When it comes to market predictions, there are 2 kinds of experts:

Those that don't know and KNOW that they don't know

and

Those that don't know and DON'T KNOW that they don't know

The predictions of the former are worthless

But the predictions of the latter are dangerous

Those that don't know and KNOW that they don't know

and

Those that don't know and DON'T KNOW that they don't know

The predictions of the former are worthless

But the predictions of the latter are dangerous

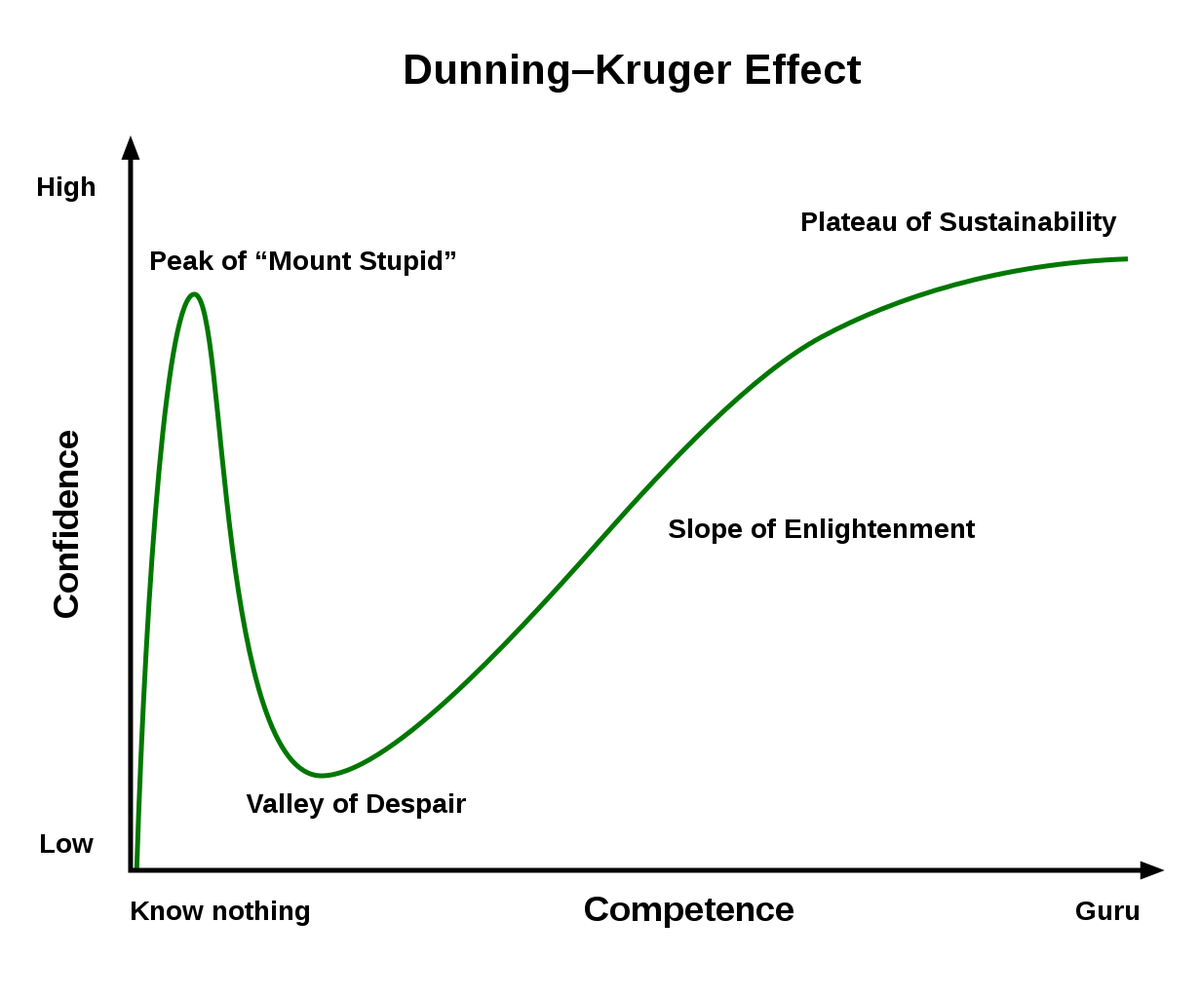

"Experts" that don't know and are clueless about their ignorance are the epitome of the Dunning-Krueger effect.

The worthlessness of their predictions is expressed with supersized confidence

The worthlessness of their predictions is expressed with supersized confidence

The truth is NO ONE truly knows.

Even the most experienced among us, who may have “seen the movie” before in the past, might not realize that this is an entirely different movie...

Even the most experienced among us, who may have “seen the movie” before in the past, might not realize that this is an entirely different movie...

But if no one can predict the future then how should you make decisions about whether you should invest or sit in the sidelines?

Step 1: Drop the impulse to predict

Step 2: Assume what you're worried about WILL happen

Step 3: Take steps to make you resilient & AntiFragile...

Step 1: Drop the impulse to predict

Step 2: Assume what you're worried about WILL happen

Step 3: Take steps to make you resilient & AntiFragile...

Think: what steps can you take today to make your financial situation or real estate portfolio *resilient* to economic volatility.

And most importantly, what steps can you take to make your real estate portfolio thrive and grow in that volatility

And most importantly, what steps can you take to make your real estate portfolio thrive and grow in that volatility

Ideas:

Stress Test your portfolio. What's the % of debt versus the value of the portfolio? Could your portfolio withstand a 10-20% drop in rental income? If not, take steps now to rebalance it. Sell an asset with high equity & refinance the debt on the rest.

Stress Test your portfolio. What's the % of debt versus the value of the portfolio? Could your portfolio withstand a 10-20% drop in rental income? If not, take steps now to rebalance it. Sell an asset with high equity & refinance the debt on the rest.

Stress Test your personal finances. How is your current income statement? Are you spending every incoming dollar? Have you accumulated non-investment debt lulled by the false sense of security of a bull market? Could your finances withstand 3-6 months of unemployment, or more?

Last, Bob Hope said it best: “A bank is a place that will lend you money if you can prove that you don’t need it.”

By the time you need it, it’s too late.

Be ready to take advantage of future opportunities and thrive by establishing credit lines with local banks now...

By the time you need it, it’s too late.

Be ready to take advantage of future opportunities and thrive by establishing credit lines with local banks now...

... And you could pursue private money partners and establish partnerships now that would spring into action as "opportunity funds" later

What else? Would love to hear your ideas

What else? Would love to hear your ideas

Read on Twitter

Read on Twitter