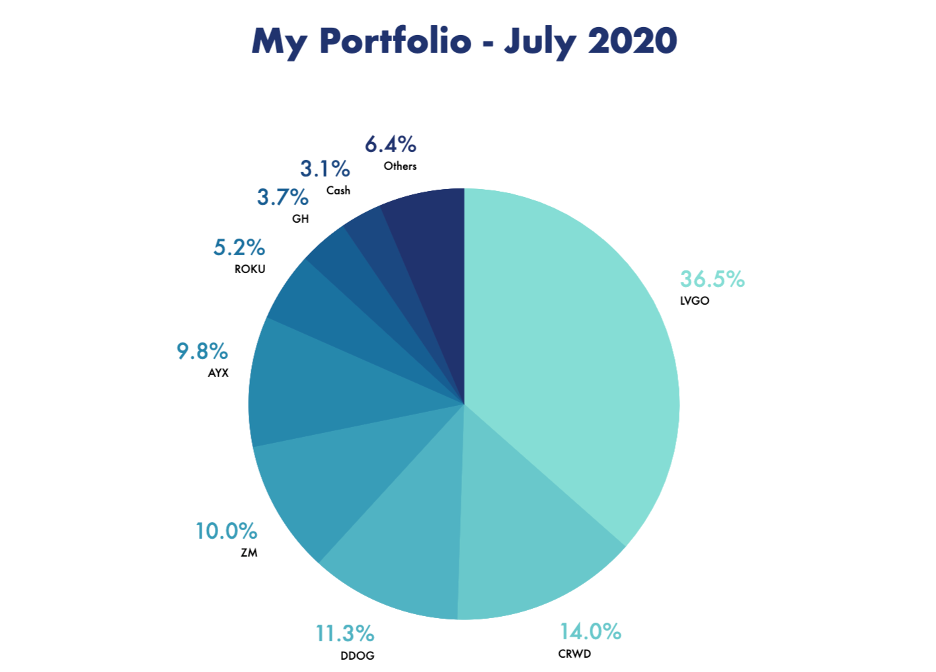

My portfolio as of Jul 31, 2020:

$LVGO – 36.5%

$CRWD – 14.0%

$DDOG – 11.3%

$ZM – 10.0%

$AYX – 9.8%

$ROKU – 5.2%

$GH – 3.7%

$API – 2.5%

$FSLY – 2.1%

Chainlink – 1.2%

$WORK – 0.6%

Cash – 3.1%

Performance: +167.7% YTD

$LVGO – 36.5%

$CRWD – 14.0%

$DDOG – 11.3%

$ZM – 10.0%

$AYX – 9.8%

$ROKU – 5.2%

$GH – 3.7%

$API – 2.5%

$FSLY – 2.1%

Chainlink – 1.2%

$WORK – 0.6%

Cash – 3.1%

Performance: +167.7% YTD

Initiated: WORK, API, FSLY

Added: DDOG, ROKU, GH

It was a relatively quiet month for my portfolio as I mostly left my core positions untouched.

While I don’t believe we’re in a bubble, many of my stocks are extended and vulnerable to ST pullbacks like the one we saw mid-July.

Added: DDOG, ROKU, GH

It was a relatively quiet month for my portfolio as I mostly left my core positions untouched.

While I don’t believe we’re in a bubble, many of my stocks are extended and vulnerable to ST pullbacks like the one we saw mid-July.

2) I am a fan of concentration and letting my winners run as a few stocks drive the vast majority of LT returns.

I only trim if I feel the valuation is unreasonable and I don’t have high conviction. Currently, I am happy with my allocations as they reflect my confidence levels.

I only trim if I feel the valuation is unreasonable and I don’t have high conviction. Currently, I am happy with my allocations as they reflect my confidence levels.

3) During the short but violent pullback mid-month, I added to $DDOG as it was my second highest confidence stock, but only my fourth largest position.

I also took a starter in $DT, which is another observability play but sold it after earnings as the growth just wasn’t there.

I also took a starter in $DT, which is another observability play but sold it after earnings as the growth just wasn’t there.

4) I also got back in $FSLY at the same time. I am still cautious about the long-term outlook for the reasons mentioned in last month’s summary ( https://twitter.com/richard_chu97/status/1278120494735200259?s=20), but I don’t doubt that in the near-term, esp after seeing the surge in e-commerce, earnings should be great

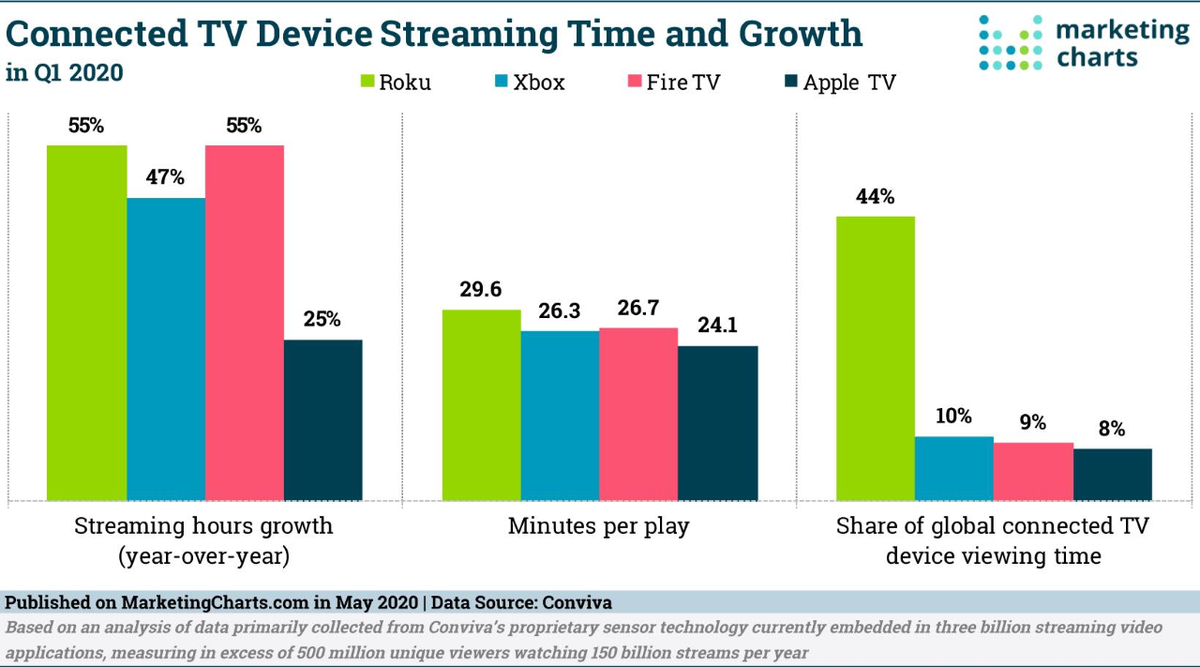

5) I added to $ROKU as well and now have a sizable position.

I am confident as ever in the long-term outlook and thought they were relatively undervalued at the time. As more ad dollars are directed towards CTV, Roku’s market-leading position will capture significant growth

I am confident as ever in the long-term outlook and thought they were relatively undervalued at the time. As more ad dollars are directed towards CTV, Roku’s market-leading position will capture significant growth

6) I added to $GH, which seemed like a reasonably valued, under-the-radar hyper-growth opportunity with incredible potential and material near-term catalysts.

While COVID will adversely impact testing volumes in the near term, I still believe GH should be a long-term beneficiary

While COVID will adversely impact testing volumes in the near term, I still believe GH should be a long-term beneficiary

7) Commentary on $EXAS’ CC supports this view:

“COVID-19 will accelerate adoption of Cologuard by 1-2 years. Patients and physicians are also looking for smarter, faster answers to guide their cancer treatment decisions, elevating the importance of our precision oncology tests”

“COVID-19 will accelerate adoption of Cologuard by 1-2 years. Patients and physicians are also looking for smarter, faster answers to guide their cancer treatment decisions, elevating the importance of our precision oncology tests”

8) I started a position in $WORK for reasons I explained in this thread: https://twitter.com/richard_chu97/status/1284913697476018176

I think the thesis will take time to play out and Teams will continue to be a drag on stock performance so I will keep my position small and might sell if I see a better opportunity

I think the thesis will take time to play out and Teams will continue to be a drag on stock performance so I will keep my position small and might sell if I see a better opportunity

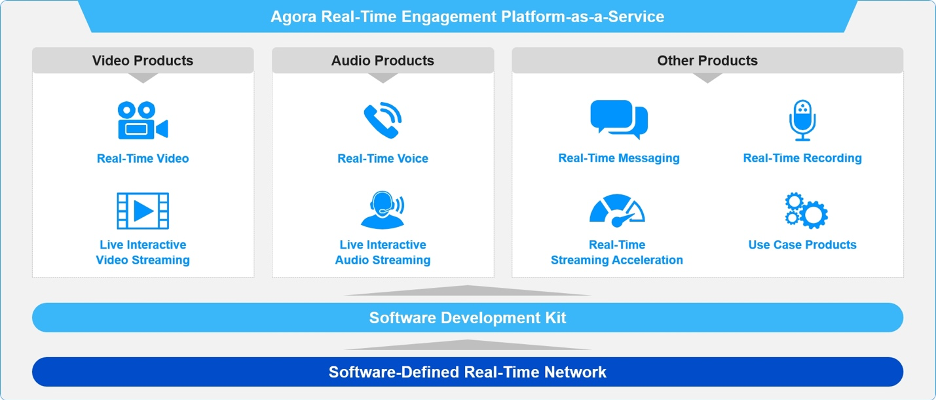

9) Finally, I started, and added to, a small position in the new IPO http://Agora.io $API. Essentially, it’s like a Chinese Twilio with a focus on mobile and video, powered by a global network of 200 co-located data centers (SD-RTN) and recognizable customers like $EDU

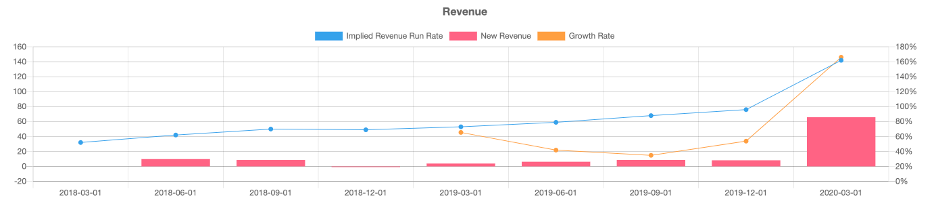

10) They have excellent financials: ARR grew 167.9% vs 65% last year in the same period (from COVID), gross margins are steady ~69%, customers grew 73% YoY from 678 to 1176, DBNER is 131% and profitability/cash flows are lumpy but headed in the right direction. From @publiccomps:

11) It’s an ADR but also has a US HQ and were founded by Tony Zhao who was a founding engineer at WebEx. A big competitive advantage comes from their purpose-built architecture and SD-RTN network to optimize video quality.

Check out @jaminball’s article: https://cloudedjudgement.substack.com/p/agora-benchmarking-the-f1-data

Check out @jaminball’s article: https://cloudedjudgement.substack.com/p/agora-benchmarking-the-f1-data

12) Lastly, in case you missed it, I started a Substack! Check out my first post here which explains my backstory: https://richardchu97.substack.com/ .

In the future, I will occasionally post deep dives there. I am working on one for $API but want to see their first earnings report.

In the future, I will occasionally post deep dives there. I am working on one for $API but want to see their first earnings report.

Read on Twitter

Read on Twitter