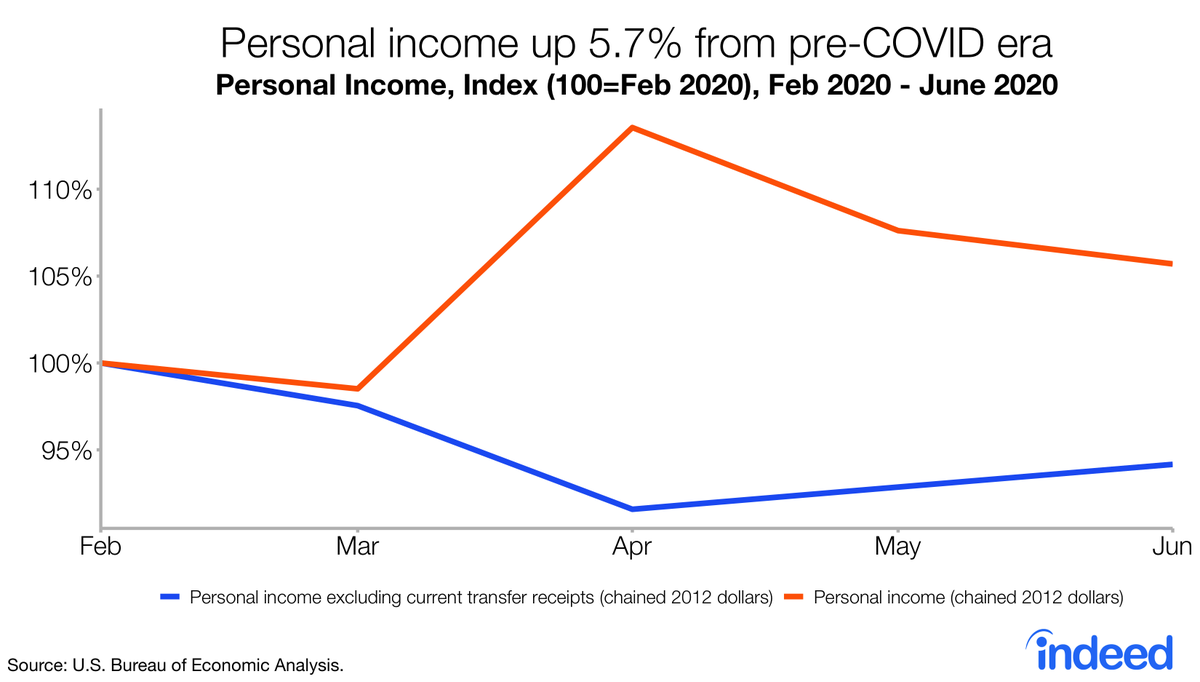

Personal income and outlays release today! Gov’t transfers are playing a key role in propping up the economy. Without them, personal income would be below its pre-COVID era levels.

1/

1/

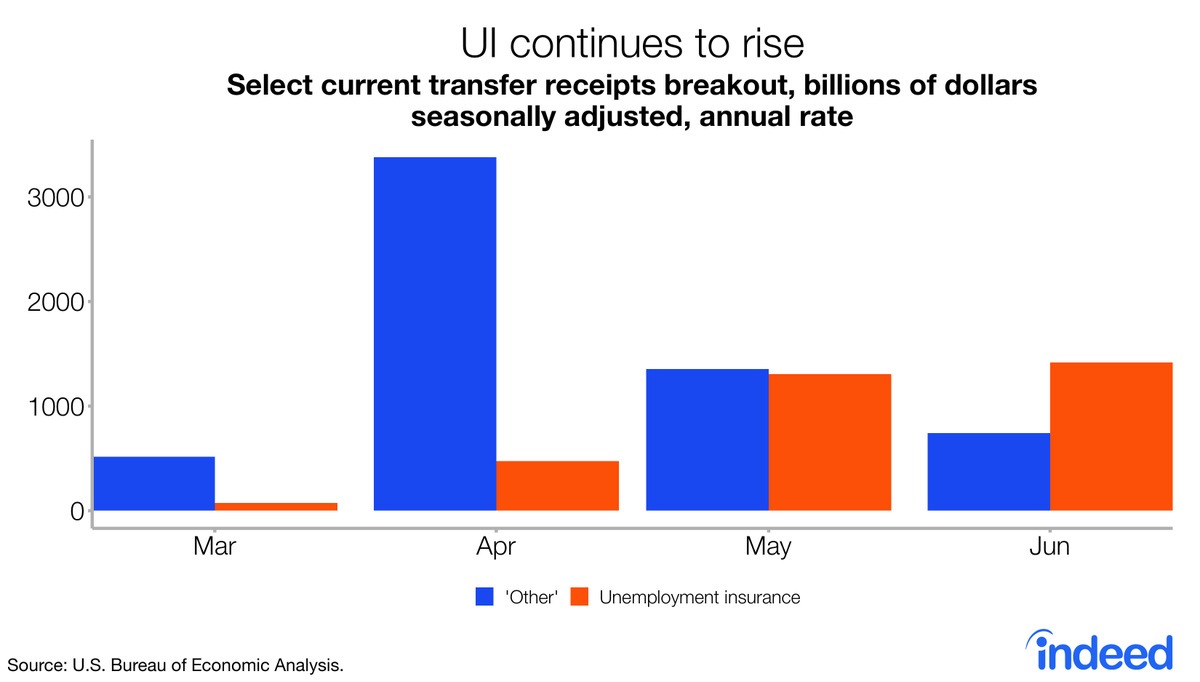

The two current transfer receipts categories changing the most are UI and ‘Other’. UI continues to climb.

2/

2/

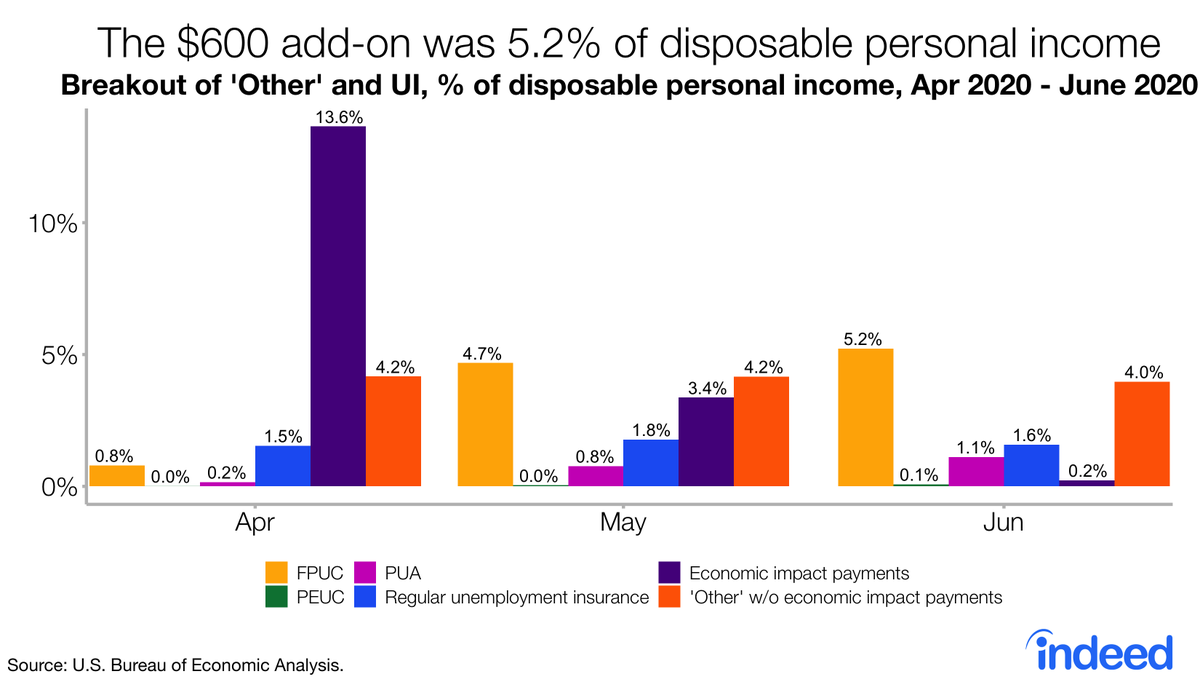

Breaking out UI and ‘Other’, the $600 add-on made up 5.2% of disposable income in June. That’s a HIGH percentage!

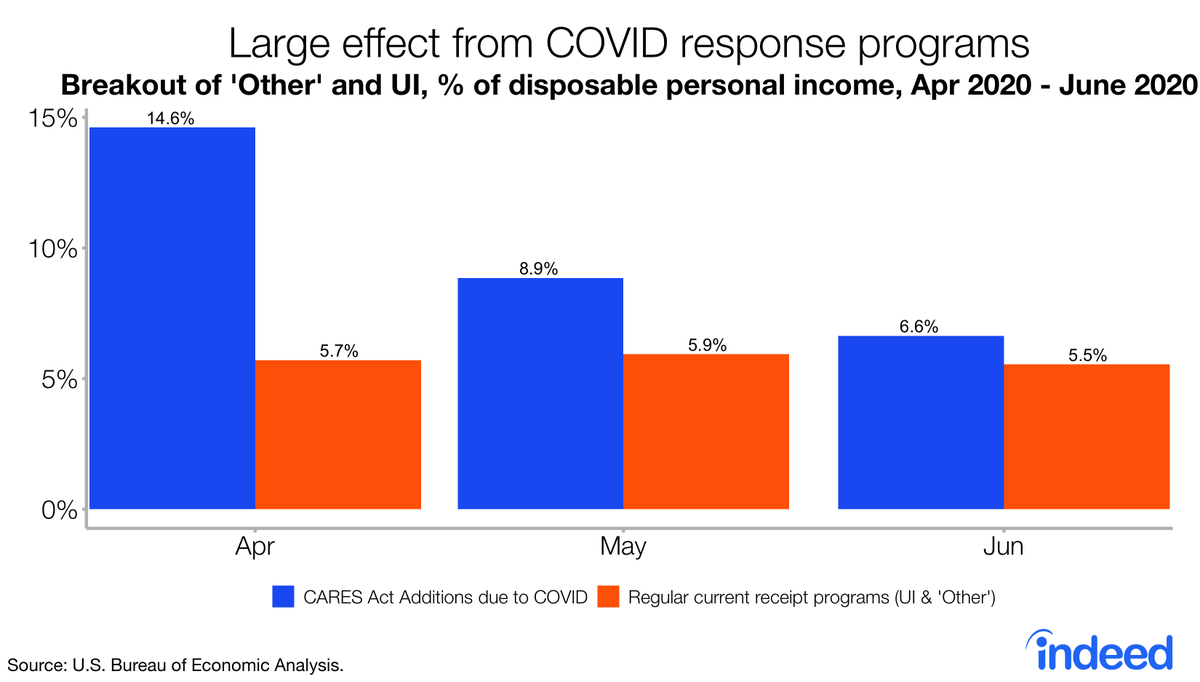

To get a feel for the magnitude of the COVID response programs, I group by the regular current receipt programs vs. CARES Act Additions due to COVID. The rescue packages made up a 6.6% of disposable income in June.

4/

4/

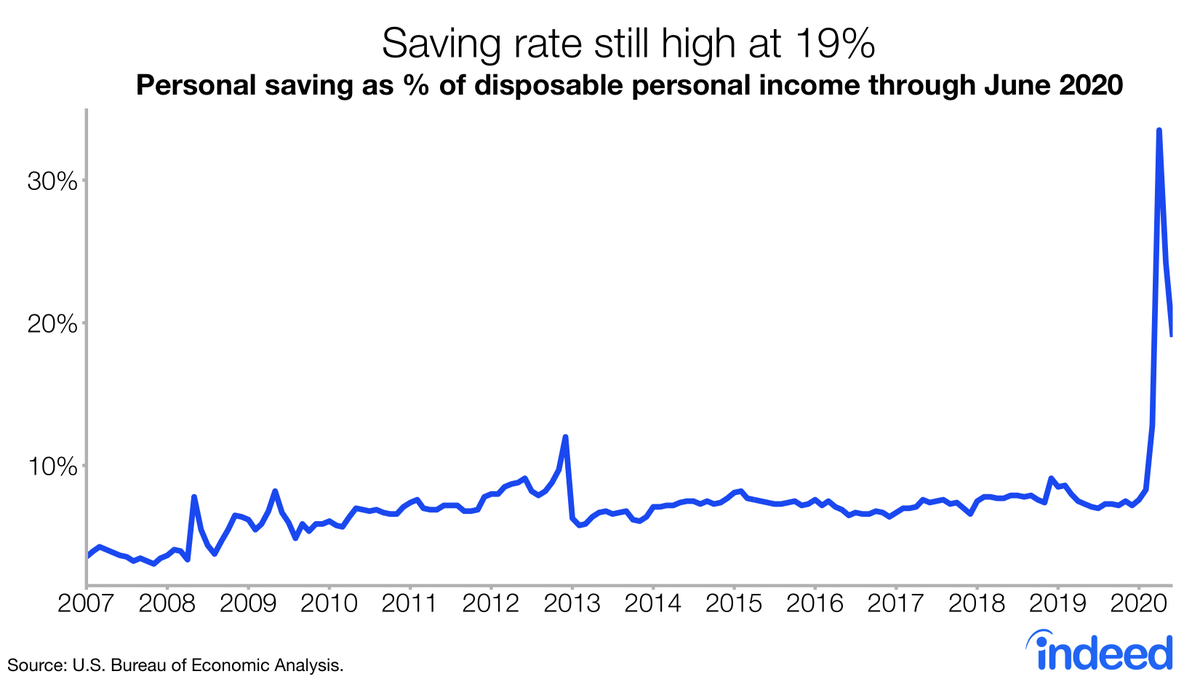

So what are Americans doing with the $$$ they have? Continuing to keep it in their pockets at record levels.

5/

5/

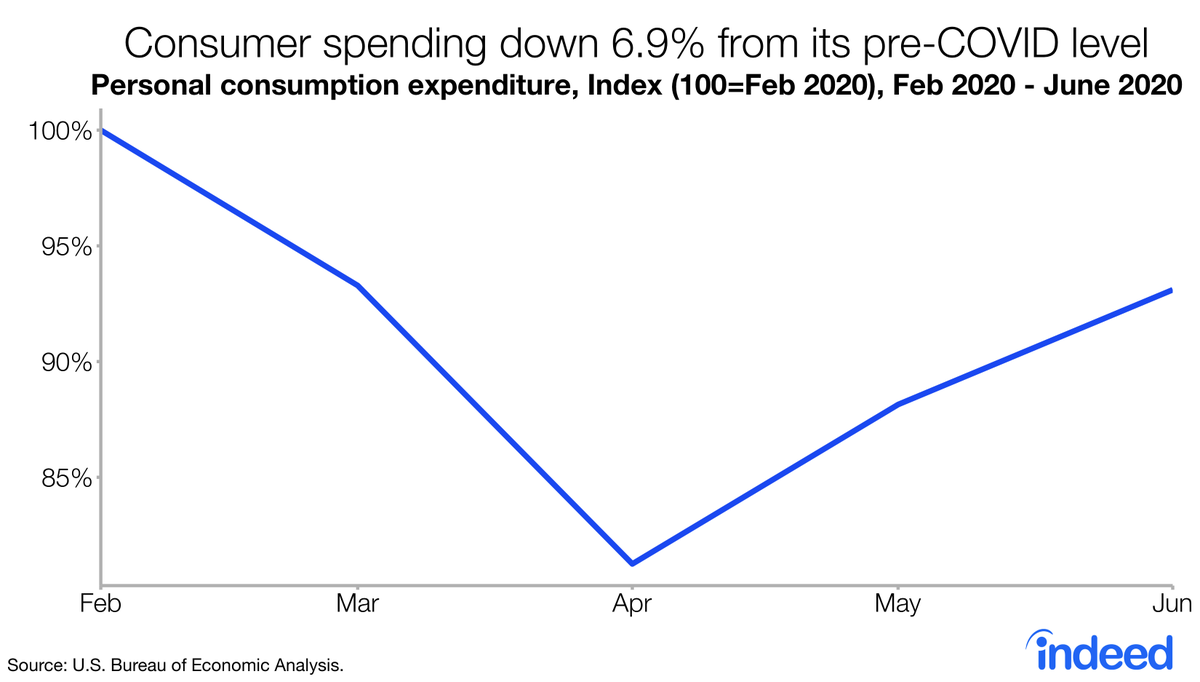

Not surprisingly, consumer spending is still down from its pre-COVID level. The virus is still boss - it pollutes the economy with uncertainty, pulling consumption down. People aren’t going to spend if they’re concerned about whether they’ll still have a job next month.

6/

6/

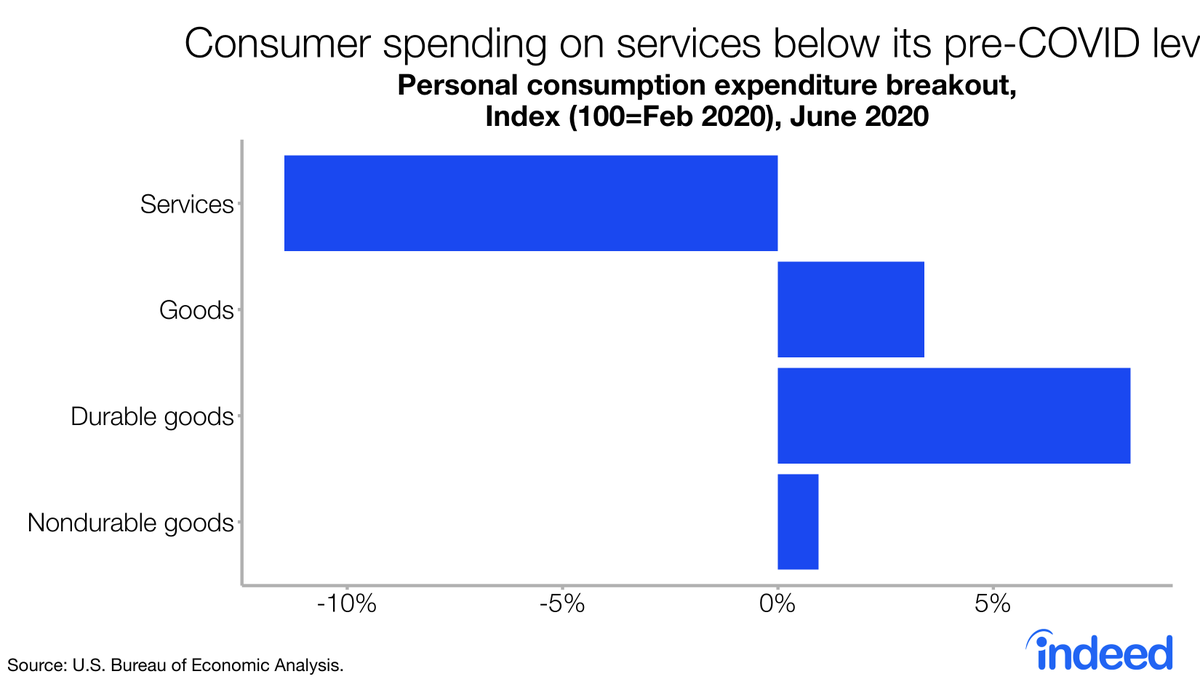

This is most evident in the service sector, where spending is down 11.5% from this pre-COVID level.

7/

7/

So what’s the big picture? The gov’t response to COVID is helping cushion people’s income from a huge shock. This helps keep spending going. But as long as the virus still rages, the uncertainty is going to make people hesitate to return to pre-COVID era consumption levels.

8/8

8/8

Read on Twitter

Read on Twitter