Navigating the current state of Canada's #economy

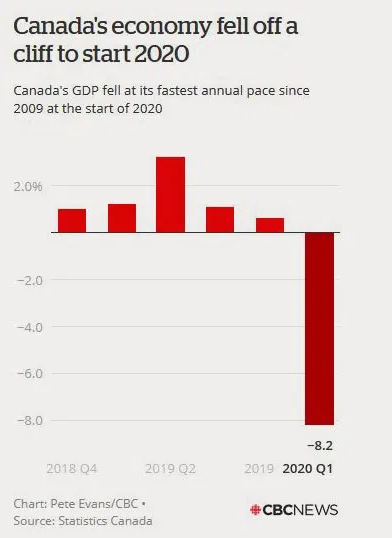

The economic shutdown prompted by the virus has pushed the country into a recession. 2020 Q1 GDP fell 2% quarter over quarter.

You may have seen charts like this which can be misleading. The bars represent annualized rates (1/7)

The economic shutdown prompted by the virus has pushed the country into a recession. 2020 Q1 GDP fell 2% quarter over quarter.

You may have seen charts like this which can be misleading. The bars represent annualized rates (1/7)

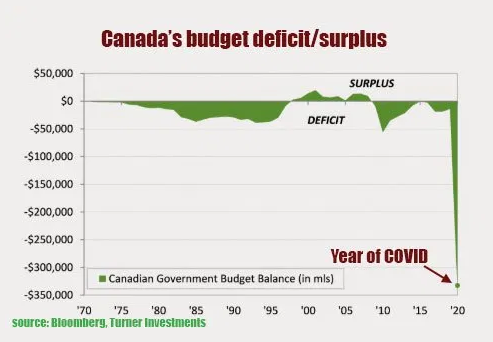

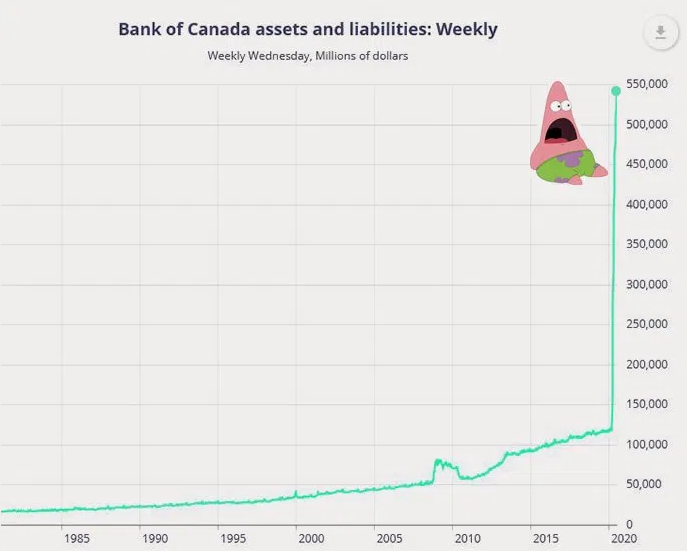

To combat the #recession our policies makers are running a huge deficit and printed an unprecedented amount of $CAD.

The @bankofcanada can create as much currency as it wants. But it can’t create real wealth - which comes from savings, investment, & productivity. (2/7)

The @bankofcanada can create as much currency as it wants. But it can’t create real wealth - which comes from savings, investment, & productivity. (2/7)

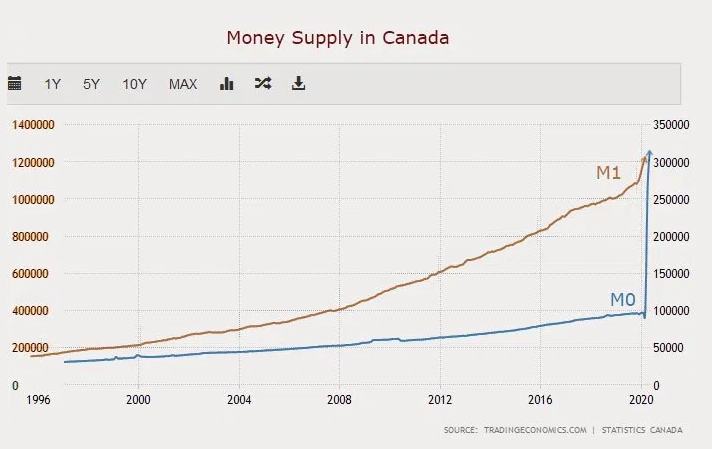

The result? An abrupt increase in the money supply.

M0 (physical cash in circulation) spiked

M1 which also includes people's chequing accounts is rising at its fastest pace ever

But people are wary of their job security & the economy. They are saving instead of spending. (3/7)

M0 (physical cash in circulation) spiked

M1 which also includes people's chequing accounts is rising at its fastest pace ever

But people are wary of their job security & the economy. They are saving instead of spending. (3/7)

This means the money supply is high, but the velocity of money is slow. This is how consumer prices have remained stable so far.

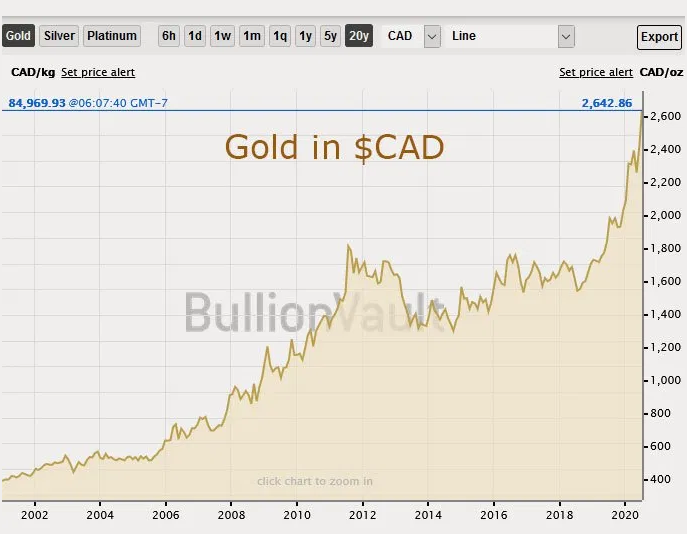

However, spooked by uncertainty - #investors have already begun to load up on hard assets and the financial markets. #gold has hit a record high (4/7)

However, spooked by uncertainty - #investors have already begun to load up on hard assets and the financial markets. #gold has hit a record high (4/7)

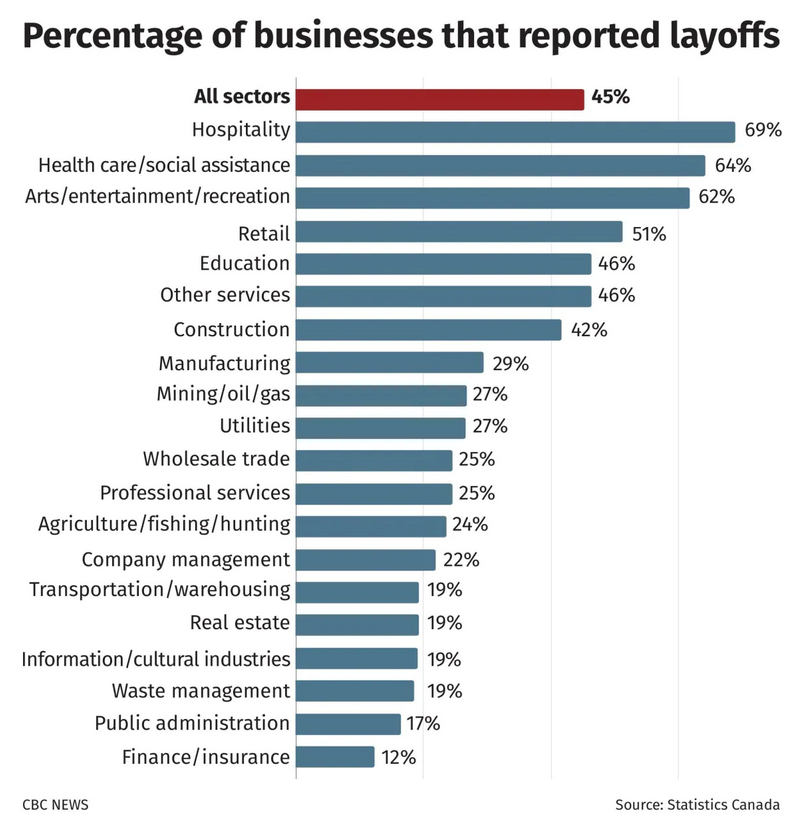

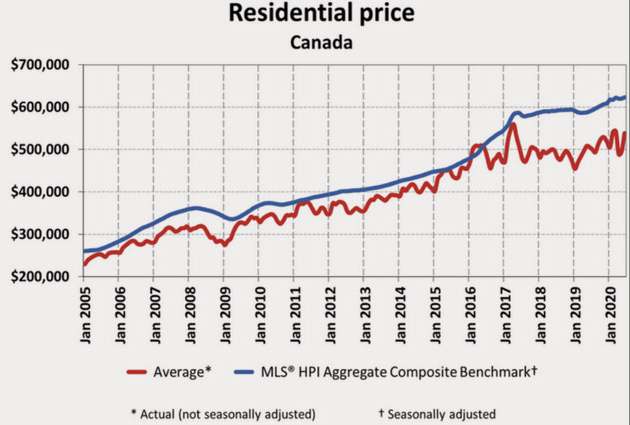

Real estate prices haven't fallen because people looking to buy homes today tend to work in tech, engineering, healthcare, or can receive help from family. Many existing families are trying to upsize

These are typically not the same workers who lost their jobs due to COVID (5/7)

These are typically not the same workers who lost their jobs due to COVID (5/7)

Canadians who have recently sold their properties are not spending it in the economy. They are either saving it or have deployed the proceeds back into another property or the stock market.

This makes it politically challenging for @JustinTrudeau to raise investment taxes (6/7)

This makes it politically challenging for @JustinTrudeau to raise investment taxes (6/7)

Read on Twitter

Read on Twitter