THREAD: This "payroll tax deferral" will likely amount to little more than some extra interest income for employers. 1/

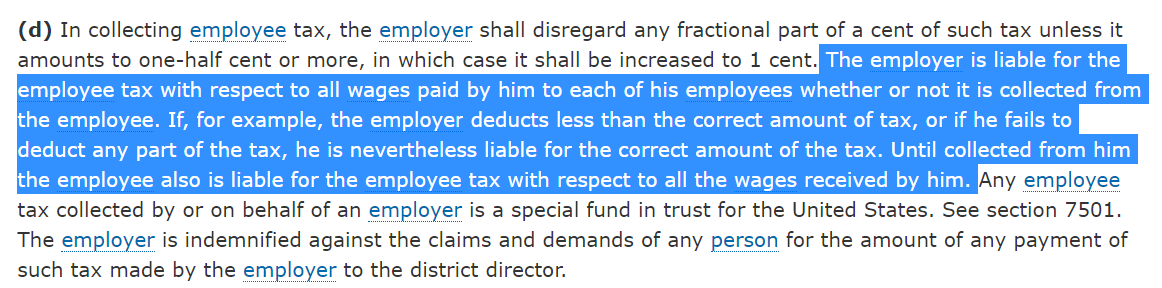

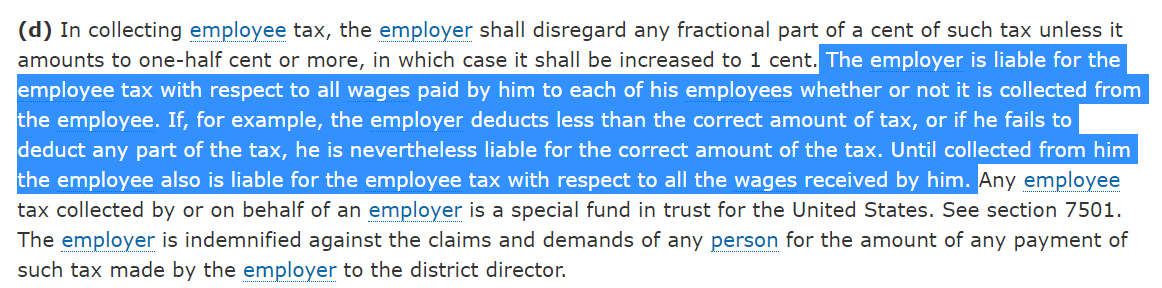

Here's the key for payroll taxes: Employers are liable for the full amount, whether they withhold the employee's half or not. (26 CFR 31.3102-1) 2/

So if an employer chooses not to withhold employee payroll taxes, they still have to get them back from the employee later. That sounds like what @EconCharlie described, which seems silly already, but it's so much messier than even that. https://twitter.com/EconCharlie/status/1285269294851514369?s=20 3/

What if the employee leaves before the employer has recouped the deferred payroll taxes? Does the employer ask their former employee to cut them a check? Remember, the employer is on the hook for the employee's payroll taxes whether they withheld thm or not. 4/

Good point from @RichardRubinDC for employees still at the same employer. Double withholding sounds bad, but it's more complicated since wages aren't constant. More like an installment plan for deferred payroll taxes, plus current payroll taxes. https://twitter.com/RichardRubinDC/status/1292457363186876418 5/

So the employer is probably never going to get back some of the deferred payroll taxes from employees who left, but the employer is still on the hook for paying them. For the employees they still have, a complex formula that gives their workers a huge pay cut. Awesome. 6/

And if your employer does try this payroll tax deferral, don't forget that later part from 26 CFR 31.3102-1(d). If the IRS can't get the employee payroll taxes from your employer (maybe they went out of business), the IRS can come after you for them. 7/

So I bet most employers still withhold employee payroll taxes, and just earn a little bit of interest on the money until they have to deposit it.

That's interest the Social Security and Medicare trust funds won't be getting, so yes, this takes money out of those programs. 8/

That's interest the Social Security and Medicare trust funds won't be getting, so yes, this takes money out of those programs. 8/

But if others have different takes on how the payroll tax deferral plays out, I'd love to hear them! 9/9

Addendum: It looks like the payroll tax deferral memorandum just applies to the 6.2% Social Security tax, not the 1.45% Medicare tax, since it refers specifically to 26 USC 3101(a) and not 3101(b).

Read on Twitter

Read on Twitter