$DIS may have spiked up on earnings, but I don't think it is done quite yet. $DIS reported a net loss of $4.72B while EPS came in at 0.08, their first loss & lowest EPS since 2001 . So why has it gone up & why do I think it will keep going up???

Thread:

Thread:

1) Revenue came in at $11.78B (a fraction of last year’s revenue).

Not including lost revenue, a factor contributing to their net loss is their payments still being made for their Fox merger.

The bright spot was news about their streaming platforms.

Not including lost revenue, a factor contributing to their net loss is their payments still being made for their Fox merger.

The bright spot was news about their streaming platforms.

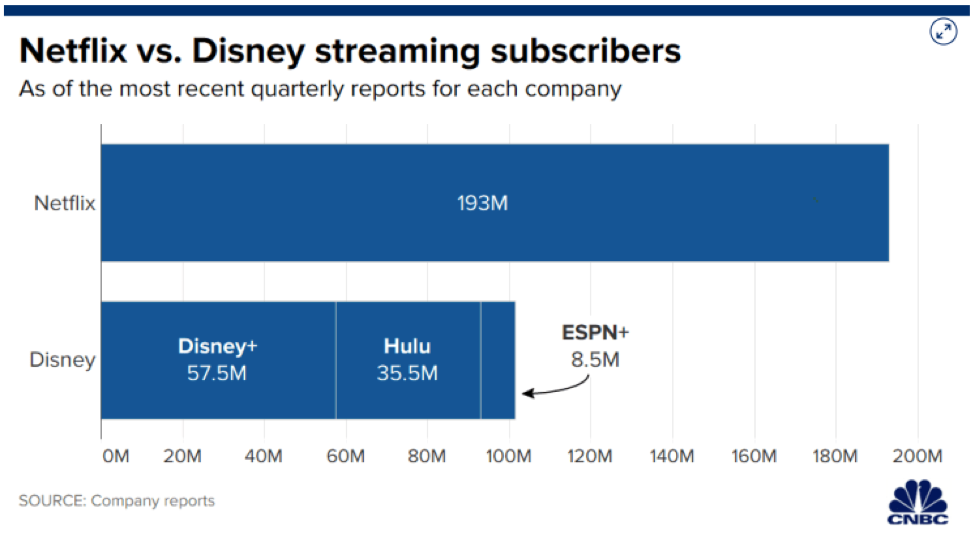

2) Combined, Disney+, Hulu, and ESPN+ now have about 104.5M subscribers (60.5M, 35.5M, & 8.5M respectively)

$DIS also announced plans to create another streaming service that will focus on international markets

$DIS previously forecast Disney+ hitting 60-90M subscribers by 2024

$DIS also announced plans to create another streaming service that will focus on international markets

$DIS previously forecast Disney+ hitting 60-90M subscribers by 2024

3) The key takeaway from earnings was the subscriber numbers

The below graph from @CNBC helps to visualize just how many subscribers $NFLX has vs all the streaming offerings of $DIS

$NFLX reported revenue of $6.15B, giving them about half the revenue off twice the subscribers

The below graph from @CNBC helps to visualize just how many subscribers $NFLX has vs all the streaming offerings of $DIS

$NFLX reported revenue of $6.15B, giving them about half the revenue off twice the subscribers

4) $NFLX & $DIS have market cap's of $223.7B and $236.8B respectively.

The vast difference in revenue is a signal that the market cap and value for these companies are off.

The vast difference in revenue is a signal that the market cap and value for these companies are off.

5) Breaking down $DIS revenue highlights the potential growth that could be seen:

$6.5B for media networks (ie TV channels)

$3.97 for direct-to-consumer (streaming subscribers)

$1.74B for studio entertainment (55% decline)

$983M for parks (85% decline)

$6.5B for media networks (ie TV channels)

$3.97 for direct-to-consumer (streaming subscribers)

$1.74B for studio entertainment (55% decline)

$983M for parks (85% decline)

6) It may take some time for parks and studio revenue to return to pre-pandemic levels (park and theater re-openings will be key), but the growth that $DIS streaming offerings should bode well for the future growth of revenue and value of the company.

7) With every major studio (not including $SNE) offering their own streaming service, $NFLX will have a limited window to license shows/films from its competitors.

$DIS meanwhile has a library spanning over 80 years.

$DIS meanwhile has a library spanning over 80 years.

8) Below you can see a flat base formed (light blue lines) but a new level of resistance may be seen at $135 (yellow line)

Should $DIS hold in the $125-135 range in the near future, that will allow the 50-DMA to catch up to the 200-DMA & provide a golden cross (bullish)

Should $DIS hold in the $125-135 range in the near future, that will allow the 50-DMA to catch up to the 200-DMA & provide a golden cross (bullish)

If you learned something today and want to receive more updates and analysis about stocks, subscribe here:

https://yahoo.us10.list-manage.com/subscribe?u=afbb3d8c21b301f6be415fe01&id=f0b66dc817

https://yahoo.us10.list-manage.com/subscribe?u=afbb3d8c21b301f6be415fe01&id=f0b66dc817

Read on Twitter

Read on Twitter