Great report by @mjmauboussin -> Public to Private Equity in the United States: A Long-Term Look

In just 25 yrs, there has been a marked shift in U.S. equities from public markets to private markets controlled by buyout and VCs.

Here's how we got here and where we go next.

In just 25 yrs, there has been a marked shift in U.S. equities from public markets to private markets controlled by buyout and VCs.

Here's how we got here and where we go next.

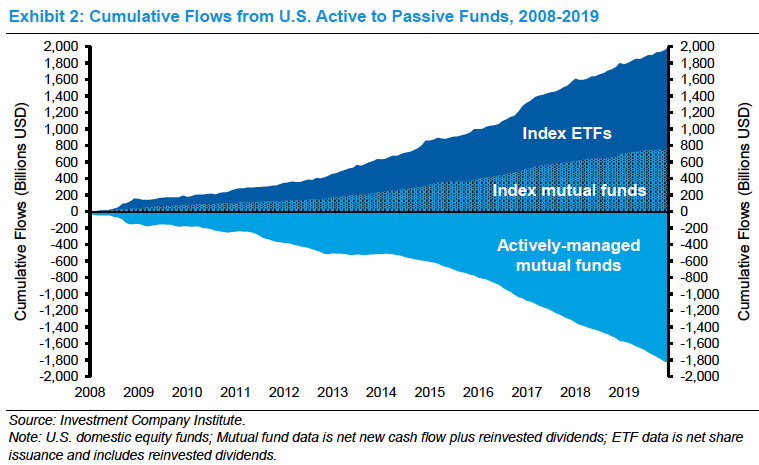

Most people know the huge shift from active to passive.

We are talking trillions, and it's only speeding up.

We are talking trillions, and it's only speeding up.

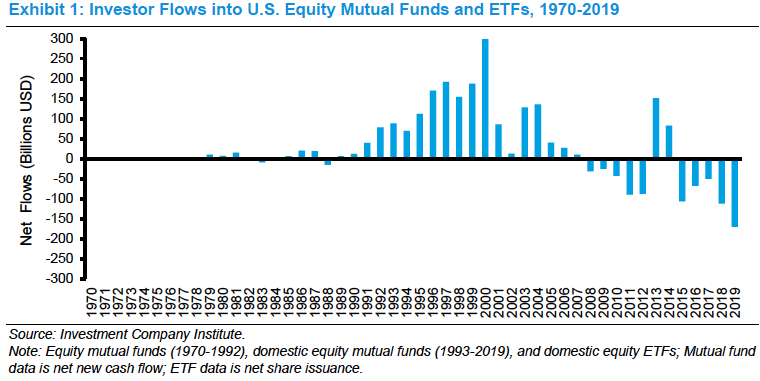

And specifically in equities, we know the extent of the outflows since 2000.

Will we finally see a turn with rates at zero?

Will we finally see a turn with rates at zero?

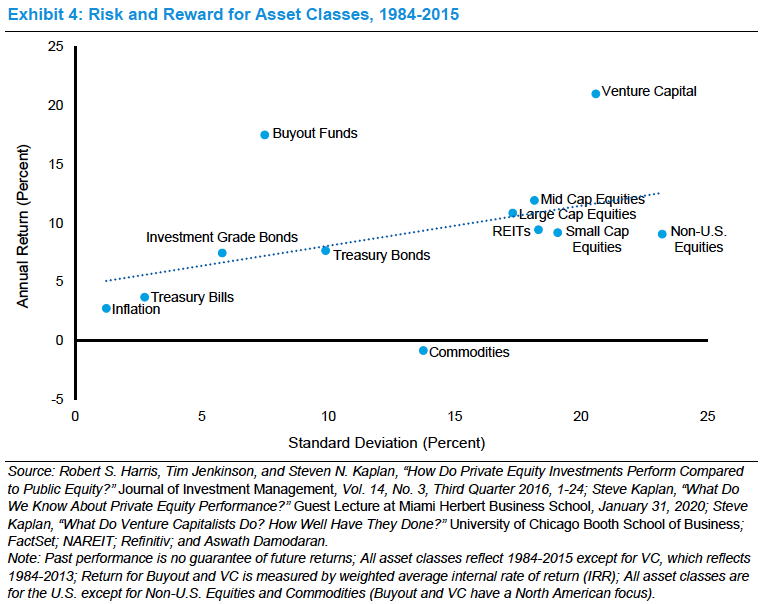

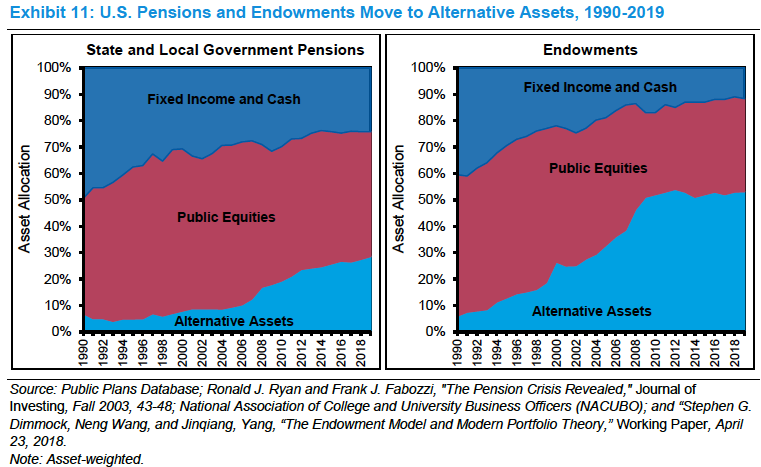

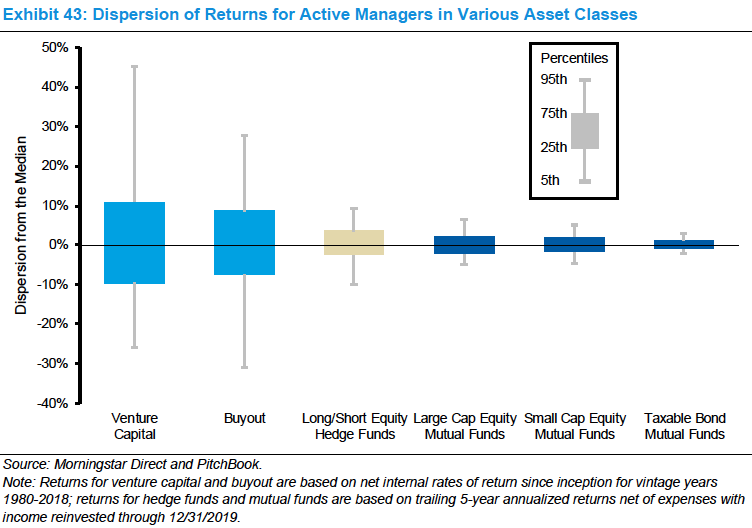

Then comes the discussion on why Private Markets - simple: higher returns with lower volatility. Every allocators dream.

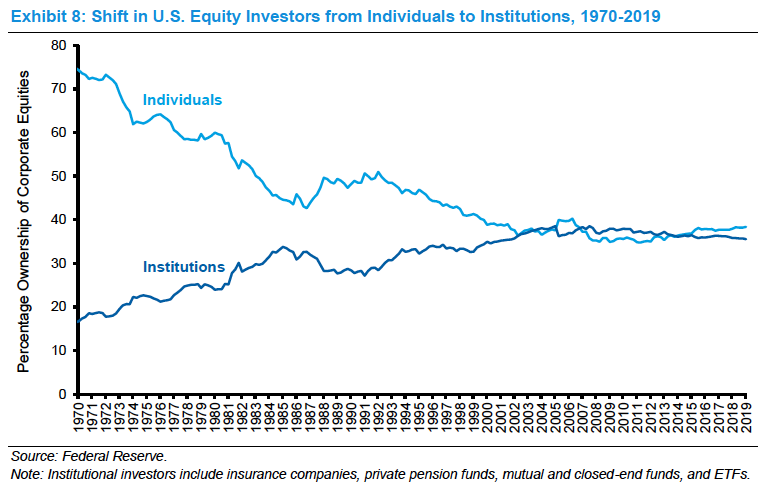

This matters even more now, because equities are an institutional game, the individual has gone from owning 75% of equities down to 35%. The institutions are the incremental driver of capital.

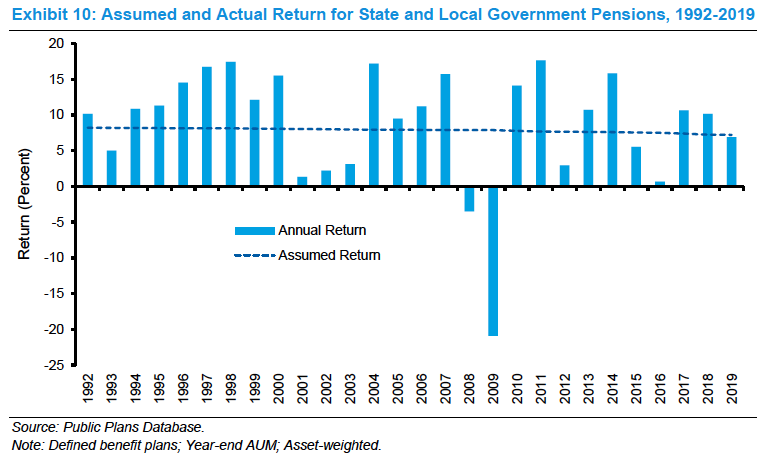

And those pensions need high private market returns to get to their high assumed returns. Will it be enough?

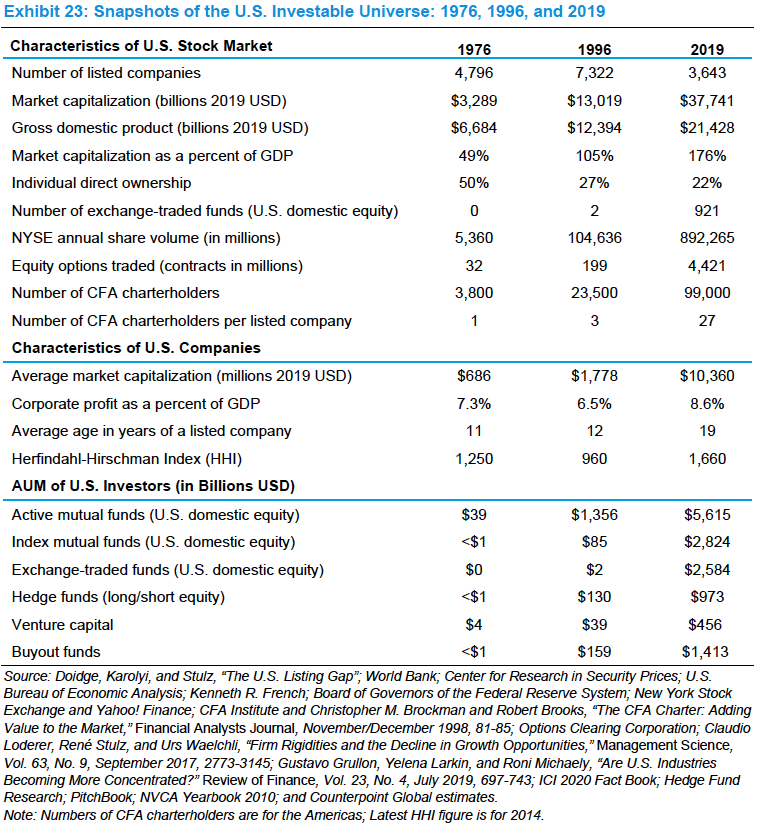

This has all happened while the public markets themselves have transformed. Was the change bigger from 1976 to 1996 or from 1996 to today?

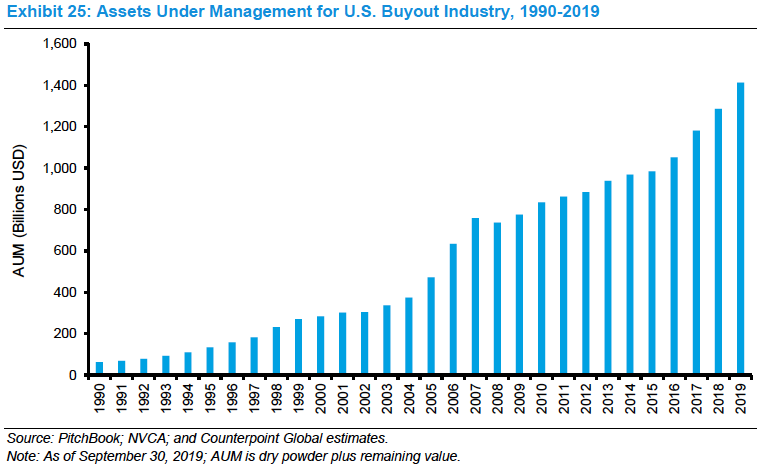

One of the big beneficiaries of the institutional move into private markets is buyouts. More than 2x AUM since 2008 and 6x since 2000.

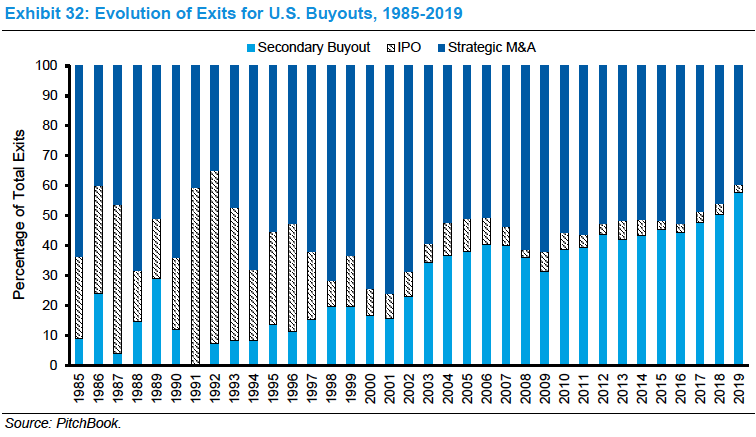

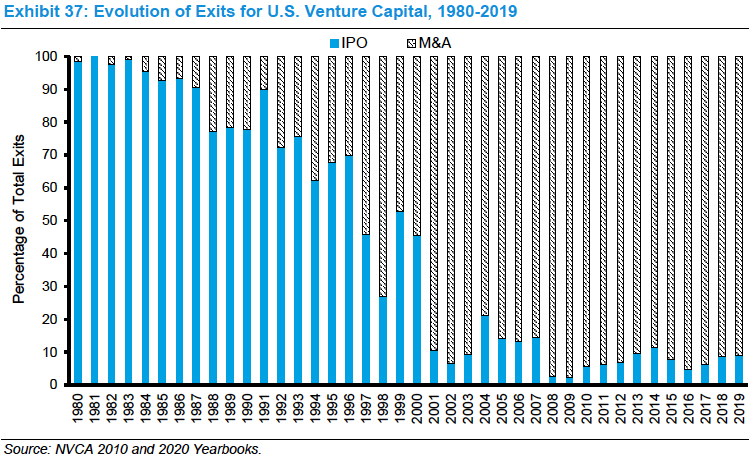

And the PE market is big enough now that it can just shuffle companies in the secondary market from one PE firm to the other. It doesn't need an IPO or M&A anymore.

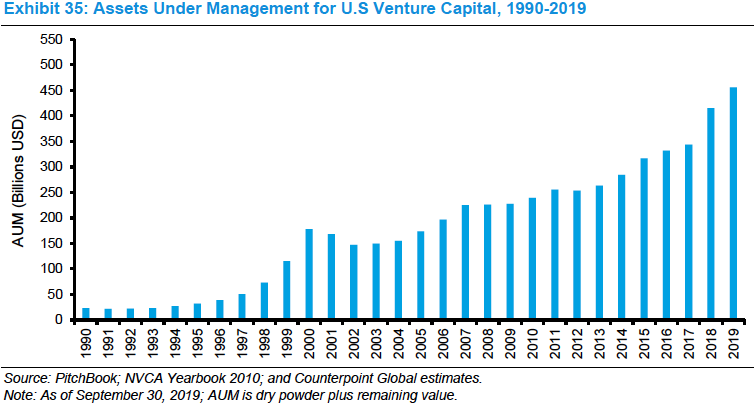

And then my personal favourite, the VC market, that is still in its infancy, only 3x larger AUM since 2000.

The authors expect much more capital to flow into PE and VC because for now returns will be higher, vol. lower and maybe the lack of liquidity is a good thing from a behavioural perspective.

Yes competition will increase and fees will go down, but the asset class room to run.

Yes competition will increase and fees will go down, but the asset class room to run.

Read on Twitter

Read on Twitter