Inspired by @marketplunger1, this week I am taking a look at Frontdoor Inc ($FTDR).

At first glance they have a beautiful technical setup and might just have tailwinds to boast. Let's dive in!

1/x

At first glance they have a beautiful technical setup and might just have tailwinds to boast. Let's dive in!

1/x

$FTDR is the single largest provider of home service plans in the United States -- operating under the brands American Home Shield, HSA, OneGuard, and Landmark brands.

2/x

2/x

If you're like me and have never heard of a home service plan before (my guess is they're less popular in Canada), it's basically insurance on appliances / systems in your home.

Pay $__ a month and if your HVAC breaks down dont worry, youre covered.

3/x

Pay $__ a month and if your HVAC breaks down dont worry, youre covered.

3/x

This bodes well for an already highly levered consumer market where large surprise purchases are a nightmare and potentially un-payable. Additionally, home buying is already a hassle so people are willing to pay every month for the peace of mind

4/x

4/x

$FTDR also corners the market through their 2019 launch of Candu.

Candu is an on-demand service that connects you with the best home0repair workers in your area. This bridges the gap between customers who don't think they need a monthly cover-all plan.

5/x

Candu is an on-demand service that connects you with the best home0repair workers in your area. This bridges the gap between customers who don't think they need a monthly cover-all plan.

5/x

$FTDR's management has ironclad their market share and barriers to entry by dont two things. The first -- they add tremendous value to both the parties they do business with.

6/x

6/x

Customers enjoy the linearity of their costs & reliability of the repayment while the repairmen are fed a steady stream of customers. Second -- $FTDR acquires technology that makes it so that neither customer nor workers want to use any other service. They are locked in.

7/x

7/x

This lock-in comes int he form of their 2019 acquisition of Streem -- an AR company that allows near-perfect communication between customer and repairman.

$FTDR's willingness to innovate & better their service in a rather boring space is insanely bullish for me.

8/x

$FTDR's willingness to innovate & better their service in a rather boring space is insanely bullish for me.

8/x

Are we protected to the downside?

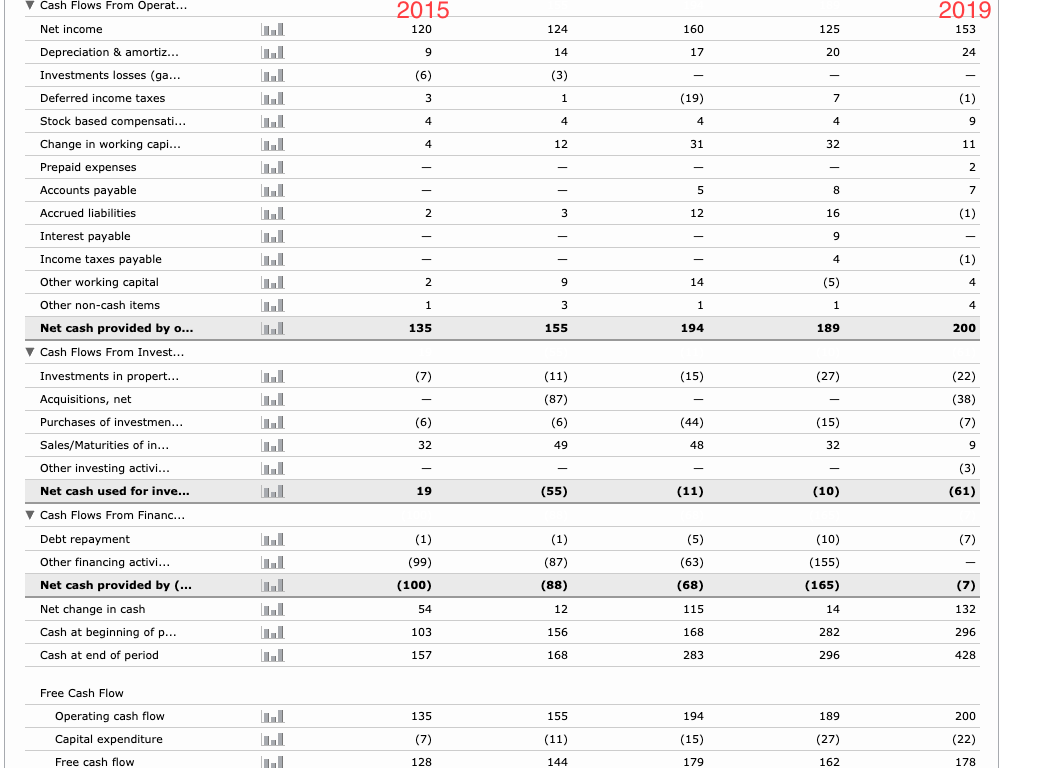

$FTDR's best protection is the fact that they run extremely light. Low CapEx allows the company to be very nimble -- allocating cash, and lots of it, wherever they see fit.

9/x

$FTDR's best protection is the fact that they run extremely light. Low CapEx allows the company to be very nimble -- allocating cash, and lots of it, wherever they see fit.

9/x

This is very important considering they were left with around ~$1b in debt when they were spun-off from their parent.

Taking into consideration the $428m in cash they hold right now, their net debt is more like $572m, or 3.2x current free cash flow.

10/x

Taking into consideration the $428m in cash they hold right now, their net debt is more like $572m, or 3.2x current free cash flow.

10/x

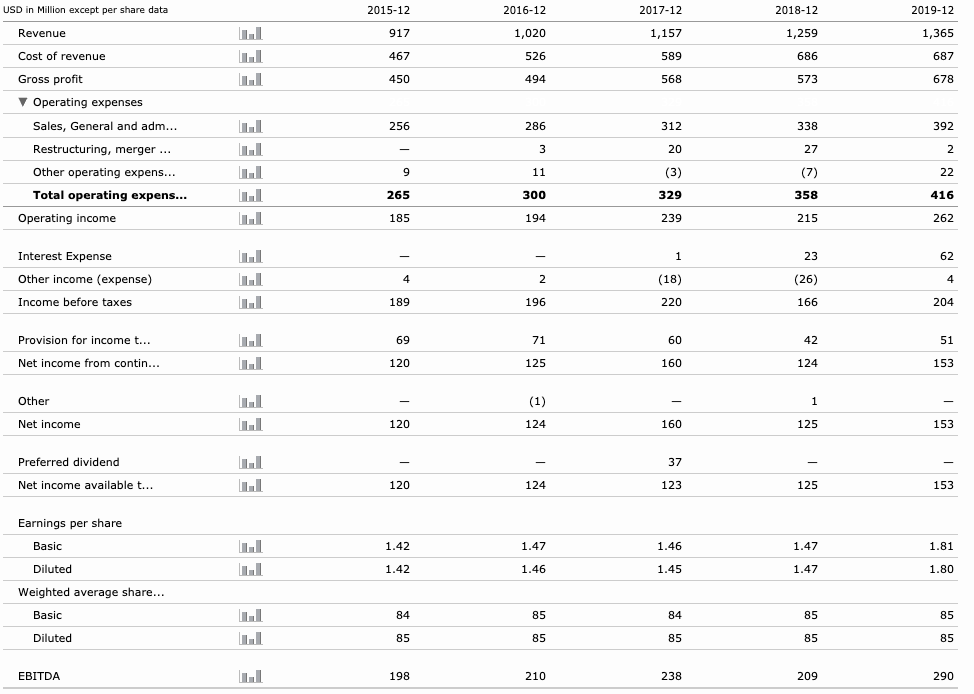

Pair this with a great EBITDA that comes from their reoccurring revenue model to add further strength to their downside.

A whopping 68% of 2019 revenue came from reoccurring sales.

11/x

A whopping 68% of 2019 revenue came from reoccurring sales.

11/x

How can we unlock the value that will allow for $FTDR's robustly light capital structure to shine and ultimately transfer over to an appreciation in share price?

For this we must take a look at the 2019 10-K.

12/x

For this we must take a look at the 2019 10-K.

12/x

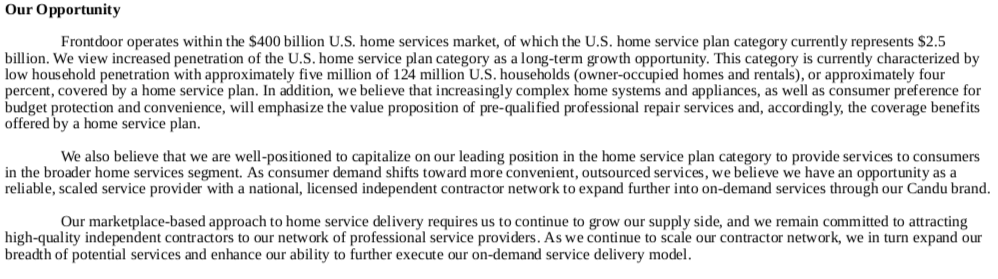

$FTDR highlights that while they are the industry leader, the market for home service plans in the USA is barely penetrated.

Only 4% of the 124m household are subscribed to a home service plan.

13/x

Only 4% of the 124m household are subscribed to a home service plan.

13/x

While maybe home service plans just aren't worth it for some people, it is my belief that as our home become more technical and connected, home service plans will only become more attractive. I would be hard-pressed to not consider that a tailwind for $FTDR.

14/x

14/x

One small pesky issue that we can't ignore is the pandemic / recession we are going through as you read this.

The answer on how this effects the home sales market is insanely complex and certainly unpredictable, but here's my best shot:

15/x

The answer on how this effects the home sales market is insanely complex and certainly unpredictable, but here's my best shot:

15/x

The fed's dovish picture of the economy leads to more printing, which will ultimately lead to more asset inflation. Housing is very much included in this. Tim Duy puts it very well in his July 29th Fed Watch article:

16/x

16/x

If (a big if, I will admit) the housing market is what leads us out of this recession, that will be very good for $FTDR's stock. I am not making my bets solely on this, but still something to consider.

17/x

17/x

To conclude this analysis let's take a look at the price action on $FTDR's chart.

I was looking for a break of the sideways range it was in, however it has decided to break to the downside.

There is still potential for a longer-term inverse head & shoulders.

18/x

I was looking for a break of the sideways range it was in, however it has decided to break to the downside.

There is still potential for a longer-term inverse head & shoulders.

18/x

I really like $FTDR because of their light capital structure, willingness to innovate, & big market growth opportunity. Without doing DCF or something of the sort, the chart price action is slowly getting less favourable to an upside break, with more info to come soon.

19/x

19/x

Read on Twitter

Read on Twitter