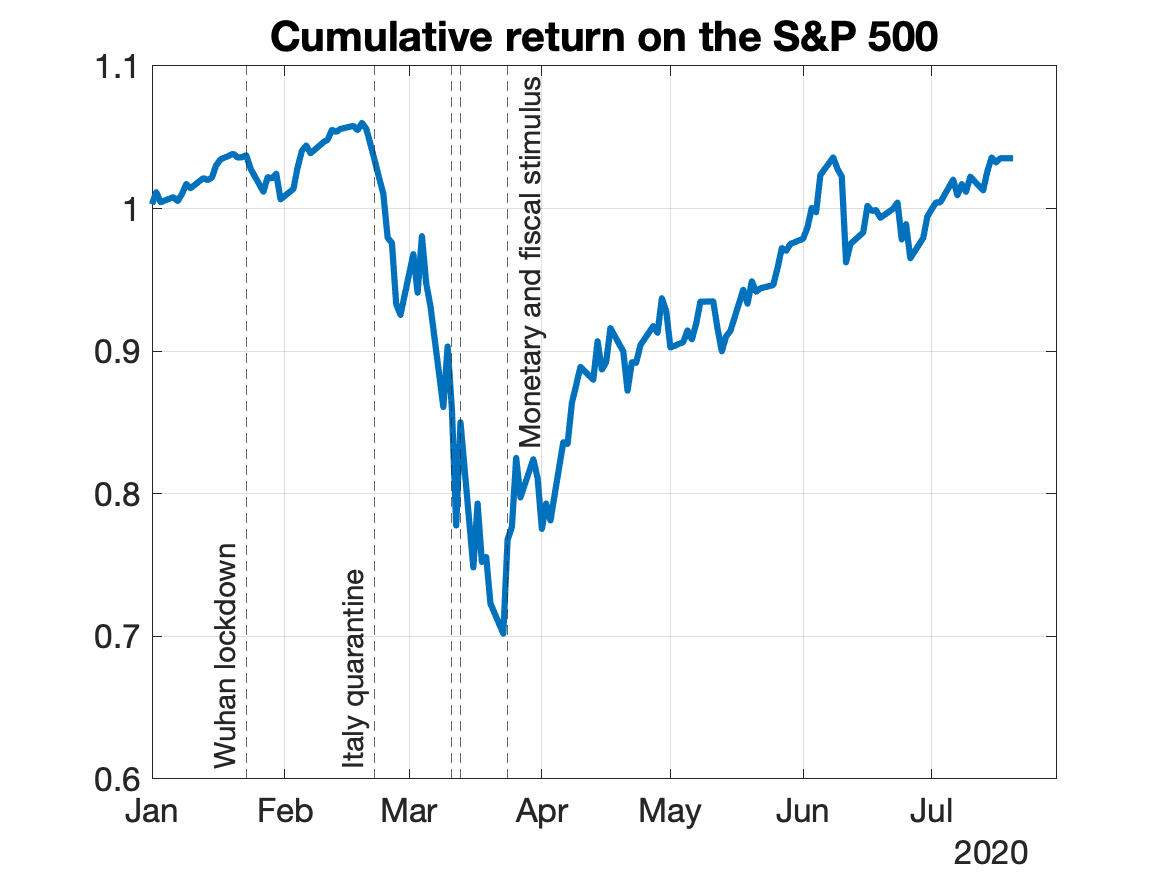

Some simple calculations to provide a perspective on the decline in the stock market and its recovery, despite the negative impact of the COVID-19 pandemic on the real economy. See here the dynamics of the S&P500 so far this year: (1/n)

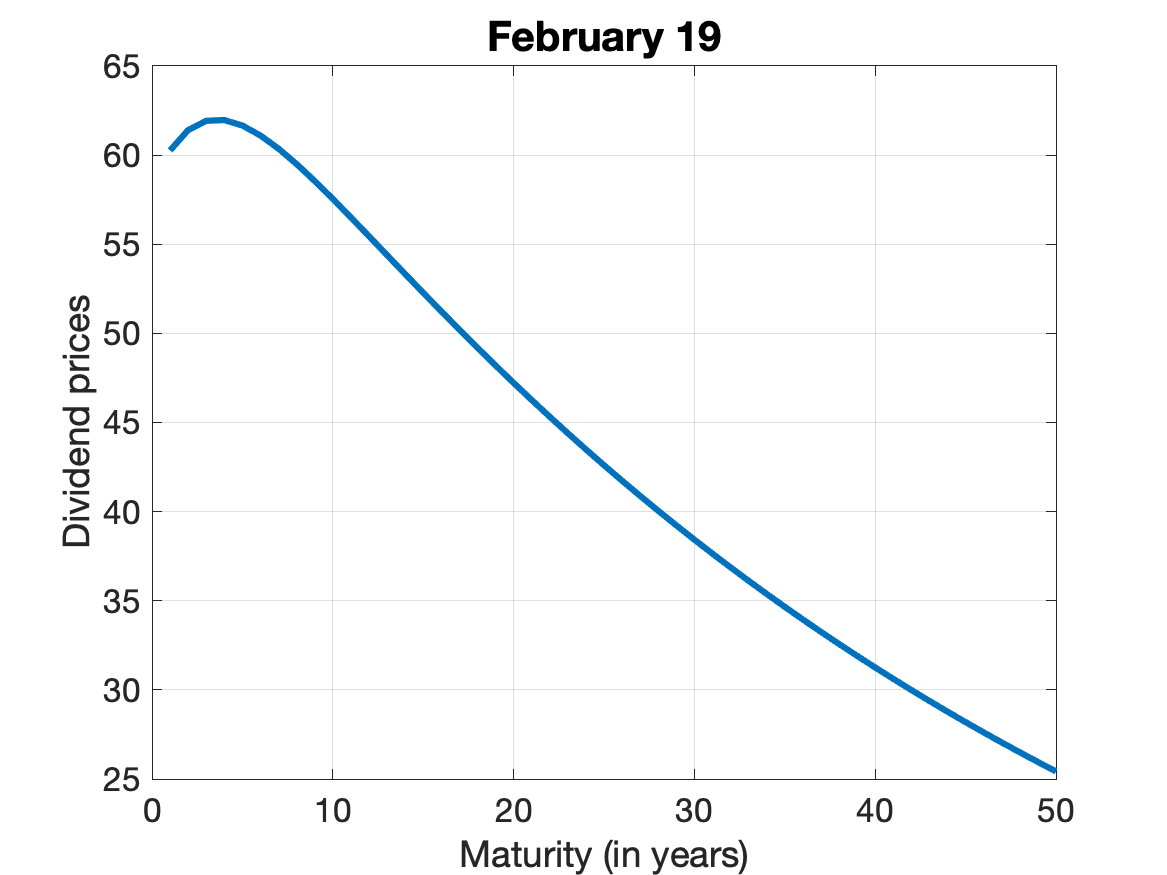

Let's start from the identity that the value of the stock market equals the present value of all future cash flows. Using dividend futures, we can compute the price of each cash flow today, and “decompose the market by maturity." A timeline of the decline and recovery by maturity

February 19: Here is the decomposition on February 19, before the COVID-19 crisis causes the market to fall. The sum of all of these claims across maturities equals the value of the S&P500 on February 19.

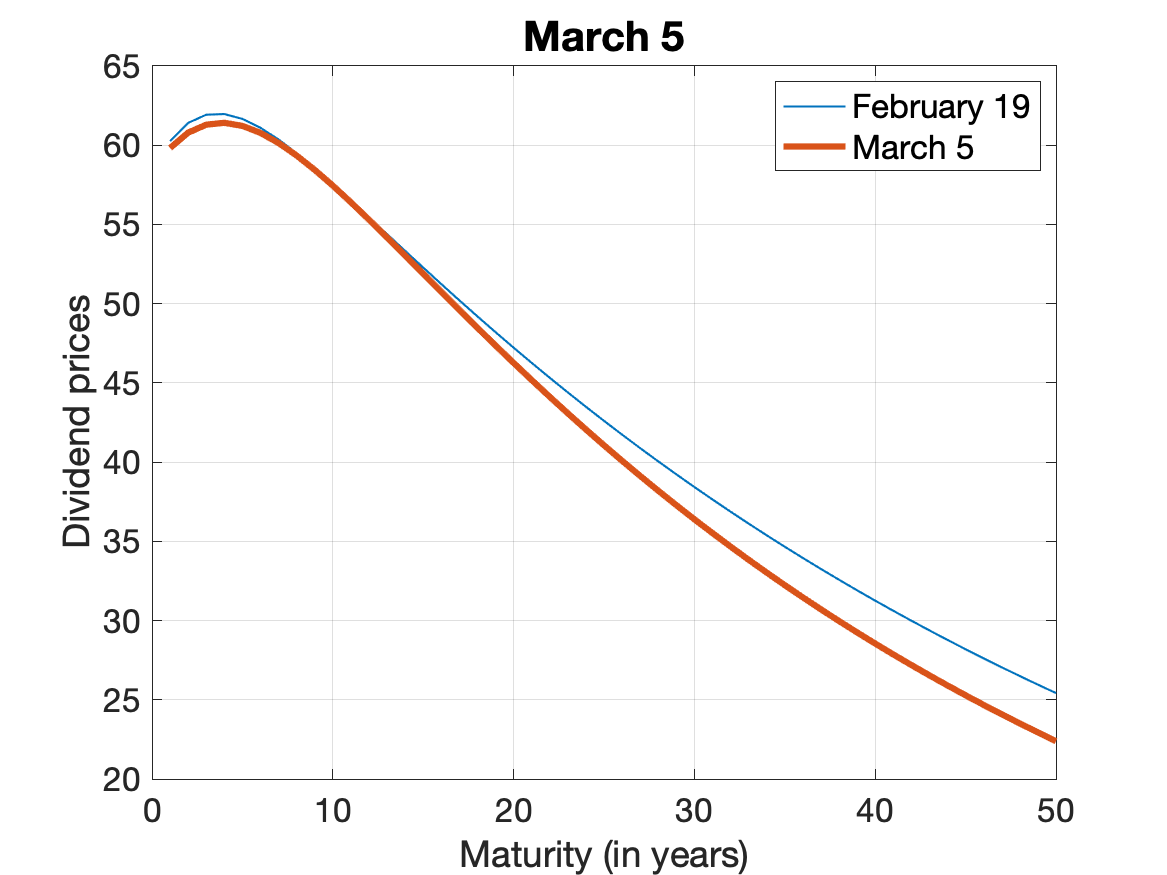

March 5: The market declines in the beginning of March, yet short-term dividend prices do not yet respond.

As pandemics (due to lockdowns, ..) presumably have the largest impact during the next one or two years (even though there can be severe long-lasting effects), this fact is most consistent with a risk aversion or sentiment shock that lowers the value of long-run cash flows.

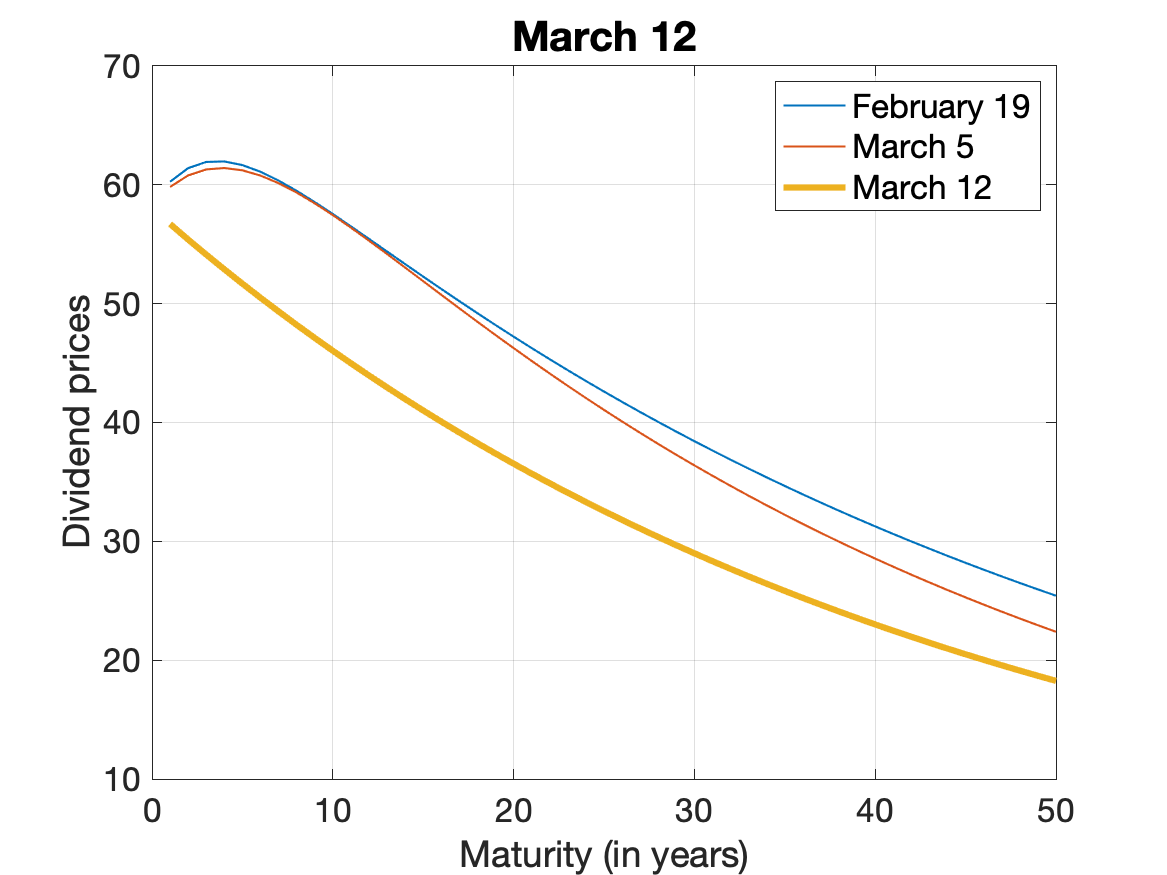

March 12: The market falls sharply and so do short-term dividend futures. This is the typical pattern during recessions and the magnitude of the decline of short-term dividend prices rivals the decline in 2008:

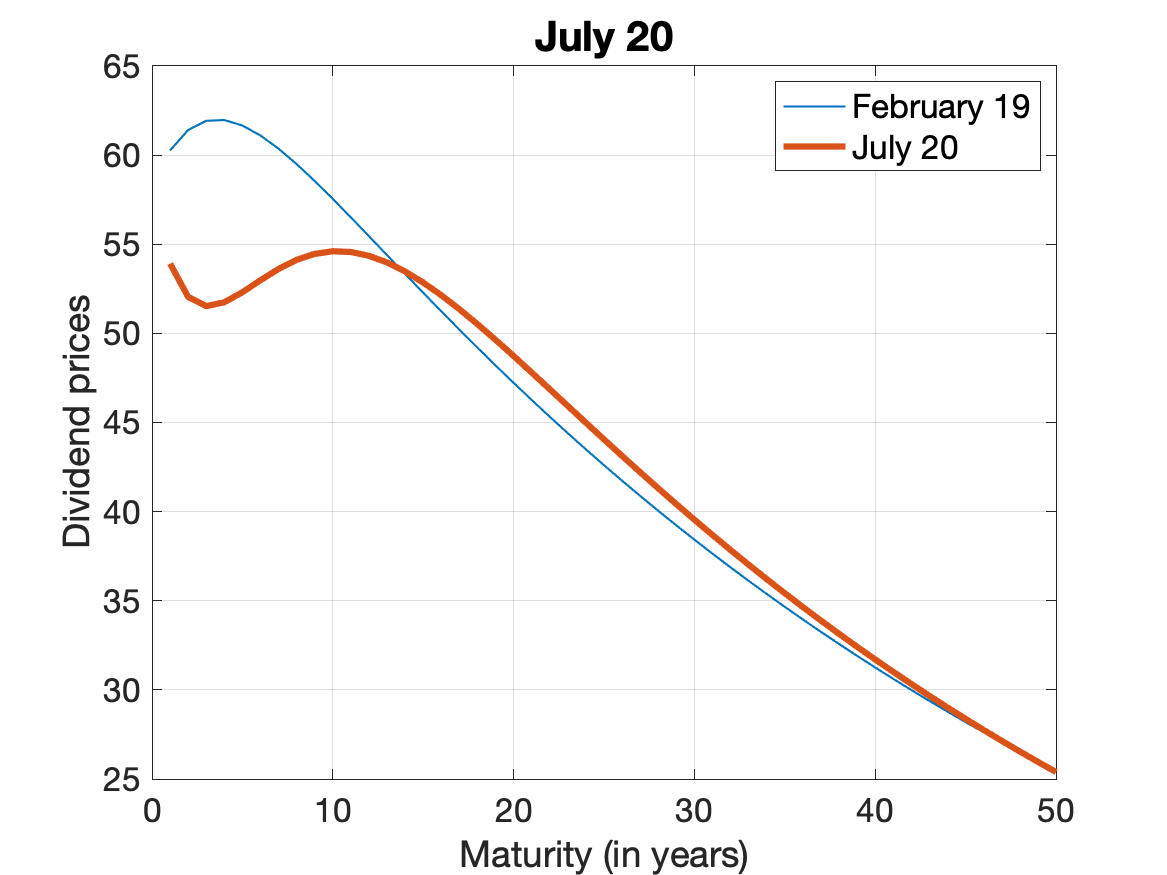

July 20: The market has largely recovered, but the decomposition reveals how the market prices the impact on the real economy:

Short-term dividend claims are still down by 10-20%, and the impact is noticeable for the next 10 years. However, the first 10 years of dividends only make up ~20% of the value of the stock market. 80% is due to value of cash flows beyond 10 years

Hence, the market does reflect the impact on the real economy, but it leads to a fairly modest decline in its overall value, in part also due to lower long-term yields.

These dynamics of short- and long-term prices around recessions are not unusual, see @NielsGormsen (2020) https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2989695.

What is unusual is the speed at which markets recovered, which may be due to aggressive polices by the Fed, demand from retail investors in inelastic markets (as in @xgabaix and @rkoijen 2020 https://conference.nber.org/conf_papers/f141240.pdf), ...

The price dynamics, across maturities and over time, is similar in Europe and Japan. For more details, see the paper here https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3555917 with @NielsGormsen.

Read on Twitter

Read on Twitter