THREAD: Long Maxcyte (MXCT LN)

If it ain't broke don't fix it. Maxcyte is another AIM-to-NASDAQ relisting.

Exciting area with very little competition, 90% gross margins and 20-30% growth in core business.

Would trade at a materially higher valuation in the US.

If it ain't broke don't fix it. Maxcyte is another AIM-to-NASDAQ relisting.

Exciting area with very little competition, 90% gross margins and 20-30% growth in core business.

Would trade at a materially higher valuation in the US.

Maxcyte's core business is producing electroporation systems.

To simplify: this entails using electricity to temporarily make cell membranes permeable, thus allowing genetic material to be inserted.

To simplify: this entails using electricity to temporarily make cell membranes permeable, thus allowing genetic material to be inserted.

Maxcyte is the only provider whose systems can operate at scale and they are used by all of the world's top ten pharma companies and 20 of the top 25.

They can either be used to get microorganisms to create biologics or in renegerative medicine.

They can either be used to get microorganisms to create biologics or in renegerative medicine.

Regen medicine is the idea of customising the attributes of human cells to fight diseases.

CAR-T therapies are the most well known. With this white blood cells are altered to get them to attack cancer cells.

CAR-T therapies are the most well known. With this white blood cells are altered to get them to attack cancer cells.

For the most part, regen medicine uses viruses to introduce new genetic material into the human cell.

This has a number of drawbacks: very expensive, slow to manufacture and, because they are viruses, humans can have immune reactions.

This has a number of drawbacks: very expensive, slow to manufacture and, because they are viruses, humans can have immune reactions.

The two regen medicines on the market today (both CAR-T) are Yescarta and Kymriah. Both use a viral vector and both are extremely expensive (cost in the hundreds of thousands of dollars). Both have had disappointing uptake.

Enter electroporation.

It is not perfect, but electroporation is the only non-viral method that is in clinical trials for regen medicine. And Maxcyte has 80% of these trials.

Its advantage is speed, cost and lack of immune response.

It is not perfect, but electroporation is the only non-viral method that is in clinical trials for regen medicine. And Maxcyte has 80% of these trials.

Its advantage is speed, cost and lack of immune response.

Maxcyte's business model is as follows.

Sell or lease the machine to drug companies, sell consumables (both at 90% gross margin), then enter into commercial licenses.

Sell or lease the machine to drug companies, sell consumables (both at 90% gross margin), then enter into commercial licenses.

The commercial licenses provide Maxcyte with milestone payments as the drug goes through trials, as well as royalties (I guess 2-3%) on any sales of the drug if it is approved.

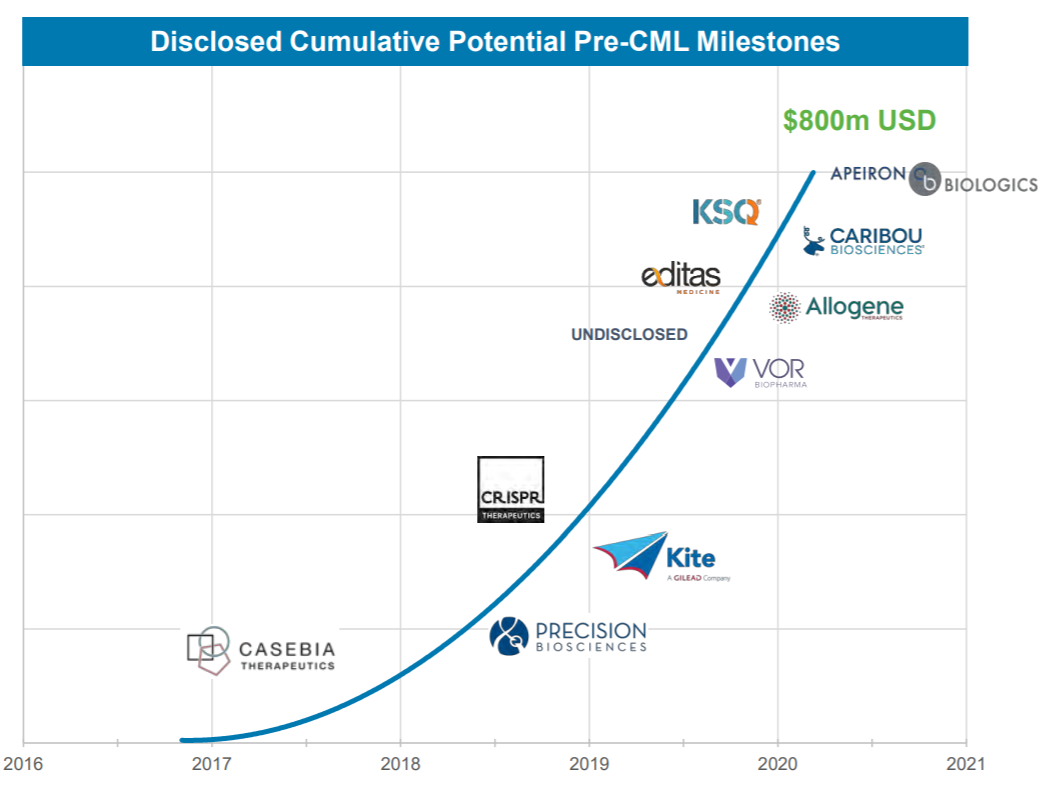

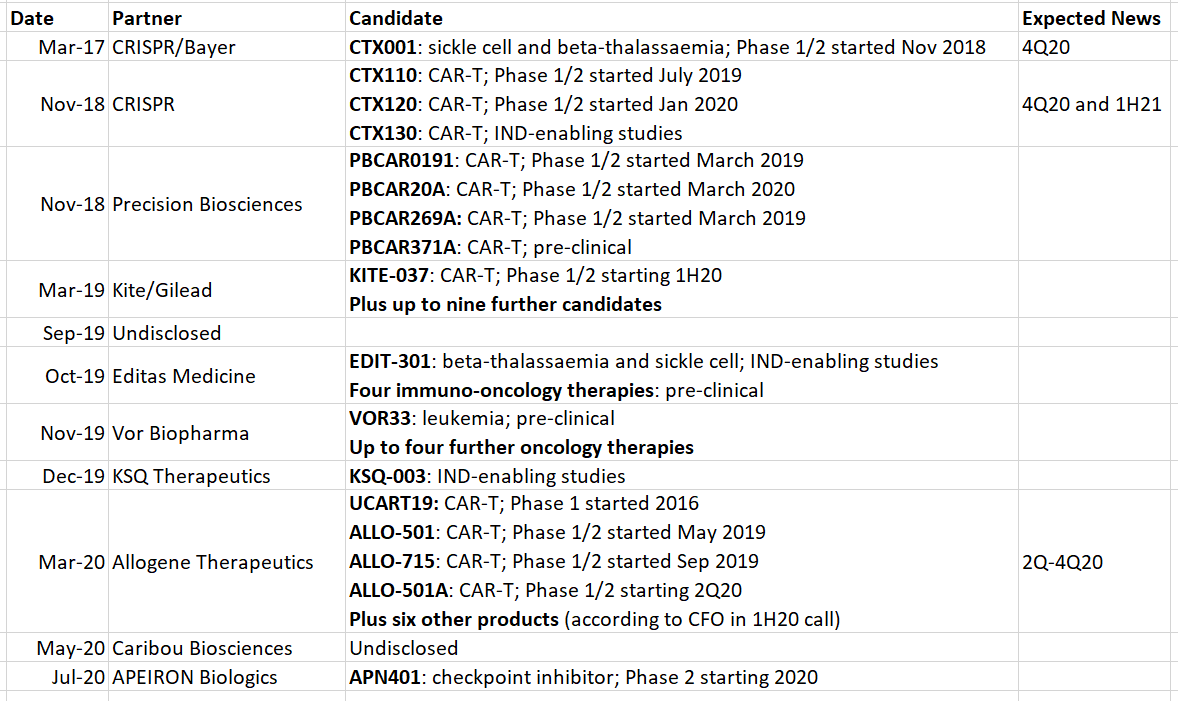

Here are the deals Maxcyte has signed so far with total possible milestone payments (>$800m)

Here are the deals Maxcyte has signed so far with total possible milestone payments (>$800m)

Examples of their licenses include some of the most exciting biotechs on the market today.

They are used in all of CRISPR's main candidates and Allogene recently moved to Maxcyte's systems. Kite/Gilead also signed a deal for up to ten molecules.

They are used in all of CRISPR's main candidates and Allogene recently moved to Maxcyte's systems. Kite/Gilead also signed a deal for up to ten molecules.

Each commercial license covers multiple molecules.

Management estimate each molecule has a risk-adjusted $10m NPV of milestone payments. Then they get royalties if the drugs are approved.

The table below shows my guess of all the molecules they have under license. I count >40.

Management estimate each molecule has a risk-adjusted $10m NPV of milestone payments. Then they get royalties if the drugs are approved.

The table below shows my guess of all the molecules they have under license. I count >40.

It is also worth noting how dramatically the number of licenses has increased in the last twelve months.

This is one of the most exciting areas in drug development and I fully expect the number of deals to keep increasing.

This is one of the most exciting areas in drug development and I fully expect the number of deals to keep increasing.

To confuse matters, Maxcyte is also developing its own drug based on its electroporation technology.

I'm not going to go into the details, but management are going to divest this by the end of the year and eliminate a significant cost base.

I'm not going to go into the details, but management are going to divest this by the end of the year and eliminate a significant cost base.

In May of this year, Maxcyte did a capital raise and brought in two specialist healthcare investors.

The way the raise was structured, Maxcyte has to move to NASDAQ within 18 months or issue more shares to those two investors.

The way the raise was structured, Maxcyte has to move to NASDAQ within 18 months or issue more shares to those two investors.

The bottom line is the core business is growing 20-30% with very significant operating leverage and 90% gross margins.

Then (if you believe mgmt) >$400m of risk adjusted milestones and possibly royalties if any of these drugs make it. Several are in phase II.

Then (if you believe mgmt) >$400m of risk adjusted milestones and possibly royalties if any of these drugs make it. Several are in phase II.

The market cap of Maxcyte is $290m.

The core business will do ~$25m in revenue over next twelve months and growing 20-30%.

Then you have the value of the drug (has had ~$50m of investments).

Then the milestones and royalties (possibly worth >$400m).

The core business will do ~$25m in revenue over next twelve months and growing 20-30%.

Then you have the value of the drug (has had ~$50m of investments).

Then the milestones and royalties (possibly worth >$400m).

Comparables in the US trade at anywhere from 11x to 25x sales (BLFS, RGEN, CYRX). And these do not have the milestone or royalty potential of Maxcyte.

My base case is that they get $50m for the drug, leaving the core trading at <10x sales plus potential milestones and royalties.

My base case is that they get $50m for the drug, leaving the core trading at <10x sales plus potential milestones and royalties.

Shares have had a run but I still think they're good value and have the obvious NASDAQ catalyst on the horizon.

Thanks to @LortJames and @Riggs_Bud who have helped me with the analysis.

/end

Thanks to @LortJames and @Riggs_Bud who have helped me with the analysis.

/end

Read on Twitter

Read on Twitter