Inflation 101

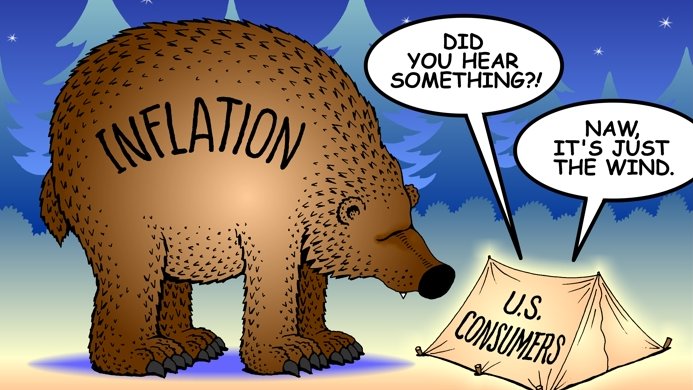

Given all of the money printing that has taken place over the last several months, you have undoubtedly heard the term "inflation" thrown around a lot.

But what is inflation and how does it work?

Here's Inflation 101!

Given all of the money printing that has taken place over the last several months, you have undoubtedly heard the term "inflation" thrown around a lot.

But what is inflation and how does it work?

Here's Inflation 101!

1/ First, a few definitions.

Inflation is a measure of the rate of increase of the price of a basket of selected goods and services.

It is typically expressed as a % and serves as an indicator of the change in "purchasing power" (i.e. what your money can buy) of a currency.

Inflation is a measure of the rate of increase of the price of a basket of selected goods and services.

It is typically expressed as a % and serves as an indicator of the change in "purchasing power" (i.e. what your money can buy) of a currency.

2/ The Consumer Price Index (CPI) and Wholesale Price Index (WPI) are the most common indexes for measuring inflation.

While typically discussed on an economy-wide basis, we may see inflation in some areas of the economy (e.g. housing) and deflation (price declines) in others.

While typically discussed on an economy-wide basis, we may see inflation in some areas of the economy (e.g. housing) and deflation (price declines) in others.

3/ In very simple terms, inflation occurs when there is too much money chasing too few goods and services.

In slightly more technical terms, inflation occurs when money supply growth outpaces economic growth.

To illustrate how this works, let's use a simple story.

In slightly more technical terms, inflation occurs when money supply growth outpaces economic growth.

To illustrate how this works, let's use a simple story.

4/ Imagine a primitive island society with 10 inhabitants.

On this island, they use rare seashells as currency. There are only 1,000 seashells on the island.

The islanders use the seashells to buy food, building materials for their homes, etc. Prices of these goods are stable.

On this island, they use rare seashells as currency. There are only 1,000 seashells on the island.

The islanders use the seashells to buy food, building materials for their homes, etc. Prices of these goods are stable.

5/ A large storm, Hurricane FEDerico (sorry!), sweeps through the region.

In the aftermath, the islanders see that another 1,000 of the rare seashells have washed up onshore.

There are now 2,000 units of the currency, but the same amount of goods.

What happens next?

In the aftermath, the islanders see that another 1,000 of the rare seashells have washed up onshore.

There are now 2,000 units of the currency, but the same amount of goods.

What happens next?

6/ So what we have is a 100% increase in money supply and no increase in the supply of goods.

Now there is more money chasing the same amount of goods, so sellers of the goods raise their prices. Simple supply and demand.

This is inflation in action.

Now there is more money chasing the same amount of goods, so sellers of the goods raise their prices. Simple supply and demand.

This is inflation in action.

7/ The impact of this differs across the two types of islanders.

Savers, who had stored seashells for later use, are punished as each stored seashell has become less valuable in its ability to purchase goods.

Asset Holders rejoice as the value of their assets appreciates.

Savers, who had stored seashells for later use, are punished as each stored seashell has become less valuable in its ability to purchase goods.

Asset Holders rejoice as the value of their assets appreciates.

8/ It doesn't sound so great, so why is maintaining steady, positive inflation a goal of central banks worldwide?

Inflation incentivizes spending by disincentivizing saving. Central banks believe spending drives growth.

So they seek inflation:

Inflation Spending

Spending  Growth

Growth

Inflation incentivizes spending by disincentivizing saving. Central banks believe spending drives growth.

So they seek inflation:

Inflation

Spending

Spending  Growth

Growth

9/ This Keynesian belief (more on this later), it should be said, is contested.

Given the rapid increase in money printing in recent months (primer below), these debates have taken center stage.

It is important for everyone to understand the basics. https://twitter.com/SahilBloom/status/1280507298083979265?s=20

Given the rapid increase in money printing in recent months (primer below), these debates have taken center stage.

It is important for everyone to understand the basics. https://twitter.com/SahilBloom/status/1280507298083979265?s=20

10/ This was a (very simple) primer on inflation. It is not intended to be exhaustive - there are certainly nuances to much of this.

I plan to do threads on the basics of monetary policy to build upon this foundation.

That was Inflation 101! I hope you found it useful.

I plan to do threads on the basics of monetary policy to build upon this foundation.

That was Inflation 101! I hope you found it useful.

11/ For other educational threads on money, finance, and economics, check out my meta-thread below. Stay tuned for more! https://twitter.com/SahilBloom/status/1284583099775324161

Read on Twitter

Read on Twitter