Arbitrage and liquidation ops give traders a chance to win big. Closing arbitrages keeps the system stable, but it comes with a cost for the participants, for the miners, and for users of the network. A thread of thoughts.

1/16 The classical auction to close an arbitrage, as extensively described in Flashboys 2.0 by @phildaian et,al, is probably the natural way to think of this. Once an opportunity to close an arbitrage pops up, players will battle in a bidding war for the opportunity to close it.

2/ Every player pushes the price of their transaction higher until the block is mined and the auction ends. Alternatively, it becomes no longer possible or economical for some parties to keep participating.

3/ The auction is quite efficient in terms of the burden on the network. Each player only posts one transaction. Each uptick in price simply replaces the old one by using the same nonce. The miners also get a good deal, such as in this example https://twitter.com/amanusk_/status/1289936059556442113?s=20

4/ The miner profited 16 ETH, on top of the block reward. The winner profited ~$14K. Theoretically, the bids can go up even higher, as long as the net profit outweighs the gas costs.

There is a different approach. In back-running (opposed to front running), bots fill the networks with transactions of the same gas price as the tx creating the arb (e.g. an oracle update). This way, they increase the chance that their tx will be included right after the arb op

6/ A good example describing this dynamic was the BZRX token launch, where one of the bots issued ~700 transactions, all with the same gas price, to try and make the first trade on Uniswap. https://medium.com/@amanusk/the-fastest-draw-on-the-blockchain-bzrx-example-6bd19fabdbe1

7/ In this auction, players increase their chance of winning by sending as many transactions as possible once the arb op (e.g. oracle update) hits the txpool. The chance to win is determined by the player’s percentage of transaction from the total sent to close the arb.

8/ This not great for the network. There are now a whole lot of transactions, basically doing nothing besides taking space in a block. Only 1 of them actually has value.

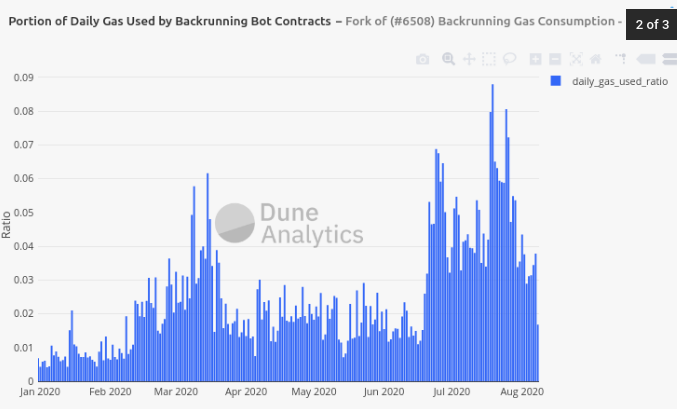

9/ This dashboard by @phabcd shows the amount of gas used by known back-running bots, which at times of high volatility can use up as much as 10% of block space, driving up gas prices.

https://explore.duneanalytics.com/dashboard/backrunning-bots-gas-consumption

https://explore.duneanalytics.com/dashboard/backrunning-bots-gas-consumption

10/ This is not great for the miners either. Instead of bidding wars over a single transaction, which go into the thousands, back-running is relatively cheap. Each tx pays a relatively small fee. The income to the miner can be a only a few hundreds. (as in the BZRX case)

11/ Part of the reason back-running exists is that miners do not have a clear preference for ordering transactions with the same gas price. Transactions are usually sorted by gas price, but for the same price, they are ordered at random.

12/ A recent fix to Geth by @hendrikhofstadt, attempts to mitigate this by introducing a time component to the sorting algorithm of the tx pool.

The sooner the transaction reaches the miner, the higher chance it will have to follow the arb op. https://github.com/ethereum/go-ethereum/pull/21358

The sooner the transaction reaches the miner, the higher chance it will have to follow the arb op. https://github.com/ethereum/go-ethereum/pull/21358

13/ If indeed all miners adopt the latest version, there will be no incentive to “bombard” the network with transactions, since only the first one will win. This might lead to a race for connectivity between the traders, instead of the aforementioned gas wars.

14/ However, adopting this is quite counter-intuitive for the miners. Bidding wars of both kinds drive up gas prices, directly benefiting the miners. They might want to opt-out of this change for as long as possible until they are forced to upgrade.

15/ It will take some time for the fix to get wide enough adoption to see a difference, but it is interesting to watch how both bots and miners adapt to the new rules.

16/ Going forward, there should probably be some middle ground. Allowing miners to scoop profits from arbitrage auctions, without overloading the network. This way all remain happy, and miners do not have to turn to front-running themselves.

Read on Twitter

Read on Twitter