I normally enjoy Joe's hot takes, but this one... yikes. It is a good example, in my view, of why relying too heavily on the "money view" (i.e.liquidity preference view) of interest rates can cause one to miss the forest for the trees. Let me explain...1/n https://twitter.com/TheStalwart/status/1292185854761459713

First, let's start with a well-known example that clearly contradicts @TheStalwart claim that the Fed sets the entire yield curve: the Greenspan conundrum. The Fed had been tightening on a very predictable basis since mid-2014 & expected LT rates to follow, but they didn't....2/n

The Fed couldn't have been clearer about what it wanted the yield curve to do and yet no cigar. As @M_C_Klein notes, Greenspan shouldn't have been surprised. Lot's of examples where the YC didn't comply with the Fed desired rate path: https://ftalphaville.ft.com/2015/09/03/2139028/greenspans-bogus-conundrum/ ... 3/n

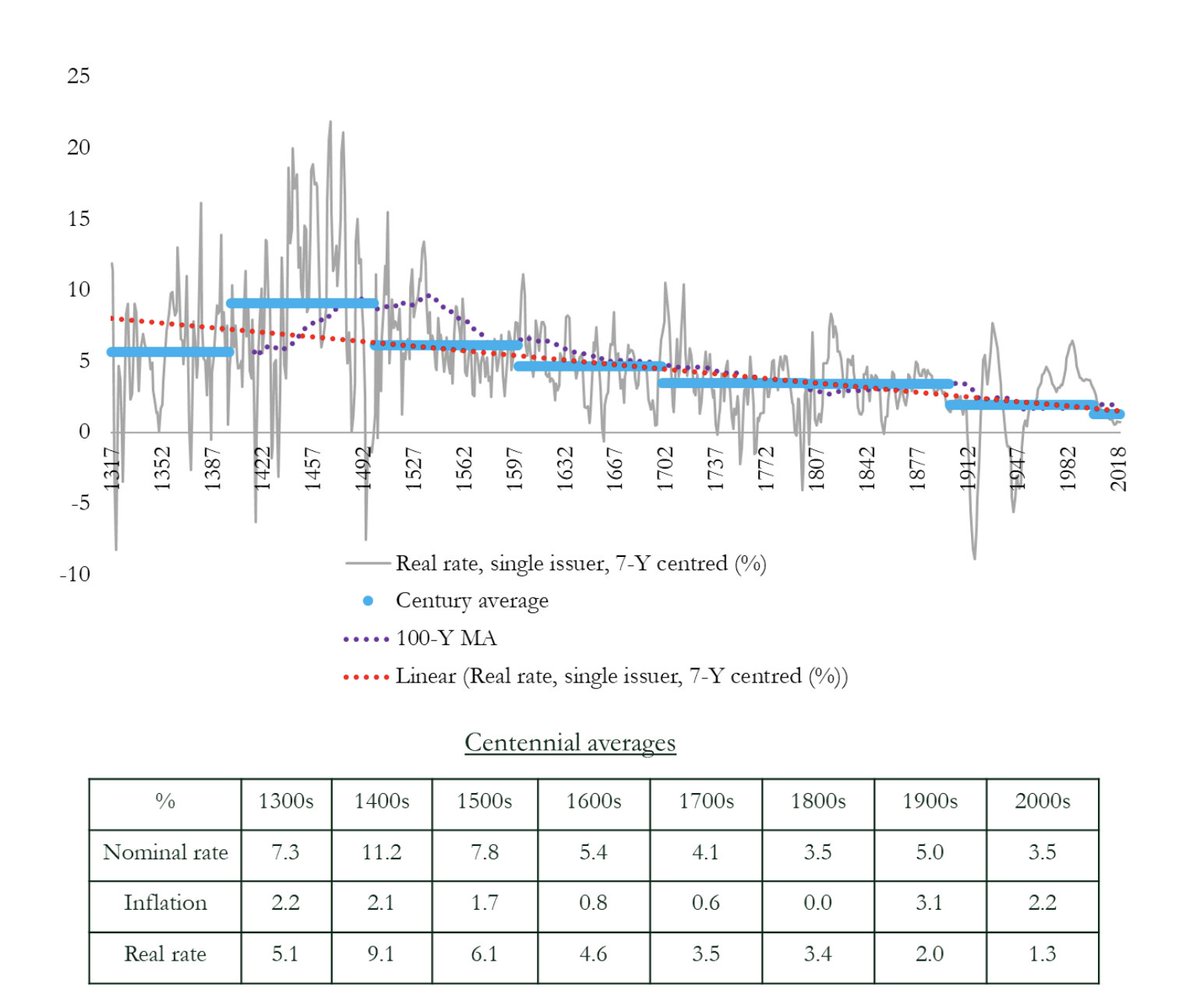

Second, there has been a sustained 40 year decline in both nominal and real long-term yields. If we take Joe's view seriously, then we have to conclude the Fed did all this! And how do we explain the similar decline in other advanced economies? 4/n

Moreover, how do we explain the 500 year decline in both nominal and real yields that exists in many cases outside of central banking (per @paul_schmelzing). Time-traveling central banks? https://www.bankofengland.co.uk/-/media/boe/files/working-paper/2020/eight-centuries-of-global-real-interest-rates-r-g-and-the-suprasecular-decline-1311-2018 5/n

The money view of interest rates can't explain these long-term trends. A real view of interest rates based on fundamentals--demographics, technology, productivity, regulatory structure, etc.--can make sense of these trends. See, for example, literature on safe asset shortage 6/n

While the money view does a good job explaining short-run interest rate movements, relying on it too hard can cause one to miss longer-term forces at work. Recall the Fed expected rate paths over past few years. They all over shot reality. Why? 7/n

Because the fundamentals of the economy forced the Fed's hand. Put differently, the Fed wanted to raise rates far more than it did, but learned quickly the economy couldn't handle it. These long-term realities also weigh heavily on the yield curve. Ignore them at your peril. End.

Read on Twitter

Read on Twitter