I am one of the few who eagerly await's the IMF's External Sector Report (in part because I have made a number of suggestions for how the IMF could improve it over the years).

The best part of this year's report?

The hint that the IMF may be moving away from the RAM ...

1/n

The best part of this year's report?

The hint that the IMF may be moving away from the RAM ...

1/n

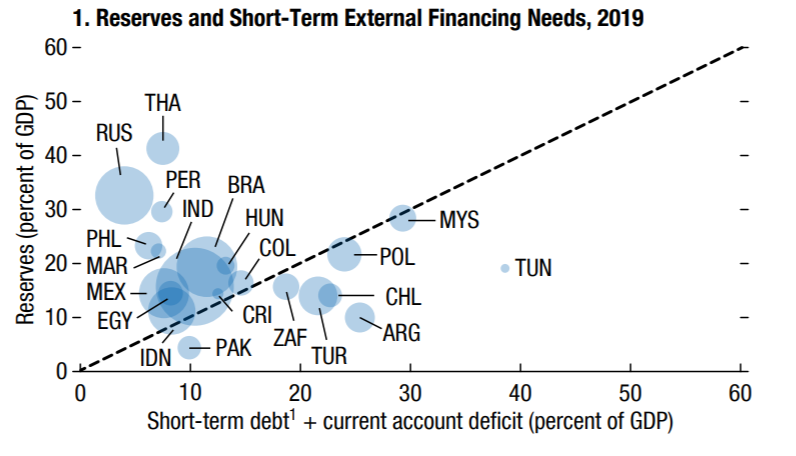

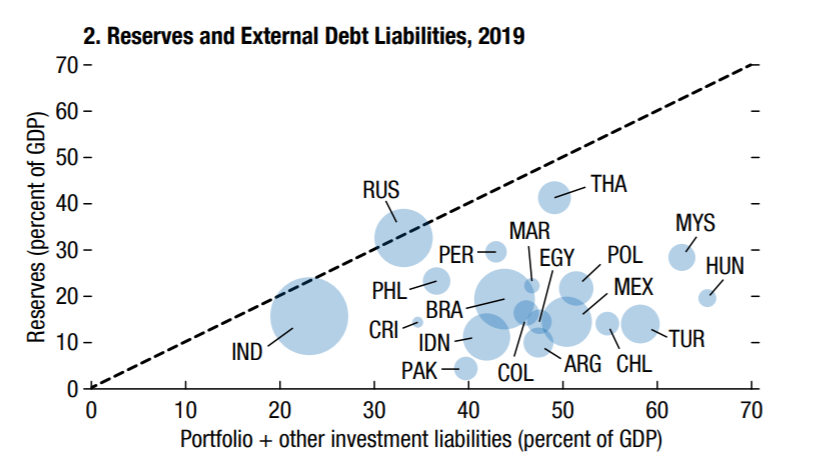

The RAM is the IMF's reserve adequacy metric, which doesn't work well (it suggests, without adjustments, that Turkey and China are equally UNDER reserved). So it is a sign of hope that IMF used STD + the CA balance and total external debt liabilities in its charts ...

2/n

2/n

Perhaps I am reading too much into these two charts, but they do suggest that the IMF has recognized that the RAM is a wildly misleading measure of reserve need (the problem is the M2 variable, as a high M2 to GDP tends to be correlated with a CA surplus ... )

3/n

3/n

So the reserve adequancy metric tends to suggest surplus countries need to hold more reserves than deficit countries.

that is a tad nuts ...

as the IMF seems to recognize in Chapter 2 of the ESR

https://www.imf.org/en/Publications/ESR/Issues/2020/07/28/2020-external-sector-report

4/n

that is a tad nuts ...

as the IMF seems to recognize in Chapter 2 of the ESR

https://www.imf.org/en/Publications/ESR/Issues/2020/07/28/2020-external-sector-report

4/n

I quote:

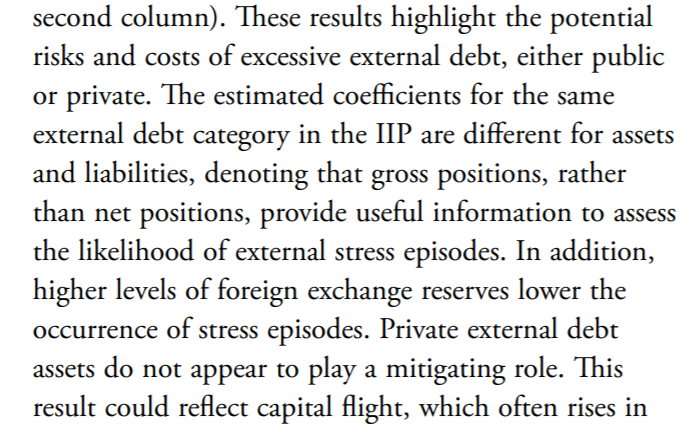

" Among other macroeconomic fundamentals, larger current account deficits are associated with higher external stress"

5/n

" Among other macroeconomic fundamentals, larger current account deficits are associated with higher external stress"

5/n

This is quite interesting -- gross external positions matter for external vulnerability, not net positions (or so it seems)

and publicly held fx reserves provide a buffer while private ones do not ...

6/n

and publicly held fx reserves provide a buffer while private ones do not ...

6/n

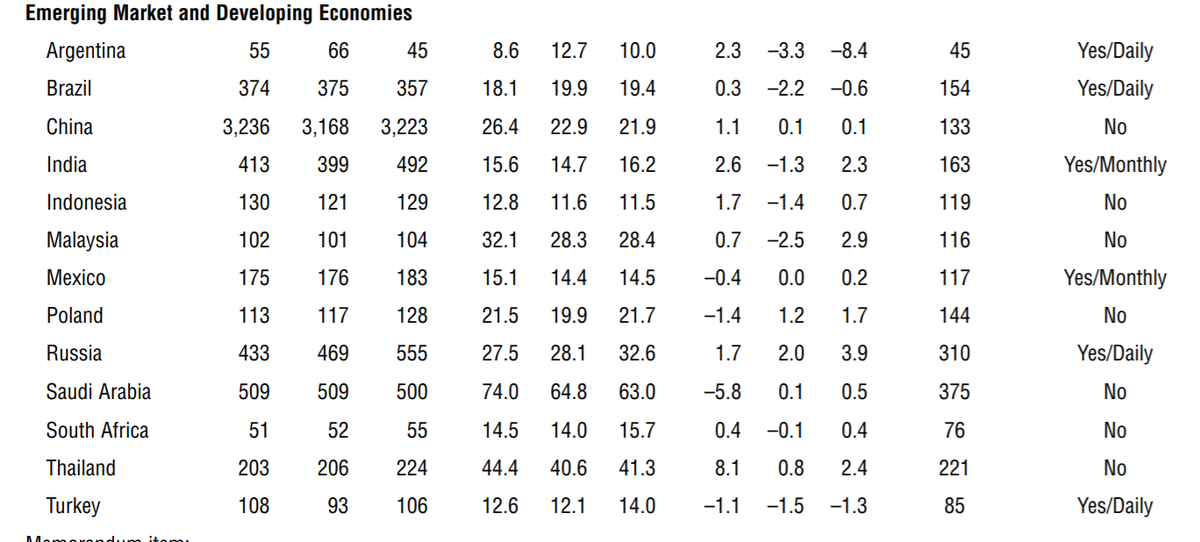

But this analysis has yet to fully filter down to the country teams which still used the reserve metric heavily in their assessments of reserve adequacy ..

and the last column here (does a country report fx intervention) needed a bit more stress testing

7/n

and the last column here (does a country report fx intervention) needed a bit more stress testing

7/n

Turkey reports its reserves daily, but not actual intervention (the intervention is now done via state banks, and to get the actual numbers you at a minimum need to wait for the forwards data -- it just isn't tops in turns of intervention transparency)

8/n

8/n

Now the bad -- the IMF joined Goldman in putting out a report that says China is as under-reserved as China (both used the RAM a bit too much, tho the IMF does qualify the China is 82% reserved point)

So on the RAM (without the controls adjustment) China is under-reserved while Indonesia is over reserved (120% of the metric ...)?

China was at 82% of the unadjusted reserve adequacy metric while Turkey (now with negative net reserves) was at 85%? Makes no sense (as the IMF implicitly acknowledges by including the reserves v gross financing need numbers for Turkey)

The IMF was willing to say that Thailand was over-reserved and has no need to intervene further (could be important for the Treasury's fx report)

But it wasn't willing to explicitly criticize Singapore for excessive intervention or excess reserves? (the policy recommendations section on Singapore's excessive surplus also highlighted fiscal while ignoring fx policy)

Come on ... there is an equality of treatment issue here

Come on ... there is an equality of treatment issue here

Last point (for now -- I also have some views on the fiscal and health policy gaps, but those are for a blog ... ) -- the IMF doesn't seem to cover Vietnam in the ESR. Don't think that will fly for much longer https://www.imf.org/en/Publications/ESR/Issues/2020/07/28/2020-external-sector-report

And yes, I can be skunk at a garden party at times ...

The IMF's reserve metric has been a big analytic problem for several years now.

It continues to be a problem in the country analysis.

Tis high time it was updated.

The IMF's reserve metric has been a big analytic problem for several years now.

It continues to be a problem in the country analysis.

Tis high time it was updated.

Read on Twitter

Read on Twitter