Gold recently hit its all-time high of $2,000. This sparked the interest of people looking to make big $ from a fast investment. It’s now down to $1,900, why did it reach this all-time high? Why was gold shining? Should you invest in Gold today?

Thread

Before you unroll tweet https://twitter.com/DONJAZZY/status/1287692540192477184

tweet https://twitter.com/DONJAZZY/status/1287692540192477184

Thread

Before you unroll

tweet https://twitter.com/DONJAZZY/status/1287692540192477184

tweet https://twitter.com/DONJAZZY/status/1287692540192477184

You can get the full thread in 1 article here on my LinkedIn newsletter: https://www.linkedin.com/pulse/gold-recently-hit-2000-what-happened-should-you-invest-odjugo

Now back to the thread

One statement you typically hear when people are describing Gold is “Gold is a store of value”. What is the rationale behind this statement? Does it still

Now back to the thread

One statement you typically hear when people are describing Gold is “Gold is a store of value”. What is the rationale behind this statement? Does it still

hold in the investment space? Should you invest in Gold?

Gold has been used as a currency as far back as 550 BC, but what is referred to as the “Gold standard” was only adopted in the late 1800s. The gold standard (which is when the value of a country’s currency is pegged to

Gold has been used as a currency as far back as 550 BC, but what is referred to as the “Gold standard” was only adopted in the late 1800s. The gold standard (which is when the value of a country’s currency is pegged to

Gold, e.g. $1 = 1 oz of Gold like how N470 = $1) was abandoned entirely in 1971 leaving room for country’s currencies to be traded directly against each other. Allowing for more direct foreign Exchange of currencies (Forex)

Is Gold really a store of value? If it is, is it a good https://twitter.com/JE_dna/status/1255791284922585088

Is Gold really a store of value? If it is, is it a good https://twitter.com/JE_dna/status/1255791284922585088

one? A store of value is anything that can maintain its value without depreciating. There are 2 ways to take this definition. You can take it in the literal sense like: if you leave Gold in a room for years without subjecting it to any harmful external circumstances, would it

remain in the same shape and quality you left it? Or you can take it in the monetary sense: has the price of Gold remained stable and continued to improve with inflation? In the literal sense, yes, it’s a store of value. In the monetary sense, well, sometimes depending on when

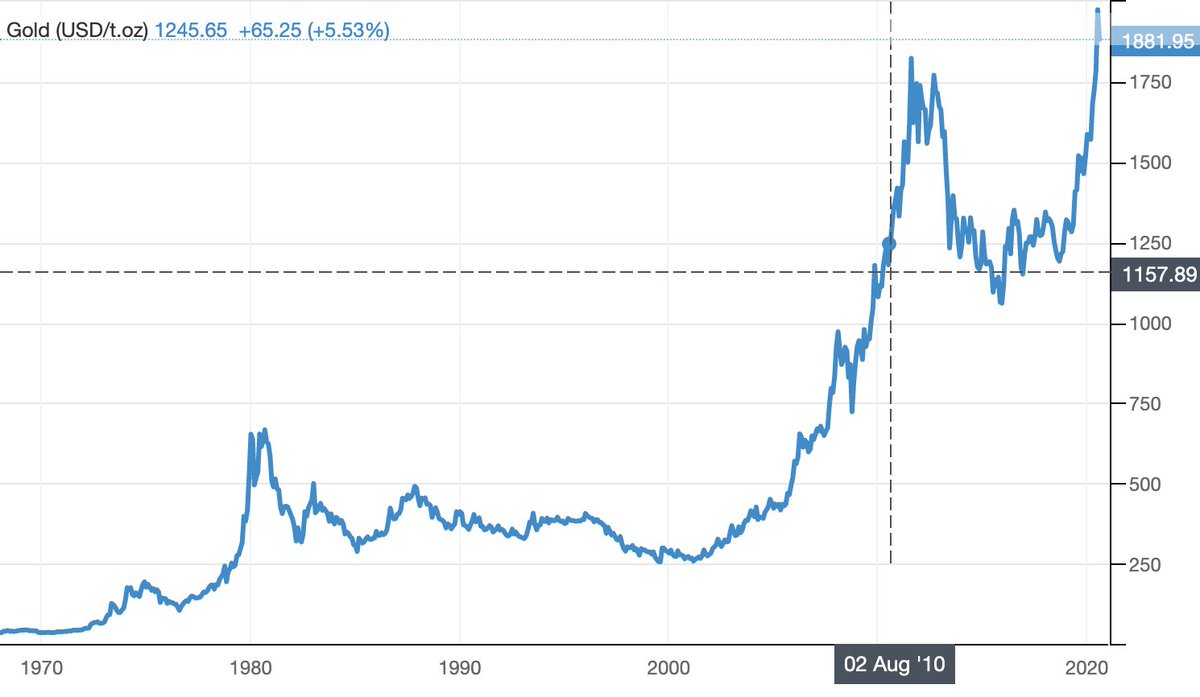

you buy and how long you hold for. For example, if you look at the charts below, if you had bought Gold a decade ago in August 2010, you would have gotten it for roughly $1,400, and today Gold is worth around $1,900 (which is about 35% return on your money or an average annual

return of about 3.5%). But if you had bought 1 year later in August 2011, you would have gotten it at just under $1,760, and for 9 years, you would not have made any significant profit, in fact, you would have lost some money.

So, is Gold a good store of value? Sometimes. Are

So, is Gold a good store of value? Sometimes. Are

there better stores of value? Yes. But more on this later.

What happened to Gold in 2020? The news of gold hitting all-time highs of $2,000 amid a global pandemic seems to have sparked interest in an investment that some people may not have even heard of or considered when

What happened to Gold in 2020? The news of gold hitting all-time highs of $2,000 amid a global pandemic seems to have sparked interest in an investment that some people may not have even heard of or considered when

looking for where to invest their money. NB: All-time highs meaning this is the highest price in history that Gold has ever gotten to. So, what happened to Gold? Why’s it “trending”?

The reason is right there in the question. The pandemic and shut down coupled with the US-China

The reason is right there in the question. The pandemic and shut down coupled with the US-China

trade “war” (I prefer dramatics because they have already signed a phase 1 deal but for 1 reason that we know, they are still playing games with the news) has made the economic future very uncertain and in uncertain times, people go to safe options like Gold. Another reason is,

that we know, they are still playing games with the news) has made the economic future very uncertain and in uncertain times, people go to safe options like Gold. Another reason is,

that we know, they are still playing games with the news) has made the economic future very uncertain and in uncertain times, people go to safe options like Gold. Another reason is,

that we know, they are still playing games with the news) has made the economic future very uncertain and in uncertain times, people go to safe options like Gold. Another reason is,

for people that prefer safe investments, i.e. people that prefer investing in treasury bills and bonds, Gold is currently performing better as an investment. With falling interest rates in the US (the Federal Reserve which is the Central Bank of the US have stated that interest

rates will remain between 0-0.25% till 2022) options like treasury bills and bonds would not be as profitable as they used to be. So even though Gold isn’t great, for an investor that likes safe investments, Gold is good enough. Another reason is the Dollar is getting weaker

(weaker for people that have Euros o not those with some other currencies

). For foreign investors in Europe and Japan, a weaker dollar means that Gold is cheaper for them to buy. Basic demand and supply: since it’s cheaper for them, more of them can afford to buy it and

). For foreign investors in Europe and Japan, a weaker dollar means that Gold is cheaper for them to buy. Basic demand and supply: since it’s cheaper for them, more of them can afford to buy it and

). For foreign investors in Europe and Japan, a weaker dollar means that Gold is cheaper for them to buy. Basic demand and supply: since it’s cheaper for them, more of them can afford to buy it and

). For foreign investors in Europe and Japan, a weaker dollar means that Gold is cheaper for them to buy. Basic demand and supply: since it’s cheaper for them, more of them can afford to buy it and

invest in it if they want to.

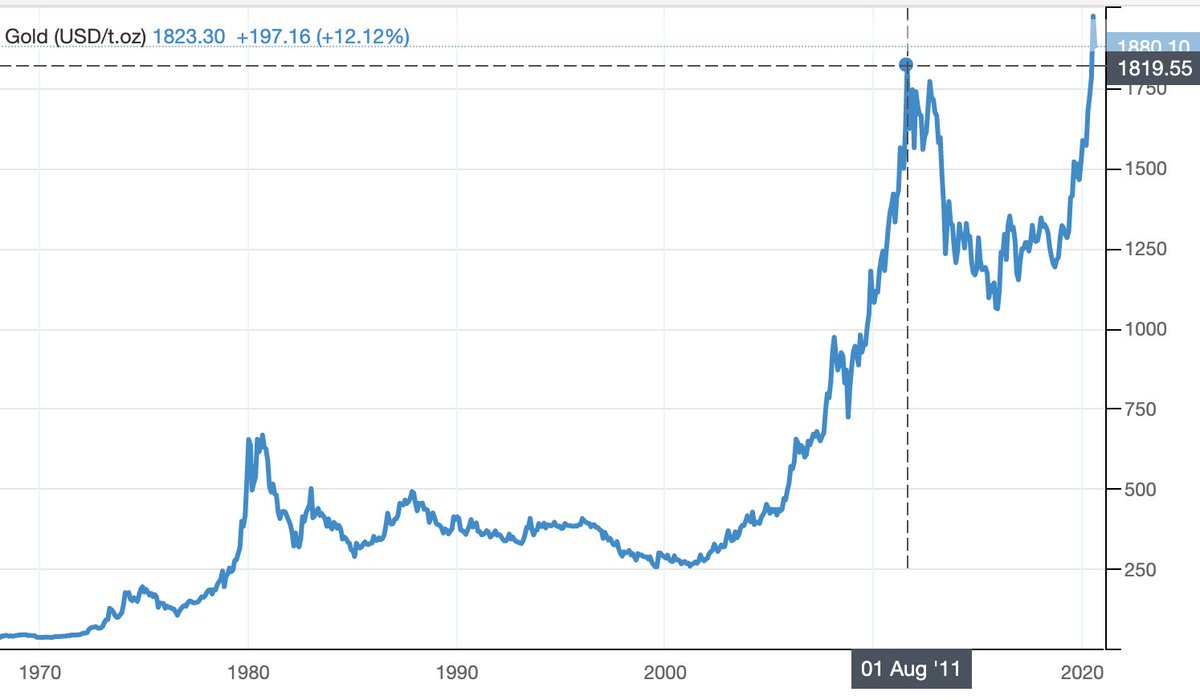

Fun fact, when adjusted for inflation, gold prices were actually higher in September 2011, to reach an inflation-adjusted all-time high, Gold would have to reach $2,135. In fact, the rise of Gold did not really start in 2020, it began in late 2018,

Fun fact, when adjusted for inflation, gold prices were actually higher in September 2011, to reach an inflation-adjusted all-time high, Gold would have to reach $2,135. In fact, the rise of Gold did not really start in 2020, it began in late 2018,

and started to accelerate when the Federal Reserve reduced interest rates in 2019.

But here’s the thing with when Gold is at its peak is, it typically means that the economy is in an uncertain time and stock prices might be lower. In this case, stock prices are rising, and gold

But here’s the thing with when Gold is at its peak is, it typically means that the economy is in an uncertain time and stock prices might be lower. In this case, stock prices are rising, and gold

prices were rising until yesterday when it fell by around $40 (more on this later). This simply means that investors don’t believe the stock market move is justified. They still don’t have reason to believe that the economy would recover soon and as such, they are hedging their

bets with Gold.

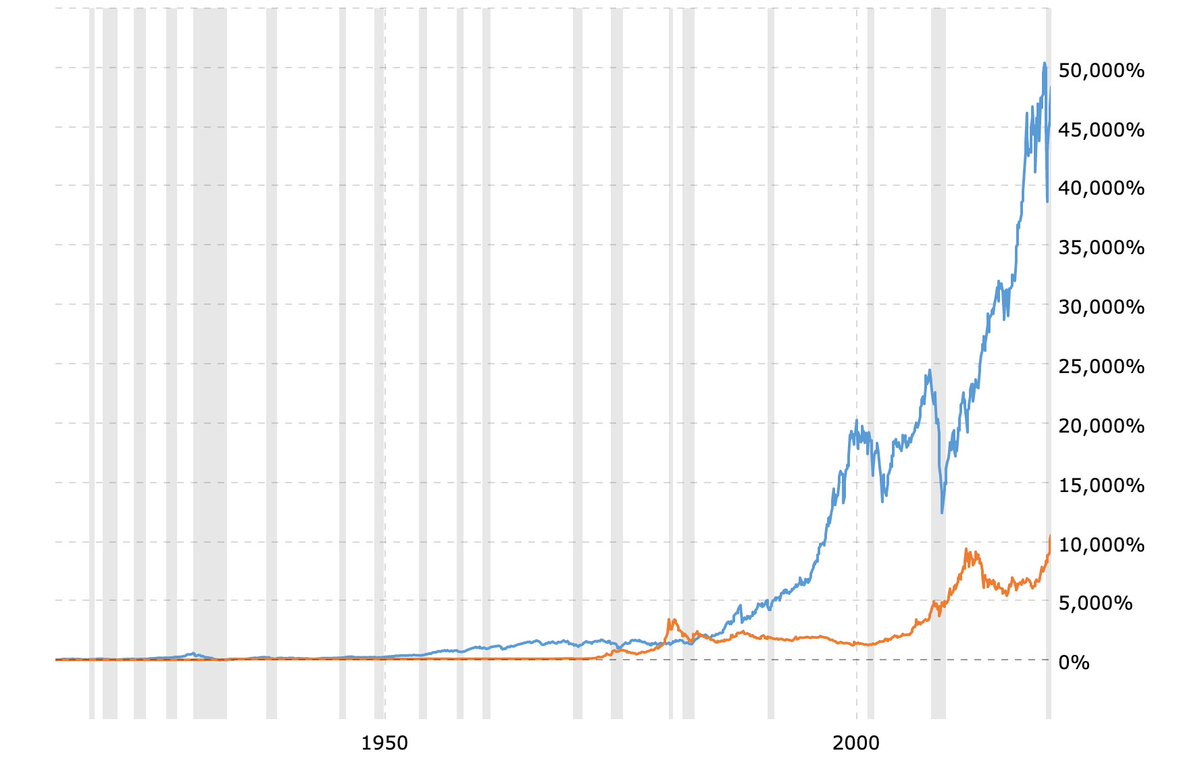

Should you invest in Gold? Maybe not. Why? Because there are better options. Look at this chart comparing the performance of the stock market to Gold. Historically, the stock market index has significantly outperformed Gold on a ratio of 3 to 1. If history is

Should you invest in Gold? Maybe not. Why? Because there are better options. Look at this chart comparing the performance of the stock market to Gold. Historically, the stock market index has significantly outperformed Gold on a ratio of 3 to 1. If history is

anything to go by, over the long term, you would be better off investing in the stock market. This chart just covers the stock market index, and if you compare it to companies like Amazon, the difference is even wider.

Does this mean that I expect the price of Gold to fall like

Does this mean that I expect the price of Gold to fall like

it did in 2010, not immediately, no. Although the price of gold fell by $40 yesterday and is starting to fall by around $60 today, we are not fully out of the uncertain times yet. Like I said earlier, the Federal Reserve has stated that interest rates will remain low till 2022,

while the trade war with China should eventually get sorted, the economy is still a far cry from full recovery and investors know this.

The truth is, the best time to have invested in Gold would have been 10 or 20 years ago, the price of Gold might be too high to invest now.

The truth is, the best time to have invested in Gold would have been 10 or 20 years ago, the price of Gold might be too high to invest now.

Even if the price does increase, it might not exceed around a 20-30% growth and it would start to fall when the world starts going back to normal and everything is back on track. Except you expect the world to continue in uncertain/bad times for a long time, this might not be the

best investment to make in the long term. As seen in the charts, those that bought in at previous all-time highs in September 2011 are still worse off today when adjusting their investment for inflation

Endnote: Gold doesn’t provide you with a dividend as stocks do, the

Endnote: Gold doesn’t provide you with a dividend as stocks do, the

transaction costs to buy and sell are pretty high and an asset that does well when things are bad might not be the best option for long term investment because as history has shown, tough times don’t last. Some investment advisers advise investors to have a portion of their total

investment say between 2-10% in Gold while others like Warren Buffet advise avoiding it altogether for reasons earlier stated. As I always recommend, you should think for yourself and determine if it is something you want to invest in.

Read on Twitter

Read on Twitter