[unpaywalled]

@synthetix_io in everyone's portfolio these days, but do the numbers add up?

https://www.theblockcrypto.com/genesis/74350/synthetix-soars-demand-side

[unpaywalled]

@synthetix_io in everyone's portfolio these days, but do the numbers add up?

https://www.theblockcrypto.com/genesis/74350/synthetix-soars-demand-side

[unpaywalled]

a pioneer of liquidity mining, synthetix has successfully bootstrapped supply side

— $630m TVL

— $94m OI

— SNX numba go up and up

— $630m TVL

— $94m OI

— SNX numba go up and up

but (as many open finance projects will soon find out) building out organic demand side is a different task altogether

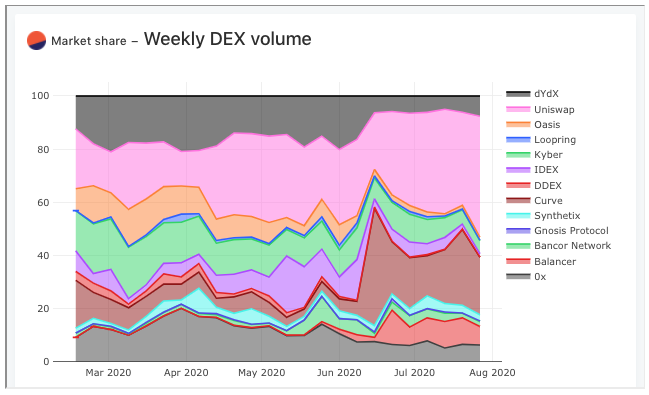

synthetix exchange, THE key value driver for SNX, has 2.28% market share

synthetix exchange, THE key value driver for SNX, has 2.28% market share

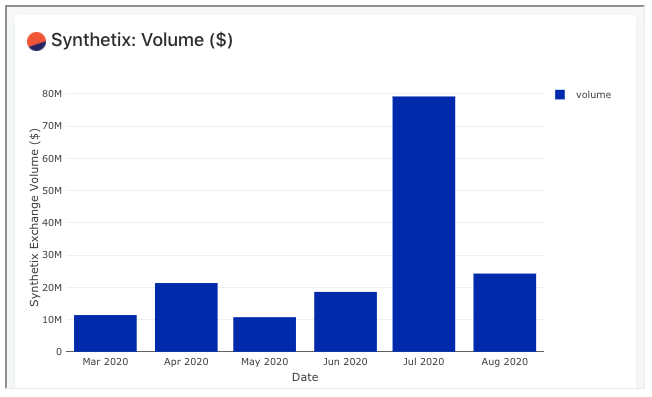

if we (perhaps generously) annualize july volumes, Synthetix falls 46% short of @delphi_digital ‘Bear Case’ 2020 YE volume target ($1.74bn), which produced a present day valuation of *$59.2m*

SNX currently trades at $890m FD mcap

SNX currently trades at $890m FD mcap

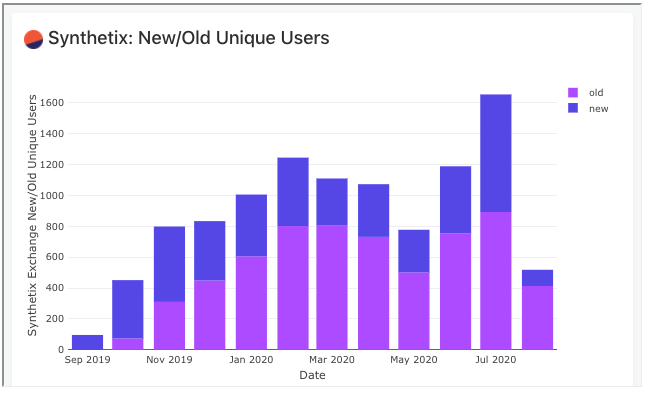

no sign of exponential growth on the unique user side (uniques up just 65% between jan-july)

how many ~$1bn companies do you know with ~1,500 unique monthly users?

how many ~$1bn companies do you know with ~1,500 unique monthly users?

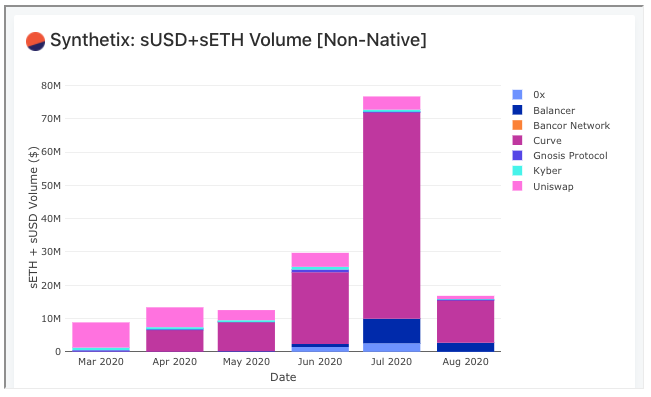

further problematic is that Synthetix is increasingly cannibalized by other exchanges — sETH + sUSD saw $163m volume on non-SE exchanges since March (SE did $166m across all pairs)

SNX stakers *do not* earn fees from this volume — need funding rate to monetize OI

SNX stakers *do not* earn fees from this volume — need funding rate to monetize OI

credit due to @synthetix_io team as far as community building, iteration, willingness to experiment etc.

but focus now *has* to shift to building a differentiated product that users actually want

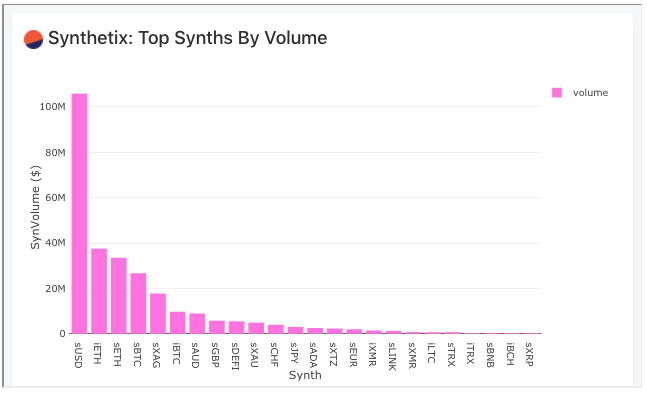

volume/OI still heavily concentrated in blue chips

but focus now *has* to shift to building a differentiated product that users actually want

volume/OI still heavily concentrated in blue chips

plenty more inside — give it a read (and then fight me in the comments if you so please!)

Read on Twitter

Read on Twitter