Trading Insight

Trading Insight

If you're interested in trading, day or swing, here is a little bit of kwoeldge.

This is what I do on a daily basis to earn about $1,000 per day usually in the first 2 - 2.5 hours of open.

Step 1 - The amount you're going to trade with will determine your strategy and the number of shares you can buy.

The goal is to pick the right stock (more on that later) at the right price.

If you can, start with $500. This is a good amount

The goal is to pick the right stock (more on that later) at the right price.

If you can, start with $500. This is a good amount

Step 2 - Scanning

Your profit is made by picking the right stock.

Since we want to maximize the shares we buy AND the probability the stock will go up (go long), we need to find the winners.

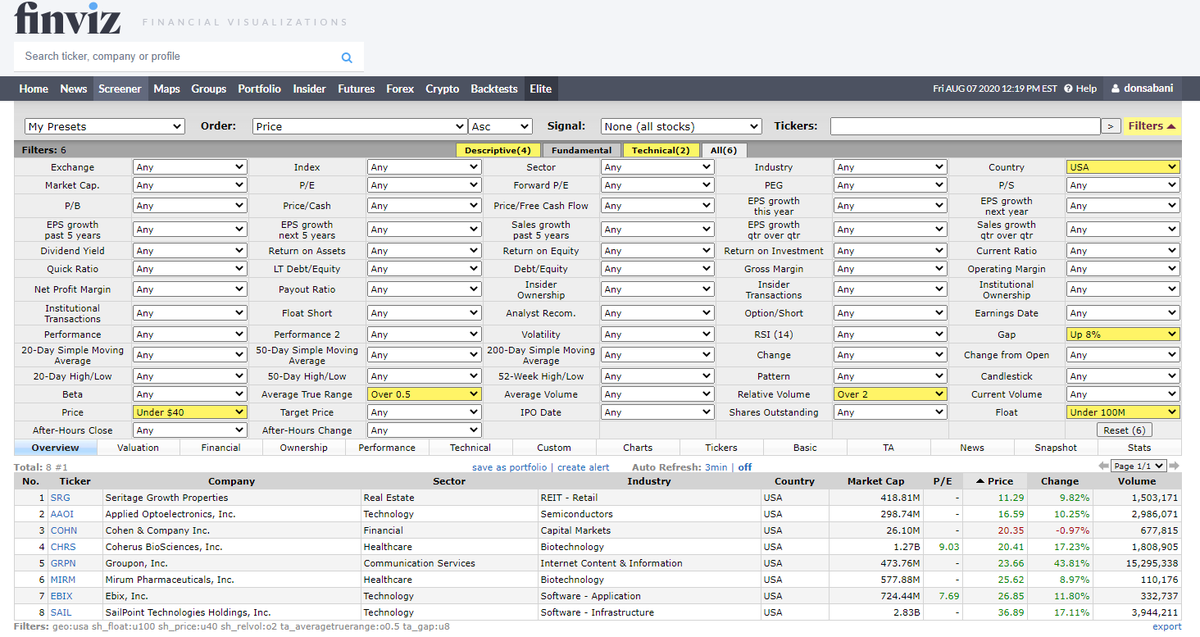

I use http://Finviz.com - it's free and has a lot of metrics

Your profit is made by picking the right stock.

Since we want to maximize the shares we buy AND the probability the stock will go up (go long), we need to find the winners.

I use http://Finviz.com - it's free and has a lot of metrics

STEP 2.1 - Scanning Criteria

I prefer relative low float stocks that trade anywhere from $3 - $40... float < 100M

High relative volume, >2

Anything that's gapping UP or DOWN pre-open

AND below the VWAP...This is my setup for entry

* I'm watching price action and volume

I prefer relative low float stocks that trade anywhere from $3 - $40... float < 100M

High relative volume, >2

Anything that's gapping UP or DOWN pre-open

AND below the VWAP...This is my setup for entry

* I'm watching price action and volume

cont'd

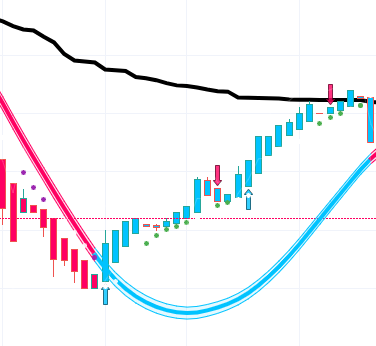

Here is a visual. The solid BLACK line at the top is the VWAP, the RED AND BLUE line is the SSL (more on this later). Notice the price was below SSL and VWAP then starts trending towards VWAP. Notice also the Blue and Green arrows. These are indicators to Buy or Sell

Here is a visual. The solid BLACK line at the top is the VWAP, the RED AND BLUE line is the SSL (more on this later). Notice the price was below SSL and VWAP then starts trending towards VWAP. Notice also the Blue and Green arrows. These are indicators to Buy or Sell

Cont'd

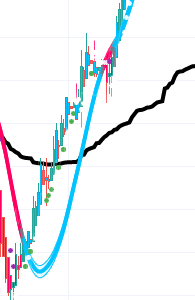

This one is a perfect setup. Price was below SSL and VWAP, starts trending UP, I have an indicator to BUY.

Price cross over SSL and breaches VWAP...Nothing but upside

This one is a perfect setup. Price was below SSL and VWAP, starts trending UP, I have an indicator to BUY.

Price cross over SSL and breaches VWAP...Nothing but upside

Here is a screen that works for my trading style. PLay around with the options to determine what works for you

Notice i am able to remove all the noise and focus on just a handful of options.

Note: If your account is <$25K, you will be restricted on trades by PDT rule

Notice i am able to remove all the noise and focus on just a handful of options.

Note: If your account is <$25K, you will be restricted on trades by PDT rule

3. Trade Setup

When do you buy or sell

The charts you see above are generated on http://TradingView.com - also free and a lot of cool resources.

You will want to add custom filters and scanners. The one above is here https://www.tradingview.com/u/Mihkel00/#published-scripts 'SSL Hybrid'

When do you buy or sell

The charts you see above are generated on http://TradingView.com - also free and a lot of cool resources.

You will want to add custom filters and scanners. The one above is here https://www.tradingview.com/u/Mihkel00/#published-scripts 'SSL Hybrid'

Play around with the usage and get familiar with what it can/cannot do.

4. Risk -

When in doubt, GTF Out. Get out by having trailing stops, or stop-limit orders. Control the Win:loss ratio

Read up on that.

4. Risk -

When in doubt, GTF Out. Get out by having trailing stops, or stop-limit orders. Control the Win:loss ratio

Read up on that.

This is just what I use after honing in on a strategy that works for me. This is not investment advice

Don't blindly start trading without testing YOUR strategy on a simulator.

Do your own due diligence (DD), make your own choices

Good luck

Don't blindly start trading without testing YOUR strategy on a simulator.

Do your own due diligence (DD), make your own choices

Good luck

Read on Twitter

Read on Twitter