I'm not a tweet storm guy, and I know a lot of my followers aren't @DetroitCityFC people, but I have some thoughts on the ownership offering, so here we go.

I want to start off saying I'm absolutely in favor of this; I'm investing, and nothing I say here is meant to disparage City. I'm full on DCTID (the things @tacoman_x86 and @frontiere_rob I say to refs on the fence line probably borders on verbal assault)

The first thing is that while you are technically investing, it's really only in the most broad sense of the word. City is offering non-voting shares, totaling 10% equity. Non-voting shares get no say in the running of the company. This differs from the Chattanooga offering.

Non-voting shares are offered to raise money all the time (this is how start ups get funded). The difference is that with those it's expected that the company will either go public/be sold, or start paying a dividend.

However, it's unlikely that City would ever be bought-out wholesale in a way that would cause the Class B shares (what is being offered) to be able to be "cashed out". In addition, the filing makes it clear it's unlikely City will ever pay a dividend either.

You're buying non-voting shares that are highly unlikely to ever be sold or realize a return. So while you are an "owner", your ownership gives you no say in running the company or chance to turn a profit. I would say this is more akin to "purchasing ownership" than "investing"

All of this is okay. However, I don't want anyone to think is really a sound investment opportunity. The Keyworth funding was a very real investment opportunity, and turned out to be an excellent one. This is not that. Knowing this, please smash the "Invest" button :).

There are also lots of interesting things buried deep in the official filings. I know it's percolated out there, but it turns out there is a sixth owner of City. To recap, we all know the original four founders. Presumably, the ownership of City was originally split four ways.

In 2019 a fifth person (Michael Lasinski) was added to the ownership group. Presumably this was to meet PLS standards that require an owner have a certain net worth (further referred to here as a "protection racket").

We don't know what he paid to join the ownership group, but I think it's safe to assume it was something significant since the PLS standards require that he control 35% of the company.

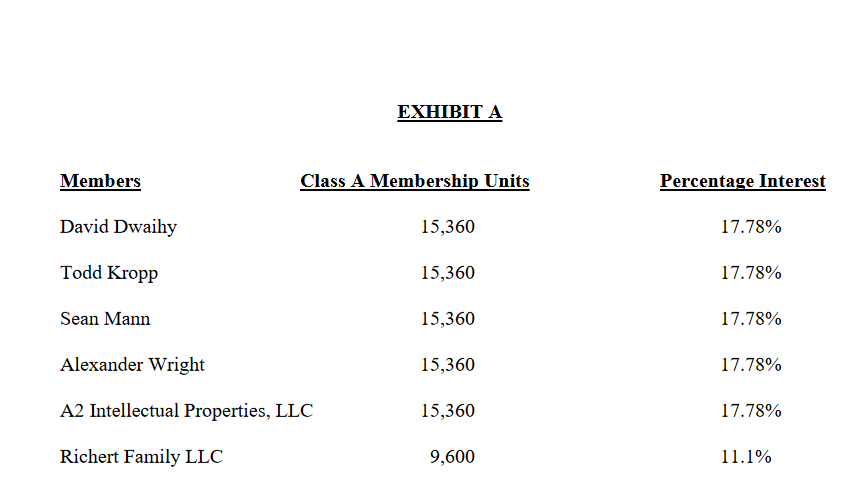

As part of the offering, City has to release a lot of information. Part of that is the actual operating agreement that governs the company ( https://dfon51l7zffjj.cloudfront.net/uploads/remote_files/90681-EGfjxm7x9fHc7JvFdwi7cRwz/2020-07-26_DCFC_Holdings_-_fourth_amended_and_restated_operating_agreement_-_fully_executed.pdf). On the last page we see the allocation of the Class A voting shares:

A2 is Michael Lasinski. Surprise, there is a sixth owner of DCFC! The holding company that owns 11.1% of DCFC was incorporated last week (7/21/20).

This sixth owner has real voting rights (just like the founders), and in fact has as much voting rights on their own as all of the WeFunder investors would have had if City had decided to give them voting rights (even if through a proxy like with Chatta).

All together, the original four founders have had to sell off 28.88% of DCFC. It's a little disappointing that they've had to give up so much and still need to raise $1M from supporters, but COVID has spared no one.

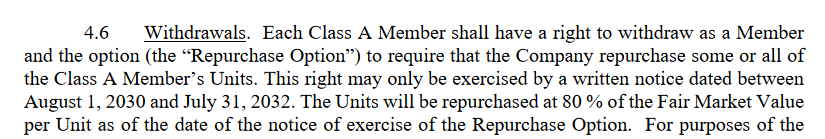

A couple of other interesting items from the operating agreement. First, it looks like there is an "escape hatch" for the ownership group members to cash out, but it doesn't activate until 2030. Basically, starting in 2030, any owner can demand they be bought out.

City is valued at $10M right now. So if one of the founders were to invoke this today (although they can't), it would mean that City would need $1.42M in cash to pay them out ($10M x 17.78% x 80%). In ten years City could (hopefully) be worth a great deal more.

All in all, the founders have set up a nice retirement for themselves should they should choose to invoke it. I have no ill will at all on this -- they deserve the ability to enjoy the fruits of twenty years of hard work.

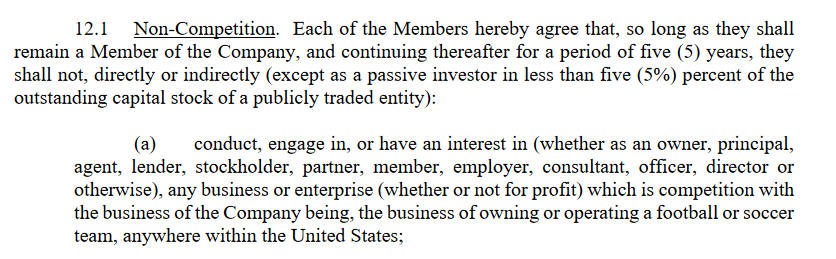

Also, there is a non-compete clause that keeps any owner from starting or joining another club for five years. A smart move after the Chatta/Red Wolves debacle.

A few additional thoughts regarding the offering. Before, I focused on the shares as investment vehicles. But I think that only tells half the story. The WeFunder investment perks are varied and (potentially substantial).

In particular, the $2,500 tier that provides a lifetime season ticket is interesting. There is an argument to be made that is under-priced even if you were purchasing it outright. Even if it's not under-priced, it's my opinion that it's a fair price to pay regardless of shares.

In that light, the shares are really a bonus (they don't hurt) and you're buying something pretty valuable. The $5,000 tier gives two lifetime tickets plus the season jersey every year. In a hypothetical were City still exists 20 years from now, this all more than pays for itself

To conclude, remember that most of us were just going to give City the $120 for our season tickets this year anyway. That City is willing to give us something in return (a form of ownership, even if a functionally token one) is pretty cool.

And who knows, maybe 30 years from now City is the jewel of American D1 soccer and the club sells for $500M -- then every $125 you invest has turned into $6,250 :)

Read on Twitter

Read on Twitter