Visa and Mastercard are often referred to as credit card companies which is far from the truth. While their logos have become synonymous with credit cards, they are by no means involved in the credit lending business nor are they card issuers

In reality, both companies operate two of the biggest payment networks in the world. To put things into perspective, Visa’s VisaNet payment network can handle up to 65,000 transactions per second (TPS).

In comparison, Ripple, which operates the well-known Ripple cryptocurrency, can only process up to 1,500 TPS. This goes to show the sheer size of the biggest payment network in the world.

So, how have these networks become so large in size and gained a global footprint in the past couple of decades? Both networks rely on what is known as the Four-Party Model. In this model, the four parties that are involved are the issuer, acquirer, cardholder, and merchant.

The payment networks help facilitate the transaction between the four parties. To simplify things, let’s assume a person would like to purchase a shirt from Bloomingdale’s and they decide to pay for it with their ENBD Visa card.

In this case, we assume that Bloomingdale’s has a POS machine that has been provided by Mashreq Bank. The four parties are the customer (cardholder), Bloomingdale’s (merchant), ENBD (issuer), and Mashreq (acquirer). The transaction will be processed through VisaNet.

Assuming that the shirt cost AED100, Mashreq will notify ENBD of the transaction and inquire if the customer has sufficient funds for it. ENBD will confirm it by blocking the amount from the cardholder’s account and informing Mashreq that the transaction can go through.

Visa not only facilitates this process, but it also applies an anti-fraud detection system which uses AI to stop the transaction in the case that it is fraudulent. Once the transaction has been approved, the customer walks away with the shirt having paid AED100.

At this point, no money has actually been moved from one account to the other, in other words the transaction has not been settled. The settlement of the transaction often takes 2 days in which the issuing bank transfers the money to Bloomingdale’s acquiring bank.

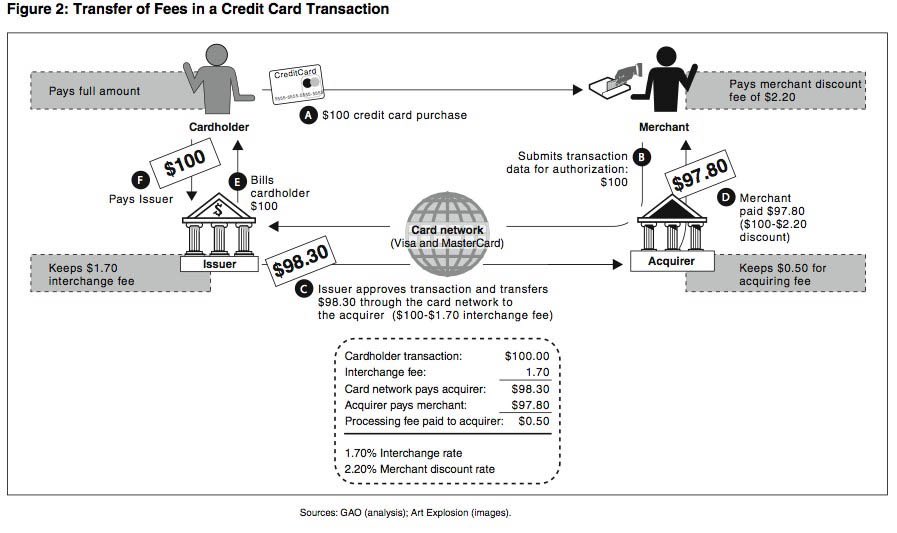

This is where things get interesting. Bloomingdale’s does not actually receive AED 100 rather it receives a marginally less amount due to the interchange and the merchant discount fees.

The interchange fee is paid by the acquirer (Mashreq) to the issuer (ENBD) in what could be described as a fee paid by the acquirer for getting them a customer that they would have never gotten otherwise (e.g. if the customer had paid in cash).

Interchange is often set by the network provider in order to streamline the process across markets and keep the economics of the transaction profitable for all parties involved. The rate is usually in the range of 1.7-1.9%; however, it can differ in many situations.

It is important to note that the network provider does not receive any interchange fee. What the network provider, Visa in this case, receives is data processing fees and other related fees for the transaction. These fees amount to a fraction of the interchange fee.

Finally, since Mashreq receives the money minus the interchange fee, they pass on the interchange fee to Bloomingdale’s along with a merchant discount fee. The difference between the interchange and merchant discount fee is the acquirer’s income from the transaction.

In essence, Bloomingdale’s had to bear the full cost to fund the interchange and merchant discount fees.

This transaction is referred to as an OFF-US transaction considering that the issuer and the acquirer were different banks. Transactions where the issuer and acquirer are both the same bank are referred to as ON-US transactions.

With fintechs entering the payments space, the Four-Party model is increasingly facing disintermediation threats. Networks are well aware of the apparent threats and have been coping well with the changes by continuously acquiring or partnering with the new players in the space.

Read on Twitter

Read on Twitter