#MoneyAtoZ

Thank you to all who guessed what Q might stand for in this alphabetical series of tweetorials about money.

Since I often say that money has qualities as well as quantity, either would have been good subjects! But...

Q is for Quincampoix. https://twitter.com/SimonDeDeo/status/1291183345863462918

Thank you to all who guessed what Q might stand for in this alphabetical series of tweetorials about money.

Since I often say that money has qualities as well as quantity, either would have been good subjects! But...

Q is for Quincampoix. https://twitter.com/SimonDeDeo/status/1291183345863462918

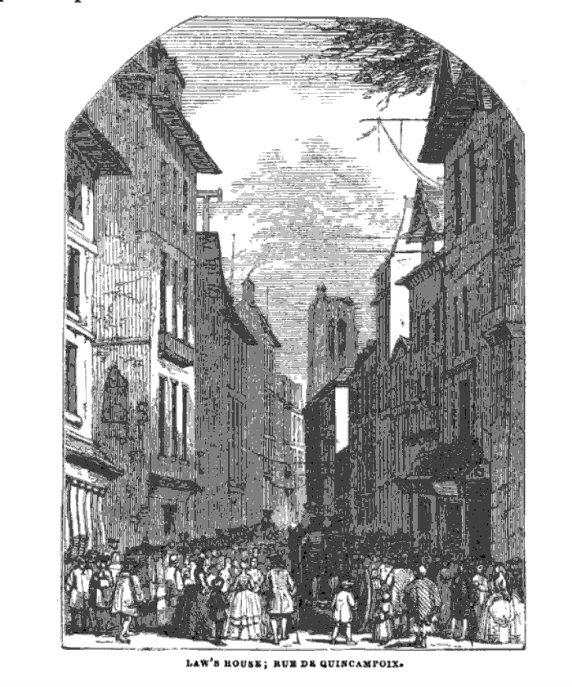

The rue Quincampoix in central Paris dates from 1200s. The word’s etymology is uncertain, but since 1720 its origins have no longer mattered. It had become synonymous with John Law, the Mississippi Scheme, and financial bubbles.

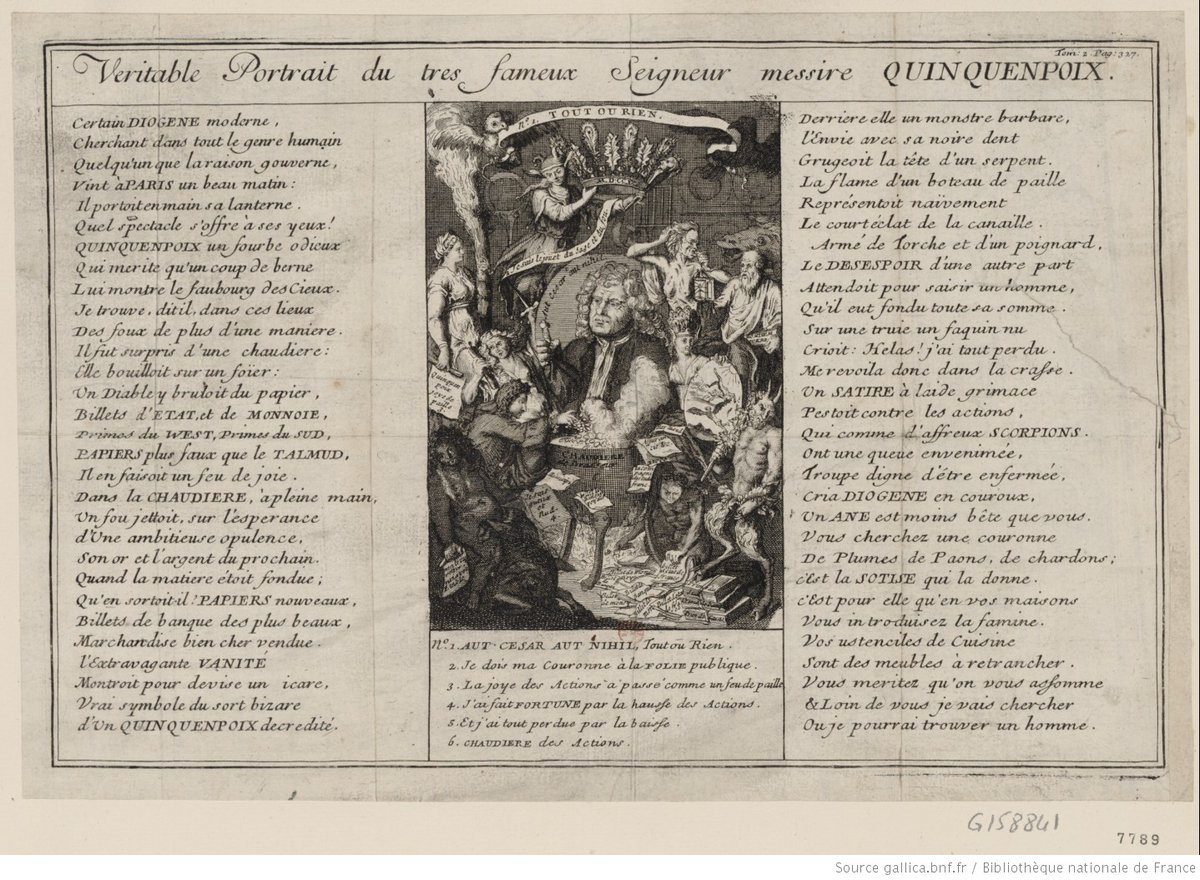

Here are two 1901 photos of 91, rue Quincampoix by Eugène Atget, via @GallicaBnF They are labelled on the back “Maison du Law” [John Law’s house]

Charles Mackay’s 1841 _Extraordinary Popular Delusions and the Madness of Crowds_ included chapters on alchemists, Mesmeric magnetism, witch trials, and all sorts of craziness, but it opened with John Law and the rue Quincampoix

Published during the first boom period for RR stocks, Mackay’s “miscellany of delusions” has itself been extraordinarily popular. The book went through 3 English editions and has not been out of print in 180 years. Libertarians still cite it approvingly https://www.econlib.org/library/Mackay/macEx.html

Mackay’s book cemented the idea of financial bubbles as structurally identical, recurring phenomena. If so-called Tulipmania was a precursor, John Law’s Scheme + the English South Sea Company were the first transnational stock bubble. Just ask PBS! https://www.pbs.org/wgbh/pages/frontline/shows/dotcon/historical/bubbles.html

#MoneyAtoZ

Fellow @simon_schama student @Anne_Goldgar has disproven many received ideas about tulip mania; @UCLHistory’s Julian Hoppit showed how political fallout made South Sea Company (Tory alternative to Whig Bank of England) into exemplary “bubble”

https://discovery.ucl.ac.uk/id/eprint/12397/1/12397.pdf

Fellow @simon_schama student @Anne_Goldgar has disproven many received ideas about tulip mania; @UCLHistory’s Julian Hoppit showed how political fallout made South Sea Company (Tory alternative to Whig Bank of England) into exemplary “bubble”

https://discovery.ucl.ac.uk/id/eprint/12397/1/12397.pdf

As for John Law & the rue Quincampoix, Arnaud Orain recently explained them not via the “madness” of crowds, but the political-social-monetary visions of Boisguilbert, Vauban, Fontenelle, etc.; efforts to rebuild France after ravages of Louis XIV's wars https://www.fayard.fr/histoire/la-politique-du-merveilleux-9782213705880

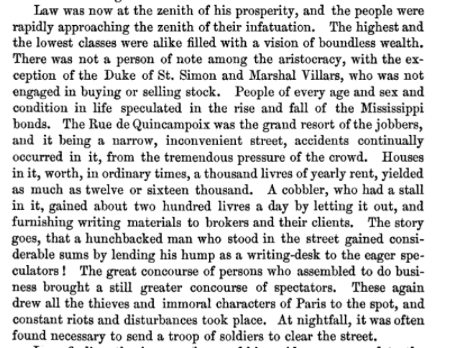

Already 300 years ago, satirists anthropomorphized the rue Quincampoix into an actor (à la “Wall Street wants xyz”). The name was also shorthand for any financial center (cf “The City”). This caricature via @GallicaBnF reveals “his” true malicious intentions

Nearly all depictions of the rue Quincampoix at the time of the Mississippi Scheme were satirical; so too of Quincampoix Inn/Coffeehouse in Amsterdam. Here are three fabulously detailed ones (also all @GallicaBnF)

Prints, pamphlets, copies of stock certificates: all the ephemera of speculation were collected together into portfolios (each with slightly different contents) titled _The Great Mirror of Folly_ --at least 200 versions exist. https://beinecke.library.yale.edu/collections/highlights/great-mirror-folly-or-het-groote-tafereel-der-dwaasheid

The @YaleICF and @WGoetzmann organized a conference about the Tafereel volumes and what they might tell us--both quantitatively and qualitatively!--about financial bubbles. https://twitter.com/YaleICF/status/1291369548151652355

In the spirit of full disclosure, I should admit I reviewed said book.

Here is the review.

It's a review of a book about a book about a bubble!

How substantial does THAT sound? Might this whole thread (or even all of #MoneyAtoZ) itself be a bubble?!

https://academic-oup-com.proxyiub.uits.iu.edu/ahr/article/119/5/1763/44766?searchresult=1

Here is the review.

It's a review of a book about a book about a bubble!

How substantial does THAT sound? Might this whole thread (or even all of #MoneyAtoZ) itself be a bubble?!

https://academic-oup-com.proxyiub.uits.iu.edu/ahr/article/119/5/1763/44766?searchresult=1

We won't know until it's done. A bubble is only recognized when it has popped. Bubbles are both fleeting + fundamentally _historical_ categorizations.

Bubbles are like revolutions. You never know you're having them until you're having them.

Tomorrow, R is for...

#MoneyAtoZ

Bubbles are like revolutions. You never know you're having them until you're having them.

Tomorrow, R is for...

#MoneyAtoZ

Read on Twitter

Read on Twitter

![Here are two 1901 photos of 91, rue Quincampoix by Eugène Atget, via @GallicaBnF They are labelled on the back “Maison du Law” [John Law’s house] Here are two 1901 photos of 91, rue Quincampoix by Eugène Atget, via @GallicaBnF They are labelled on the back “Maison du Law” [John Law’s house]](https://pbs.twimg.com/media/Eexz37zXoA8-8KI.jpg)

![Here are two 1901 photos of 91, rue Quincampoix by Eugène Atget, via @GallicaBnF They are labelled on the back “Maison du Law” [John Law’s house] Here are two 1901 photos of 91, rue Quincampoix by Eugène Atget, via @GallicaBnF They are labelled on the back “Maison du Law” [John Law’s house]](https://pbs.twimg.com/media/Eexz38rWsAYi1JI.jpg)