prior to further refining into finished fuels). another small sign of market shift away from Alberta's main export...

11/12

11/12

b/c in a world where @CER_REC is still projecting  in Cdn oil production, less upgrading capacity for heavier crudes means AB producers will have to compete more and more for diminished refinery availability & so accept marginally lower WCS prices.

in Cdn oil production, less upgrading capacity for heavier crudes means AB producers will have to compete more and more for diminished refinery availability & so accept marginally lower WCS prices.

https://www.cer-rec.gc.ca/nrg/ntgrtd/ftr/2019lsnds/index-eng.html

12/12

in Cdn oil production, less upgrading capacity for heavier crudes means AB producers will have to compete more and more for diminished refinery availability & so accept marginally lower WCS prices.

in Cdn oil production, less upgrading capacity for heavier crudes means AB producers will have to compete more and more for diminished refinery availability & so accept marginally lower WCS prices.https://www.cer-rec.gc.ca/nrg/ntgrtd/ftr/2019lsnds/index-eng.html

12/12

Read on Twitter

Read on Twitter