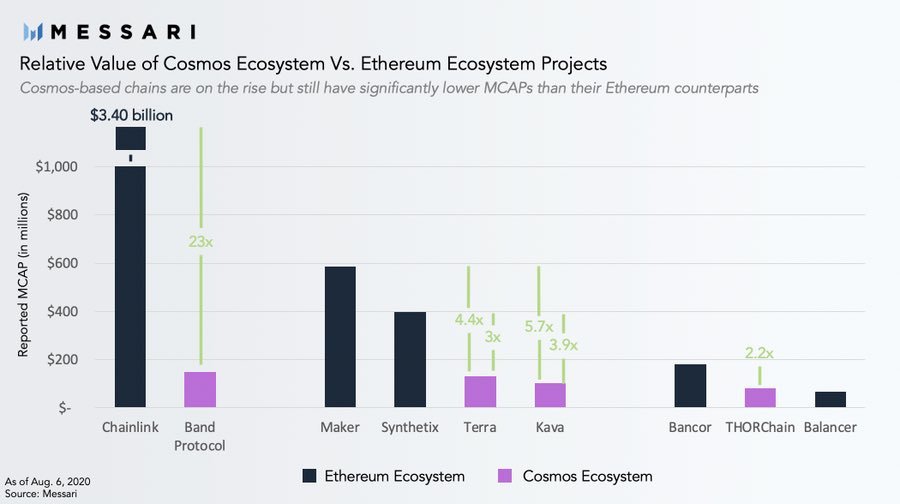

As Ethereum faces challenges scaling and interest in DeFi goes parabolic, there hasn’t been a better time for a parallel DeFi ecosystem to break out.

In part II of our series on Cosmos, @WilsonWithiam and I unpacked the relative valuations $BAND, $KAVA, $LUNA, and $RUNE.

1/

In part II of our series on Cosmos, @WilsonWithiam and I unpacked the relative valuations $BAND, $KAVA, $LUNA, and $RUNE.

1/

First a quick recap on part one.

TL;DR - Cosmos has quitly built a parallel DeFi ecosystem, assembling the likes of Band, Kava, Terra, & THORChain to do so. https://twitter.com/wilsonwithiam/status/1291402119547944960

TL;DR - Cosmos has quitly built a parallel DeFi ecosystem, assembling the likes of Band, Kava, Terra, & THORChain to do so. https://twitter.com/wilsonwithiam/status/1291402119547944960

Let’s begin with Terra $LUNA.

Terra is a seigniorage shares stablecoin blockchain built using the Cosmos SDK.

It’s value is ultimately derived from transaction fees the Terra blockchain generates + seigniorage.

Terra is a seigniorage shares stablecoin blockchain built using the Cosmos SDK.

It’s value is ultimately derived from transaction fees the Terra blockchain generates + seigniorage.

Terra generates the highest transaction fees of any blockchain outside Bitcoin and Ethereum, in large part due to its payments app Chai, which hosts 1.8 million users.

The Chai app is one of the top and fastest growing finance apps in Korea.

The Chai app is one of the top and fastest growing finance apps in Korea.

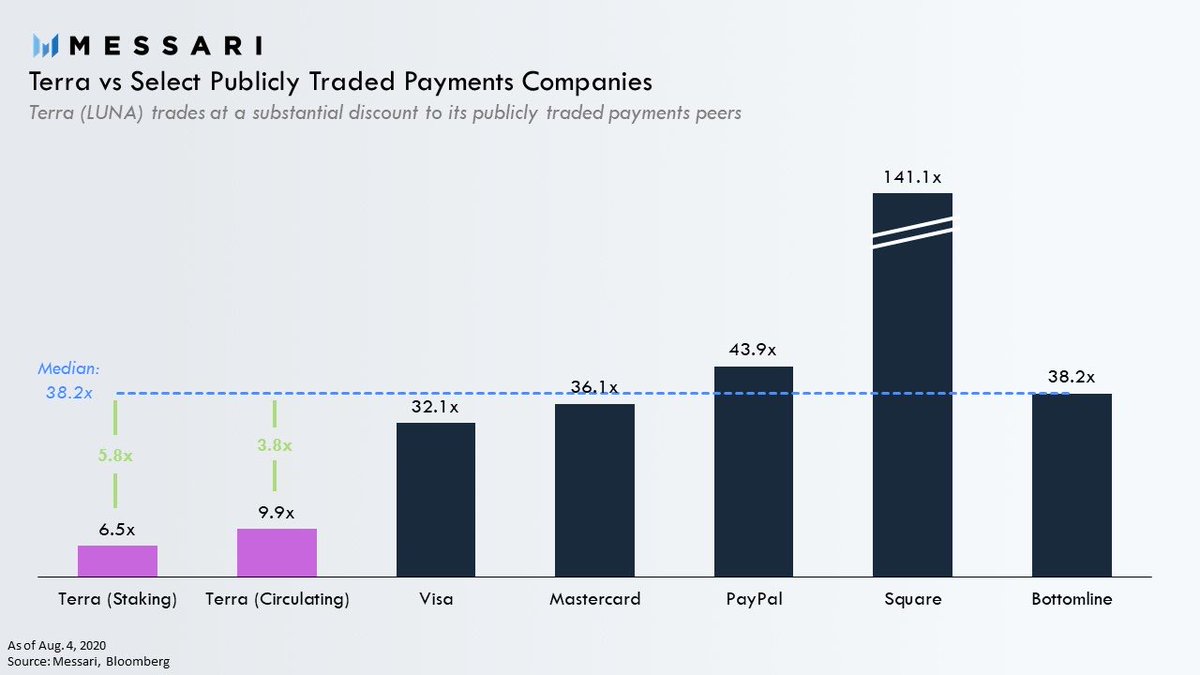

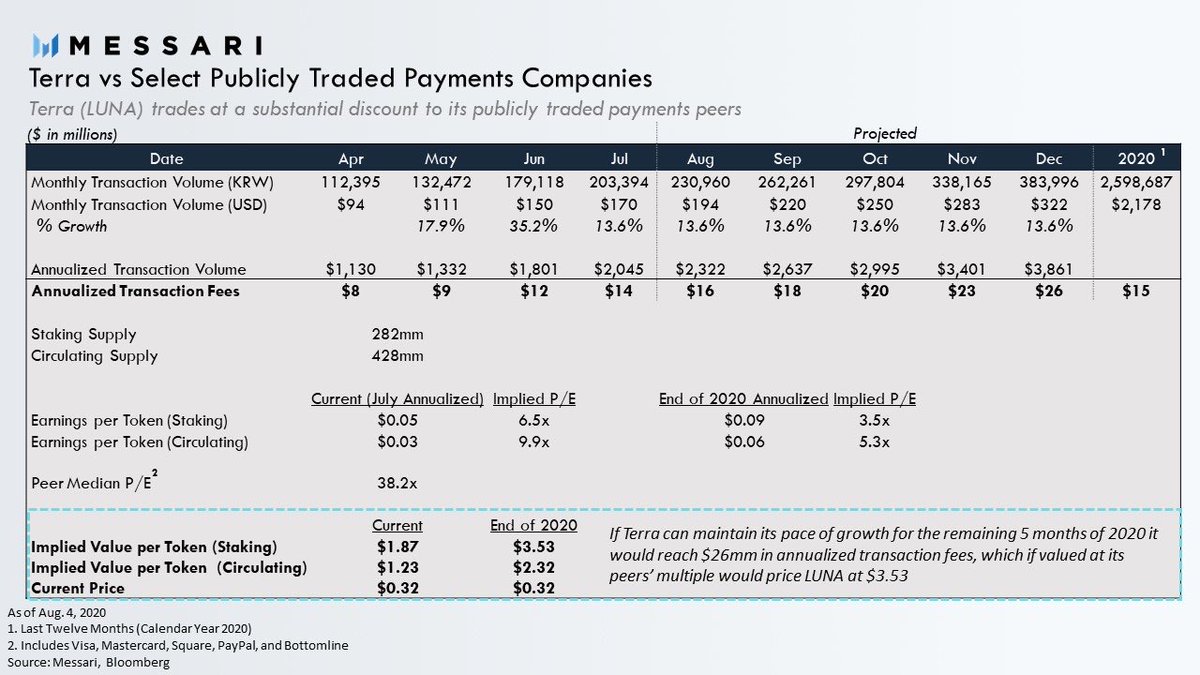

Despite Terra’s impressive growth and adoption LUNA trades as a significant discount to its payments peers.

Terra is currently at $2 billion annualized transaction volume pace.

By the end of the year if it’s maintains its pace of monthly growth it could reach $3.8 billion, which at the 0.675% transaction fees clipped produces $26 million in transaction fees.

By the end of the year if it’s maintains its pace of monthly growth it could reach $3.8 billion, which at the 0.675% transaction fees clipped produces $26 million in transaction fees.

If LUNA were to be valued like it’s peers by year end it would imply as much as a $3.53 price - 10x > current.

Factoring in Terra’s upcoming Anchor money market protocol and Columbus-4 upgrade that will enable smart contacts adds option value on top of that. h/t @MapleLeafCap

Factoring in Terra’s upcoming Anchor money market protocol and Columbus-4 upgrade that will enable smart contacts adds option value on top of that. h/t @MapleLeafCap

Next $KAVA.

Like Maker, Kava is a decentralized lending platform enabling users to borrow money by posting collateral to a smart contract.

But unlike Maker, Kava lives on its own independent blockchain.

Like Maker, Kava is a decentralized lending platform enabling users to borrow money by posting collateral to a smart contract.

But unlike Maker, Kava lives on its own independent blockchain.

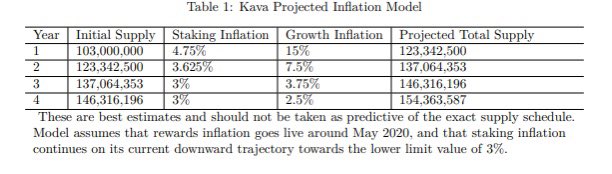

In addition to receiving the economics of the Kava credit system and governance over it, Kava also secures the Kava blockchain, with stakers receiving inflation and fees generated by the Kava blockchain.

The latter point is important because it impacts KAVA’s economics.

The latter point is important because it impacts KAVA’s economics.

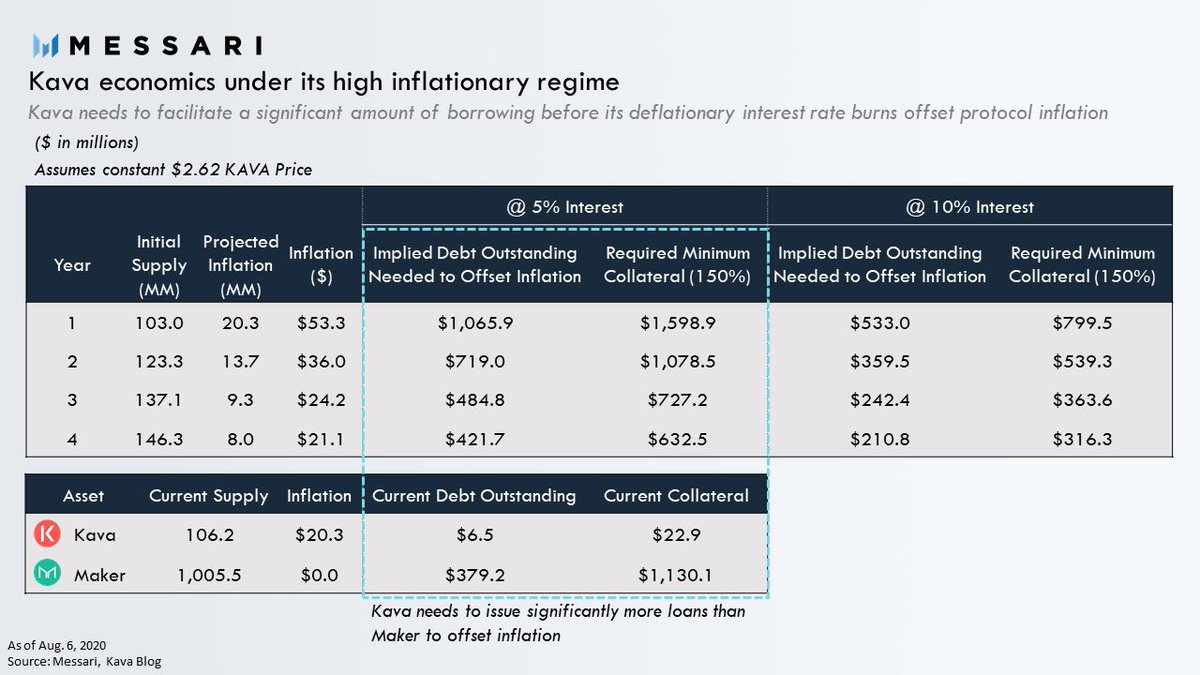

Kava’s interest income is a deflationary force that burns KAVA as interest is paid, but it competes with the inflationary force of inflation rewards distributed to Kava stakers and Kava liquidity providers (new liquidity mining program).

The inflation schedule is aggressive.

The inflation schedule is aggressive.

To offset its inflation in the next 4 years, Kava would need to facilitate far more loans than Maker currently has.

Clearly Kava is prioritizing growth in its early years over value capture.

Which makes sense given how the previous decades’ traditional tech companies scaled.

Clearly Kava is prioritizing growth in its early years over value capture.

Which makes sense given how the previous decades’ traditional tech companies scaled.

Kava is early and in ways more flawed than Maker is, which currently faces its own challenges.

But Kava’s more ambitious product vision (like more synthetic assets), interoperability with the Cosmos ecosystem, and creative monetary policy make it an interesting project to watch.

But Kava’s more ambitious product vision (like more synthetic assets), interoperability with the Cosmos ecosystem, and creative monetary policy make it an interesting project to watch.

Now $BAND

Like Chainlink, Band Protocol is a decentralized oracle solution aimed at bridging the on-chain world of cryptocurrencies to the off-chain world of events and data.

However, unlike Chainlink Band Protocol is an independent blockchain built using the Cosmos SDK.

Like Chainlink, Band Protocol is a decentralized oracle solution aimed at bridging the on-chain world of cryptocurrencies to the off-chain world of events and data.

However, unlike Chainlink Band Protocol is an independent blockchain built using the Cosmos SDK.

Over the past few months Band took a page from the Chainlink playbook, announcing a ton of partnerships, which has been rewarded with a breathtaking breakout, now up 32x on year-to-date after its just announced Coinbase Pro listing.

Oracle tokens have been on a tear this year. https://twitter.com/ryanwatkins_/status/1291421882525392903

Oracle tokens have been on a tear this year. https://twitter.com/ryanwatkins_/status/1291421882525392903

Clearly the relative valuation play and anchor to LINK’s valuation has worked so far.

Of course the key difference between Chainlink and Band is that Chainlink is live and operational, while Band is still rolling out its mainnet.

Of course the key difference between Chainlink and Band is that Chainlink is live and operational, while Band is still rolling out its mainnet.

This key difference may explain the still large valuation gap between Chainlink and Band (in addition to Chainlink simply being overvalued).

Or it could suggest there’s still room to go.

Or it could suggest there’s still room to go.

Now $RUNE

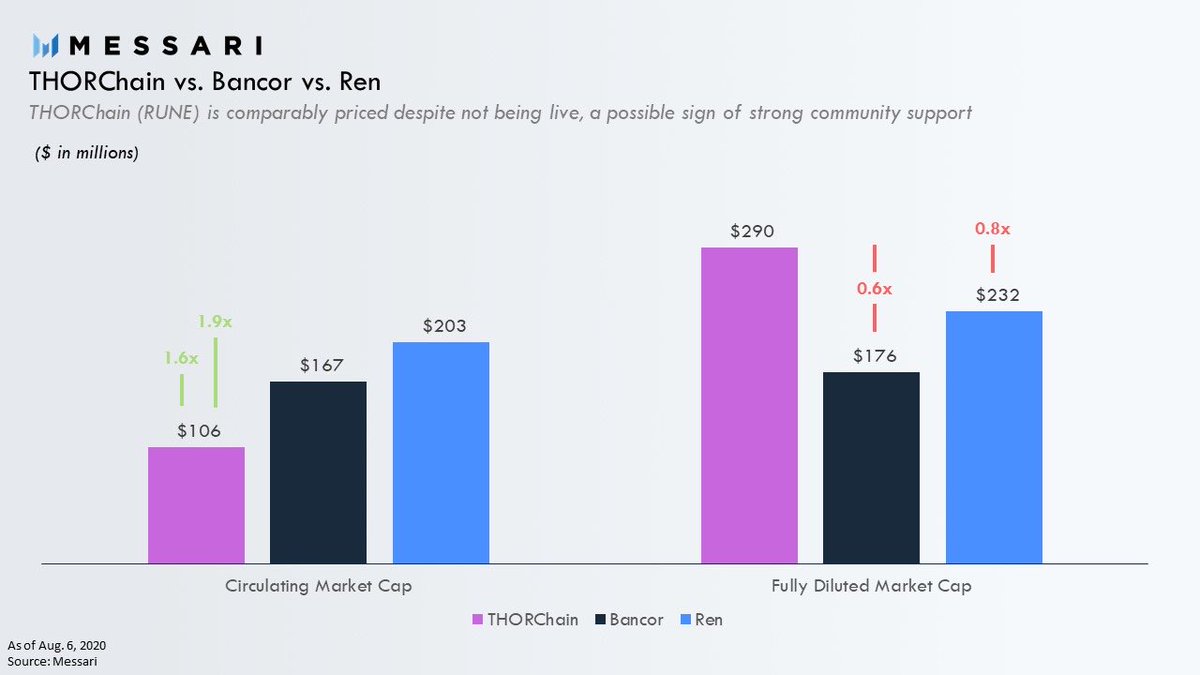

THORChain (RUNE) is a proposed automated market maker (AMM) that closely resembles Bancor (BNT), except for cross-chain exchange.

THORChain will be an independent, Cosmos SDK enabled blockchain.

THORChain (RUNE) is a proposed automated market maker (AMM) that closely resembles Bancor (BNT), except for cross-chain exchange.

THORChain will be an independent, Cosmos SDK enabled blockchain.

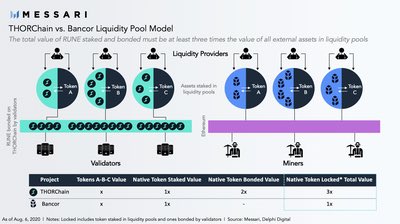

RUNE doubles as both the base pair for each asset supported by the exchange, and the asset THORNodes bond as collateral to control and secure the flow of assets into and out of liquidity pools.

RUNE’s dual utility plays a central role in THORChain’s economic model.

RUNE’s dual utility plays a central role in THORChain’s economic model.

With some clever token economic design the relationship between validators and LPs means the value of RUNE staked and bonded on the network must be at least three times the value of external assets held in liquidity pools (since each pool is 50% RUNE).

THORChain is young and unproven, but it boasts an active community and a hyper-growth incentive model that has contributed to its being priced comparably to other AMMs like Bancor, and alternative interoperability solutions like Ren.

Despite not being live, the market could be pricing RUNE at a premium considering THORChain plans to offer a relatively differentiated product in a high-growth sector.

With a token model that can grow alongside the network, THORChain is well-worth monitoring.

With a token model that can grow alongside the network, THORChain is well-worth monitoring.

Many of the best investments over the past year have been relative value plays like AAVE vs COMP, KNC vs ZRX, SNX vs MKR, BNT vs other AMMs, and BAND vs LINK.

We’d expect many more to play out this way.

We’d expect many more to play out this way.

It’s important to remember that lower relative valuations do not necessarily imply undervaluation, and there are many valid reasons why these projects are valued below their Ethereum counterparts.

However, in an inefficient market like crypto, these lower relative valuations could imply mispricings.

https://messari.io/article/the-rise-of-defi-on-cosmos-and-relative-valuations-part-two

https://messari.io/article/the-rise-of-defi-on-cosmos-and-relative-valuations-part-two

https://messari.io/article/the-rise-of-defi-on-cosmos-and-relative-valuations-part-two

https://messari.io/article/the-rise-of-defi-on-cosmos-and-relative-valuations-part-two

Read on Twitter

Read on Twitter