How to invest in Unit Trusts?

Easy as ABC [THREAD].

Easy as ABC [THREAD].

A Unit Trusts can be defined as a regulated investment pool which is funded by investors and managed by a investment manager. A Unit Trusts manager will invest the pool of money into underlying assets which can be diversified into many industries.

Pool of money (Easy for me to understand) is the money all the investors put into a unit trust.

The underlying assets which the unit trust manger will invest in will earn returns in capital growth or/and income.

The underlying assets which the unit trust manger will invest in will earn returns in capital growth or/and income.

So basically the underlying assets can be a range of shares and other assets which the unit trust manager will invest the pool of money into. It is important to know that the the investment manager will invest the pool of money inline with the objective of the unit trust.

You don't control which underlying assets(shares for example) must the unit trust invest into.

The investment manager is the person who decides which underlying assets to buy inline with the objective of the unit trust and the mandate.

The investment manager is the person who decides which underlying assets to buy inline with the objective of the unit trust and the mandate.

When you invest your money into a unit trust your basically buying small units (blocks). The number of units you have determines how much you will get and the risk that you will have. The nice thing about unit trusts is that your unit is diversified into many underlying assets.

So for example your unit Trusts investment manager may invest the pool of funds into many shares in different industries from banking to retails so it can be diversified and limit risks.

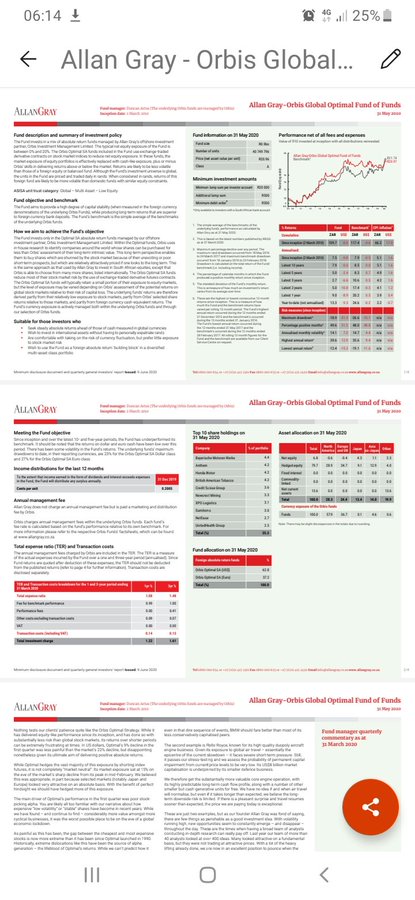

Fees & cost of a unit trust are one which are regulated within the larger industry of investment and finance. All unit trust companies such as Allan Gray & Investec are required to calculate and publish all fees and cost of each unit trust so that you know what your entering into

It is also important that a unit Trusts also has a fund factsheet with the objection of the trust, the fees, policies and holdings. (FUND FACTSHEET BELOW E.G)

When the underlying assets see growth as a whole also each unit (block) will see growth.

When the underlying assets see growth as a whole also each unit (block) will see growth.

For example you bought one unit(block) for R1 as the underlying assets which are for example shares in many industries grow your unit (block) value also grows and now it is R5 and you made a profit of R4 if you sell your unit at that time.

But as all investment, risks are attach to it. If you buy each unit at R1 and over a year the underlying assets drop and you will see your unit will drop to R0.70 meaning you will make a lose if you sell that time.

Remember you don't own the unit trust but own a unit within the unit trust. So basically the underlying assets don't belong to you but below to the unit trust. In terms of returns you will get your returns based on the number of units you bought into the unit trust.

For example: if you bought 10 units for R1 each it will mean that you have R10 worth of units and if each unit increases to R2 each it means your value in that unit trust base on the number of units will increase to R20.

The value of a unit trusts is called a Net Asset Value which is the value of the whole unit trust without the cost of running the unit trust. So basically the price of value of your unit within the whole unit trust is base of the Net Asset Value divided by the number of units.

Also the value of the unit price is never the same. It changes base on the value of the underlying assets in the greater market. So for example if today the value of the underlying assets is high each unit in the unit trust will be expensive to buy but if the underlying assets...

...are low in value the opposite will happen.

You can buy unit trusts in companies such as Allan Gray, Investec, Absa Money Market Fund and also Old Mutual. There are many other companies which you can on you own look into.

You can buy unit trusts in companies such as Allan Gray, Investec, Absa Money Market Fund and also Old Mutual. There are many other companies which you can on you own look into.

As always it is important that you research first and you also look at the fund Factsheet too and study it carefully. Some Unit Trusts start from R500 a month like Allan Gray and Absa. Also I know Sanlam has one for R200 per month.

What important as well is to now your capital gain tax margin. Because your investment may look good on paper but come end of term on your return of investment and get a shock as big daddy SARS will come for his part in your money.

Remember to follow me for more informationtive content. I am @IvynSambo

Reminder: My content is base on my knowledge and understanding. It does not serve as financial advice. It is only for educational purposes.

For any financial advice speak to a registered advisor with FSCA.

Reminder: My content is base on my knowledge and understanding. It does not serve as financial advice. It is only for educational purposes.

For any financial advice speak to a registered advisor with FSCA.

Read on Twitter

Read on Twitter