$GRWG HUGE GAP UP

UP 43% ON 10 x Avg Daily Volume

Closing in top 92% of bar. Higher prices likely. May be start of a trend. Daily and weekly chart attached.

Long 12.50, will add more if it pulls back 50% of bar.

UP 43% ON 10 x Avg Daily Volume

Closing in top 92% of bar. Higher prices likely. May be start of a trend. Daily and weekly chart attached.

Long 12.50, will add more if it pulls back 50% of bar.

1/ $GRWG Reasons for going long. First technical. Huge Gap Up on 10x avg volume, closing in top 92% of bar. That's not my Aunt Monica buying. It's a footprint left by the institutions and a sign of big buying. Biggest volume ever. Could be just the start of the move.

2/ $GRWG fundamentals are excellent.

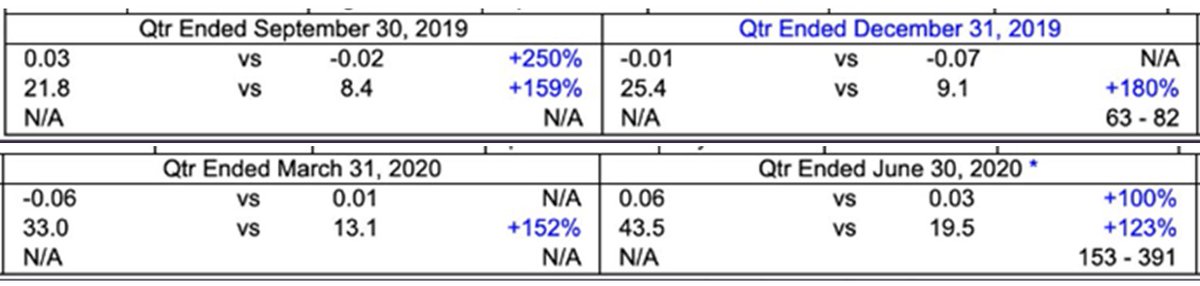

Revenues up 123% to $43.5 million for Q2 2020 vs $19.5 million for Q2 2019.

Adjusted EBITDA of $4.6 million for Q2 2020 vs $1.7 million for Q2 2019, an increase of 166%, $.12 per share, basic.

That's Non Gaap EPS of .12/.06 in Q219 (100%)

Revenues up 123% to $43.5 million for Q2 2020 vs $19.5 million for Q2 2019.

Adjusted EBITDA of $4.6 million for Q2 2020 vs $1.7 million for Q2 2019, an increase of 166%, $.12 per share, basic.

That's Non Gaap EPS of .12/.06 in Q219 (100%)

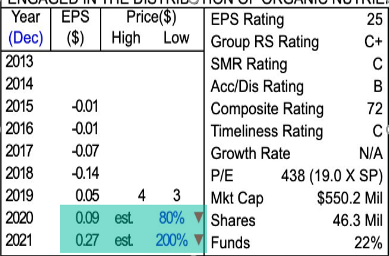

3/ $GRWG last 4 quarters earnings and sales via marketsmith. Sales: 123%, 152%, 180%, 159%. Earnings last quarter 100%.

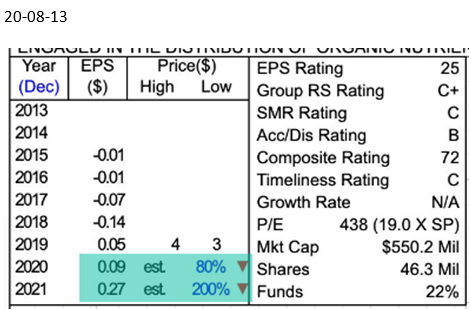

4/ $GRWG Look at history of annual EPS growth and what's expected via marketsmith. 2020 EPS expected to be 80% growth, 2021 = 200% growth. This was before yesterday's earnings report where it raised guidance... but coming to that.

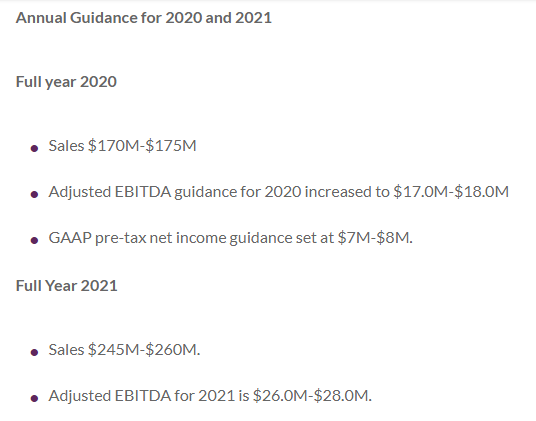

5/ $GRWG In it's company press release yesterday it raised annual Sales and Adjusted EBITDA guidance . See chart. Let's dive into this a little more to see what it actually means...

6/ $GRWG 1st Qtrly sales were 43.5/19.5 (123%), beat 36.6 est by 6.89 or 18.9%. That's a huge beat of the estimates. Last yr sales was 79.8. It raised 2020 Sales guidance to 172.5 from previously estimated 143.47 which is 116% sales gr from last year, and beat estimates by 20%

7/ $GRWG It raised it's 2020 adjusted EBITDA to 17.5M, from Q1 when it guided 2020 at 13M - that's a 34% raise. With 41M shares outs Non Gaap EPS would be Adj EBITDA/shares = .43c for 2020

8/ $GRWG with EPS of .43 stock is trading at PE of $12/.43= 28. Extremely low for a stock growing EPS and Sales > 100%. IMO it's undervalued. Price will eventually go up to it's fair value and is likely what is already happening with institutions yesterday as they caught on.

9/ $GRWG sales was raised to 172.5 from last qtr 137.5 guidance. A 25% raise. Huge! 172.5/79.7 will be 116% sales for 2020. At $12 P/S is only 2.86 (2020). IMO, this is way too low and undervalued for a stock growing earnings and sales>100%. Such stocks often have P/S of 10-40

10/ $GRWG if institutions catch on they push price up, which may be already happening. Either way, when a company keeps raising both sales and EPS like this qtr after qtr, it usually means more growth than expected and good things are in store. Price is likely to keep going up.

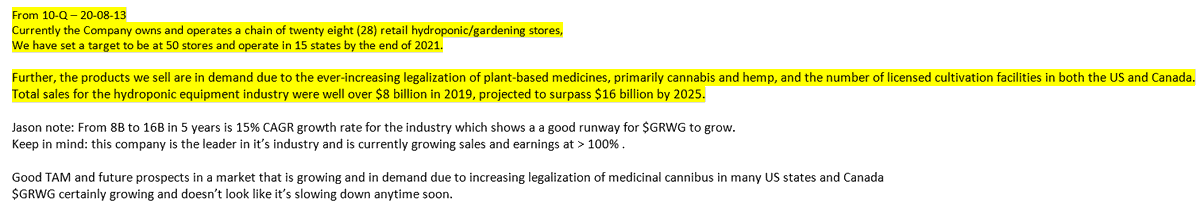

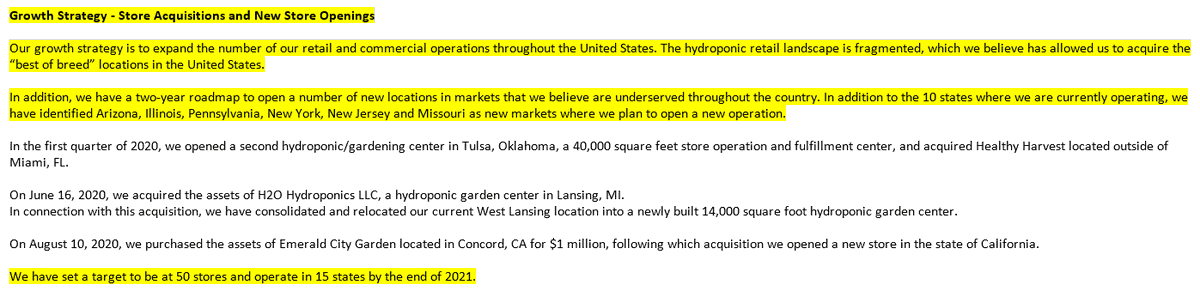

11/ $GRWG Growth strategy:

Currently the Company owns and operates a chain of twenty eight (28) retail hydroponic/gardening stores,

We have set a target to be at 50 stores and operate in 15 states by the end of 2021.

Good growth prospects ahead. see attached from 10-Q.

Currently the Company owns and operates a chain of twenty eight (28) retail hydroponic/gardening stores,

We have set a target to be at 50 stores and operate in 15 states by the end of 2021.

Good growth prospects ahead. see attached from 10-Q.

12/ $GRWG Growth strategy

13/ $GRWG

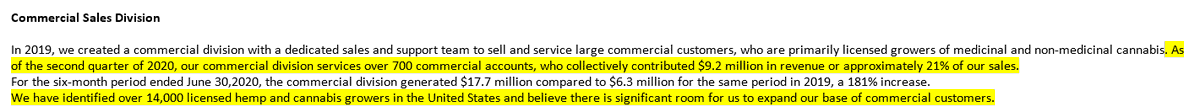

Commercial Sales Division

We have identified over 14,000 licensed hemp and cannabis growers in the United States and believe there is significant room for us to expand our base of commercial customers.

Commercial Sales Division

We have identified over 14,000 licensed hemp and cannabis growers in the United States and believe there is significant room for us to expand our base of commercial customers.

14/ $GRWG

EPS est of 2020=.09(80%) and 2021=.27 (200%) have not taken into acct the recent beats and raise in guidance. They're all likely to go up. If the company reported .12c Non Gaap EPS in Q2 alone, and with the company's growth trend is it likely to remain .09 for 2020 ?

EPS est of 2020=.09(80%) and 2021=.27 (200%) have not taken into acct the recent beats and raise in guidance. They're all likely to go up. If the company reported .12c Non Gaap EPS in Q2 alone, and with the company's growth trend is it likely to remain .09 for 2020 ?

15 /$GRWG Although the fundamentals are great, William O'Neil has taught me to study charts for confirmation. No matter what fundamentals or analysts say - the charts don't lie. Price and volume speaks for itself.

So far at 12:43 pm on Friday. Let's see how it closes at 4pm.

So far at 12:43 pm on Friday. Let's see how it closes at 4pm.

16/ $GRWG - Weekly gaps like this are rare. Here's what some other stocks did when they had charts like this. Shows the value of learning from charts. TWLO weekly strong bar after EPS Gap was up 66% on the week with 3.3 x Avg weekly volume, biggest ever. Before and after.

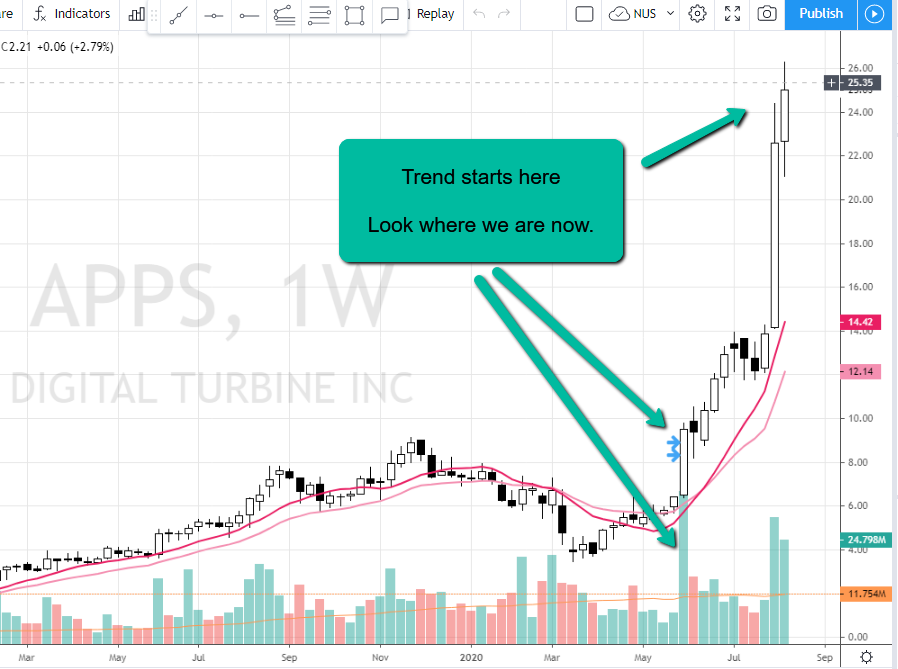

17/ $GRWG

look at $APPS - Week closes up 48%

on 3.3 x avg 50 Week volume

Closing range of bar - 92% - before and after.

I'm not saying all charts do this, I may be wrong, but probabilities are good when weekly bar starts like this.

look at $APPS - Week closes up 48%

on 3.3 x avg 50 Week volume

Closing range of bar - 92% - before and after.

I'm not saying all charts do this, I may be wrong, but probabilities are good when weekly bar starts like this.

18/ $GRWG - study what happened with $CHGG

before and after

CHGG - UP 49%

7.5x 50 WEEK AVG VOL

Closing Range = 98%

before and after

CHGG - UP 49%

7.5x 50 WEEK AVG VOL

Closing Range = 98%

19/ $GRWG SUMMARY

* Super Fundamentals - Strong Annual Earnings and Sales > 100% and expected to rise.

* Strong market with good TAM and increasing demand.

* Leader in it's group.

* Keeps raising guidance, quarter after quarter.

* Not affected by Covid - open - deemed essential

* Super Fundamentals - Strong Annual Earnings and Sales > 100% and expected to rise.

* Strong market with good TAM and increasing demand.

* Leader in it's group.

* Keeps raising guidance, quarter after quarter.

* Not affected by Covid - open - deemed essential

20/ $GRWG SUMMARY CONT..

* Undervalued at $12 - low PE of 28 and P/S of 2.86 for a stock growing EPS and Sales > 100%

* high future estimates for 2021 - prices likely to go up.

* Institutional buying shown this week with high volume.

*Charts confirming

What's not to like?

* Undervalued at $12 - low PE of 28 and P/S of 2.86 for a stock growing EPS and Sales > 100%

* high future estimates for 2021 - prices likely to go up.

* Institutional buying shown this week with high volume.

*Charts confirming

What's not to like?

21/ $GRWG

I tweeted this study as a journal to me, as a record of my reasons for buying. Some may benefit from the thought process. My goal is try to catch big winners. They usually start with strong high vol bars. Of course I could be dead wrong. But I like the probabilities.

I tweeted this study as a journal to me, as a record of my reasons for buying. Some may benefit from the thought process. My goal is try to catch big winners. They usually start with strong high vol bars. Of course I could be dead wrong. But I like the probabilities.

$GRWG Closes the week up 47% on the high of a Bar.

On 8.9x avg weekly volume - that's HUGE and rare.

Closing in top 99% of bar,

Shows not many profit takers and those who bought believe prices are going higher. Likely in it longer term. Daily and weekly charts speak volumes.

On 8.9x avg weekly volume - that's HUGE and rare.

Closing in top 99% of bar,

Shows not many profit takers and those who bought believe prices are going higher. Likely in it longer term. Daily and weekly charts speak volumes.

22/ $GRWG MARKET OPPORTUNITY

23/ $GRWG - GROWTH STRATEGY

24/ $GRWG SALES GROWTH 2018 & 2019 shows strong trend up that is still in early stages of it's 5 year plan

25 / $GRWG Store unit growth - projects 13 additional stores in 2020 and up to 50 by 2021 mentioned in it's most recent qtrly report 20-08-13

projected goal of 50 by end of 2021, to clarify.

Read on Twitter

Read on Twitter