I'd like to offer some thoughts on $STNG's debt situation hoping to dispel some of the confusion about it.

STNG's financials are quite complex as they have a multitude of credit facilities with lots of activity every quarter.

Please feel free to criticize/question my thinking.

STNG's financials are quite complex as they have a multitude of credit facilities with lots of activity every quarter.

Please feel free to criticize/question my thinking.

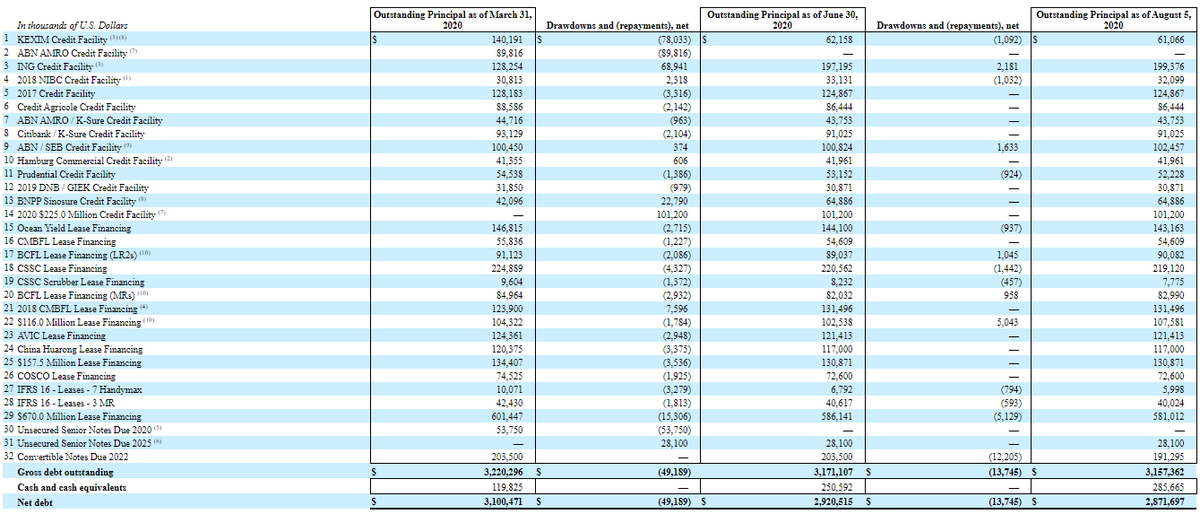

Let's start with STNG's debt facilities & outstanding principals. We can clearly see that STNG has eliminated $62,934,000 of its principal debt between Mar 31st & Aug 5th.

They also increased cash by $165,850,000.

The combined effect is a reduction of $228,774,000 in NET DEBT.

They also increased cash by $165,850,000.

The combined effect is a reduction of $228,774,000 in NET DEBT.

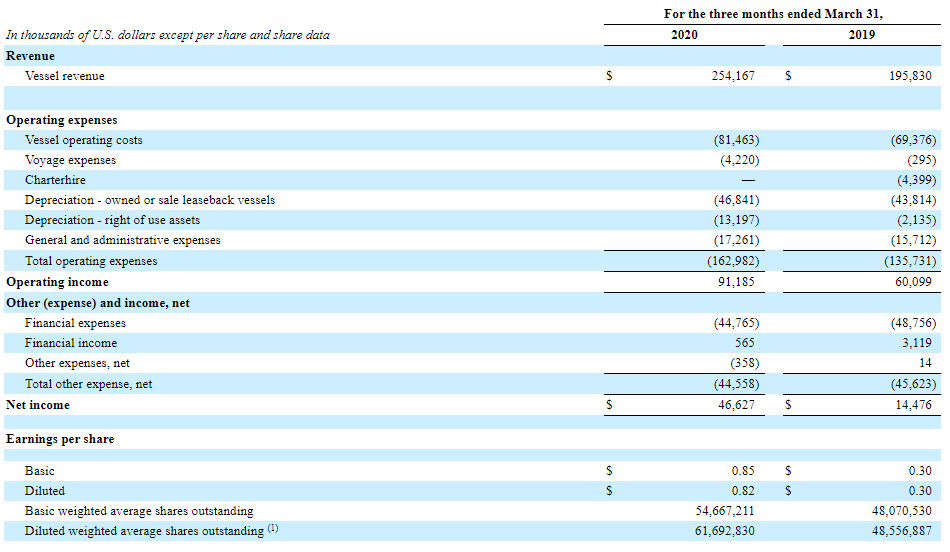

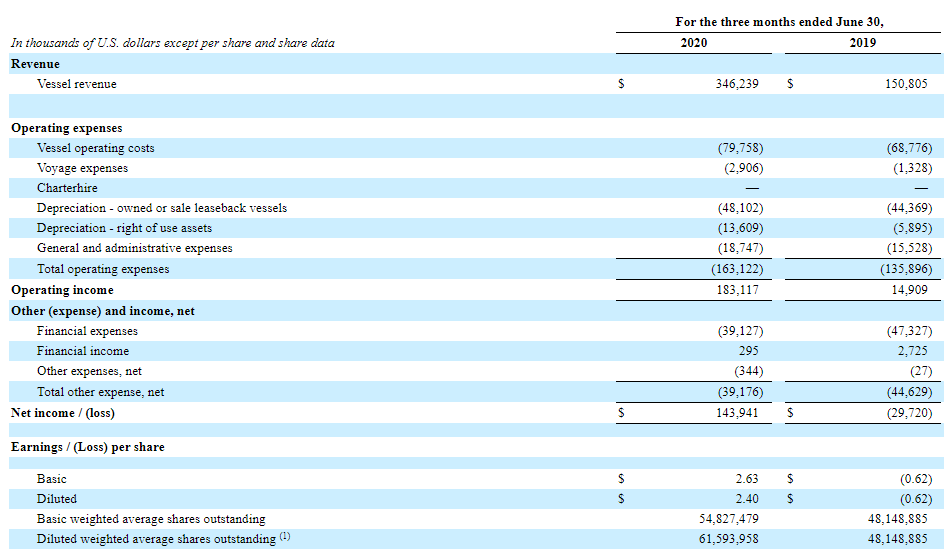

This has allowed for a reduction of $5,638,000 in financial expenses between March 31st and June 30th.

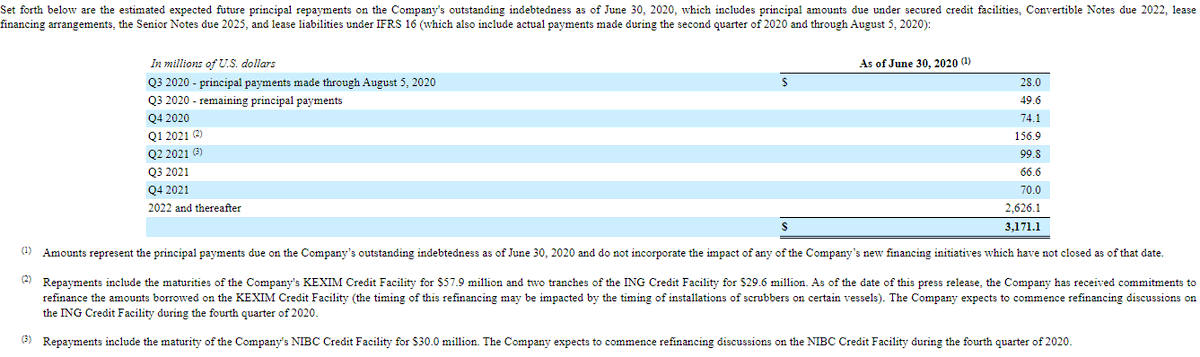

Finally, the future debt repayment schedule. STNG has currently $285.7mil of cash.

They have to repay $123.7mil by the end of 2020. This they can easily cover.

In Q1, 2021 the company has to repay $156,9mil but $57.9mil of this are already in talks to be refinanced.

They have to repay $123.7mil by the end of 2020. This they can easily cover.

In Q1, 2021 the company has to repay $156,9mil but $57.9mil of this are already in talks to be refinanced.

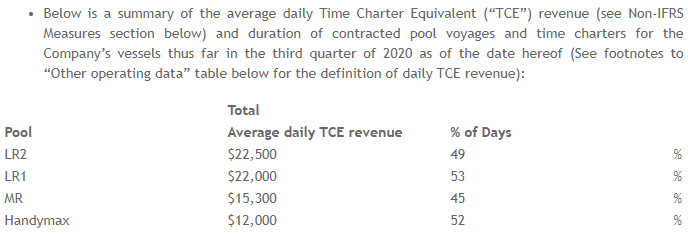

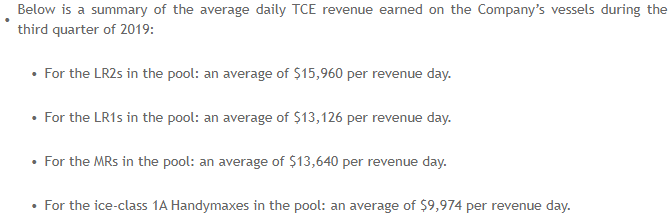

STNG'll need $222.7mil by Mar 31st, 2021 to cover debt obligations. This $ is already available & until then STNG'll be cash-flow positive as Q4 & Q1 are seasonally the strongest quarters & Q3, 2020 is guided to be quite stronger than Q3, 2019 when STNG generated $140mil in CF.

My conclusion is that Scorpio Tankers face less risk of dilution than the market discounts for this year and the next.

Especially as the product destocking is going faster and less painfully than expected. https://www.freightwaves.com/news/how-are-tankers-coping-with-floating-storage-hangover

Especially as the product destocking is going faster and less painfully than expected. https://www.freightwaves.com/news/how-are-tankers-coping-with-floating-storage-hangover

Read on Twitter

Read on Twitter