Corporate credit markets decoupled in March; bond issuance boomed but discretionary bank credit stalled

Unequal access to credit between large firms and the rest is the topic of today's #BIS_Bulletin

A thread follows

https://www.bis.org/publ/bisbull29.htm

Unequal access to credit between large firms and the rest is the topic of today's #BIS_Bulletin

A thread follows

https://www.bis.org/publ/bisbull29.htm

First, some facts:

The weekly series on new borrowing in debt markets surged at the end of March (left panel); but most of the surge came from bond issuance (middle panel) rather than from syndicated loans

The weekly series on new borrowing in debt markets surged at the end of March (left panel); but most of the surge came from bond issuance (middle panel) rather than from syndicated loans

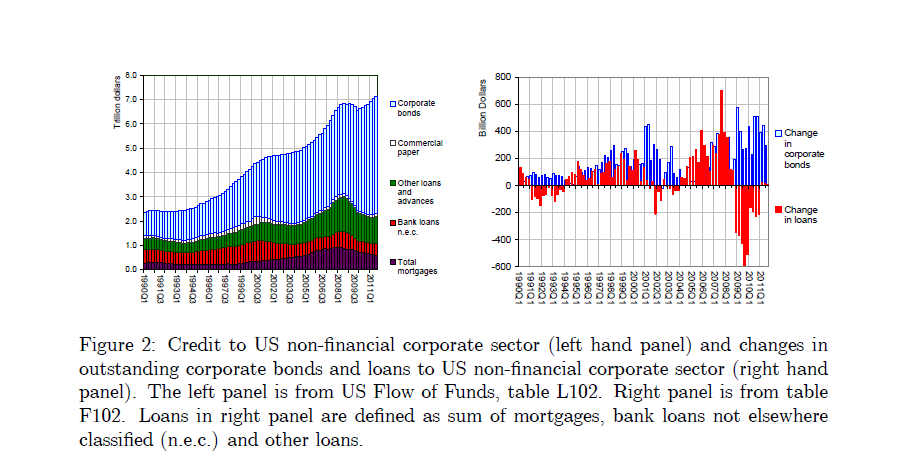

This decoupling of the bond and syndicated loan market is a repeat of what happened in the aftermath of Lehman, when loan volumes crashed and bond issuance surged (right-hand panel)

Some background:

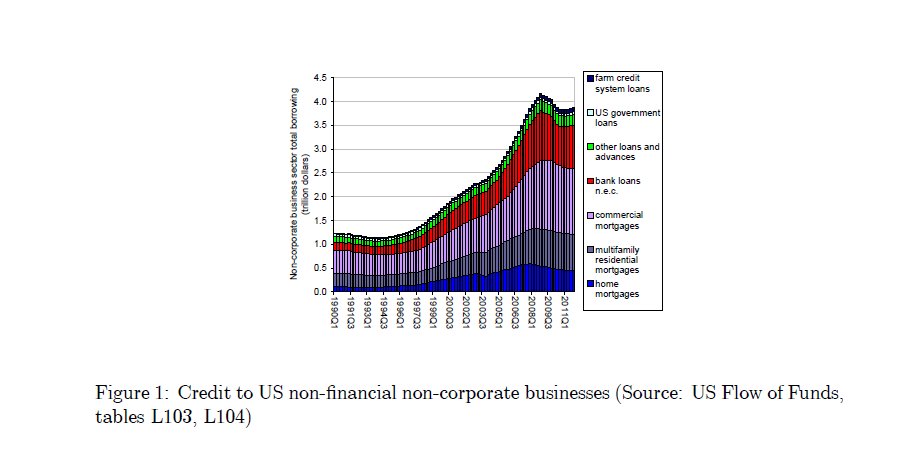

We know that small firms bear the brunt of the credit crunch; non-corporate non-financial businesses in the US saw a decline in outstanding borrowing after 2008

https://www.nber.org/papers/w18335

We know that small firms bear the brunt of the credit crunch; non-corporate non-financial businesses in the US saw a decline in outstanding borrowing after 2008

https://www.nber.org/papers/w18335

But *corporate* non-financial businesses (mostly large firms) kept on borrowing; the surge in bond issuance (blue bars on the right) easily made up for contraction in bank credit (red bars on the right)

https://www.nber.org/papers/w18335

https://www.nber.org/papers/w18335

Fast forward to this year:

The banking sector was not the epicentre of the financial crunch in March 2020 - this is one important difference from 2008

But we see a similar (though less extreme) decoupling between bonds and loans

The banking sector was not the epicentre of the financial crunch in March 2020 - this is one important difference from 2008

But we see a similar (though less extreme) decoupling between bonds and loans

Why?

Because monetary easing reaches the bond market directly, whereas when banks are involved, there is an extra filter to navigate; and banks turn more cautious in an economic downturn

Because monetary easing reaches the bond market directly, whereas when banks are involved, there is an extra filter to navigate; and banks turn more cautious in an economic downturn

The strains on the banking sector are visible in the sharp increase in loan loss provisions (left-hand panel)

Banks also saw their credit lines being drawn in large amounts so that new discretionary lending will have suffered as a result; drawn credit lines of US commercial banks went from 650 billion dollars at end-2019 to 1,050 billion dollars at end-March

https://www.federalreserve.gov/releases/efa/efa-project-syndicated-loan-portfolios-of-financial-institutions.htm

https://www.federalreserve.gov/releases/efa/efa-project-syndicated-loan-portfolios-of-financial-institutions.htm

Disparities between large firms and the rest has been a recurring theme during the Covid crisis; the bond-loan decoupling only makes this worse

Bond issuance has large fixed costs (you need a credit rating, access to the sell-side, etc.); large firms (with annual revenue above $1 billion) have taken the lion's share of new bond issuance

Although large firms have taken the lion's share of bond financing, they are not the ones that need the money more; the two most vulnerable sectors (red dots in the left hand panel) don't have many large firms

Instead, there is pretty good evidence that the additional borrowing has gone to build cash buffers; cash ratios have gone up for large firms (second panel), the proceeds are not earmarked (third panel), and maturity has gone up

This "feast and famine" in credit underscores the importance of completing the last mile of the credit flows to the borrowers at the end, especially those that are exclusively reliant on bank financing

Reposting this op ed in the @FT by Agustin Carstens on completing the last mile https://twitter.com/BIS_org/status/1244212074877718529?s=20

Read on Twitter

Read on Twitter