1/ Issue #43 dropped yesterday. @MohamedFFouda starts the newsletter with the question: At What Point Does DeFi become ReFi? https://twitter.com/rsarrow/status/1291727726647431168

2/ At the heart of DeFi’s explosive growth lies the DeFi governance token

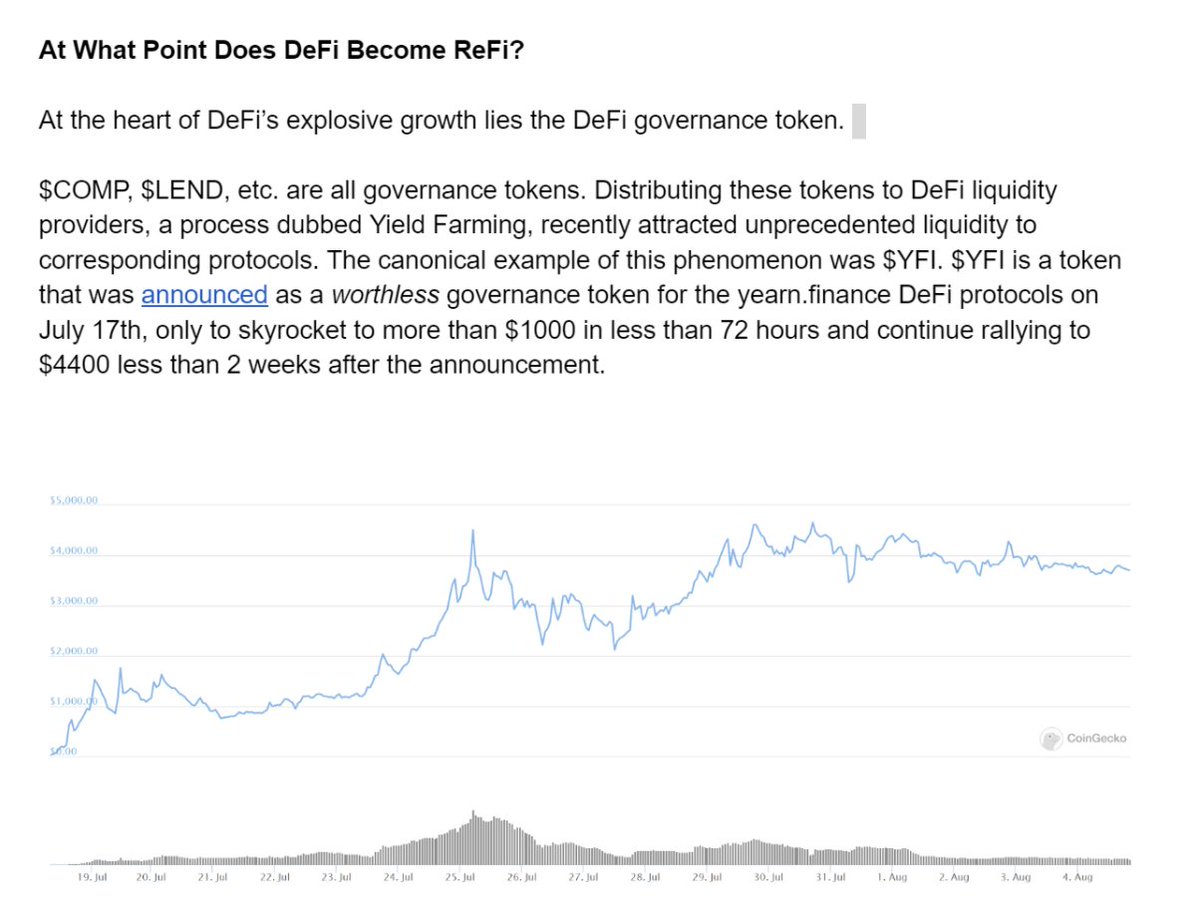

$COMP, $LEND, etc. are governance tokens. Distributing them to DeFi liquidity providers, aka Yield Farming, attracted liquidity

$COMP, $LEND, etc. are governance tokens. Distributing them to DeFi liquidity providers, aka Yield Farming, attracted liquidity

3/ Voting Power

Though it’d be convenient to dismiss governance tokens’ rising value as speculative, something interesting is occurring beneath the surface.

Venture funds akin to a16z, which holds $MKR & $COMP, likely aren’t flipping tokens for a quick buck.

Though it’d be convenient to dismiss governance tokens’ rising value as speculative, something interesting is occurring beneath the surface.

Venture funds akin to a16z, which holds $MKR & $COMP, likely aren’t flipping tokens for a quick buck.

4/ There are several advantages governance tokens have over traditional stocks/shares. In traditional startups/enterprises, shares allow the owner to vote in a friendly CEO or other C-level executives. Governance tokens eliminate the need for voting by proxy.

5/ What are steelman arguments against governance tokens becoming stocks 2.0?

1. Governance token distribution is fairer than equity rounds

2. These decentralized protocols cannot be regulated

3. The protocol can be forked if there are massive points of contention

1. Governance token distribution is fairer than equity rounds

2. These decentralized protocols cannot be regulated

3. The protocol can be forked if there are massive points of contention

6/ The above largely overestimates the ability to course correct. Let’s examine each

1) Token Distribution

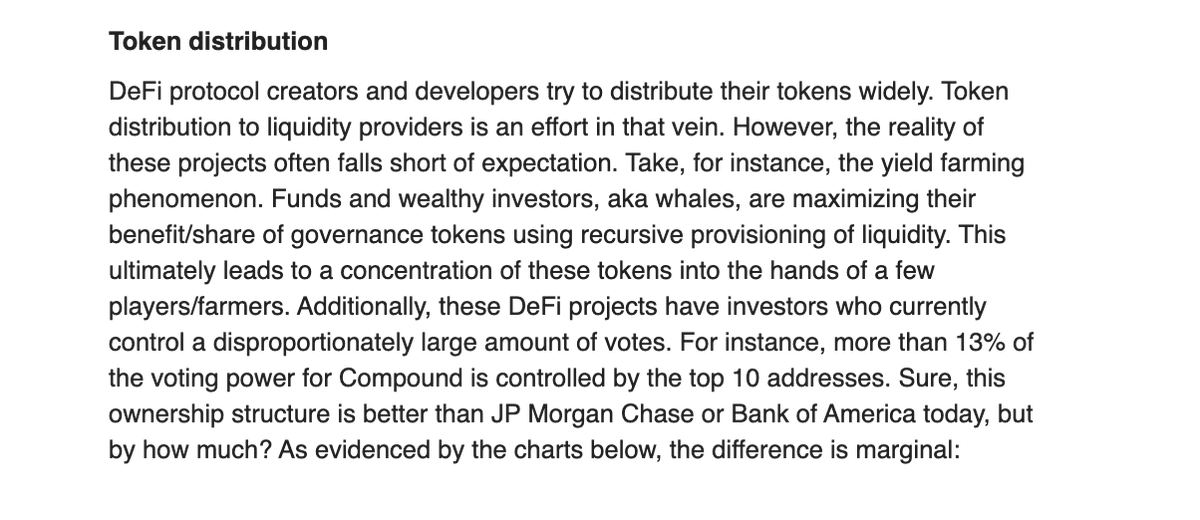

DeFi creators & devs try to distribute tokens widely. Token distribution to liquidity providers is an effort in that vein. But reality often falls short of expectations

1) Token Distribution

DeFi creators & devs try to distribute tokens widely. Token distribution to liquidity providers is an effort in that vein. But reality often falls short of expectations

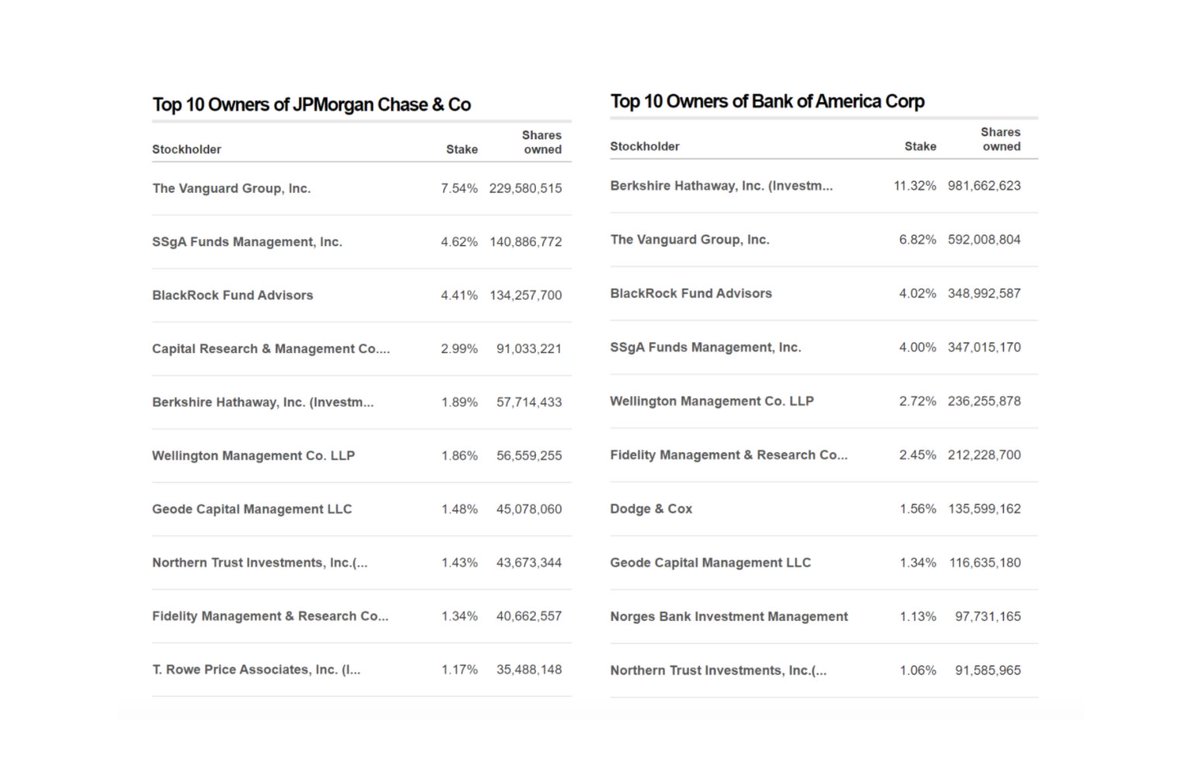

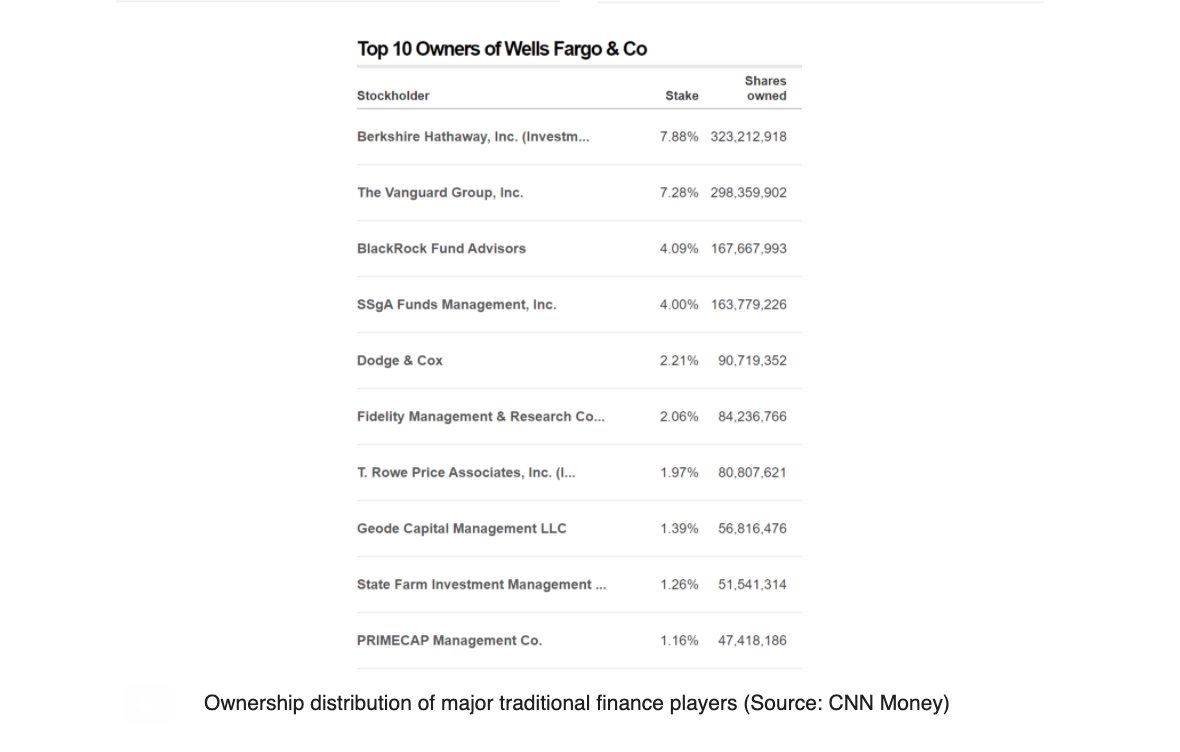

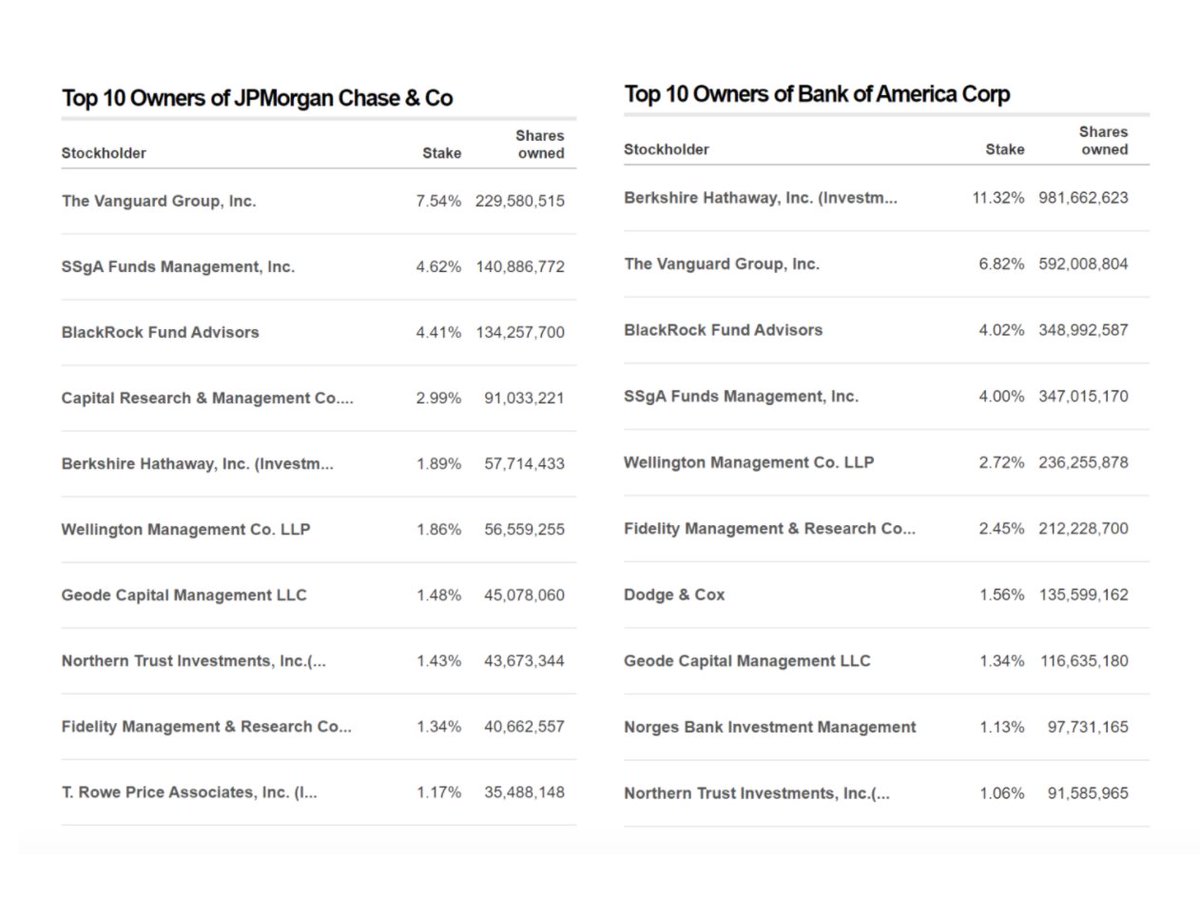

7/ For instance, more than 13% of the voting power for $COMP is controlled by the top 10 addresses. Sure, this ownership structure is better than JP Morgan or Bank of America today, but by how much?

As evidenced by the charts, the difference is marginal:

As evidenced by the charts, the difference is marginal:

9/

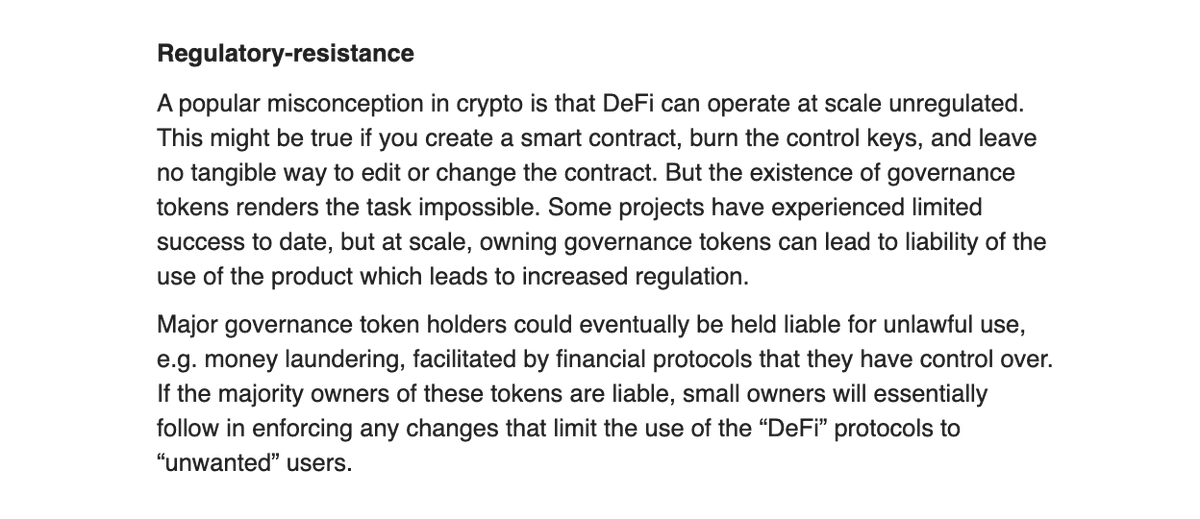

2) Regulatory-resistance:

A popular misconception in crypto is that DeFi can operate at scale unregulated. This might be true if you create a smart contract, burn the control keys and leave no tangible way to edit or change the contract.

2) Regulatory-resistance:

A popular misconception in crypto is that DeFi can operate at scale unregulated. This might be true if you create a smart contract, burn the control keys and leave no tangible way to edit or change the contract.

10/

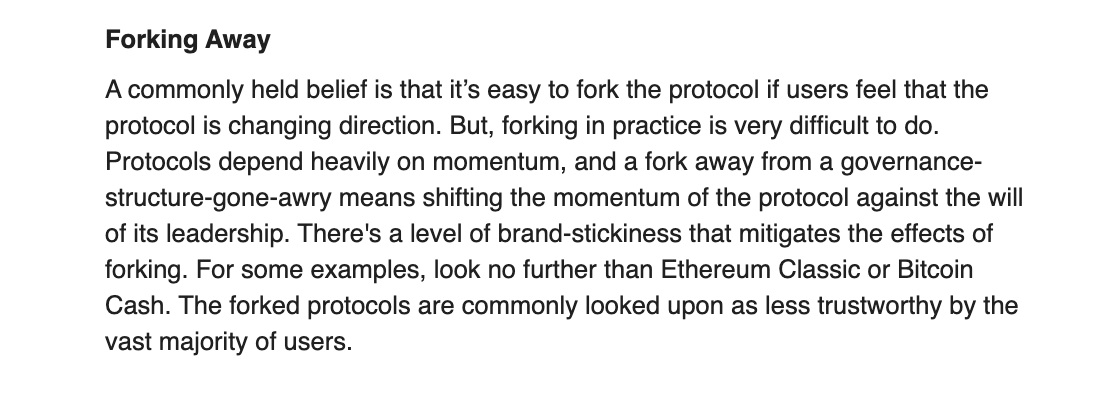

3) Forking Away: A commonly held belief is that it’s easy to fork the protocol if users feel that the protocol is changing direction. But, forking in practice is very difficult to do.

3) Forking Away: A commonly held belief is that it’s easy to fork the protocol if users feel that the protocol is changing direction. But, forking in practice is very difficult to do.

11/ There are two other factors that make forking almost impossible

First, currently successful DeFi protocols are building moats by investing & supporting other DeFi protocols that will integrate with them & serve their community

First, currently successful DeFi protocols are building moats by investing & supporting other DeFi protocols that will integrate with them & serve their community

12/ Second, the major investors and backers of popular DeFi protocols are essentially the same small group of investors. Compare that to the list of top 10 shareholders of JPMorgan and BoA above: you’ll quickly see that the game is not that different.

Read on Twitter

Read on Twitter