8 signs this #DeFi bull market is nowhere close to slowing down

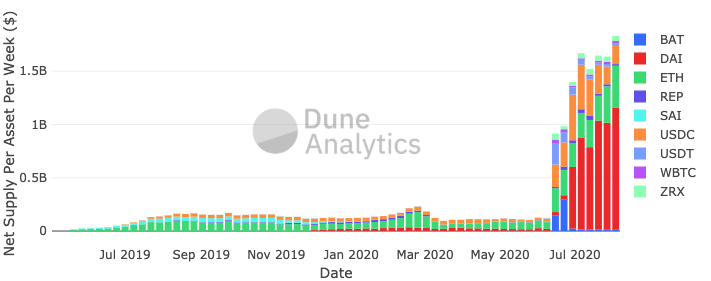

1. Assets supplied to @compoundfinance have risen nearly 14x since the launch of the $COMP governance token, with supplied assets increasing from $124m on June 14th to $1.84B today.

h/t @nickmartitsch

h/t @nickmartitsch

3. Since launching a little over 4 months ago, @BalancerLabs has already hit the following milestones:

- $500m cumulative volume

- $6m fees for liquidity providers

- Currently averaging $10m in daily volume and more than 1k unique daily traders

h/t George Lambeth

- $500m cumulative volume

- $6m fees for liquidity providers

- Currently averaging $10m in daily volume and more than 1k unique daily traders

h/t George Lambeth

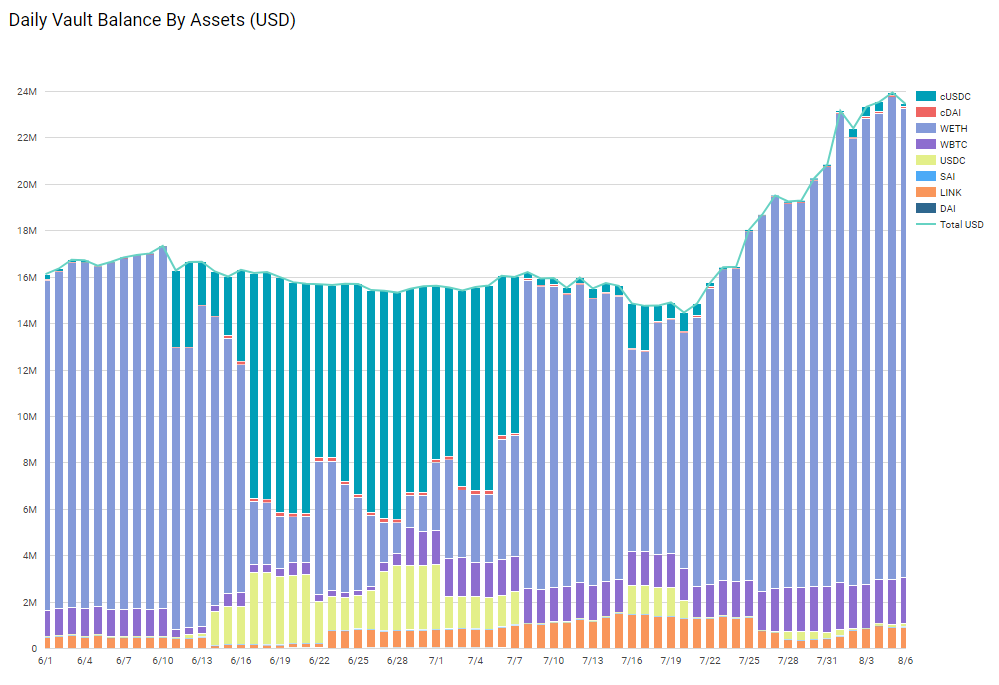

4. Value locked in @SetProtocol is once again at ATHs (~$23.5mil) with almost all of the capital currently positioned in $ETH, $WBTC or $LINK. This means that, collectively, all of the Sets are bullish on the market.

h/t @sassal0x

h/t @sassal0x

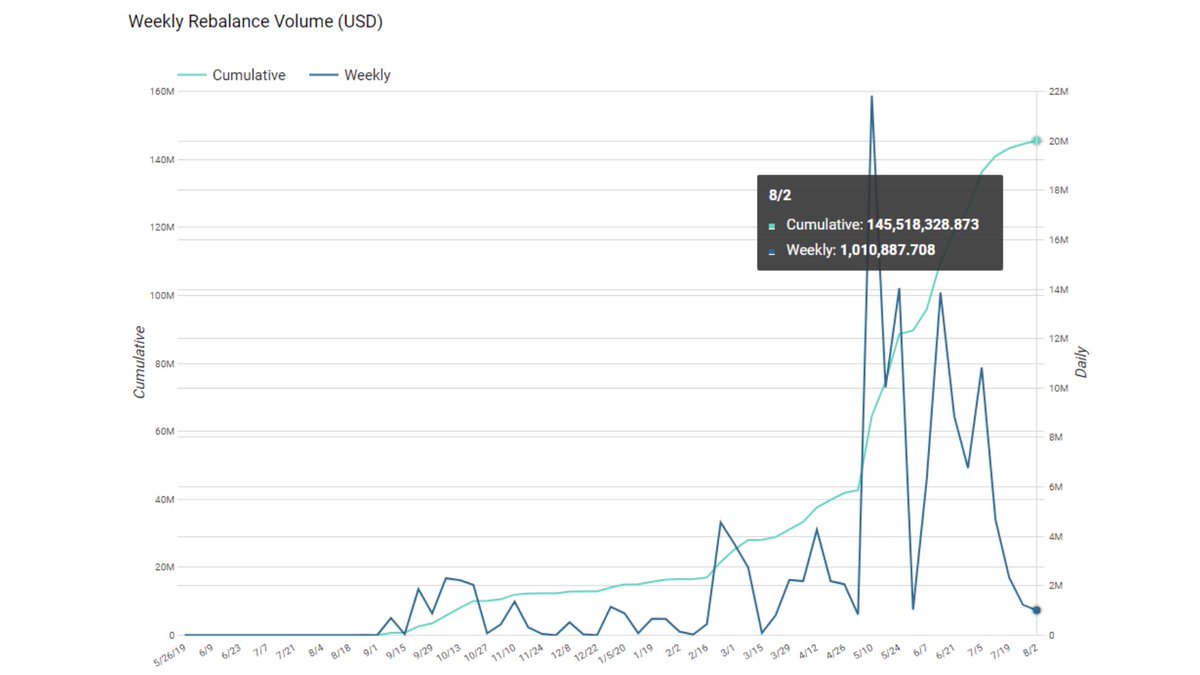

5. @SetProtocol has now processed $150m in rebalance volume with little to no slippage.

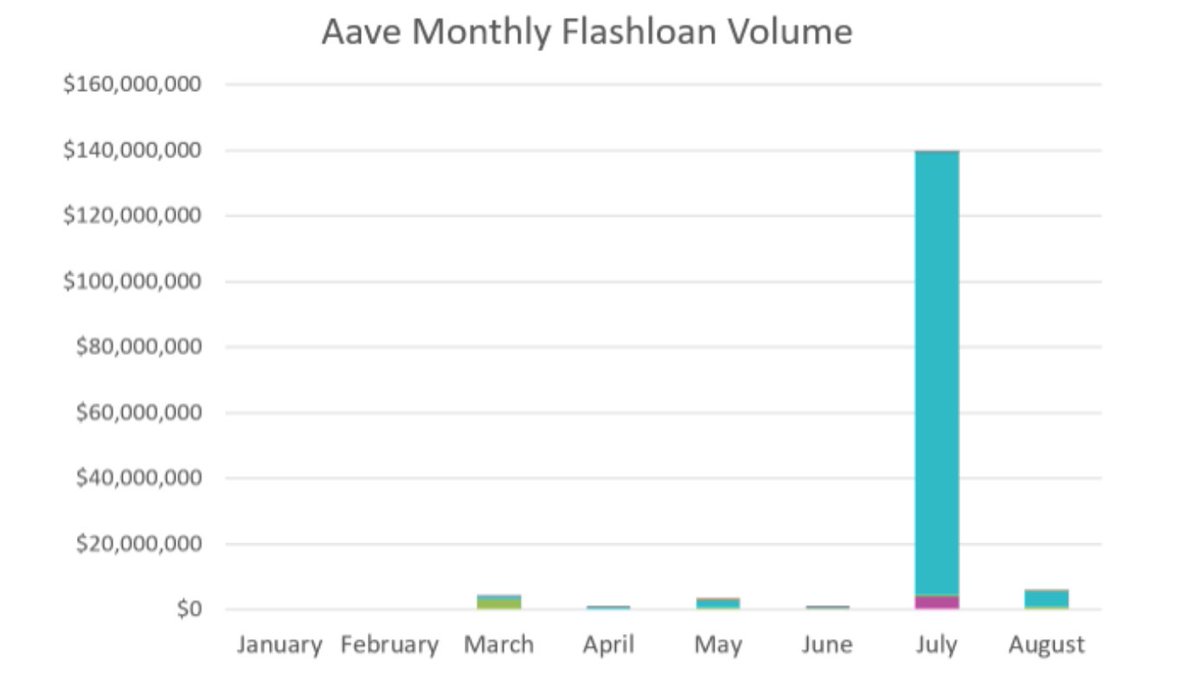

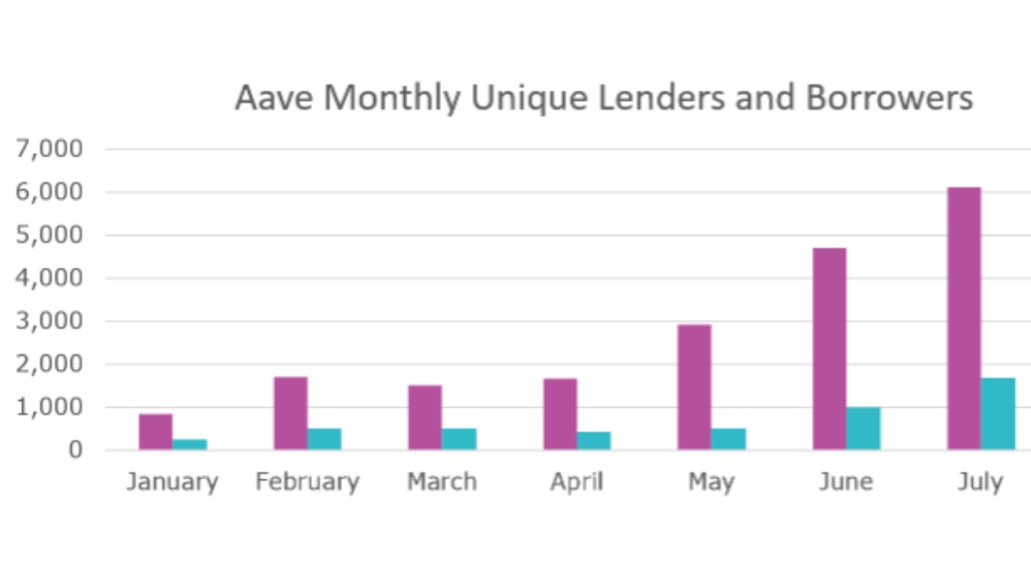

7. The number of users on @AaveAave continues to trend upwards, with July boasting ~8k combined lenders and borrowers.

h/t @isakivlighan @DuneAnalytics

h/t @isakivlighan @DuneAnalytics

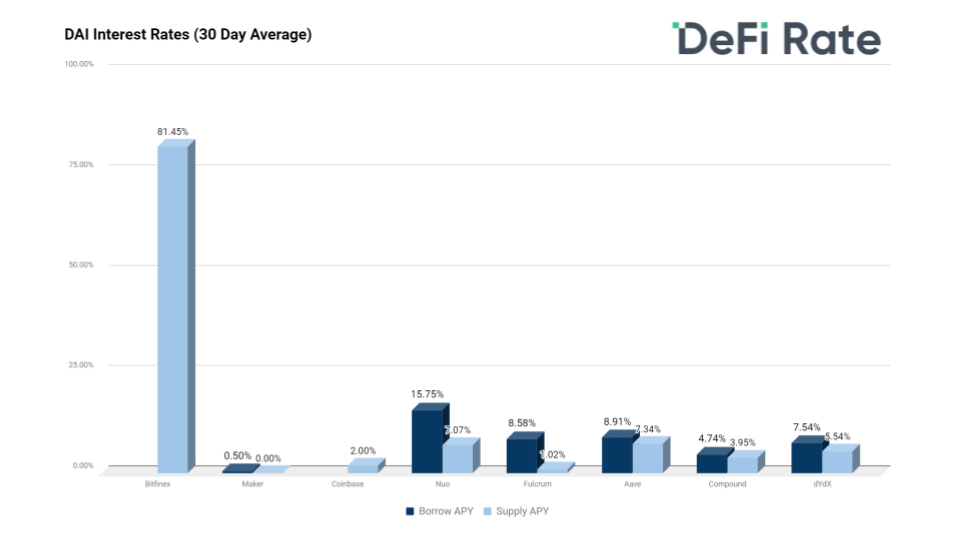

8. Borrowing $DAI from @MakerDAO is cheaper than ever. Anyone can use popular collateral like $ETH, $USDC, and $WBTC to borrow $DAI from the Maker protocol for 0% interest.

h/t @0x_Lucas

h/t @0x_Lucas

Looking for more #DeFi fundamentals? Subscribe to my crypto analytics newsletter @OurNetwork__: https://ournetwork.substack.com/subscribe?utm_source=menu&simple=true&next=https%3A%2F%2Fournetwork

Read on Twitter

Read on Twitter