Do states with lower income tax have an advantage in sports free agency?

Do states with lower income tax have an advantage in sports free agency? And if so, do they win more championships?

Time for a thread

1) Sports media has continuously pushed the narrative that state income taxes make free agency unfair.

Their argument hinges on the idea that athletes would rather sign with a team located in a state with no income tax, than with a team in a state with a high income tax.

Their argument hinges on the idea that athletes would rather sign with a team located in a state with no income tax, than with a team in a state with a high income tax.

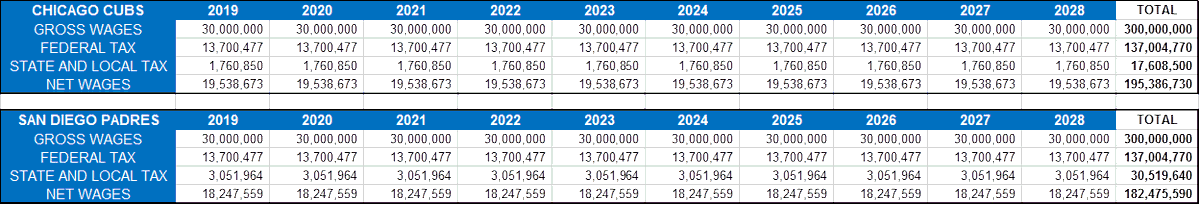

2) Let’s take a hypothetical look at Manny Machado’s 10-year $300M deal.

Machado signed with the Padres, which have a 13.3% state income tax. What if he signed with the Cubs?

Machado could make ~$13M extra over lifetime of his contract based on difference in state income taxes

Machado signed with the Padres, which have a 13.3% state income tax. What if he signed with the Cubs?

Machado could make ~$13M extra over lifetime of his contract based on difference in state income taxes

3) The problem? It’s not always that easy.

Things like “Jock Taxes”, which are taxes imposed by states on the earned income of visiting teams playing in their state, can have a significant impact on net wages and aren’t always easy to calculate years in advance.

Things like “Jock Taxes”, which are taxes imposed by states on the earned income of visiting teams playing in their state, can have a significant impact on net wages and aren’t always easy to calculate years in advance.

4) Even if there was an obvious tax advantage for a free agent choosing a team, it would still be just one of many factors including:

- The overall size of the offers

- The relative quality of the teams

- The player’s schematic fit

- Their desire to work with a specific coach.

- The overall size of the offers

- The relative quality of the teams

- The player’s schematic fit

- Their desire to work with a specific coach.

5) Take Tom Brady for instance - It's estimated that Brady sacrificed between $60-$100 million in earnings to give the Patriots flexibility within the salary cap.

It’s hard to imagine Brady would turn around and sign with the Buccaneers just to pocket an extra million or two.

It’s hard to imagine Brady would turn around and sign with the Buccaneers just to pocket an extra million or two.

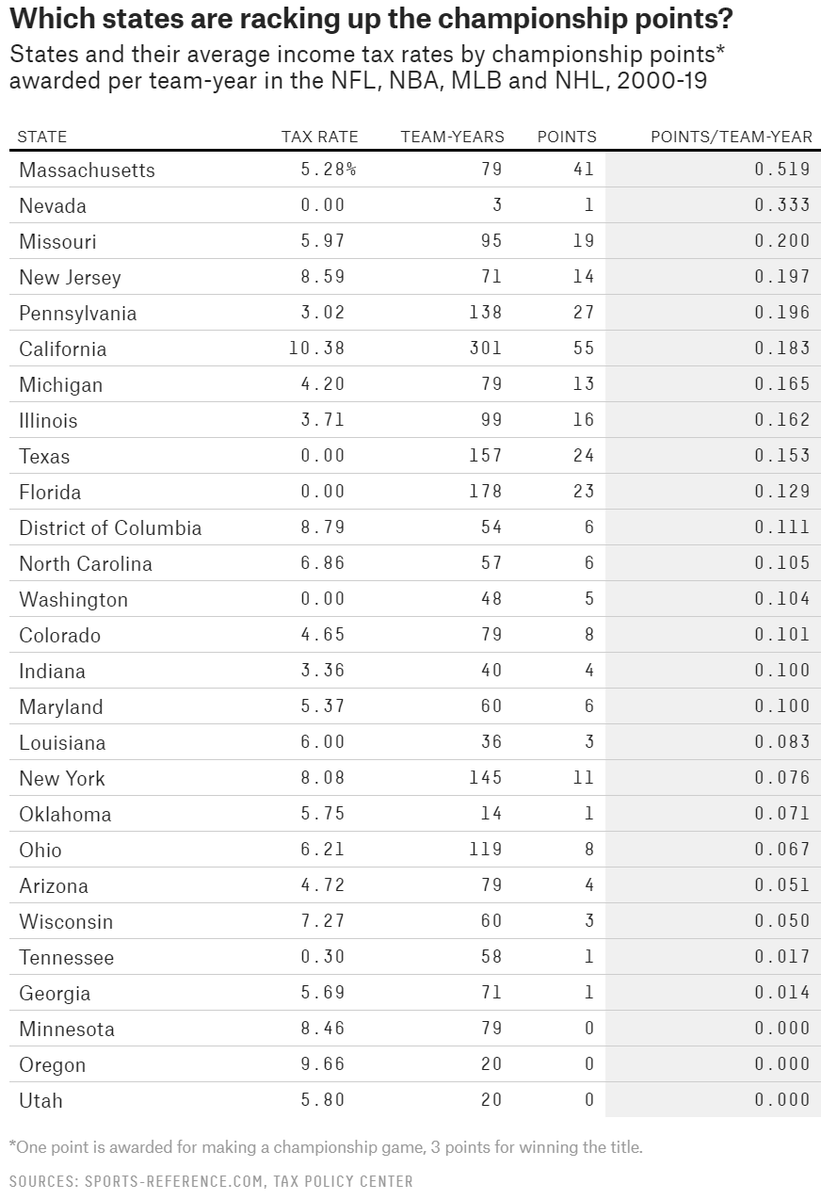

6) If low tax states were really at an advantage to sign superstar players, wouldn’t they win more? Let's take a look.

Chart math:

- 1 point for team qualifying for championship

- 3 points for winning the title

- Total championship points are divided by team-years played

Chart math:

- 1 point for team qualifying for championship

- 3 points for winning the title

- Total championship points are divided by team-years played

7) Looking at the list, it doesn’t look like there’s any correlation between states with the lowest income-tax rates and winning championships.

When you look at the 4 major US pro sports leagues, there is effectively zero correlation in wins to low taxes too.

When you look at the 4 major US pro sports leagues, there is effectively zero correlation in wins to low taxes too.

8) Why aren’t teams in low tax states recruiting more superstars & winning titles?

- Low taxes matter more to lower paid players

- Best players prioritize things other than just $$

- Big markets like NY/LA carry high taxes but give superstars more brand exposure/endorsements

- Low taxes matter more to lower paid players

- Best players prioritize things other than just $$

- Big markets like NY/LA carry high taxes but give superstars more brand exposure/endorsements

If you learned something today and want to receive more updates about the business and money behind sports, subscribe here. https://huddleup.substack.com

Read on Twitter

Read on Twitter