As I said, payroll tax cuts are the hydroxychloroquine of economic policy. But let me nerd out a bit on exactly why they're so useless right now 1/ https://twitter.com/paulkrugman/status/1292418243332919296

Econ 101 says that in the long run, under normal conditions, payroll tax cuts r passed on to workers in higher wages. Some qs about that proposition, but put that aside. The key point is that we need short-run relief under abnormal conditions — and tax cut won't provide it 2/

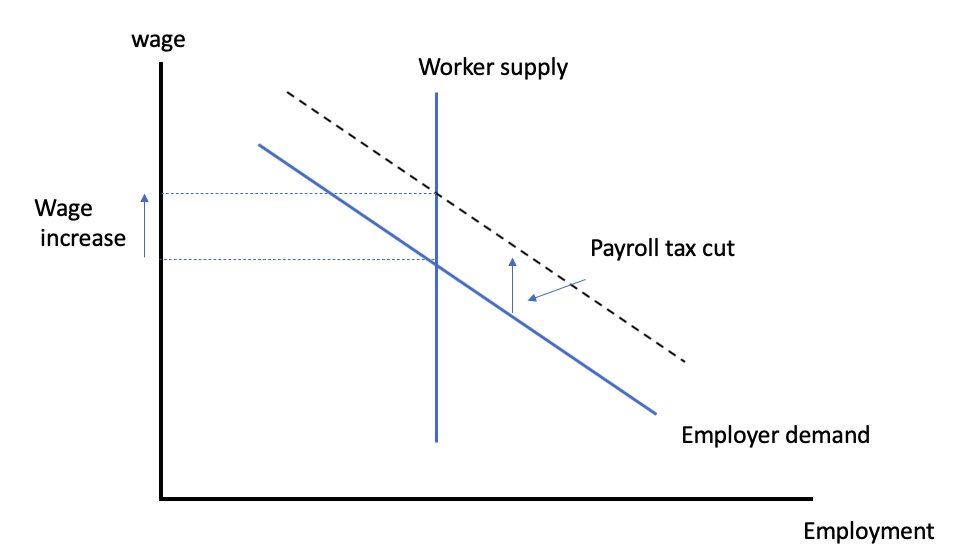

Here's the Econ101 logic. Demand for workers depends on cost, which includes wage plus payroll contribution. Supply is inelastic: # of workers not thought to depend much on wage. So tax cut shifts D up, leading to wage rise 3/

But none of this relevant now. Employers not on their normal demand curve, bc they are shut by pandemic. Worker supply highly elastic, because huge number of unemployed seeking scarce jobs 4/

So no reason to believe employers will create jobs; they can't. Nor will they raise wages. Why should they, when workers begging for jobs? They'll just pocket the tax cut. This is just a giveaway to business — and specifically to businesses hurt least by Covid-19 5/

So this is just about the worst policy idea I've seen since, um, telling people they don't need to wear masks 6/

Read on Twitter

Read on Twitter